Free cap table template for CFOs who like to plan ahead

Even the cleanest spreadsheet can hit its limits. This free cap table template by Fidelity Private Shares can help early-stage teams track equity clearly and correctly, while setting the stage for a seamless transition to a more scalable solution when needed.

Pre-formatted for equity events (ex: SAFEs, options, dilution)

Audit-friendly and investor-ready structure

Fully editable, built for early-stage use

Easy migration to the Fidelity Private Shares (FPS) platform when you’re ready to scale

I’d like to buy my SF peeps a beer

If you’re a finance leader in the SF area, I’d love to buy you a Miller Lite or three on Thursday February 12th. I’m hosting it at an undisclosed Bay Area location, guarded by a squad of ferocious miniature Bernedoodles.

Seriously though, let’s all have a fun night of “networking” (ugh I hate that word).

RSVP below to meet fellow nerds.

“Rumors of my death have been greatly exaggerated”

In January 1954, Ernest Hemingway and his wife Mary chartered a small plane for a sightseeing tour over the Congo River in Uganda. Mid-flight, the aircraft hit a telegraph wire and crash-landed deep in the jungle near Murchison Falls.

Miraculously, the couple survived. With no rescue in sight, they spent the night in the wild, swatting away mosquitoes and sharing a flask of whiskey under the stars (Mary was a real ride or die).

The next morning, a second plane arrived to take them to medical care in Entebbe. But shortly after takeoff, that aircraft exploded in mid-air and crashed. This time, the impact looked much worse.

Newspapers around the world reported Hemingway's passing.

But nearly 24 hours later, to everyone's astonishment, he emerged from the jungle near a local village… bruised, shirtless, puffing a cigar, with a bottle of gin in one hand and a bunch of bananas in the other. "Rumors of my death," he quipped, "have been greatly exaggerated." (Source)

That's SaaS on Friday. It’s (apparently) dead.

The median EV to NTM Revenue multiple officially has a 3 handle on it.

We’ve ground down to a ten year low, and headlines are awash with eulogies for the good old days.

To put that into context, my dad's friend's concrete pouring business just sold for 3x revenue and 12x EBITDA. That's better than DocuSign.

ServiceNow was the first of Hemingway's plane crashes on Thursday:

(BTW, their retention rate actually went up to 98%)

In the words of Jamin Ball from Clouded Judgement:

"Confidence in the SaaS business model has shattered. SaaS businesses were long thought of as 'cash flow annuities.' Loose money early on, flip profitable, and then every year print cash predictably. You could then calculate the 'intrinsic value' of a SaaS business by summing the present value of every annual cash flow, with a terminal value assumption."

I’ve long ragged on the efficacy (word?) of DCF models. But that’s the mathematical expression of the confidence that was.

The fears center on retention rates (will they stay stable?) and terminal value (is everything going to zero?)

My argument, as someone who runs companies rather than invests in them, is that investors have thrown their hands up and just said this shit is too hard. I don’t want to figure it out. Which creates the big discount.

From my POV…

The bear case requires you to believe three things simultaneously:

First, that retention rates will blow up. They haven’t materially moved in the last 12 to 18 months. They are obviously down from 2021 when you could print NDRs above 140% as headcount’s skyrocketed. But to use ServiceNow as an example, their renewal rate actually went up a point to 98%.

Growth is def down. Lots of that growth was linked to those sky high NDRs. Yet most SaaS companies have stronger Rule of 40 profiles than two years ago now that they’re not losing 150% of revenue; they're just getting there using more profit points than revenue points. Which, funny enough was always the argument against SaaS… that it produced no profits. Damned if you do, damned if you don’t, I guess.

Second, that AI will be delivered through something other than SaaS. But... it's not. Anthropic sells a subscription. OpenAI sells a subscription. AI native ERPs? SaaS. AI native billing? SaaS. AI native CRMs? SaaS. And also, every vertical AI startup is a SaaS business. Maybe how you price it changes. Many a company has moved to a hybrid pricing model that combines subscription and usage. That’s a natural evolution. But to believe it all goes to zero because of AI, means you’re also betting against the primary distribution for AI.

It’s the snake eating it’s own tail!

Third, and this is the big one, that startups with no data will outcompete incumbents who have all of it.

ServiceNow has every ticket your org has ever filed. Every resolution. Every escalation path. They know how your company breaks and fixes itself.

Salesforce knows your entire customer history. Who bought, why, when they churned, what brought them back.

NetSuite has the receipts from Sales kickoff for that ridiculous bar tab in 2019.

You don't think they can build agents on that? You think these guys are incapable?

I'm not telling you to buy anything. I don't pick stocks. I run companies. I’ve spent more time in QuickBooks than pecking away at a Bloomberg.

And to that point, I've spent my career inside these systems that the market is betting against. I've seen how deep the roots go. And from where I sit, the narrative that AI kills SaaS requires you to bet against the data moats, bet against the distribution model, and ignore that retention hasn't materially cratered in the last 12 months.

That's a lot of scared money making a lot of simultaneous bets. And betting it all goes to zero because it’s hard to figure out is pretty lazy.

Investors throwing up the red flag

Hemingway walked out of two plane crashes with a bottle of gin and a cigar. SaaS will be fine.

“Is it time for the ServiceNow earnings call?”

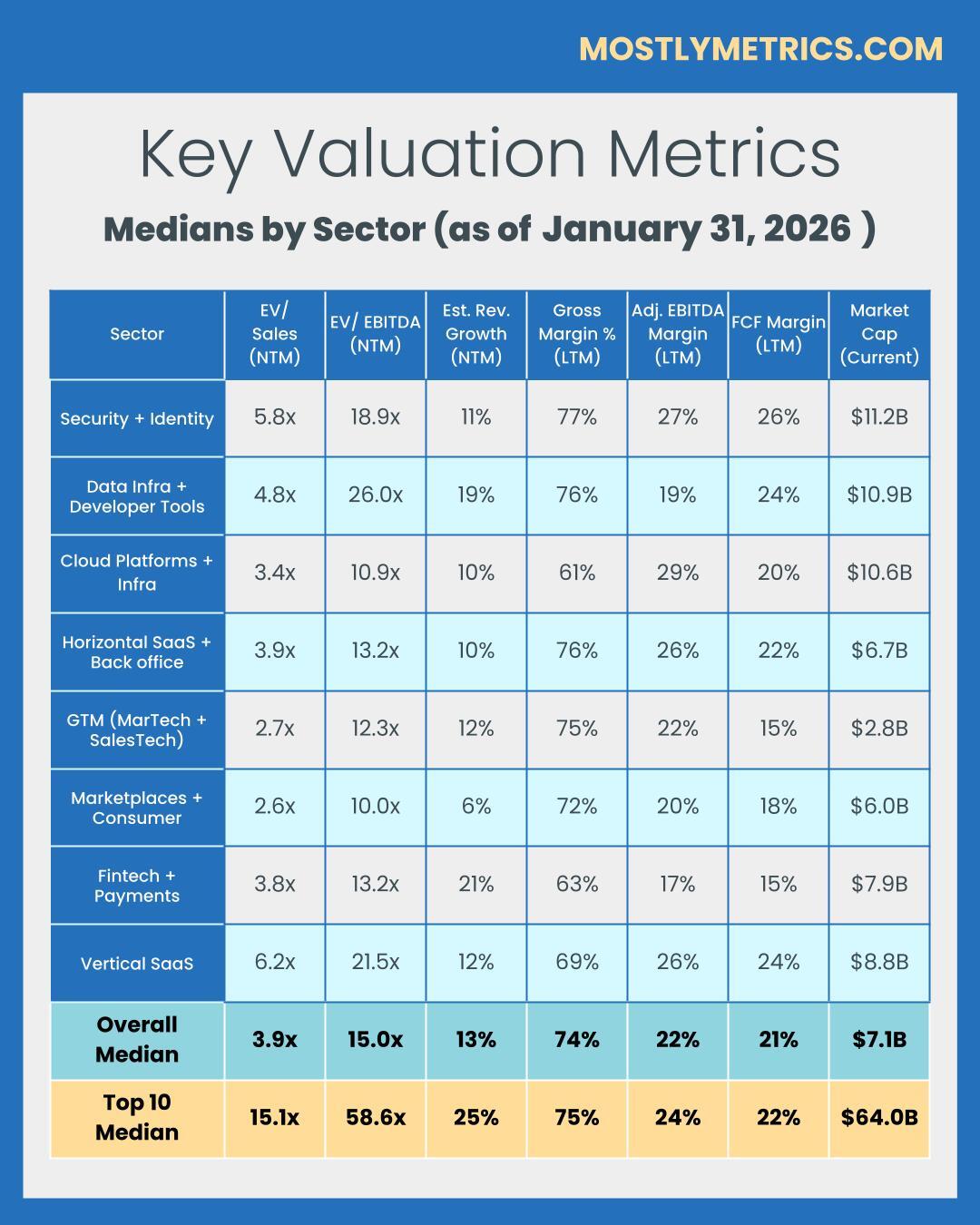

TL;DR: Medan Multiples are DOWN week over week.

The overall tech median is 3.9x (DOWN 0.1x w/w).

What Great Looks Like - Top 10 Medians:

EV / NTM Revenue = 15.1x (DOWN 0.4x w/w)

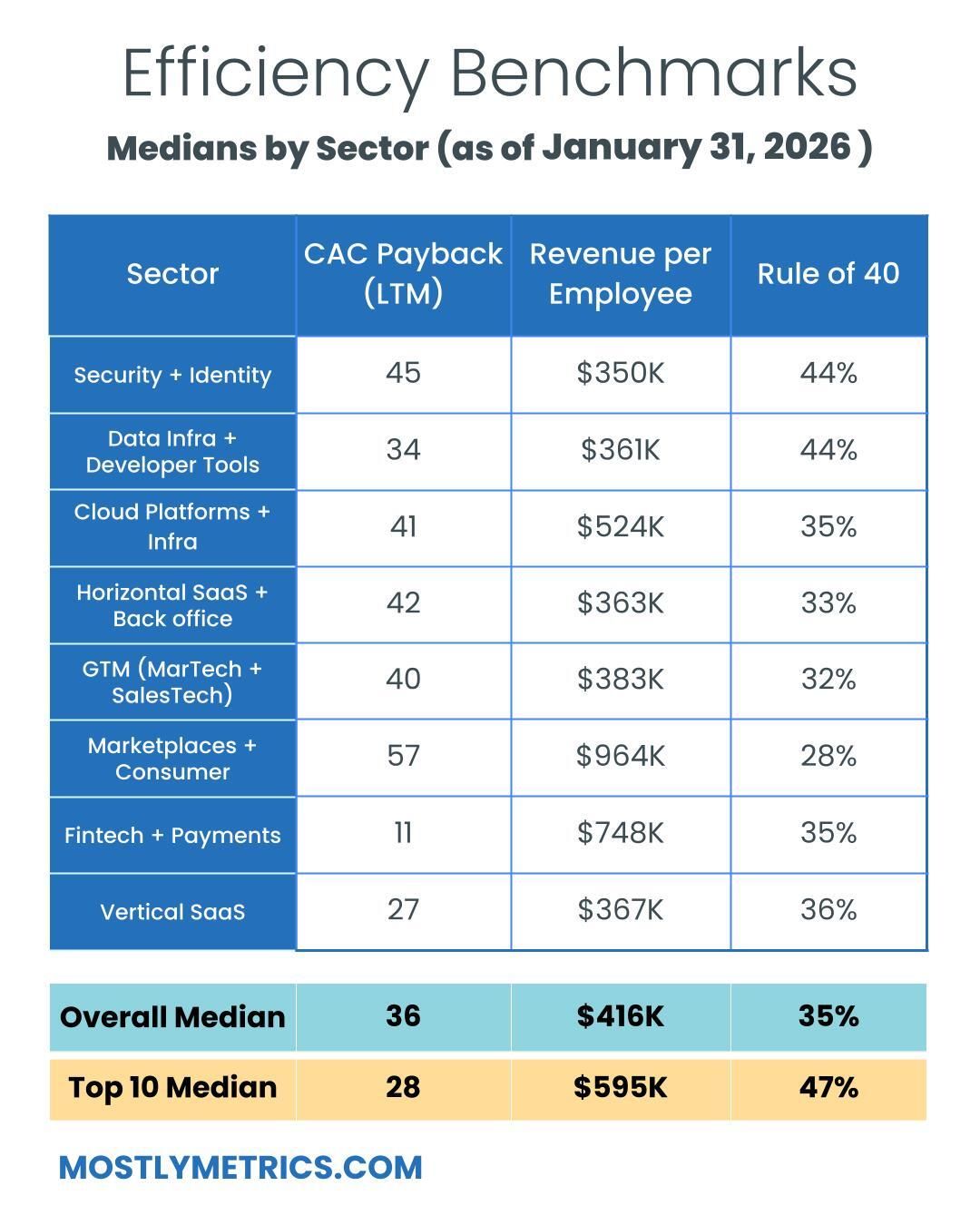

CAC Payback = 28 months

Rule of 40 = 47%

Revenue per Employee = $595k

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 146

Recent changes

Added: Navan, Bullish, Figure, Gemini, Stubhub, Klarna, Figma

Removed: Olo, Couchbase, Dayforce, Vimeo

Population Sizes:

Security & Identity = 17

Data Infrastructure & Dev Tools = 13

Cloud Platforms & Infra = 15

Horizontal SaaS & Back office = 19

GTM (MarTech & SalesTech) = 18

Marketplaces & Consumer Platforms = 18

FinTech & Payments = 28

Vertical SaaS = 17

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Sales and Marketing costs are measured on a TTM basis, but lagged by one quarter (so you skip a quarter, then sum the trailing four quarters of costs). This timeframe smooths for seasonality and recognizes the lead time required to generate pipeline.

Revenue is measured as the year-on-year change in the most recent quarter’s sales (so for Q2 of 2024 you’d subtract out Q2 of 2023’s revenue to get the increase), and then multiplied by four to arrive at an annualized revenue increase (e.g., ARR Additions).

Gross margin is taken as a % from the most recent quarter (e.g., 82%) to represent the current cost to serve a customer

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

OPEX

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.

Please check out our data partner, Koyfin. It’s dope.

Wishing you a CS team with appropriate incentives,

CJ