A sign you’re a new parent still attempting to iron out your identity - Spotify’s “Wrapped” reveals your #1 song in 2023 was “Wheels on the Bus” by Raffi… closely followed by “Big Dog” by Benny the Butcher and Lil Wayne.

2023 was a year of transition in a lot of ways:

It was my first full fiscal year as a CFO (note: didn’t get fired)

It was my second year as a dad (and first year as a father of two)

It was my first year as the Joe Rogan of Metrics, launching the Run the Numbers Podcast (shout out Producers Nancy and Nat, you rock)

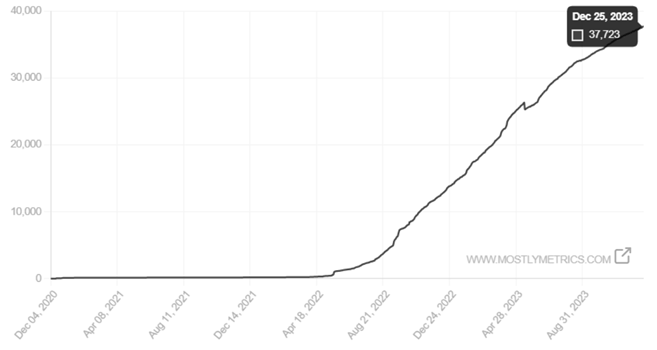

And it was my first time putting out two (dope) pieces of Mostly metrics content each week (the keys of my dusty Lenovo are BEGGING for a break).

I’m determined to improve in each of these areas of life in 2024.

So here’s what’s in store for Mostly metrics readers in the new year…

As many of you probably realized, Mostly metrics went on a series of (highly publicized) dates with Brex in 2023. Things heated up, and we’ve decided to take a big next step, moving in together and signing a three month lease…

Brex will be our presenting sponsor for Q1 of 2024.

This was after careful consideration, and meeting one another’s parents (I interviewed Art Levy, Chief Strategy Officer here on MM, and Michael Tannenbaum, CFO / COO graced the Run the Numbers podcast).

This is great news. Because your boy LOVES writing, and HATES selling ads. So yea, lock it in baby. My vintage IKEA is already en route to the new crib.

And over on the paid side of things, after extensive user research from our kickass product team (aka me zipping one-off emails to random readers from my iPhone 7 in between sets of pull ups at the gym) we’ve decided to revamp the structure to provide “more value”.

In 2023 I discovered people want to go deeper, and get incredibly tactical, on core finance, strategy, and ops topics. Our Annual Budget Series really brought this to light - people lost their fucking minds over “Modeling Pipeline Coverage” and “Building Sales Capacity”. Who knew!?

This inspired me to think about what else could be a “series”. I decided that each month should be able to stand on its own as a single topical (or is that the lotion term?) playbook.

Here’s the (preliminary) programming we’ve scheduled (subject to change, as I may be deeply inspired by something I learn myself as a CFO):

January: Board Preparation and Management

Participants, structure, and mistakes to avoid

Material prep, useful templates, and metrics to include

February: Startup Fundraising

Getting your story right

Investor targeting

How to run a successful fundraising process

How to review a term sheet

March: Treasury

What bank accounts should I keep my cash in?

How do venture debt facilities work?

How do interest rates and the Fed actually impact me?

April: A crash course in Investor Relations

How CFOs prepare for earnings calls

Tools for investor targeting and research

Beat and raise models

May: IPO Processes

Types of offerings

Roadshow timelines

Components of an S1

Metrics to hit

June: Middlemen & Take Rates

Marketplaces

Platforms

The Chicken or the Egg Problem

July: Competitive Moats

Types of competitive moats

Competitive moats in action

August: Annual Planning

ROUND 2 MY PEOPLES!!!

September: Cap Table Management

How a 409a works

Getting rich off secondaries

Dilution

October: The CFO Software Stack

Planning and forecasting

Payments

Record keeping and payroll

BI and Analytics

November: Vertical Software

Owning the control point

The “layer cake” strategy

Harnessing the power of messy data

December: Sales Compensation

Commission rate benchmarking

Types of variable comp

Do SPIFFS actually work?

(Shameless plug to get onboard now if you see a topic mentioned here that you are excited for)

Paid emails will continue to (mostly) come out on Thursday’s. Some months may have four emails; some months may have two; some months may have six - it all depends on what the topic calls for.

I’ve taken something said to heart:

“People don’t want more emails; they want better emails.”

And that’s what I’m determined to do - provide better emails for all our subscribers. So crank the Nickelback and let the chips fall where they may, cuz I’m about to send it. Skizzerp.

This will be a good year. I can feel it in my bones. Walter says thank you. Much love, from the Mostly metrics writer’s room:

Mostly making the world a bit better

In each month of 2023 we donated the first $1,000 of reader subscription dollars to a different charity. Here’s what all the paid homies contributed to in 2023:

Ending school gun violence (Sandy Hook Promise)

Housing for families traveling to get their kids care at out of state hospitals (The Paul Magnus Foundation)

Curing Cystic Fibrosis (CFF)

Rebuilding Ukraine (Sweet Anok)

Curing breast cancer (American Cancer Society)

Building wells in Africa (Charity Water)

Maui wildfires (Hawaii Community Foundation)

Spinal muscular atrophy (Cure SMA)

Finding homes for some of Walter’s friends (The Humane Society of Naples)

Saving panda bears (World Wildlife Foundation)

Local youth running scholarships (Gulf Coast Runners Scholarship Fund)

School supplies for orphans in the Congo (Hope for All)

A quick word from our sponsor - Brex

Manual, time-consuming expense processes are costing you more than you know. Or maybe you do know, but are too focused on growth to deal with it. Brex can help.

Brex is how finance people get non-finance people to spend smarter. Their AI-powered cards + payments + software approach is more intuitive and scalable than anything out there and empowers employees everywhere to make better $$$ decisions and finance leaders like you to close the books faster.

Smart cards, automatic receipts, automated approvals, global travel, and real-time visibility in one place boost accuracy, efficiency, and compliance. It’s one total spend platform and a universe of benefits.

Some Thank You’s

Shout out to my top 5 recommenders in 2023. I’m appreciative of your partnership, and a HUGE fan of your writing.

from

from the

from

from

from