Mostly metrics is proudly powered by Brex

As a CFO, I've always hated how much of my day is choosing between control and speed.

You either get real-time visibility or you get your team moving fast — never both.

My Brex card is different. Brex gives me the controls I need without slowing down important expenses, like Wally’s dog treats or Producer Ben’s cool gizmo sound things. With Brex, receipts are automated, expenses hit in real time, and categorization doesn't require three people and a spreadsheet. I can see exactly where money's going while we focus on growing the Mostly Metrics world empire (also, Sales Guy Matthew, just because you CAN expense and eat $32 of Chipotle doesn’t mean you HAVE TO).

Finance doesn’t have to slow companies down - it can and should push them forward.

See why 35,000+ global companies (and me!) use Brex to spend smarter and move faster:

Mostly Talent - Finance Recruiting

Gee wiz. I run a recruiting company now. Life comes at ya fast.

Mostly Talent is currently filling positions for a Director of Strategic Finance, Controller, FP&A Manager, and VP of IR across Series B through Pre-IPO companies. These searches move fast.

If you're hiring, work with us here.

If you're passively open to new roles, get into the ecosystem here.

How Grindr Forecasts User Reactivations

We're conditioned to think flat retention curves equal success. Get to a “flat” run rate within each user cohort as fast as possible, and keep it there. KEEP THAT LINE UP!

Grindr is evidence of a surprising reality: reactivation curves can be just as lucrative.

And we know this because they're a Rule of 77 company. Yes, you read that right. Revenue growth of 30%, Adjusted EBITDA margins of 47%. The dating app most CFOs couldn't pick out of a lineup is running circles around half the SaaS companies in their mental comp sets (yes, all CFOs have mental comp sets).

I sat down with Vanna Krantz, the CFO who took Grindr public, and she described their user base in a way that immediately broke my brain: "consistently inconsistent."

Users vanish. POOF!

They return. LET’S DATE!

They vanish again. They return again. But when they come back, they're ready to transact. Their yearly active users massively outweigh their monthly active users.

The denominator swings hard, but the motivation is always there.

That's the opposite of Disney+, where Vanna previously served as CFO. And it's really the opposite of any subscription model you've probably seen before. Grindr is an episodic, in-market product that cannot be modeled like a linear, habit-forming one.

After talking to Vanna, I realized how powerful a reactivation model can be at scale when you pair a dedicated user base with durable unit economics and thoughtful pricing. The whole conversation rewired how I think about three things:

The first question every B2C finance leader should ask: are we a retention app or an attention app? Because the model for each is completely different.

Churn isn’t a funeral if you know your users and their motivations; it may just be a quick nap.

And if you're anchoring to Monthly Active Users (MAU) and that’s the wrong timeframe, you're running the risk of allocating resourcing based on the wrong number. Yearly Active Users (YAU) may be where the real economics sit if you really know your users.

Let's get into it.

Picking Your Measuring Stick

Grindr's monthly active user count swings because people dip in and out of the product based on life moments, not a calendar. Someone might be super active for 10 days, disappear for 40, then come back when they move cities, end a relationship, or just feel like connecting again.

The MAU number itself is huge… 15.1 million average… spread across a user base generating 130 billion chats and 62 billion photos shared per year. Those are not the numbers of a product people completely forget or churn from. It’s part of their social graph. And despite churn, all the signals are growing.

But there’s a problem: when you calculate paid penetration using MAU as your denominator, it always looks like an uphill battle. Vanna called it out directly - their 8% paid penetration has a "wicked headwind" because MAU continues to grow. Reading between the lines, the business is certainly winning, but the metric makes it look like it's treading water and bleeding users at an alarming pace.

While Average MAU can serve as one indicator of platform health, it is not a primary metric by which we manage our business. Beginning with our Q4 2025 earnings report, we will shift to disclosing Average MAU on an annual basis, which reflects our approach to monitoring long-term user trends and which we believe is consistent with many of our public consumer Internet peers.

From talking to Vanna, I began to realize that Grindr doesn't lose users, but rather, loses attention temporarily. And they have enough trust in their historical cohort data that they'll recapture it later in a surprisingly predictable manner.

While Grindr monetizes through subscriptions (and ads), their underlying service is a utility for moments of high purpose. This is why using a hard retention curve makes the model lie to you.

Cohort Curves Don't Flatten… Because They're Not Supposed To

At Disney+, Vanna had the clean, sexy streaming curve: big spike, early churn, then a long flat tail propped up by new releases like The Mandalorian. You could reliably model it. You could present it to the board with limited explanation. It behaved just as you’d expect it to.

Grindr's retention curve has the opposite shape. Cohorts never "settle." Users don't graduate into stability - they cycle in and out with eerie regularity. The result looks less like a retention curve and more like a heartbeat monitor that in aggregate keeps growing up and to the right in a funky dance.

And when you inspect the seasonality, it gets even more interesting. It's a core part of the forecasting model and varies by country (because they’re in every country).

Ramadan shifts behavior every year, and it's visible in the data. This reminded me of the seasonality Snowflake sees in their forecasting in Japan during Golden Week.

The micro patterns repeat globally. As Vanna said, users "tend to behave similarly by season."

And to complicate matters, their investor deck cites a stat I can't stop thinking about: at any given moment, 27% of weekly active users are traveling. Grindr’s users are highly mobile. And travel is one of the strongest reactivation triggers in the entire ecosystem.

My takeaway is that people don't quit the app… They re-enter when their circumstances change. And their circumstances change a lot.

How Grindr Prices for Episodic Windows (And Why Weekly Plans Changed Everything)

Before we go deeper into forecasting, you have to understand something fundamental about Grindr's pricing: it isn't built for retention. It's built for bursts.

They matched their pricing model to user behavior.

Most subscription companies optimize around monthly or annual plans. Grindr went rogue and introduced a weekly premium tier, and it turned out to be one of their most powerful revenue levers.

Here's the context.

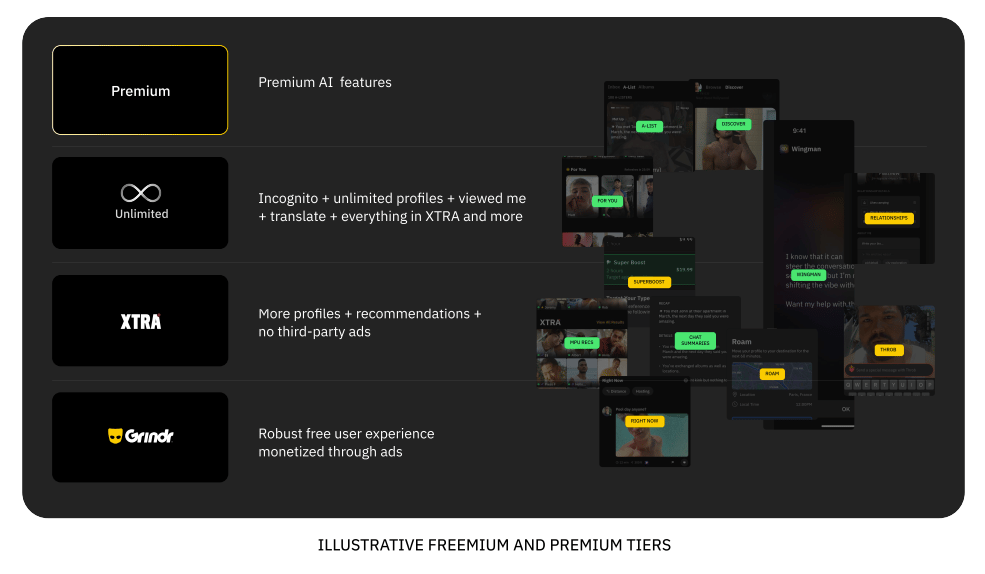

92% of users are on the free tier. They are monetized through advertising and hopefully upgrade to a paid subscription at some point.

Only about 8% convert to paid.

So monetization has to align with short windows of intense need, rather than a monthly subscription cadence.

When Vanna joined, the cheapest paid plan was the standard monthly at $19.99 (the equivalent of a cocktail in New York, as they put it). But the team realized a huge percentage of users don't need or want a full month of premium features. They need it for a weekend trip. A few high-intent days. A breakup. A move to a new city. A quick reactivation window.

So they tested a weekly offer at $12.99. Same premium features, with a smaller time commitment and lower psychological hurdle.

Demand exploded.

And here's the counterintuitive part: users didn't downshift into cheaper plans. They converted more frequently, and often renewed again the next week or month. It was like Grindr was double dipping.

Vanna confirmed as much on the Q1 2024 earnings call:

"Our app offers immediacy to our community. And therefore, the weekly proposition has really followed that intent and major use case. We have not found the level of cannibalization that I might have expected. And in fact, a reactivation rate which we've been absolutely able to track now over the one-year period is extremely healthy."

Weekly plans meant more paying users and higher ARPU.

Why a Cheaper Plan Makes ARPU Go Up

In most SaaS models, lower price equals lower ARPU. Full stop. In purpose-driven businesses, lower price equals higher willingness to convert during motivated moments.

A user who pays $12.99 one week, leaves, then returns two more times that month is more valuable than a user who never commits to $19.99 upfront. Instead of ~$20 they make between ~$26 and ~$39 in high intent months.

While a monthly subscription optimizes for habit a weekly subscription optimizes for need. And when need is episodic but intense, weekly wins every time because the pricing curve is relatively inelastic.

How This Sets Up the Forecasting Model

The pricing architecture reinforces everything about Grindr's reactivation thesis. Users come back in bursts, so you sell them bursts. Monetization should therefore spike at peak demands, rather than drip neatly over time. When you step back, you start to realize that activity windows are revenue windows. And you can optimize pricing to meet the moment, not the month.

You don't forecast "recurring subscription revenue" at Grindr. You forecast recurring reactivation revenue. And weekly pricing is the clearest expression of that strategy.

We're conditioned to chase flat retention curves. But depending on your business model, Grindr's EBITDA chart suggests it can be OK to chase (and forecast) something else entirely.

Run the Numbers Podcast

In this episode of Run the Numbers, I sat down with Vanna Krantz, former CFO of Disney+ and Grindr, to explore what it takes to lead finance through massive inflection points.

Vanna reflects on building Disney+’s subscription model from scratch under Bob Iger’s leadership and the pressure of launching a global product with no precedent.

Shifting to Grindr, Vanna breaks down how the company went public with remarkable efficiency (boasting 40% EBITDA margins and under 200 employees) and how she modeled for a user base that consistently churns and returns.

She also opens up about career longevity, work-life balance, and helping women find sustainability and acceleration in leadership.

Looking for Leverage Newsletter

Don’t Waste the All-Hands

How to Explain Company Results to Your Employees (in a way that doesn't suck)

The company all hands, or town hall, is underutilized air time. If you think about it, it’s the most expensive hourly meeting you have as a company.

And yet… Most finance leaders treat it like a metrics death march through hell. Here's the quarter. Here are the numbers. Here's the forecast. Any questions? No? Great, back to the coal mines.

That's a missed opportunity.

You have the floor. You have the attention. And you're sitting on context nobody else has. You know which customers are actually profitable. You know why the board keeps asking about that one pipeline metric. You see the cash balance every morning.

Engineering doesn't have that. Sales doesn't have that. Marketing definitely doesn't have that.

So don't waste the airtime reading numbers off a slide they could've skimmed in an email. Your job is to weave financial context into their weekly activities.

Here are five ways to make that time count.

Wishing you align your user retention and pricing strategies,

CJ