A messy or missing cap table might not just slow you down, it could cost you your next fundraising round.

VCs get flooded with pitches, and if your equity is confusing or missing, they’ll move on fast.

Fidelity Private Shares is an all-in-one equity management platform that helps you maintain a clean cap table, an organized data room, and a clear equity story.

But who holds the budget?

One of the biggest unlocks in my finance career was getting better at describing who bought our products.

Who was at the other end of the sales process?

What decision making authority did they have?

What “type” of budget was it?

And, in excruciating detail, how do they access the money in their company bank account so it could moonwalk over into ours?

Knowing how to communicate this leveled up my interactions with investors by an order of magnitude.

I know there are a bunch of sophisticated sales methodologies out there… MEDDIC and MEDDPICC and a few others that sound like a late night infomercial that cures gout. This is not a drunken attempt at describing a sales strategy to finance folks. This is about financial story telling, and the gravitational pull the budget holder has on your company narrative.

Today we’re talking about how Samsara talks about budget holders (very meta).

In this piece I want to tease out how one of the best does it in an effort to help younger, smaller companies who may still be finding their story-market-fit (I think I just made up a new term, YOLO).

Real quick context - Samsara is the system of record for the world of physical operations. Industries like construction, energy, oil, gas, transportation, field services, etc. Those industries make up about 40% of global GDP. They're really large and still use a lot of manual processes.

Samsara has a full-stack IoT (internet of thangggs) solution that slaps sensors on physical assets (trucks, tools, equipment) and pulls data off of them. Then they use AI to surface insights that help customers save on fuel, maintenance, labor, and insurance.

Their ICP is a safety leader, sometimes an ops exec, sometimes the company owner. It’s the person whose budget goes kaboom when things break.

And Samsara is crushing it. They’re doing nearly $2B in ARR and growing ~30% year-over-year. You’ll regularly see them in the top ten for revenue multiples that we track each week below.

I listen to a lot of earnings calls. Sometimes I'll scribble down a term when I think, "Oh, wow, I've got to figure out how to use that when I describe a business I’m analyzing or pitching my own."

I was listening to CFO Dominic Phillips on an earnings call when he emphasized:

“We’re selling into non discretionary operations budgets.”

That’s when my Spidey senses went up. What does that packet of cool sounding words mean…

So when he came on my podcast, I asked him. He explained:

“We talk about selling into the operations budget. And for these physical operations customers, on average, they spend 80% of revenue on their operations budget. All of their frontline workers, all of their assets, all of their vehicles, all of the money they spend on fuel and maintenance and all of their accidents and insurance, all of that, those go into the operations budget. And that's what we're attacking.

As I said, this is really a big ROI sale. And so if we can go into this really large budget and we can help you shave down your operating expenses by deploying our technology, even by a few percentage points, there's massive amounts of savings to be had because the budgets are so large and they're non-discretionary because they have to spend them to generate revenue.”

Jurassic park is really a two hour corporate training video about the ultimate operations budgeting miss

To tease out the important positioning points:

They’re selling to large enterprise customers that have complex physical operations.

Those budgets are massive.

Customers need to spend those budgets to make money.

There’s a lot of upside in an account once you prove ROI.

That’s a good spot to be.

But here’s where we go Inception level.

I asked why he emphasized the term non discretionary:

“This is my storytelling attempt at really trying to create a little separation from Samsara and some of the traditional SaaS companies that, again, are either tied to seat-based pricing or are tied to IT budgets where maybe those budgets are a little bit more discretionary.

All of those kinds of phrases and words that I'm using in the earnings call are intended to make that very apparent to investors so that they keep us in the same high growth software bucket, but maybe not in terms of the potential risks that some of these other businesses are facing.”

The way in which he describes the budget holder allows the company to benefit from the secular tailwinds of an industry, while insulating itself from many of the inherent risks.

For the finance leaders at younger companies, you can add this to your toolkit. It’s a really cool way to pitch because it allows people to quickly draw analogues (jump starting their mental models), while also describing how you’re even better off.

Make the Budget Holder the Hero of the Story

The budget holder is the hero of your company financial story. You are arming them with solutions that allow them to do their job better and [make more money, avoid more cost, hire people faster…]. And that’s why they (happily) pay you.

Describing the budget holder in a contemplated manner credibly shows investors:

You’ve located a large pool of money that sits with a specific group of users

You understand what metrics this person uses to evaluate ROI, as well as the person (usually a CFO or CIO) who helps them access that budget

You’ve confirmed which internal channels they go through to get said money out

You know that if you prove the value, they're going to keep spending with you.

“That's right. If it's very large and they absolutely are going to spend this money on things that are going to drive revenue and you're going to help them directly save money on that budget and it's quantifiable.”

Yes, business is “art” and there is “strategy”, but a big component is just flat out knowing the characteristics of who’s buying, maniacally serving their needs, and tailoring your narrative accordingly.

If you were selling to Jurassic Park, you’d want to know that Dennis Nedry was the only IT guy on payroll, and that Hammond was too cheap to invest in basic cybersecurity or access controls.

While they spared no operational expense on velociraptor padlocks, 2FA was out of the question. So they might not be in market for what you’re selling.

Run the Numbers Podcast

This was an absolute treat. Dominic joined me on the RTN podcast to talk about:

The stamps he earned on his CFO passport in route to the chair

How Samsara forecasts the business on a monthly and quarterly basis

The metrics he uses to describe the business

How relying upon sell side investors for feedback is a total life hack

An amazing story about meeting Marc Andreeson

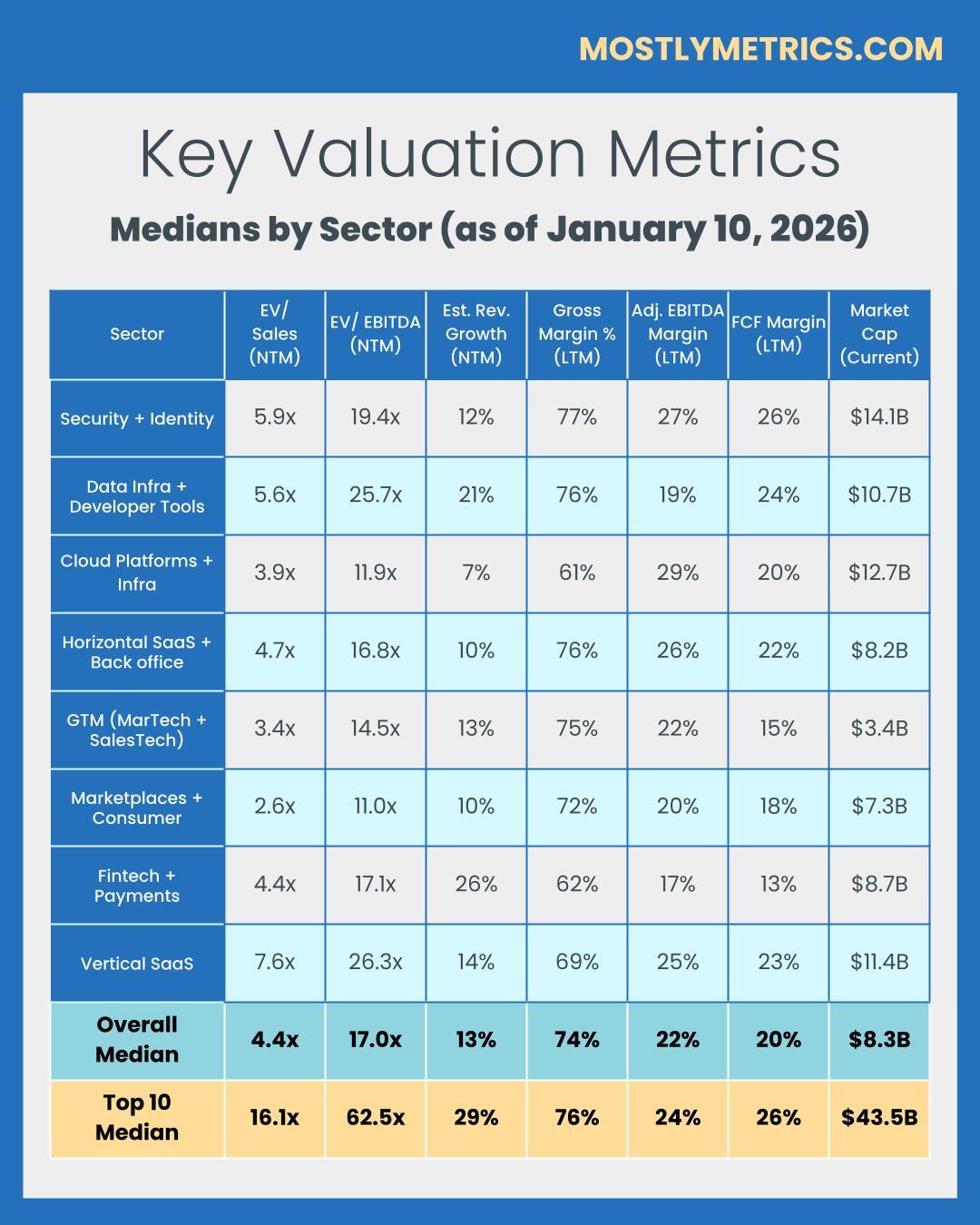

TL;DR: Medan Multiples are UP week over week.

The overall tech median is 4.4x (UP 0.3x w/w).

What Great Looks Like - Top 10 Medians:

EV / NTM Revenue = 16.1x (UP 1.0x w/w)

CAC Payback = 25 months

Rule of 40 = 44%

Revenue per Employee = $601k

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 146

Recent changes

Added: Navan, Bullish, Figure, Gemini, Stubhub, Klarna, Figma

Removed: Olo, Couchbase, Dayforce, Vimeo

Population Sizes:

Security & Identity = 17

Data Infrastructure & Dev Tools = 13

Cloud Platforms & Infra = 15

Horizontal SaaS & Back office = 19

GTM (MarTech & SalesTech) = 18

Marketplaces & Consumer Platforms = 18

FinTech & Payments = 28

Vertical SaaS = 17

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Sales and Marketing costs are measured on a TTM basis, but lagged by one quarter (so you skip a quarter, then sum the trailing four quarters of costs). This timeframe smooths for seasonality and recognizes the lead time required to generate pipeline.

Revenue is measured as the year-on-year change in the most recent quarter’s sales (so for Q2 of 2024 you’d subtract out Q2 of 2023’s revenue to get the increase), and then multiplied by four to arrive at an annualized revenue increase (e.g., ARR Additions).

Gross margin is taken as a % from the most recent quarter (e.g., 82%) to represent the current cost to serve a customer

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

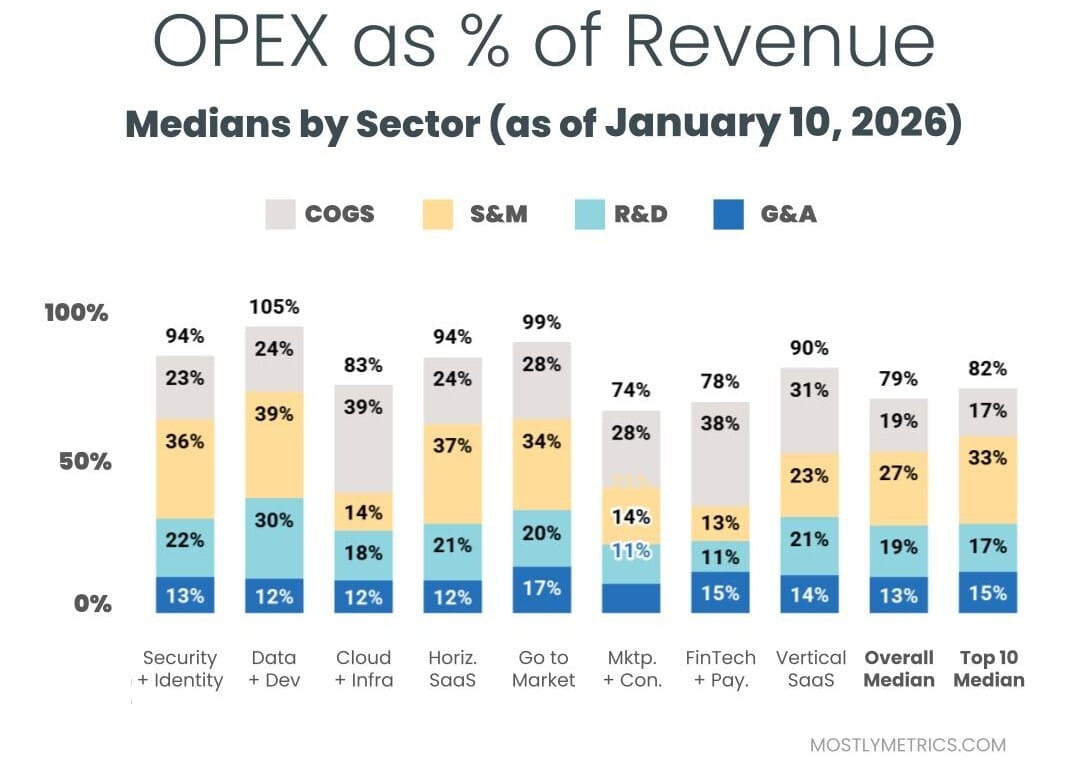

OPEX

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.

Please check out our data partner, Koyfin. It’s dope.

Wishing you a lead left banker who leads you to a day 1 pop,

CJ