A messy or missing cap table might not just slow you down, it could cost you your next fundraising round.

VCs get flooded with pitches, and if your equity is confusing or missing, they’ll move on fast.

Fidelity Private Shares is an all-in-one equity management platform that helps you maintain a clean cap table, an organized data room, and a clear equity story.

a live look into the writing of this piece. my editor is loud, gassy, and full of strong opinions.

What’s the “Lead Left” Banker in an IPO Process?

As the explore in John Wick 2,

“He who is furthest left, with the largest Helvetica font, gets the most money.”

The “Lead Left” banker is called such because they are literally on the top row, on the far left, of the IPO cover.

They are “in charge” of the overall process, quarterbacking the launch amongst the management team, legal teams, auditors, and slew of other banks. They dedicate the most resources and bear the greatest reputational risk if it flops.

A quick refresher: with today’s securities laws you can’t offer primary shares to the public without a registered bank. The bank takes on the legal burden of registering the shares with the SEC and quite literally “underwriting” them (meaning if hypothetically no one showed up to the yard sale, they would be left holding the bag).

I’m over simplifying this, as the bank would never allow that to happen. That’s why they set the price after they’ve lined up buyers (i.e., have built the book…) Another reason why IPOs are priced to be massively oversubscribed.

In a direct listing, which can technically be done without an investment bank (and their fees), only secondary shares are offered. That means the cap table incurs no dilution and existing shares (those of current investors and employees) change hands.

For companies raising more than a billion dollars, the banks typically charge an aggregate fee of 4% to 5% (it’s all negotiable). For IPOs raising less, say sub $500M, the fees can stretch into the high single digits (7% to 8%).

I took a shot at what banks made this year on IPOs:

Total Raised includes both primary and secondary. Based on company filings.

To use Reddit in 2024 as an example, Morgan Stanley secured the coveted lead left spot.

I remember this being a big deal (no pun intended), as it broke the post COVID IPO winter and many a banker had second families to feed.

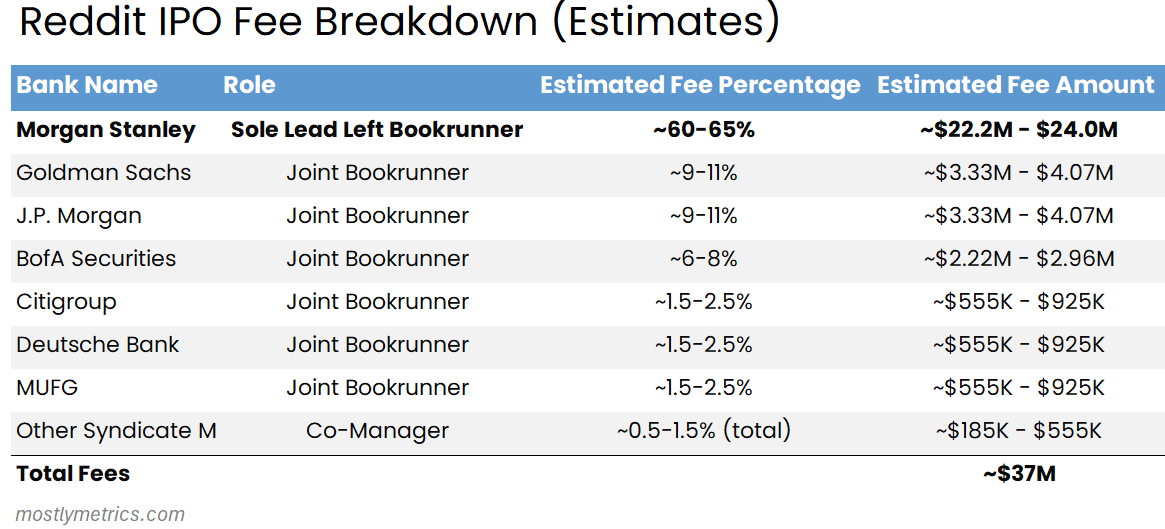

Reddit’s IPO raised $748M, comprised of $519M in primary and $229M in secondary proceeds. The banks get paid on both the primary and secondary shares sold (or the entire $748M) because they are facilitating all sales. And in this deal they received just under 5% in fees, or a total of $37M for the offering.

The group of banks, which in more formal mob parlance, is called a “syndicate”. And what would banker’s fees be without fees buried inside the fees?

Within that ~5% fee, there are portions allotted for different responsibilities.

Management fee = 20% (all to the lead left)

Underwriting fee = 20% (most to lead left)

Selling concession = 60% (split up based on share allotments)

The exact commission by individual bank isn’t publicly available, but here’s an industry best guess estimate of how it may have been split up for Reddit:

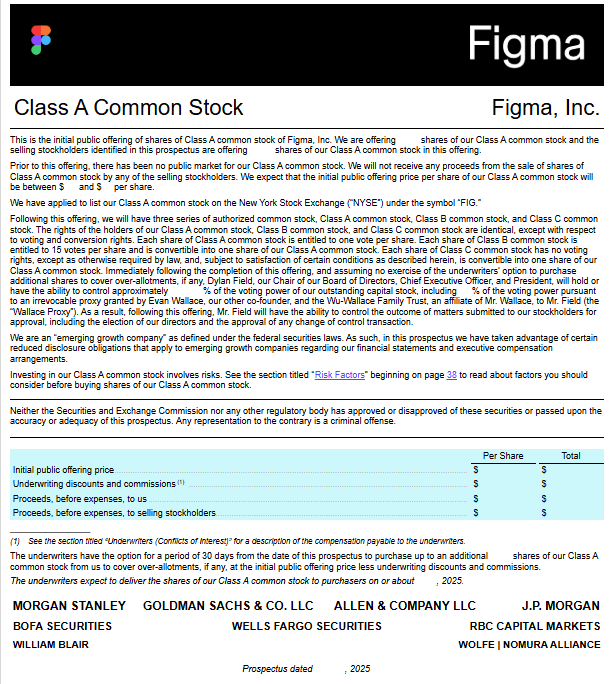

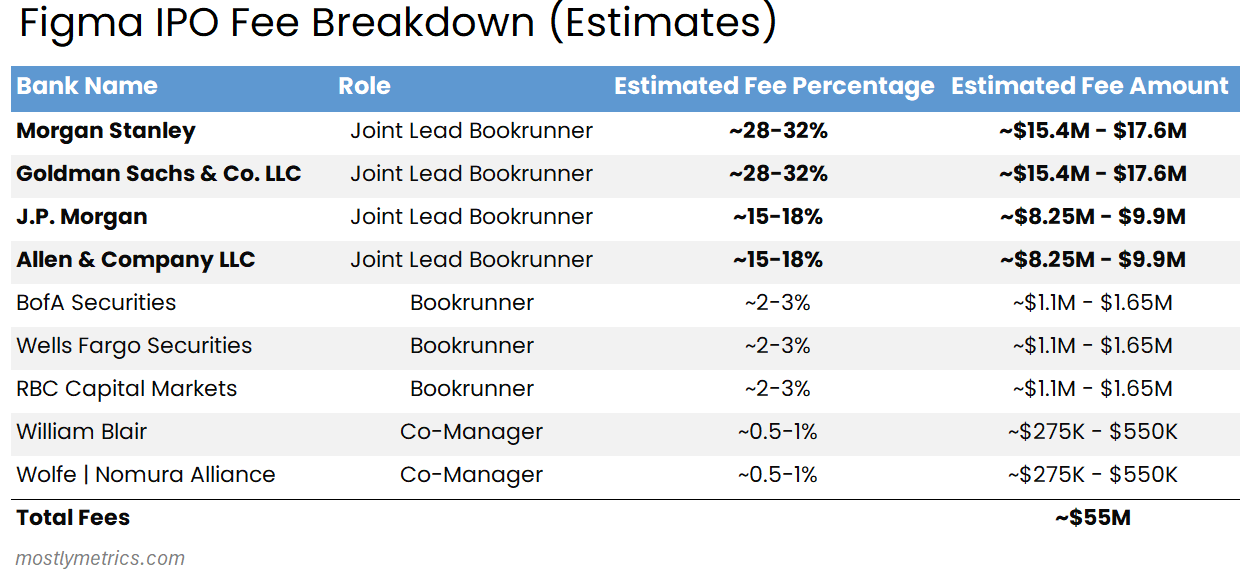

Notably, in recent years we’ve shifted from a “single lead left” to a “joint lead” model for larger IPOs. Figma is a great example. This IPO had FOUR lead book runners. That means that Morgan Stanley, Goldman, Allen & Co, and JP Morgan split the bulk of the proceeds (and left the Snicklefritz for the likes of Wells Fargo and William Blair).

The 4 Horsemen

Figma raised $1.2 billion. $400M of that was primary proceeds (it goes on the balance sheet for the company to hire more people, buy shit), and $800M was linked to existing early investors selling portions of their positions (Index, Greylock, Sequoia, Kleiner Perkins).

The banks received 4.5% commission on the entire $1.2 billion amount, or $55M.

My best guess on how it went down

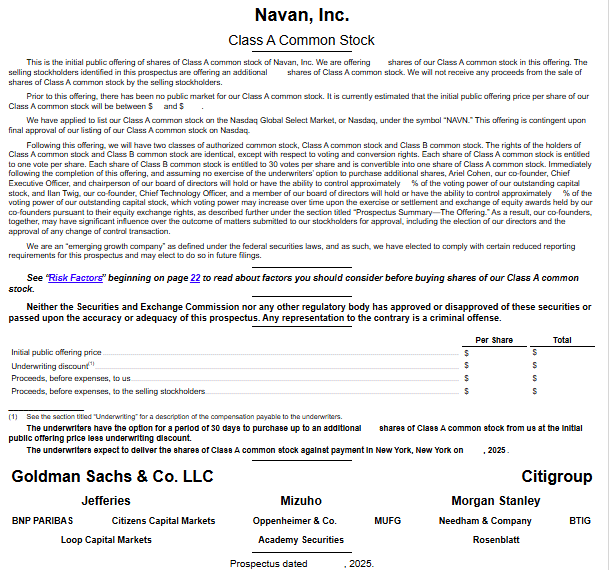

Navan is another IPO that was co-led, this time with Goldman and Citi at the helm.

It’s important to remember that an IPO is the most lucrative product a bank can sell you. That’s why the courting process starts years beforehand. In Reddit’s case, Morgan Stanley had been working with the company across multiple products and advisory services since 2018. And they designed a bespoke way for Reddit to direct shares to moderators and users of the platform. They played a six year long game heading into 2024.

There’s also some unofficial horse trading that goes on. Say you are the company IPO’ing and you sell something that banks could buy - like a security product or development tool. It’s hard to imagine that Goldman’s developers are not using Figma.

As Ben Affleck’s character Chuckie Sullivan remarks in Good Will Hunting:

"Your situation would be improved if I had $200 in my back pocket. And an order form for 10,00 licenses. And a venture debt facility with attractive pricing.”

And it goes both ways. The company wants to have adequate sell side coverage once they are public. And the banks that do the best on the buy side are not always the same that do the best on the sell side. Their willingness to provide sell side research coverage post IPO would be a lot higher if they could make a million bucks by being on the third row of the cover as a co-manager.

None of this would ever be in writing, but you understand how share of wallet plays into the picture. IPO negotiations are really a series of a hundred other micro negotiations.

Last Year and This Year

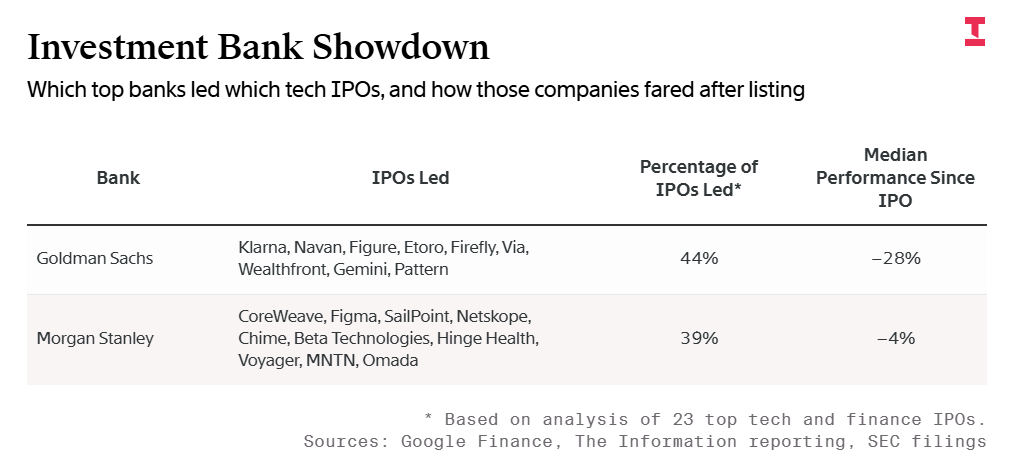

In 2025, Goldman Sachs and Morgan Stanley took the cake. They participated in almost all major IPOs, and made a lot of money.

And you best believe the contest for OpenAI’s IPO in [2026? 2027] began years ago. It could be the largest IPO ever, as the company incinerates capital and will be raising an ungodly amount at potentially a trillion dollar valuation.

As Cory Weinberg from The Information reports:

“Goldman Sachs has recently been close to OpenAI, and the bank advised OpenAI on its restructuring from a nonprofit earlier this year.

Sarah Friar, OpenAI’s CFO, is a former Goldman equity research analyst.

Morgan Stanley, meanwhile, has courted OpenAI from its early days and signed on as one of its first clients, as well as collaborating with OpenAI to build products for Morgan Stanley’s research and wealth management team.”

With Anthropic and SpaceX also contemplating takeoff (punches self in face) 2026 might shape up to be the year of fees. Someone tell Porsche of Greenwich to get the showroom ready.

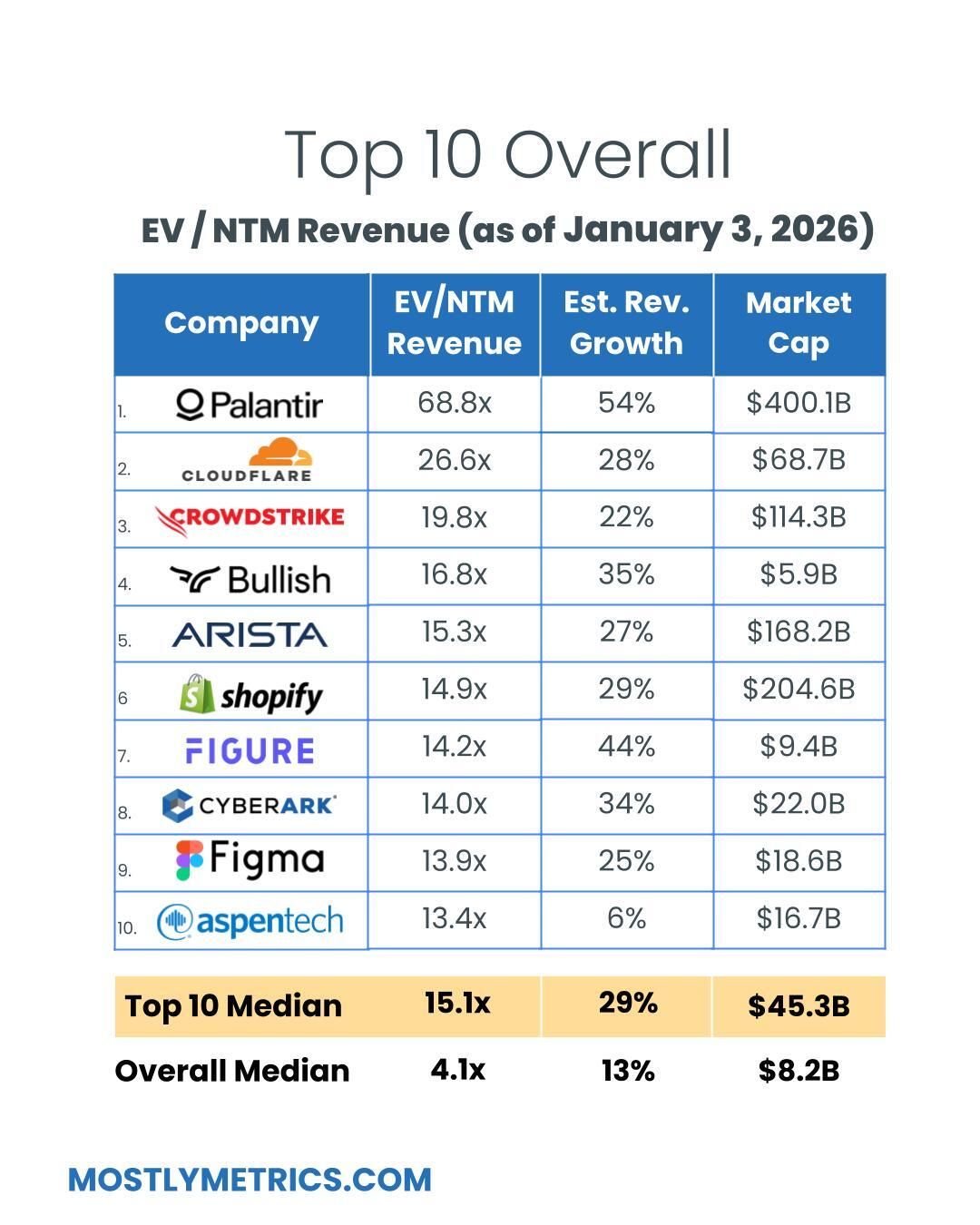

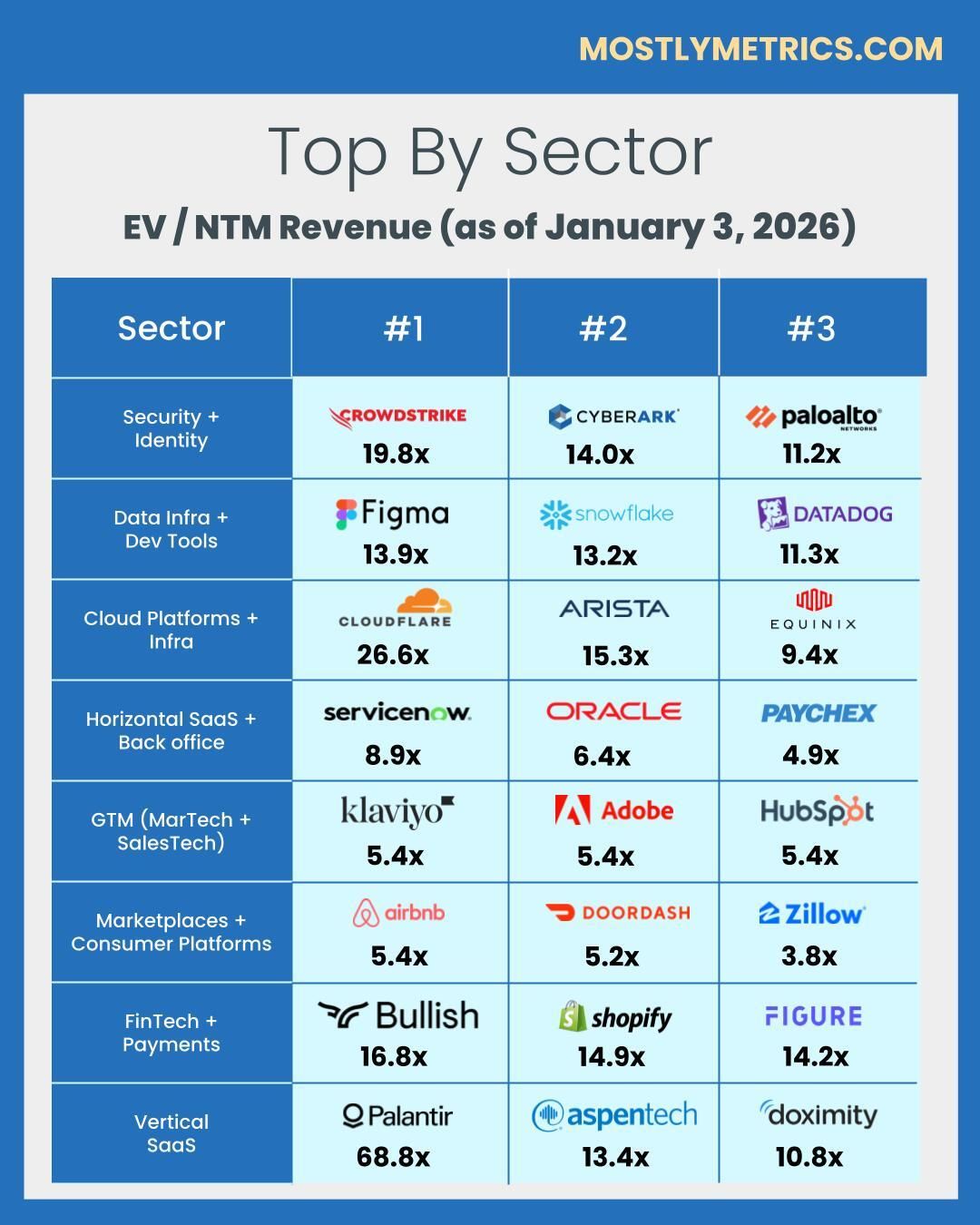

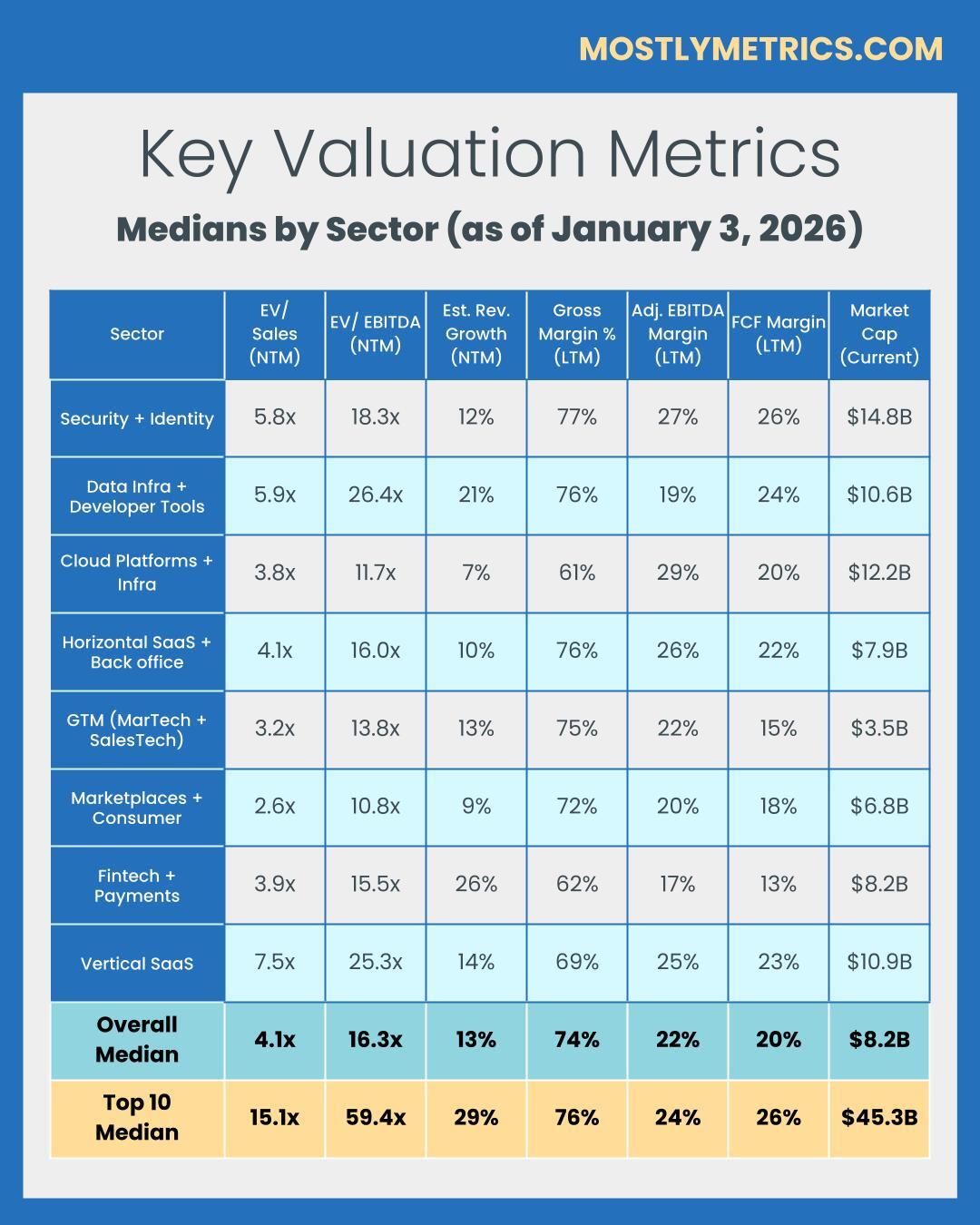

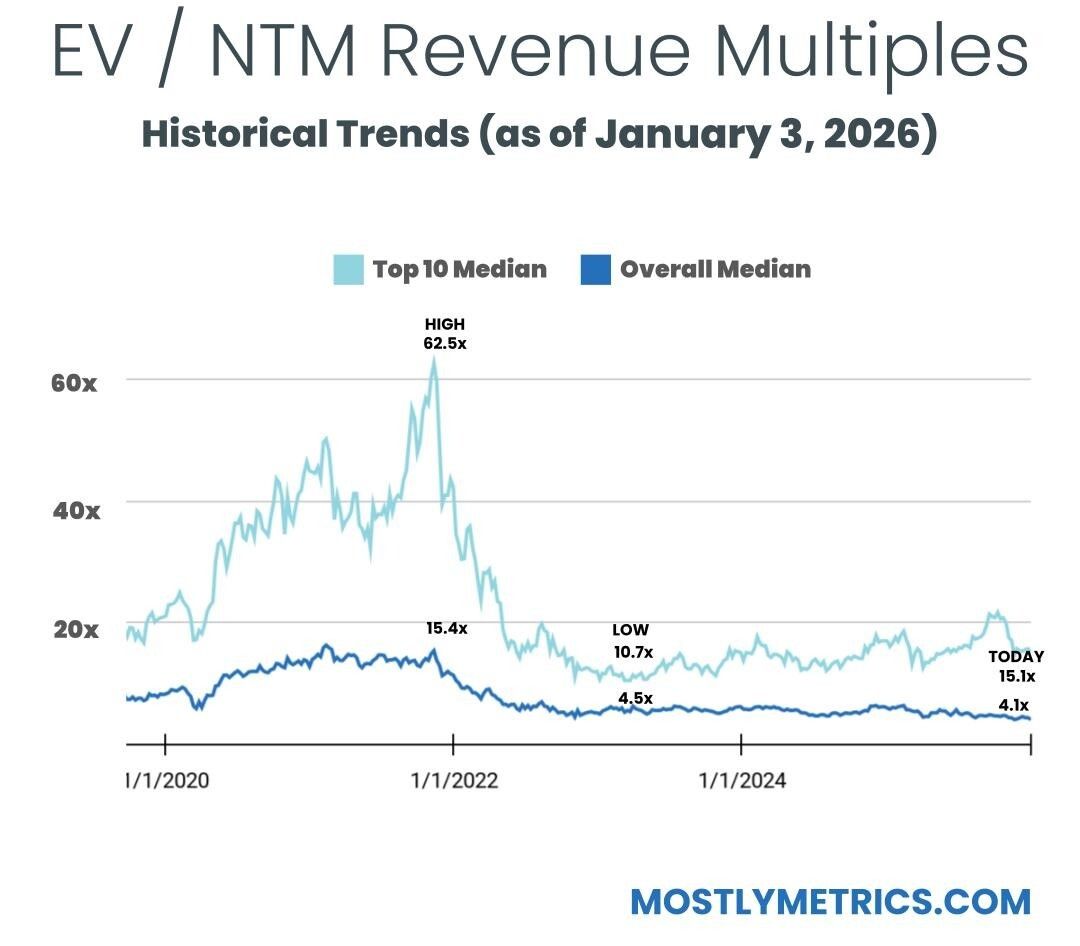

TL;DR: Multiples are DOWN week over week. The overall median is hovering around 4.1x.

Top 10 Medians:

EV / NTM Revenue = 15.1x (DOWN 0.6x w/w)

CAC Payback = 25 months

Rule of 40 = 45%

Revenue per Employee = $601k

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 145

Recent changes

Added: Navan, Bullish, Figure, Gemini, Stubhub, Klarna, Figma

Removed: Olo, Couchbase, Dayforce, Vimeo

Population Sizes:

Security & Identity = 17

Data Infrastructure & Dev Tools = 13

Cloud Platforms & Infra = 15

Horizontal SaaS & Back office = 19

GTM (MarTech & SalesTech) = 18

Marketplaces & Consumer Platforms = 18

FinTech & Payments = 28

Vertical SaaS = 17

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Sales and Marketing costs are measured on a TTM basis, but lagged by one quarter (so you skip a quarter, then sum the trailing four quarters of costs). This timeframe smooths for seasonality and recognizes the lead time required to generate pipeline.

Revenue is measured as the year-on-year change in the most recent quarter’s sales (so for Q2 of 2024 you’d subtract out Q2 of 2023’s revenue to get the increase), and then multiplied by four to arrive at an annualized revenue increase (e.g., ARR Additions).

Gross margin is taken as a % from the most recent quarter (e.g., 82%) to represent the current cost to serve a customer

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

OPEX

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.

Please check out our data partner, Koyfin. It’s dope.

Wishing you a lead left banker who leads you to a day 1 pop,

CJ