Mostly metrics is proudly powered by Brex

As a CFO, I've always hated how much of my day is choosing between control and speed.

You either get real-time visibility or you get your team moving fast — never both.

My Brex card is different. Brex gives me the controls I need without slowing down important expenses, like Wally’s dog treats or Producer Ben’s cool gizmo sound things. With Brex, receipts are automated, expenses hit in real time, and categorization doesn't require three people and a spreadsheet. I can see exactly where money's going while we focus on growing the Mostly Metrics world empire (also, Sales Guy Matthew, just because you CAN expense and eat $32 of Chipotle doesn’t mean you HAVE TO).

Finance doesn’t have to slow companies down - it can and should push them forward.

See why 35,000+ global companies (and me!) use Brex to spend smarter and move faster:

The Life of a Professional Number Two

I’ve fully embraced the identity of “the guy behind the guy” throughout my career.

Totally cool with Robin moniker, just don’t know why I gotta wear these weird underpants

The first time I took on a key supporting role was as Chief of Staff to the CEO. Doing that job well allowed me to transition into an FP&A leadership role, where I served the CFO on a daily (hourly) basis. And doing that job well allowed me to get to the CFO seat myself.

As a CFO, in the majority of investor, customer, and employee interactions, I found myself playing the Robin to the CEO’s Batman. More specifically, I was the secondary communicator.

The CEO talks, the room watches, and you're there to listen, augment, and occasionally save the day without blowing up their spot.

Ken Stillwell of Pega Systems has been a professional number two since his late twenties, as a CFO and COO across VC-backed, PE-backed, and public companies. I wanted to know what he's learned about communication from that seat.

The Listening Advantage

When you're the number two, the eyes and ears in the room aren't on you. You're second banana.

And that's an unfair advantage.

The CEO is performing. They're thinking about what they're saying, how they're saying it, reading faces, adjusting in real-time. It's a lot of cognitive load.

You get to just... listen. Download. Process.

As Ken put it:

"You have the advantage of when you're not the CEO, you can watch things from a perspective of learning, hearing what's said, and processing that information."

That processing time is like information arbitrage. It's what lets you do the two things that make a number two invaluable: augment in real-time, and debrief after.

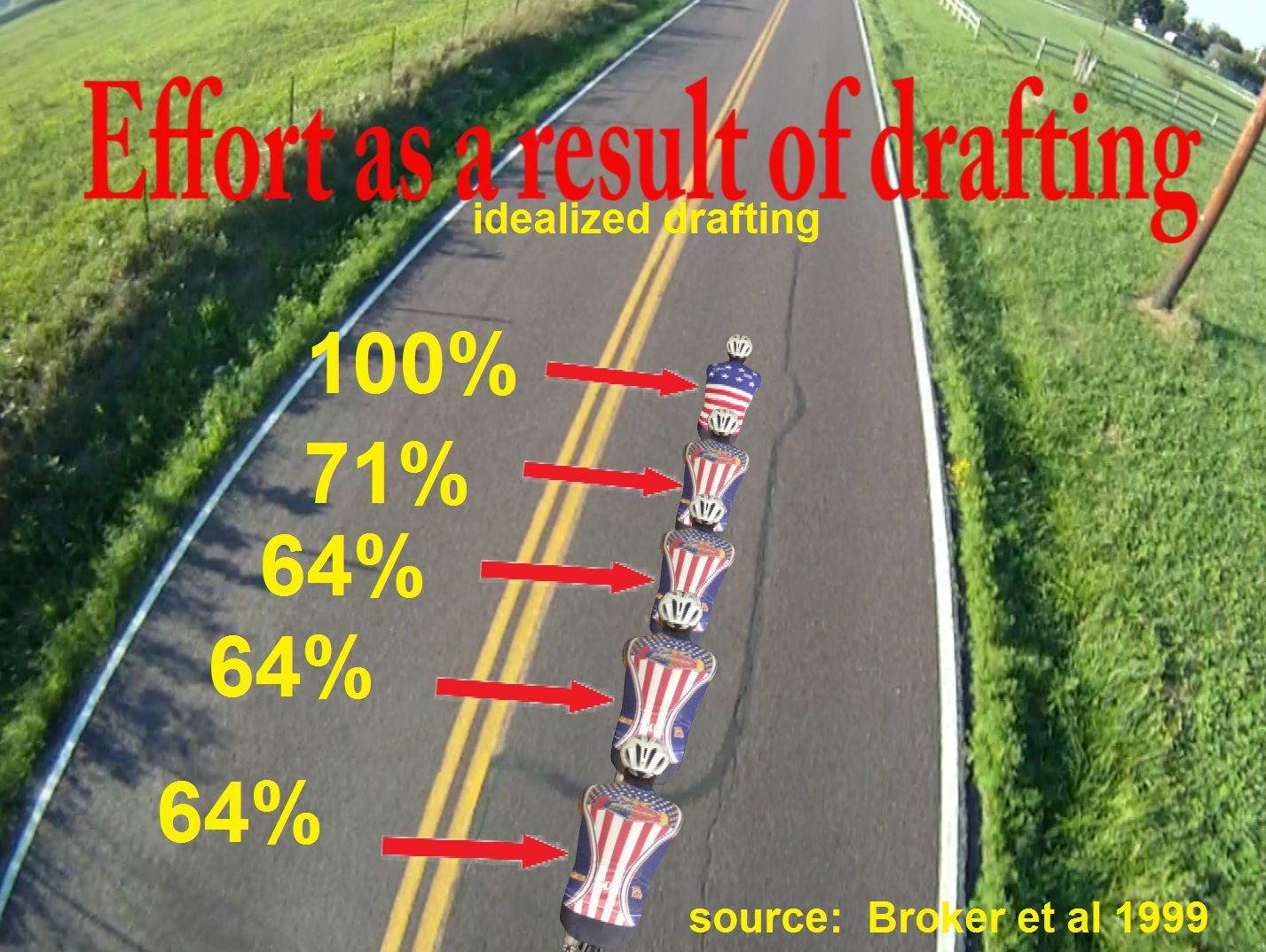

The Art of Drafting

That listening advantage pays off two ways: in the room, and after it.

In the room, your job is to draft off the CEO. Close gaps. Add color. Fill in what they missed or what didn't land.

The phrases are subtle:

"To piggyback on what Jim said…"

"That's right. And something else we've been focusing on…"

You're not correcting. You're completing. Its incremental.

Ken does this on earnings calls. Even when the CEO is reading a script Ken's seen three times, he's still listening for opportunities:

"Even sometimes when I hear our CEO reading a script as it was written, it might form an idea that I might not have thought of before, so I'll grab a pen and scratch out a paragraph and rewrite a sentence. I know our compliance teams are a little nervous because they think Ken is going to say something, but I try to give more color on what happened in the quarter."

After the room, you flip the script. Now you're the one giving feedback.

"Did you mean this, or did you mean that?"

"What someone could have heard was this, versus what I think you meant to say."

And it goes both ways. Ken's team reviews transcripts from fireside chats and investor conferences. They'll tell him what landed and what didn't:

"Our head of investor relations will come back afterwards and say, hey, you said this, but it might be interesting if you said it a little differently to hit that message."

The best duos are constantly calibrating, and scaffold their blind spots with team members who can give feedback.

Decoding the Question Behind the Question

This is the number one skill for a professional number two: figuring out what someone is actually asking.

"One of the things that executives don't do well—and you'd expect them to do it better—is they aren't always good at reading the room. They're not always good at understanding what's the question behind the question."

Investors are the worst offenders. They rarely say what they mean. Your job is to crack the code:

The words aren't always the point. They have motivations, insecurities, objections they're dancing around.

The trick is confirming you've decoded it right.

These are my go-to phrases (feel free to write them down):

"Let me play back what I heard…"

"Let me repeat what I think you meant…"

"Here's what I think is behind your question…"

You're not guessing out loud. (Don’t do that, lol..) You're giving them a chance to say "yes, exactly" or "no, what I really meant was…".

And either way, you've moved the conversation forward and now have more information.

Flying too Close to the Sun

The danger of sitting close to the sun is, well, that shit hot.

Every great number two has gotten got. A few ways I've seen it happen (and done it myself):

Monopolizing the Q&A. You assume the CEO doesn't know the answer; maybe it's a granular finance question, maybe it's something you live in daily… so you jump in… And keep jumping in…. Suddenly you've answered four questions in a row and the CEO is sitting there like a prop. Not great.

Over-correcting in real-time. There's a difference between "To add to what Jim said…" and "What Jim really meant is…" One artfully drafts. The other obnoxiously undermines.

Committing before the CEO does. A fellow exec asks for budget, or a timeline, or a yes/no in front of the room. You answer before the CEO can. Even if you're right, you've just made a decision that wasn't yours to make publicly.

Gee Willikers, Batman

The toughest part of being a number two is preparing every day like you’re the number one. Taking mental reps so you can credibly step into any situation. But continually ceding the limelight in service of a greater, collective good.

To take a step back… as a professional number two, the goal isn't to become Batman. It's to (in my best Morgan Freeman voice) make Batman look like he never needed you… even when he did.

“Tiger Global? yes this is Robin. No, sorry, Batman isn’t available right now.”

Run the Numbers Podcast

In this episode of Run the Numbers, I sit down with Ken Stillwell, CFO and COO of Pegasystems. We explore the realities of leading from the second seat.

This episode covers:

Guiding Pega through the shift from term licenses to ARR and ACV

Sales compensation best practices

The limits of KPI and benchmarking obsession

Why private equity often drives sharper execution the public markets

Looking for Leverage Newsletter

How Forecasting Changes as You Scale

"The less you do, the more you do. Let's see you pop up… That's not it at all… Do less… Ok, no, you gotta do more than that, it looks like you're boogie boarding."

This scene reminds me of the forecasting process at early-stage companies. The number of cycles I've wasted over-engineering a six-tab Excel forecast just to be 40% off—when I could have been 10% off using simple multiplication on a yellow legal pad—is more than one.

This is an analysis of what changes about your forecasting process when you are just starting out (and trying to guess your TAM) to when you’re a public company (and using your historical data to forecast earnings).

Wishing you don’t fly too close to the sun,

CJ