I’m just gonna be straight with you… there’s a TON of bad business advice flying around right now…

“Companies are only hiring AI engineers”…

“You need VC money to scale”…

“This economy is bad for starting a business”…

If you’ve fallen for any of these oft-repeated assumptions, you need to read Mercury’s data report, The New Economics of Starting Up. Mercury surveyed 1,500 leaders of early-stage companies across topics ranging from funding, AI adoption, hiring, and more, to set the record straight.

What they discovered is equal parts surprising and encouraging:

79% of companies surveyed, who have adopted AI, said they’re hiring more because of it.

Self-funding is the number one avenue for accessing capital — even for tech companies, with half likely to bootstrap.

87% of founders are more optimistic about their financial future than they were last year, despite prevailing uncertainties.

To uncover everything they learned in the report, click the link below.

*Mercury is a financial technology company, not a bank. Banking services provided through Choice Financial Group, Column N.A., and Evolve Bank & Trust; Members FDIC.

Here I go again, on my own

No I don't know where I'm going

But, I sure know where I've been

Hanging on the promises

In songs of yesterday

And I've made up my mind

I ain't wasting no more time

In January of 2025 I was lucky to help sell PartsTech, the tech company where I was CFO.

Tendies.

I had a decision to make once the wires cleared. Go the serial CFO route, signing up for another tour of duty, or go HAM on the newsletter and pod. Harvard Business School actually wrote a full case study on my decision making process.

Which is fucking wild because the other media case study they taught this year was on a podcast called Acquired…

almost nailed the pose

You can run NPV models to the moon trying to gauge the opportunity cost of foregoing ~1% in company equity as a CFO at each stop, but in reality, I’d subconsciously made the decision years ago. For better or worse, through some high highs and low lows, I’ve always lived by a code (as Omar in The Wire says, a man gotta have a code):

Whenever given an opportunity to bet on yourself, do it. It’s the best risk adjusted return you can make (other than buying Bitcoin in January of 2009).

I do have to admit - I had some anxiety in all of this. My biggest fear was there would be no incrementality of going all in. That there wasn’t extra juice to squeeze, growth to be had, dope-er articles to write if I made this my full time gig.

I mean, how many times can I write about gross margin?

Because I’ve actually seen it go the other way - people make their side hustle their main hustle and they end up not only hitting a point of diminishing returns, but actually destroying value. Specifically, for writers, they become detached from the day to day subjects they cover, relying on the drivel they read on twitter for inspiration. And they also go overboard on how many times they hit send with all their new found time (as I’m constantly reminding myself: people want better emails, not more emails).

Luckily, that didn’t happen.

The podcast listenership tripled year on year.

The newsletter growth remained consistent at about 1,000 net new subs per month (it’s hard to grow at a faster rate once you hit a certain size).

Our reports got wayyyy better (tech stack report, the state of the agentic finance stack, quarterly private company benchmarks)

We held 10 completely full CFO dinners.

And we launched two new mediums - Looking for Leverage (a newsletter for PE portco CFOs) and Mostly Growth (GTM Strategy pod with buddy Kyle Poyar). Both are growing and make money.

So yea, that’s cool. I guess I now run a media company.

I’m in the (niche b2b email media) empire business

As a funny aside, it’s hard to describe to parents at school or neighbors at cookouts what I do for a living.

When you tell people you’re a CFO, they instantly get it, and there’s some status associated with it.

When you tell people you create content online, they give you a confused look and try to size up if you are poor / rich / living in your mom’s basement.

But I’ve never been more fulfilled. I use the word “fulfilled” rather than “happy” because with ambition comes a certain level of “never happy”.

In fact, I used to think it was some bull shit when people said follow your dreams. Do what you love. Chase your passion.

“My mans I’m out here trying to make $, I ain’t got time for that small boy mindset...”

But I’ve found there’s a unique zone where you can stack what you’re passionate about, what you’re good at, and angle it towards what’s also valuable. That’s what I’m doing, and I find it immensely rewarding.

It’s rewarding from a financial perspective, too. Mostly Media generated +$3 million in revenue across newsletters, pods, reports, and dinners this year, more than doubling compared to when it was my side gig. To some this sounds like a ludicrous number, which it absolutely is. But I also have to compare that to what I can make as a CFO. Oh, and daycare for three kids costs approx $2.6 million.

In the background of all of this is an element of being alone. Would I miss the banter with coworkers over sales pipeline and crappy conference swag?

Luckily I’ve recreated that for myself. I’m blessed to work with the machine that is Sales Guy Matthew, who bet on our collective ability to make magic (I told him on day one: I’m a cow… milk me).

I’m also fortunate to work alongside our Benevolent Creative Dictator Ben. He’s the Martin Scorsese of B2B. He lives in Hollywood. I think he has a cat. He’s essentially a professional YouTuber now, which he’s always wanted to be, and that makes me happy that he’s happy and he gets to do it with me.

We also added producer Steve aka Stevey Stoves bc all he does is cook.

And I wouldn’t be able to keep this train on the tracks without Michelle on the accounting side, who worked with me at PartsTech, and Sarah running podcast ops, whom I was lucky to meet because her husband reads the newsletter. They collectively keep us kids from burning the house down.

So yes, I went out on my own. But I def don’t feel alone. I’ve assembled my version of the B2B Avengers. Plus, I met more than 200 CFOs at the dinners I hosted this year. My network was never this strong as a sitting CFO.

What excited me about 2026?

Helping you hire / get hired.

We’re expanding Mostly Talent, our match making service, bringing a full time recruiter in house. We will recruit specifically for finance managers, directors and VPs in the tech space (click here to hire top talent from our readership).

And we’re also releasing a tech stack benchmarking tool so you can determine the best fit for your size and stage year round (not just when I drop the annual report in Feb).

I’m all charged up.

Speaking of charging my crystals…

Producer Ben recently asked me what my goal was in all of this. I paused to think about it, and realized I was chasing a feeling.

It’s the feeling of being one and a half Miller Lites deep at my kitchen counter, typing away on my dusty Lenovo at 10:15pm while the rest of the family is sleeping… laughing to myself over some dumb meme that I know will rip when people open their email in the morning. Writing is inherently hard, but every once in a while, you feel like you’re flying.

I had a visceral reaction watching this scene with Brad Pitt in the F1 movie (just replace going 230 MPH into a turn with stringing together three consecutive sentences on AI Gross Margins without stumbling).

That’s what I feel when I write and what I hope people feel when they find something new, useful, and entertaining in my content. While I write about fundraising and metrics and building finance teams, I hope they open each email and hit play on each podcast with the same eager anticipation of “this is going to hit like it was made for me.”

So while I promise to deliver you content that makes you better at your job in 2026, my North Star is to deliver it with a certain feeling.

Here’s to chasing it in the new year.

More on What I’m Building…

My friend Paul Stansik (Operating Partner at Parker Gale, and all around good guy) interviews me on the origins of Mostly Metrics and the b2b media company I’m building. We cover the leap from CFO to full time “creator”, our product lines, and how the company makes money. Even if you aren’t a CFO, and you’re just fascinated in “solopreneurship” or whatever we are calling it these days, this is a good time. Plus, Paul pulls no punches.

Paul writes the fantastic Hello Operator newsletter, a field guide for PE backed executives.

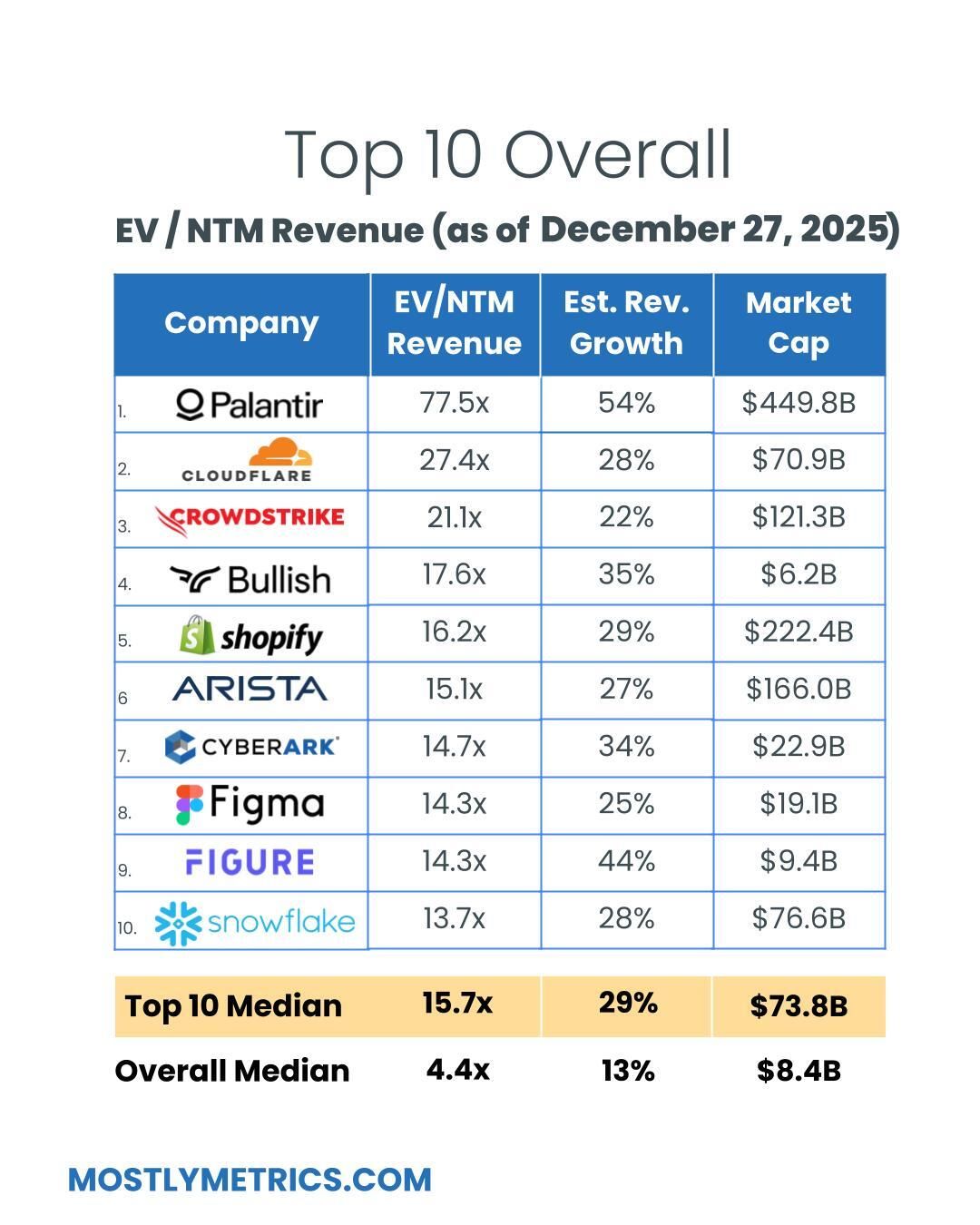

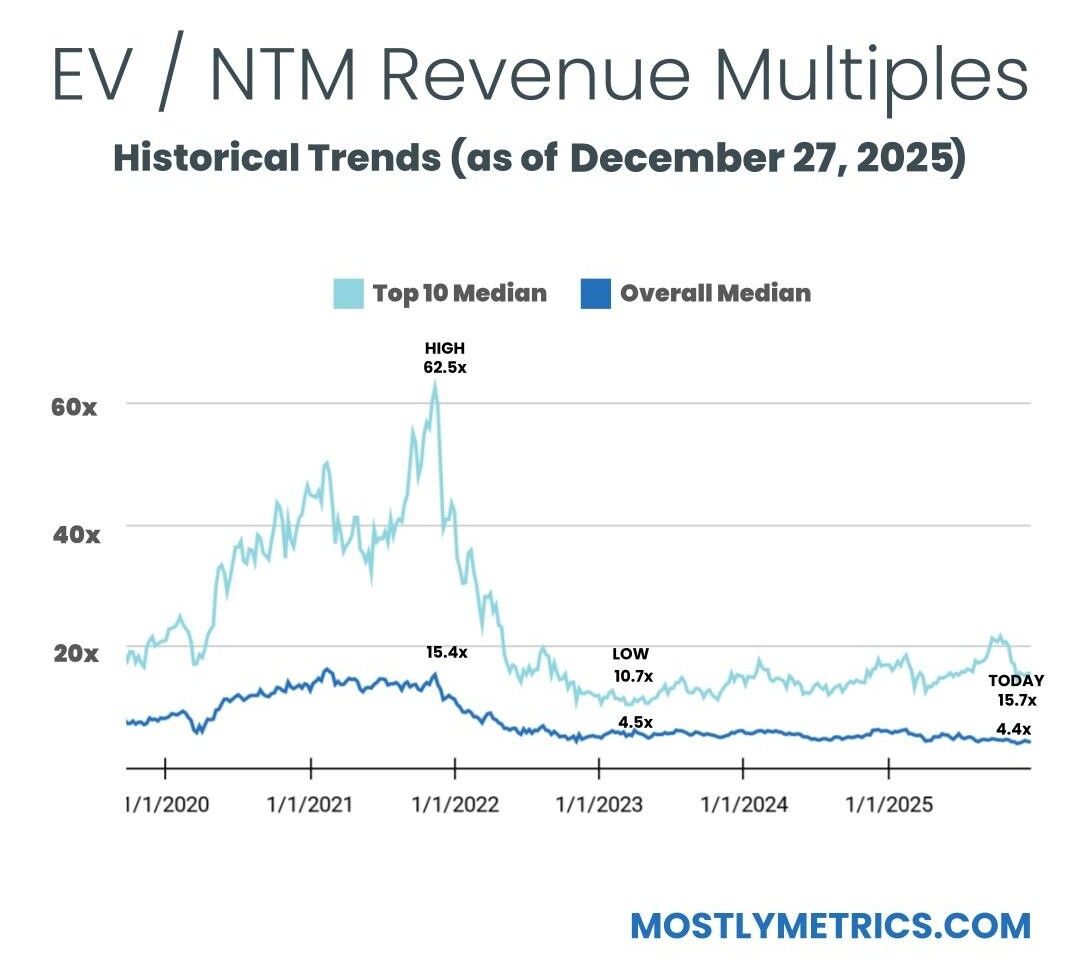

TL;DR: Multiples are FLAT week over week. The overall median is hovering around 4.5x.

Top 10 Medians:

EV / NTM Revenue = 15.7x (UP 0.1x w/w)

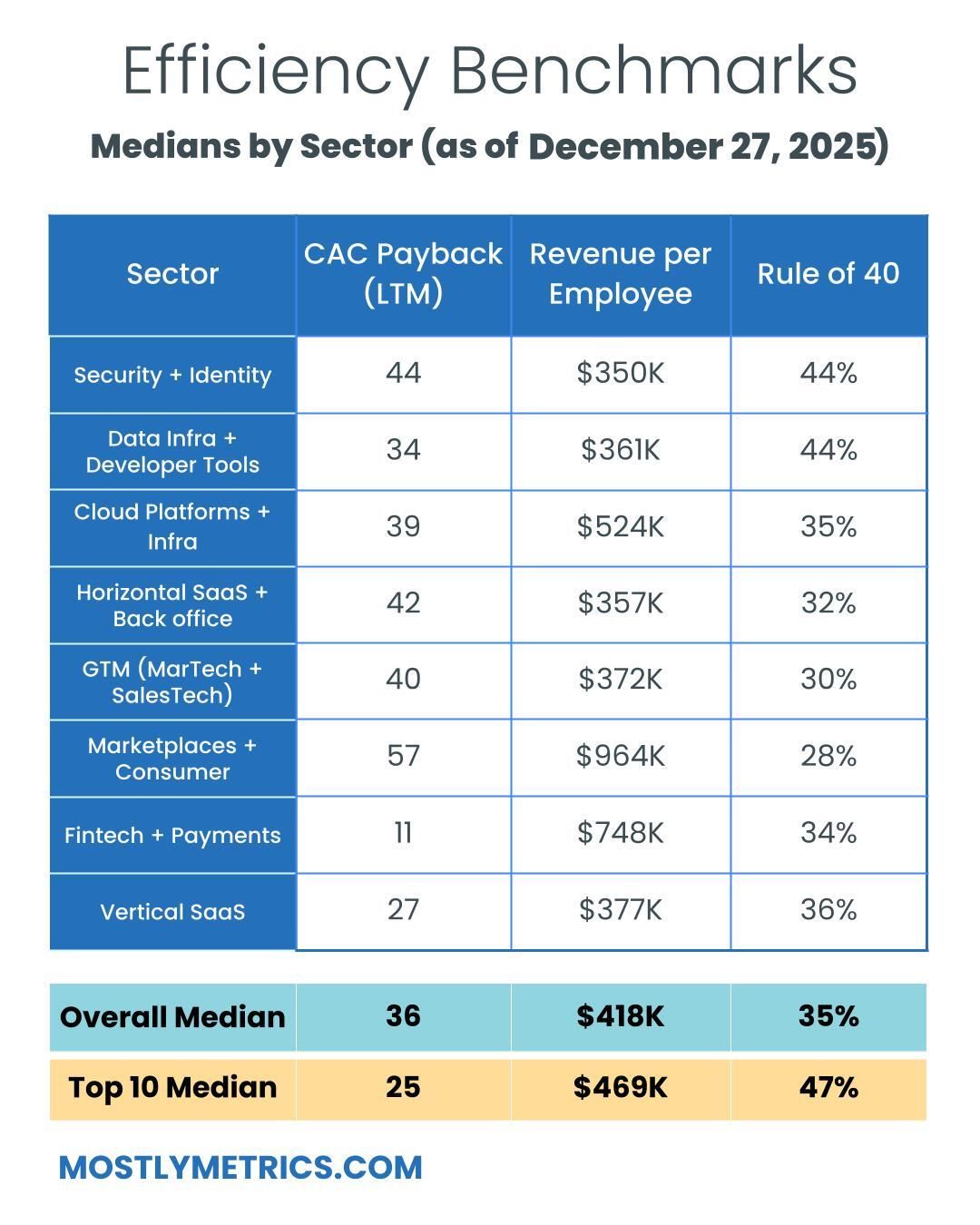

CAC Payback = 25 months

Rule of 40 = 47%

Revenue per Employee = $469k

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 147

Recent changes

Added: Navan, Bullish, Figure, Gemini, Stubhub, Klarna

Removed: Olo, Couchbase

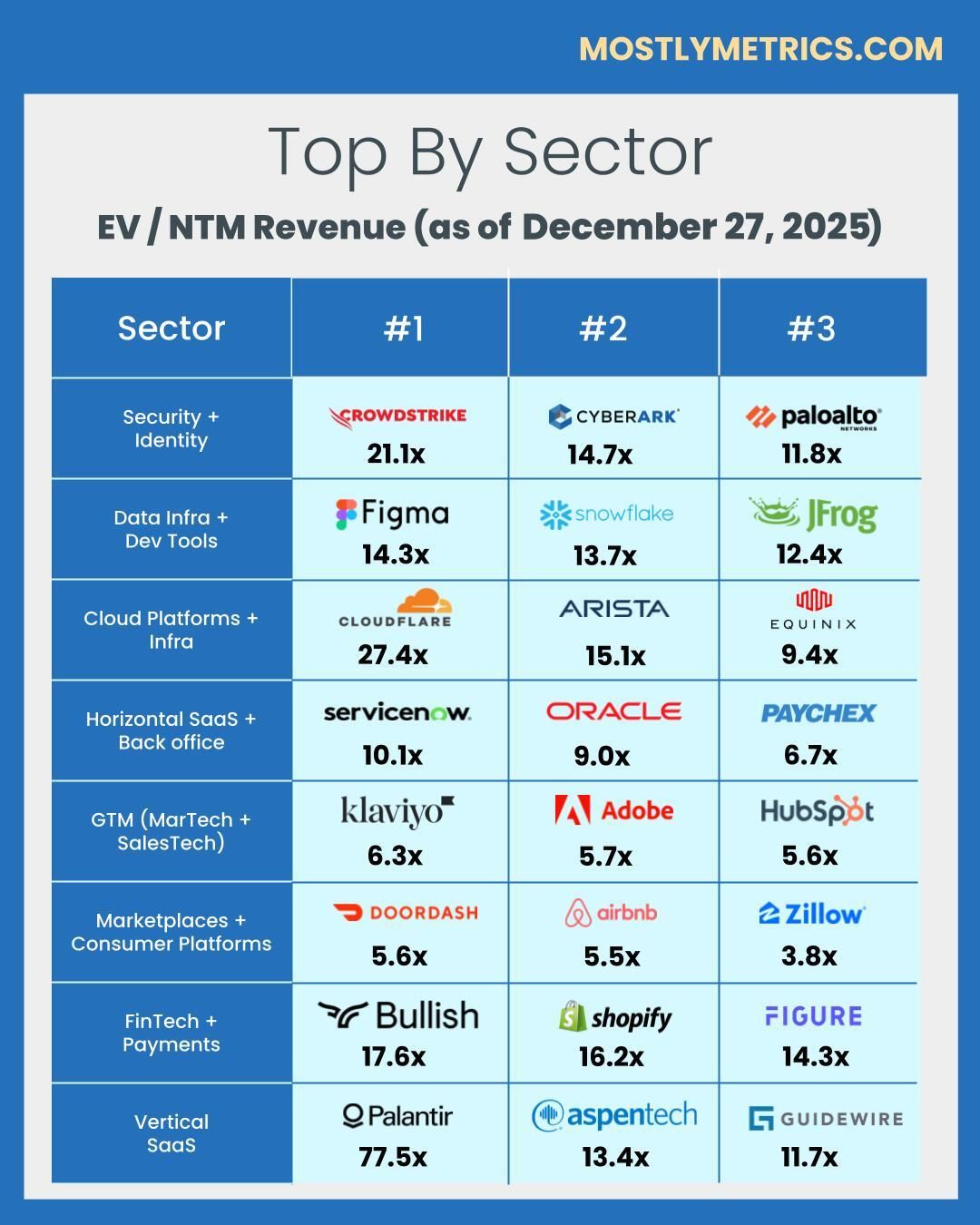

Population Sizes:

Security & Identity = 17

Data Infrastructure & Dev Tools = 13

Cloud Platforms & Infra = 15

Horizontal SaaS & Back office = 20

GTM (MarTech & SalesTech) = 19

Marketplaces & Consumer Platforms = 18

FinTech & Payments = 28

Vertical SaaS = 17

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Sales and Marketing costs are measured on a TTM basis, but lagged by one quarter (so you skip a quarter, then sum the trailing four quarters of costs). This timeframe smooths for seasonality and recognizes the lead time required to generate pipeline.

Revenue is measured as the year-on-year change in the most recent quarter’s sales (so for Q2 of 2024 you’d subtract out Q2 of 2023’s revenue to get the increase), and then multiplied by four to arrive at an annualized revenue increase (e.g., ARR Additions).

Gross margin is taken as a % from the most recent quarter (e.g., 82%) to represent the current cost to serve a customer

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

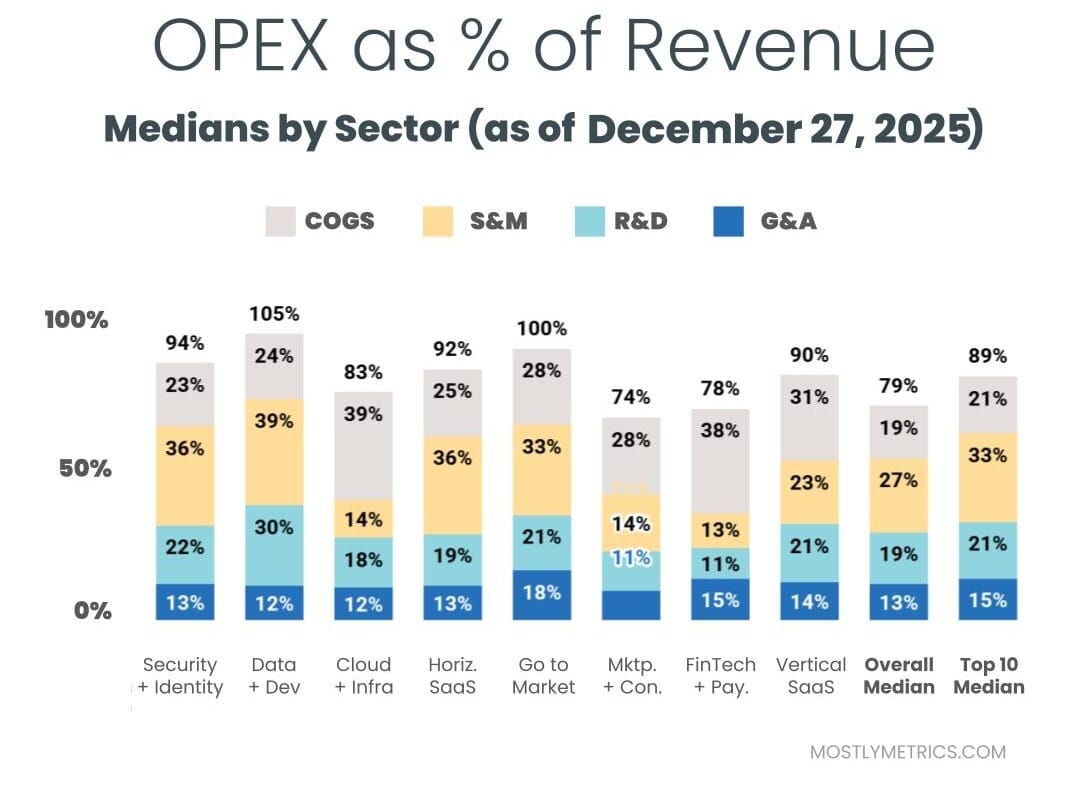

OPEX

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.

Please check out our data partner, Koyfin. It’s dope.

Wishing you a CAC Payback period that cooperates with the laws of physics,

CJ