👋 Hi, it’s CJ Gustafson and welcome to Mostly Metrics, my weekly newsletter where I unpack how the world’s best CFOs and business experts use metrics to make better decisions.

You can’t be everything to everyone. I’ve tried - just ask my in laws.

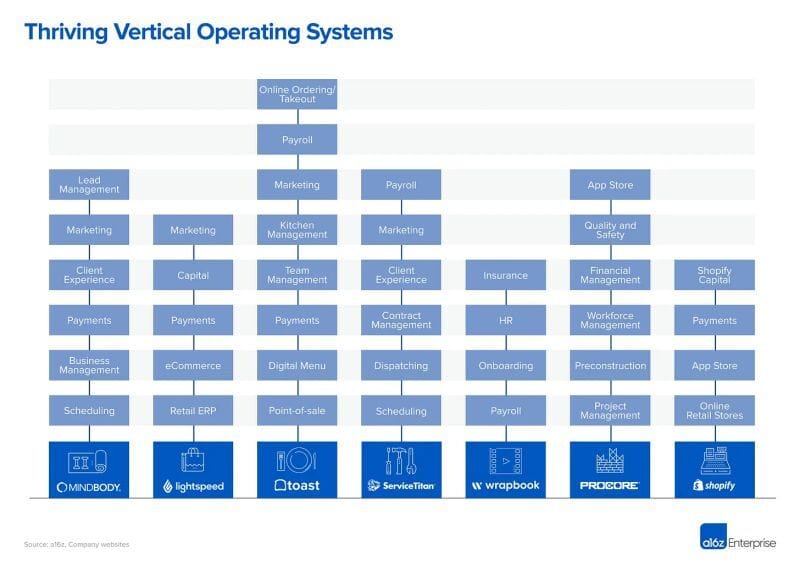

In all seriousness though, that’s kinda what Horizontal SaaS promises (or tries) to be. You can think of Horizontal SaaS as broad-based tech that is industry agnostic; a sales person at a Cybersecurity company can use HubSpot the same way a sales person at a Health Supplements company might use it. It literally tries to make all industries happy.

Vertical SaaS, on the other hand, takes a specific industry and caters its offerings to hyper-specific use cases: When a Hollywood director needs to process payroll for the cast, they don’t use ADP, they use Wrapbook.

Just as Vertical SaaS is purpose-built for a specific end consumer, the application of metrics must be deliberate as well. This is due to the nuances in Vertical SaaS go to market models, end consumer buying habits, and underlying data structures.

The beauty and chaos of vertical SaaS

If a a Vertical SaaS provider owns a control point, like a CRM or quoting software for a merchant, it can build an unfair opportunity to sell multiple products to the same customer overtime.

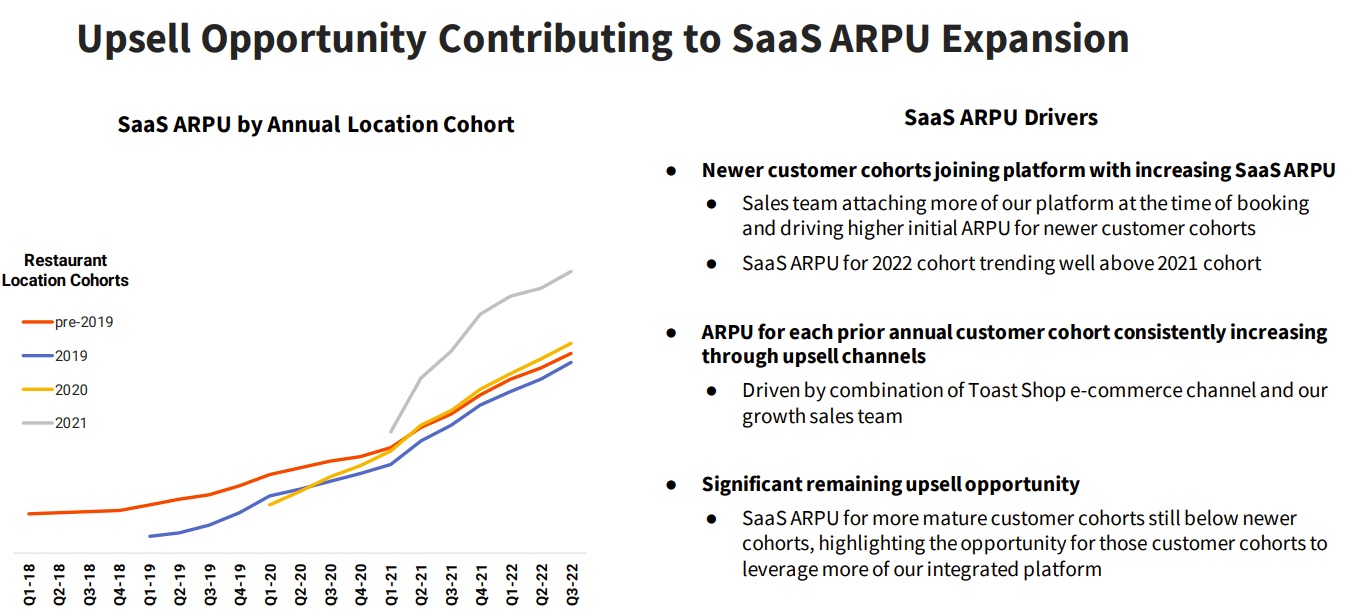

And that’s, like, super cool and stuff, since multi-Product companies enjoy higher ARPU (average revenue per user), LTV (lifetime value), and NDRs (net dollar retention rates) as a result.

When done right, what may have initially appeared to be a small-ish TAM becomes much, much larger.

This guide covers the metrics you’ll want to keep a close handle on when scaling a Vertical SaaS company. Some of these metrics you’ve probably heard of before, but we’re looking at them today specifically from the perspective of a Vertical SaaS operator.

Metrics #1 through #3 are for everyone. Metrics #4 through #19 are for paid readers only.

AOV = Total revenue / Number of transactions

Many Vertical Software companies are involved in high velocity transactions with smaller basket sizes. For example, a Horizontal Software company may sell a productivity solution for product managers with an AOV of $15,000 (e.g., Asana, Monday, Clickup). But a Vertical software company like Toast may make the bulk of it’s revenue from a take rate on a high volume of $100 dinner orders.

There are two ways to increase average revenue per user - increasing average order size (more taquitos per order) and increasing velocity of orders (more customers buying taquitos). The first is harder to do - to use another example, Mindbody might not be in a great position to get people to buy higher priced gym memberships (there’s a ceiling on that), but it sure can help the gym sign up more people, faster by offering add on marketing products.

ARPU = Total revenue / Total users

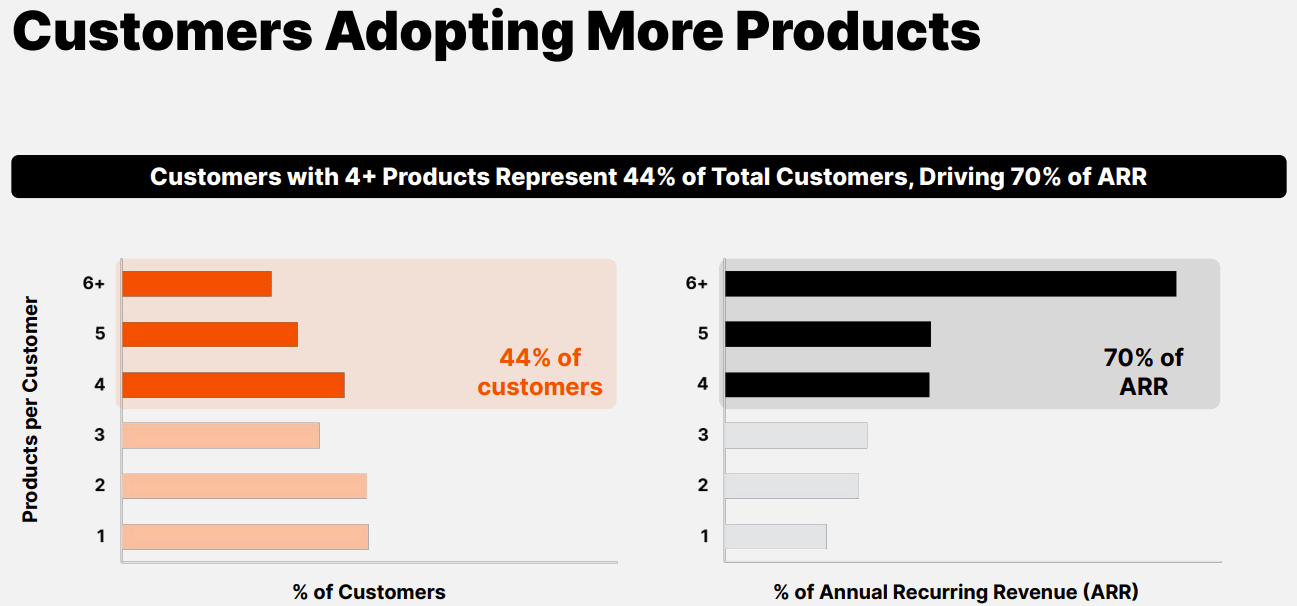

How much wallet share can you gobble up per customer? This metric aggregates the AOVs across multiple products. It’s important because vertical SaaS companies are inherently multi-product and can stack multiple AOVs from one customer.

And when you own multiple sides of the equation, you can measure ARPU for both sides of the transaction:

Average revenue per supplier

Average revenue per customer

You can increase ARPU by getting a customer to buy more of the same product, increasing the price of the same product, or selling them additional products.

Stack ranking customers by ARPU is a healthy exercise, as it points out any customer risk you may have; a large portion of your sales may be reliant on just a few nodes in your network. This can be a potential point of friction when it comes to negotiations (“give us a better price!”), and presents execution risk to hitting your plan (“OMG, Customer x got hit by a bus!”).

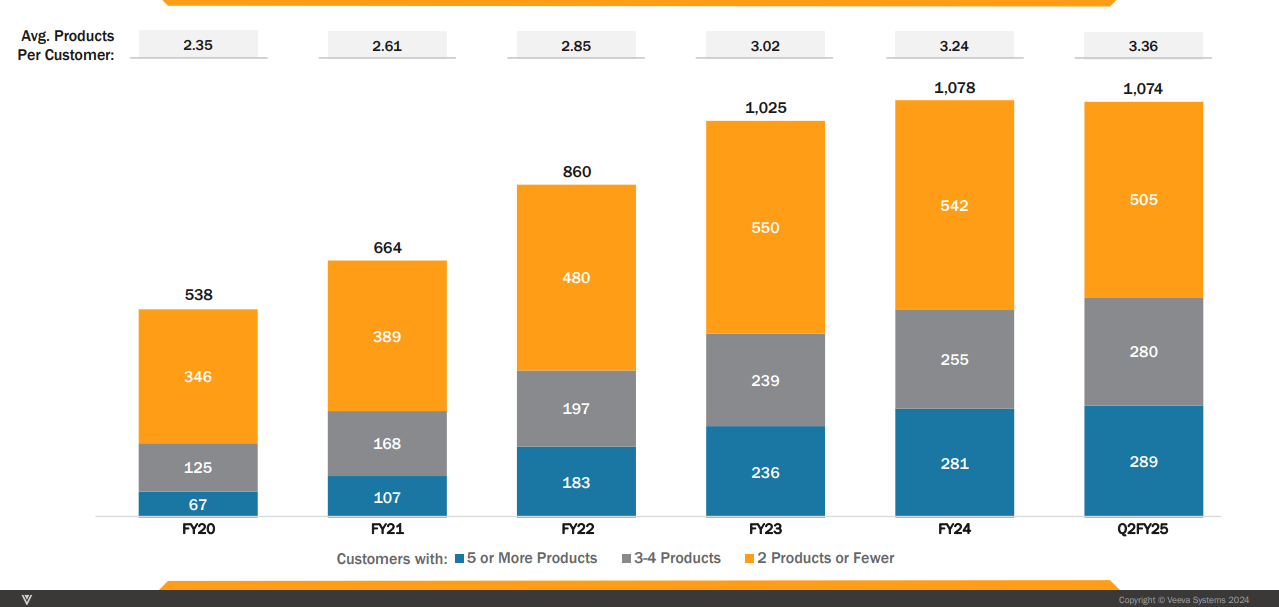

Product Attach Rate = Total Products Sold / Total Customers

In contrast to their Horizontal peers, Vertical SaaS companies are well positioned to capitalize on a product “layer cake” strategy. The goal is to get customers fully embedded on one core product and “attach” to others in the portfolio over time.

Most vertical SaaS companies start by solving one specific use case for one industry persona, and then expand their offerings to cover other aspects of their day to day workflow. The thinking is that if you become the trusted source for one core job-to-be-done, you can more easily cross-sell other products, some of which will appear free to the end user (like payments).

The most common products vertical SaaS companies attach to their initial “Control Point”:

Consumer Payment Processing: Toast helps restaurants get a better credit card processing rate and then keeps a percentage of the interchange from each bill.

Lending: Mindbody will help gyms pony up the cash to buy that expensive Lats machine so you can get those massive gains.

Data, Analytics, and Benchmarking: The initial product a vertical software company offers is usually sitting on a treasure trove of industry specific data. And data is the new oil. For example, if you’re already helping schedule what jobs gets done on the auto bays, you can probably help the mechanics get a better grip on the labor required to complete the job, and maybe even the prices they are paying for the parts. Guidewire does something similar, where they’ll use the data they gather to help insurance companies benchmark their insurance claims.

Payroll: Procore helps contractors pay everyone contributing to the job site. Payroll is largely looked at as a commodity service, and if businesses can save time, consolidate vendors, and have a slightly better experience, it’s an easy cross sell. According to Bessemer, there’s $10 - $25 per employee per month up for grabs on the payroll side of the equation. That’s a lot of dough at scale.

Here’s Veeva’s multi product attach rate to drive the point home:

*Metrics #4 through #19 are for paid readers*

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content.

UpgradeYour subscription unlocks:

- In-depth “how to” playbooks trusted by the most successful CFOs in the world

- Exclusive access to our private company financial benchmarks

- Support a writer sharing +30,000 hours of on-the-job insights