AI-native ERP: Why Rillet says we’re entering a once-in-decades reset

Wow! Two of my favorite companies teaming up for a collab!!!

Scott throwing the roc to Nic

If you’ve worked with legacy ERPs, you know the pain: fragmented data, brittle integrations, and workflows that stall automation. In this Unpack Pricing episode, Metronome CEO Scott Woody talks with Rillet founder Nicolas Kopp about why AI is forcing a fundamental rethink of financial systems of record. They explore why clean upstream data (and not LLM magic) is the key to automation, how modern companies are redefining finance ops, and why “ERP” is about to mean something entirely new. If you care about the future of financial infrastructure, this is a must listen.

Ok here’s a hiring mistake I’ve gotten wrong in my career (twice actually): trying to combine two roles into one.

At one company we needed someone to take on IT. Not full time, as we were only 75 people, but we had a terrible track record of getting new hires their laptops on time. Plus, it was becoming a drain on the CTO to provision Microsoft office licenses

I waited exactly three days for excel before saying F’it Jobu I’ll do it myself, and just put it on my personal card.

$110 well spent.

Simultaneously, we also needed someone to do recruiting ops. We were growing pretty rapidly and the time it took our in-house recruiter to set up meetings with candidates and make sure interviewers logged notes was slowing down our productivity. And it was damaging to our company brand. Potential hires were going weeks without hearing back, simply because the next interviewer in line didn’t see an automated notification from Greenhouse saying it was next batter up, or didn’t have the social pressure to keep the trains rolling.

So we did what many companies do… we combined these two needs into one role.

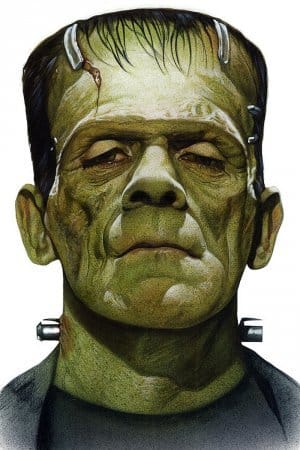

My name is Frank. I do IT+ Recruiting Ops

They were both “G&A”, right? They both required organization and communication skills amongst cross functional stakeholders (my least favorite string of words to see in a job rec. full of sound and fury, yet signifying nothing). And it wasn’t like we were going to require the person to do any “tier 2” work for either role, like actually resolving the complicated IT support tickets or interviewing candidates. It’s all just logistics and organization!

So we made ourselves a sandwich that we thought the org could digest:

You probably guessed it already, but this role went horribly. We had to let the person go (eliminate the role, is the legal term) within 6 months. It was too difficult for them to context shift between two incredibly different roles with different measures of “what good looks like”.

In retrospect we took a flyer on someone who on paper kinda sorta weirdly fit the bill for each of these but was really a master of none (they wouldn’t have been our first or even fourth choice for either of the positions on their own).

At the end of the day though, the fault was entirely ours. We (I) were being cheap. We didn’t want to pay full price for two roles that we needed 40% of the time. And you get what you pay for.

This predicament is all too common at startups that are just getting their footing - I’m talking the Seed through Series B stage - where you have a whole host of needs, but aren’t yet of scale to comfortably fund the resourcing needed to do the job correctly (after all - who are we to have a full time recruiting ops person and a full time IT person at a sub $10m company?)

Just saw this responsibility off and glue it on over there

Now, this footfault isn’t exclusive to finance (although common). It can exist elsewhere in the org, too. I’ve seen it many times in product - someone you think can be both a PM and a C minus Web Designer. Or in Engineering - trying to smash together some weird ass chief of staff role with a scrum master.

It is, however, incumbent upon finance to be the backstop, the voice of reason, when these FrankenRoles pop up.

And I get that can be hard because someone is proposing that you, gasp, SAVE MONEY!

There’s a fox in our mental hen house!

But our job is really resource allocation. That’s getting the most productive yield out of the investments we make in the org. It’s not to save money, but to put marginal dollars (and headcount) to their best use cases.

Funding headcount that is set up to fail is a bad resource allocation decision. You save money, but destroy value.

Bonus! The other time I made this mistake

Equity administration + treasury.

I mean, they have to check the bank accounts to confirm employees exercised their options right?

The other end of this hiring mistake spectrum is scooping up “great talent” without a role or position in mind.

CEOs love to do this. They see someone, a brilliant stud, who hits the job market for some reason or another - company goes under, company gets acquired, company lays people off - and they wanna swipe in and hire the person right away.

“If we don’t get this person someone else will. They will be a force multiplier no matter what we have them do! We’ll figure out their role later!”

I experienced this once where we brought in a talented VP of FP&A. The problem was we already had a talented VP of FP&A. But a board member said we’d be silly not to scoop this person up. So to honor the ZIRP and FOMO Gods, we did it.

To put this in perspective, it was like the Yankees picking up A Rod, despite already having Jeter at short, and moving him to third. Except we didn’t have a third to put him at.

We made up a nebulous VP of Finance Special Projects title and thought we could will it into working. However, this left a smart person with unclear direction just kinda bumbling around the area behind the infield and outfield, in search of value to add.

What’s worse, it made the current VP of FP&A look over their shoulder like is this person around in case I screw up? Is this a fall back plan if I drop a pop fly?

What started as a good thing became a source of wasted capital and paranoia.

My favorite Chief People Officer Amber would always say “we hire for the role, not the person.”

When you hire for the person, you talk yourself into unnatural staffing models that not only do a disservice to the person you’re now employing, but also the people who were on board before hand.

And that’s the part of the equation we often forget - it jacks up the flow of the game for other people.

CFOs are like the general manager of a sports team. They may not have last say in who gets hired, but they can point out where they are against the salary cap and stop the owner from hiring two short stops, or asking someone to play both second and third for the same salary.

Name a better GM. I’ll wait.

So next time you have a job rec come across your table that looks like something that was cobbled together in a lab, ask if the org is setting themselves up for failure. The body will reject the organ if you try to insert a Nissan JUKE carburetor where the liver goes.

Run the Numbers Podcast

Brian Brown, CFO at Rocket Companies (the folks behind Rocket Mortgage and Redfin) joins me to demystify the company’s business model and how it supercharges the American home buying experience.

On this episode we discuss:

The hidden marketing touchpoints in mortgage servicing (steal these for SaaS)

The recapture rate metric

Forecasting the business on a DAILY basis

The process of acquiring (two) other public companies (in the same month)

Rocket is a staple of the American home buying experience and this was a bucket list conversation with a thoughtful leader (and amazing storyteller).

Mostly Growth Podcast

It’s so funny that we dropped this episode where we analyzed the daycare pricing model right before the whole Minnesota daycare scandal broke. Unintentional and ironic.

Also, I now have three kids in daycare, plz pray for me.

We go deep on pricing… for daycares, Salesforce, and Whole Foods.

We also discuss:

If changing your pricing model is a toll on your sales team

Which vendors are giving the deepest discounts on multi year deals (using real benchmarking data)

The state of the AI SDR market (and how much of these features will be bundled and table stakes in five years)

Wishing you stop setting VC thirst traps,

CJ