When I think about companies that have survived the perilous journey upstream from SMB to Midmarket to Enterprise, while simultaneously evolving from a point solution to a best of breed platform that CFOs genuinely appreciate, Brex comes to mind.

I’ve been lucky to get to know one of the original gangsters behind the company’s strategic vision - Art Levy, Brex’s Chief Strategy Officer.

Like McNulty from the wire, there isn’t a case this guy won’t take on, even if it means pulling out some creative stops. Art has a great mind for monetizing innovation across multiple market segments and product lines, both organically and inorganically, which is why I was excited to jam out with him during this interview.

In season 1, Episode 6 of the Wire, Det. Lester Freamon explains:

"We’re Building Something, here, Detective,

We’re Building It From Scratch.

All The Pieces Matter."

Indeed. When it comes to corporate strategy, all the pieces do matter.

TL;DR:

Part I: Going up market

When to go upstream to the Enterprise

The nuances of going downstream to the mid market

Adjusting your pricing and packaging for different buyers

Part II: Adding new products

When to add a second product

Chances your second product is as successful as your first

The strategy behind giving away some features for free

Part III: Platforms vs Point Solutions

What’s a point solution?

Starting out at as a platform

Part IV: Build vs Buy

M&A’s failure rate

Who drives M&A: Product vs Corp dev

Things that go wrong with M&A

Talent M&A vs Business M&A vs Product M&A

Part V: Lightening Round

Giving your younger self advice

Overrated metrics

A message for startup founders

Enjoy this convo with one of the biggest brains in the game.

Part I: Going up market

This is a difficult question. I think some of the time good companies are “forced” to go upstream by their customers, rather than it being just a “preordained” choice of the leadership team.

Bill.com, Slack, Brex, Square, Shopify all started with “startup/SMB” customers and then realized that they could iterate on their product to service their growing base, add features, and “grow with their customers,” rather than ceding them to the upmarket competitors for bill pay, chat, merchant acquiring etc.

This cadence and situation is very different from a startup with a downstream product / customer base simply “deciding” one day to go upmarket. This is sometimes a trap, as the product, GTM, CX and everything in-between is very different upmarket.

While the TAM and ACVs can look alluring, it is a brand new “zero to one” motion in this type of situation. Even the marketing and positioning has to be different, which people traditionally sleep on.

Neither is easy. I think it is more natural to go upstream in markets where companies grow fast, because as noted above, you can scale with your customers, listen to what they need as they grow and ship some of those features. In that world, you are scaling over time and it’s a more natural curve to upmarket, rather than picking up and going from, say, 10 FTE’s to 10,000 FTE’s.

If doing the latter, you need to re-imagine your salesforce, your product positioning, and your product itself. I think Square and Shopify have been relatively successful moving upmarket, but they still are not in the “Enterprise” conversation in the same way their competitors are (Adyen and Magenta, respectively).

On the downstream side, Coupa has tried to push from Enterprise into the middle market, but the challenge is that price is prohibitive for some of these smaller companies, and the salesforce is prohibitive from Coupa’s side. What got you here isn’t getting you there.

Example: your field sales reps cannot be calling small SMBs and spending time on demo’s when the ACV’s are much lower. So now you have to build a whole inside Sales team and paid acquisition strategy - it’s a whole new territory.

More natural is what Bill has done. I remember listening to a recent earnings call where Rene Lacerte (Bill’s CEO) mentioned how they are seeing larger and larger companies using Bill.com, even as they have not targeted them. This is an early indicator of PMF with a different customer cohort.

This is a very tough question and there are whole firms set up to help with this. I loved the book Monetizing Innovation which helped us think through Willingness to Pay to ensure we take a scientific approach to understand what customers want, what customers need, and what customers will pay for (sometimes all different).

Further, we had to ensure we had a full cross functional monetization team testing the elasticity curve for certain features. You need to put your features on trial and make people pay for the features they say they want. You need to talk to customers in each Segment to ensure you are solving their problem in the cost effective way for them. It sounds obvious, but many companies try to take shortcuts.

Part II: Adding new products

This goes back to jumping S-curves and understanding that hypergrowth will not last forever. Even products with strong retention will inevitably face headwinds that slow growth and make it progressively more challenging and expensive to grow at scale. Things like competition or channel saturation slow growth and organizations need to invest in a new growth strategy.

It’s not easy to know when but we like to say “only the paranoid survive” because if you wait until your growth has slowed, then it’s too late. Case in point is Brex with Empower - if we had waited until the current macroeconomic environment turned against tech to start building our spend product that we sell to all 250+ FTE companies, we would be in a bad situation.

Here we were lucky enough to invest in leading indicators. We heard threats that they would churn if we didn't add XYZ, so we were able to navigate technological change, preference shifts, and competition.

I think you certainly should not be adding a second product under $10M of revenue because then in my opinion you don’t really have product market fit. But that doesn’t mean once you hit that level you should build a second one. There are many successful companies that truth be told have never even cracked more than one product. The truth is, most second products fail, and it is VERY hard to become a platform.

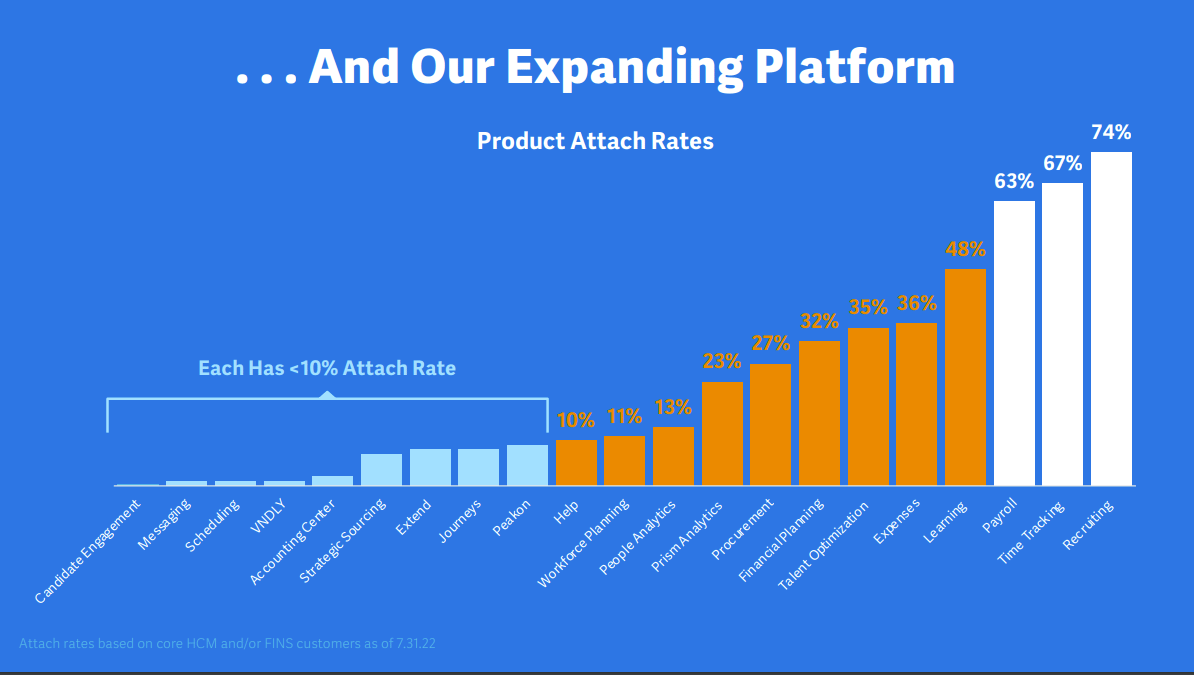

I think so. Your DNA as a company allowed you to create that first product, so to harness that energy into something new and different is challenging. If you look at some of the largest B2B software companies (Workday, Coupa) they have seen some good attach but many of their products are still not doing well, since cross-sell is hard, positioning is hard. Most companies don’t realize that just because someone buys one thing from you, doesn’t mean they will buy another. Look at Coupa - very strong procurement product; wouldn’t you want to buy T&E software from them too? And yet, it hasn’t taken off. See below for Workday’s list of products - so many of them have tiny attach rates and have been in market for 10+ years!

We do here at Brex - it’s called “Brex Essentials”. It’s a product for growing companies that has limited seats, limited capability. And our main product is paid - it’s called “Brex Plus,” and includes all the add-ons.

Part III: Platforms vs Point Solutions

There are many differences. A point solution solves a single key pain point that must be contained and causes pain, but is not necessarily “all encompassing”

A platform is strategic and helps you run your business. Think, Expensify - “point solution for solving reimbursements for employees” vs. Brex - “a system of record for all Spend, card, non-card, travel and reimbursement, with forward and backward looking financial tracking and forecasting.”

The selling motion for point solutions and platforms is also different, with platforms going all the way to the C-suite and having a land and expand strategy. Point solutions tend to be mid-level in their decision makers, with lower ACVs.

I think you can be a platform to start - look at Salesforce, Siebel Systems etc. but I do think it is hard.

Part IV: Build vs Buy

First and foremost, you need to level with your CEO that 70% of M&A “fails.” You need to look at it as a capital allocation bet, similar to any other decision to push resources and talent to a problem.

You need a strong internal evangelizer and champion on the EPD side and the Business side. The joke about Corp Dev teams is that they hunt the bear in the woods, chase him to the cabin (the company), let him in and slam the door and say “deal done!”

Many M&As die in the integration phase. Deals that integrate well strike the balance between adjusting to the buyer’s norms and culture while still maintaining “startup” DNA and hustle. Most of the time keeping the Founders of the M&A is important, so you should do what you can to keep them happy.

I like to ask myself the following M&A questions:

Do they solve a key product need for me?

Why can’t I just be their vendor and try out their services? What do we gain by buying them?

Are they a competitor of mine and am I being out-executed?

Does their business have clear subject matter or geographical expertise?

Do they create a clear cross-sell opportunity for my product?

How strong is my internal champion for this deal?

Strategy/M&A needs to bring Product along, and then let them lead. M&A germinates the deal and then lets the right Engineering / Product person run with it.

Strategy might find the Target, but if Product doesn’t bite, iterate, get super pumped on the integration, it will never work.

Deals are about people, not fake synergies. You need to ensure that there are people at the Buyer whose full time jobs are ensuring the Target is successful; that the Founders at the Target feel comfortable, and are happy.

If the Founders of the Target leave the Buyer shortly after closing, it almost never works out. You need them to feel invested in the joint success of the new company. We are one company - basically the opposite of some M&As where Target still has their own office, their own email addresses years after (see Waze:Google). Once you sell your baby, you have to jump in with two feet; otherwise it isn’t working out, at least not from the Buyer's POV.

Talent M&A - Team matters most here. Buy a company primarily for the people. Can be a great way to hire quickly, especially folks who have worked together for years (and sometimes in a specific desired geography or sector) and can hit the ground running.

Product M&A - Product matters most here. Buy a company primarily for their product and core customer. If executed correctly, Product M&A can be a great tool to achieve your mission more quickly and much more efficiently.

Business M&A - P&L matters most here. Buy a company primarily to generate synergies from the combination and adjacencies from revenue, product and team. Most common for platform businesses (i.e., 1+1=3).

Part V: Lightening Round

Find your strength early, and exploit it. Optionality doesn't lead to greatness. Ever. And relationships are critical. So build them as best you can.

Employee count - I hate when people asked me early on how things were going and expected an FTE count…like that makes a good business?!

“Festina lente”

(From Latin, translates loosely to “make haste slowly”.)

A big thanks to Art for the strategic masterclass.

What I’ve Been Reading

The Product Roadmap at any company may as well be the 5 Year P&L Forecast. You can’t build a long term forecast for your company without understanding how the Product team builds stuff you can sell off the back of the truck. Plus, other than Finance team, I’d say the Product team is the most supportive of metric driven decision making. Now that’s my kinda peoples!

Get smarter on Product strategy each week from my man Pawel Huryn and The Product Compass newsletter.

Quote I’ve Been Pondering

“If you want to train really well, you have to be a little bored.”

-Again to Carthage, by John L. Parker