After years in tech finance, I’ve learned that great companies need more than capital – they need true partners who understand their DNA.

MUFG’s Growth & Middle Market Technology Banking practice is what happens when you bring together the most experienced, most connected tech bankers in North America in one room – with the generational commitment of a $3 trillion global powerhouse behind them.

From pre-IPO startups to scaled public companies, this team is structured to help your company keep pace with lending solutions, strategic advice, and risk management products tailored to tech CFOs.

Contact Group Head Bob Blee to discuss how MUFG is empowering a brighter future for the tech ecosystem.

This is State of the Private Markets, a monthly series where we deliver the most compelling valuation, hiring, and revenue insights on pre-IPO candidates. Think of this as your backstage pass to the companies shaping the future before they hit the public markets.

Today we will cover:

The Deal Spirits: Are they real?

Valuation: The most valuable private tech companies

Hiring: The fastest-growing teams

Layoffs: Companies making cuts

Sector Highlights: A deep dive into Aerospace, Procurement, and Productivity sectors

Company Spotlights: Updates on Plaid, Figma, and Rippling

Executive Moves: Pre-IPO CFO hires

After scrolling LinkedIn, I had a sobering realization: I might be the only person who didn’t advise Wiz on their record-setting deal—or share a deep spiritual connection with the founders. Time to step up my networking game.

I actually walked into Starbucks this morning and the barista was like,

“Iced coffee for CJ. Also, I once caffeinated the Wiz founders.”

Damn, bro.

But beyond all the backslapping, the deal spirits are real.

Over lunch, a banking exec told me:

“Despite the market getting rocked the last three weeks, I haven’t had this much inbound since pre-Covid. The deal spirits are whispering.”

In addition to 3 long awaited IPOs (Coreweave, Klarna, Stubhub), rattled off a list of recent acquisitions in :

Wiz acquired by Google for $32B

Ampere Computing acquired by SoftBank for $6.5B

Moveworks acquired by ServiceNow for $2.9B

NextInsurance acquired by Munich Re for $2.6B

Weights and Biases acquired by Coreweave for $1.7B

NinjaTrader acquired by Kraken for $1.5B

Gretel acquired by Nvidia. Price undisclosed but sounds like >$300m

DataStax acquired by IBM. Price undisclosed but sounds like >$1B

Something’s in the air.

Speaking of fresh air—maybe, just maybe—we’re entering a new chapter where we no longer have to use ZIRP as the comparison point for everything.

Fun fact: we’ve now been out of ZIRP longer than we were ever in it.

Peak ZIRP era: ~2 years (2020–2022)

Post-ZIRP era: 3 years and counting (2022–2025)

Anyway, back to the hot question: Did Google overpay for Wiz?

First off, from a biz dev perspective, this deal was artful AF. My friend Art summed it up best (before it ever happened, lol):

In July of 2024, Wiz was reportedly at $500M ARR, growing ~100% YoY. And reports put them at $700m today.

If Google paid a multiple on forward gaap revenue…

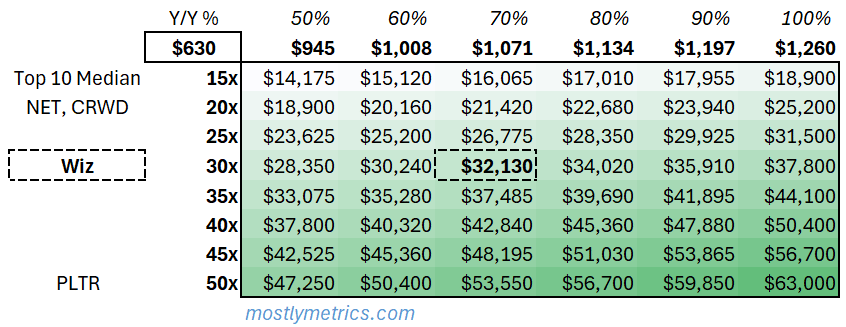

Assume a 10% delta between today’s $700M in ARR and their actual Last Twelve Months in Gaap revenue you get to ~$630M in revenue

Remember, ARR is like an exit balance at a point in time

You haven’t recognized all of it

And if Wiz continues growing at, say, 60% to 70% YoY—we’re talking a ~30x forward revenue multiple

That’s 2x what the top 10 median public tech comps are trading at. It doesn’t reach Palantir levels of insanity, but it’s still a rich number.

And that’s the magic of strategic buyers. Google can plug Wiz into its distribution engine and extract value a PE shop simply can’t. It’s not just ARR—it’s synergy-ARR.

So yeah, 30x might sound wild—until you realize that to Google, this wasn’t a software acquisition. It was an infrastructure upgrade. And for that, you pay up.

At the end of the day, Google’s not paying for what Wiz is—they’re paying for what they think Wiz unlocks. And in this market, that kind of confidence is starting to feel contagious.

The Most Valuable Private Tech Companies

Stripe is now valued at a whopping $91.5 billion, a step function change from $70 billion in the prior month. This brings them to a stone’s throw of their previous high water mark of $95 billion in March of 2021. At an estimated $6 billion in revenue, that would represent ~15x current revenue, which makes sense given Adyen is trading in the ~20x range.

Question: What’s the most valuable private marketplace in the world? Well, if you exclude companies held by conglomerates like Ant Group and Wanda, it’s OnlyFans. That puts it ahead of GoPuff, Turo, and Stubhub in the private sphere, the latter of which just announced its intent to list on the NYSE in the coming weeks (Stubhub S1 breakdown here).

OnlyFans had a record-breaking year in 2023, eclipsing $1.3 billion in revenue—a 20% year-over-year increase—and generated an eye-watering $658 million in profit before tax, which was up 25% from the previous year (OnlyFans analysis here).

Who else could IPO this year? With the announcement of Klarna going public (S1 analysis here), and reduced scrutiny over financial consumer protection laws under the new administration, Chime is a fintech worth keeping your eyes on for a potential IPO run in 2025.

HC Trends

When it comes to tech businesses, people are the biggest investment. Over 70% of SaaS expenses go towards headcount, making hiring trends a leading indicator of future revenue growth (or contraction).

With Position (join waitlist) we tracked headcount across 5,000+ private companies to uncover the trends.

Fastest Hiring Companies

Filtering for companies with more than 500 total employees who have also raised more than $500 million in capital, the logos below increased total headcount at the fastest rate year-on-year:

Startups like xAI (1,439% growth) and Perplexity (941%) are scaling teams at a rate rarely seen outside of early Facebook or Uber days. This isn’t just growth—it’s a full-on land grab for talent in AI.

Despite massive growth rates, many of these companies are still relatively lean. For example, Anyscale grew 366% but has only 653 employees. This suggests a transition from scrappy startup to structured scale-up—and the growth is likely to continue as product-market fit firms up.

In a chart dominated by AI companies, Poppi—a soda brand—is the lone CPG breakout with 120% headcount growth. It’s a reminder that consumer products, especially those with massive brand momentum and distribution scale (like a PepsiCo acquisition), can grow teams just as fast when demand hits.

And here are the companies who pulled back most aggressively:

Notable callouts:

Klarna→ The Buy Now, Pay Later giant has slashed total headcount, total customer support costs, and total S&M costs for three years straight, per their S1 (breakdown here). They credit the reductions to AI efficiencies.

Aqua Security→ Competes in the crowded Cloud Native Application space, focusing on containers. Raised ~50% of their funding in March of 2021.

OutSystems → The software development and deployment platform raised their Series E at $9.5B in Feb of 2021. Valuation corrected to $4.3B as a part of their Series G in Oct 2022.

Sector Specific Highlights

Aerospace

There are four levels to ultra wealth:

Eric Schmidt, the former CEO of Google, has transitioned to a new role as CEO of Relativity Space, a rocket startup, after acquiring a controlling stake in the company. You can do that when you’re rich - buy your way into a super cool rocket company, and fulfill the fourth level to my Maslow’s Hierarchy of Rich Guy Stuff above.

Despite landing some splashy pre-orders from the likes of Richard Branson’s Virgin, Boom’s path to commercial supersonic travel looks increasingly cloudy. The -12.4% headcount growth hints at internal belt-tightening. Despite the turbulence, the Founder/ CEO’s LinkedIn is hilarious.

Why this matters:

This sector is polarizing. Winners are those who either build irreplaceable infrastructure (SpaceX, Astranis) or solve niche but critical bottlenecks (Impulse). Everyone else? Facing increasing gravity.

Procurement

The lines between the traditional categories of “Procurement” and “Spend Management” are blurring.

Ramp has entered the procurement convo. With a new $13B valuation, 106% headcount growth, and $1.73B raised, Ramp has broken away from just corporate cards. It has rapidly evolved into a full-blown spend management platform, expanding into bill pay, procurement, and accounting automation.

Zip, now valued at $2.2B with 41% headcount growth, is scaling fast. It's riding the wave of procurement becoming a more strategic, CFO-aligned function. Zip’s early success shows that procurement workflows—once an afterthought—are now a real wedge for workflow automation and compliance visibility in large orgs.

Vendr, which pioneered “SaaS buying as a service,” is showing signs of contraction with -12.4% headcount shrinkage. As CFOs tighten budgets and bring vendor management back in-house, the outsourced SaaS procurement model may be losing steam—or at least facing pressure to prove deeper value beyond initial savings.

Why this matters:

The landscape is splitting: Ramp and Zip are bundling finance and procurement functions under one UX, while Tropic and Vendr took more vertical approaches.

Tropic, at a $334M valuation with leaner funding ($59.7M), is a dark horse to watch—focused on mid-market and modern tooling. They lead with an emphasis on their SaaS capabilities and deep data pricing insights rather than negotiation as a service.

Productivity and Collaboration

Productivity tools are being bolstered, or crushed, by AI.

Grammarly’s core writing assistant was once a category-defining tool, but the rise of ChatGPT and broader generative AI eroded its moat. With users now expecting full-sentence rewrites, tone shifts, and content creation—not just typo fixes—Grammarly found itself at risk of becoming a feature, not a platform. The acquisition of Coda, a flexible document collaboration app, is a bold move to pivot into the AI-native productivity suite arena. It signals Grammarly’s intent to reinvent itself as a full-stack workspace tool, not just a writing plug-in.

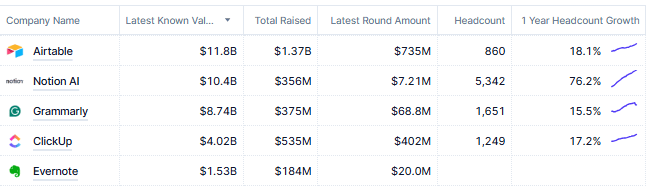

At $11.8B, Airtable holds the highest valuation here, yet has just 860 employees. This suggests a focus on efficiency and a more methodical move upmarket. With $735M raised in its last round, the company is well-capitalized, and likely pacing itself after earlier rounds of aggressive expansion.

Once a category-defining note app, Evernote’s $1.53B valuation is now dwarfed by newer entrants. With only $20M raised recently and no significant headcount growth, the company is clearly in a defensive position—possibly maintaining a loyal base but no longer shaping the category.

Why this matters:

Where Airtable is owning databases-meets-spreadsheets, Notion is pushing into AI writing + docs, and ClickUp wants task + project management dominance.

The competitive frontier isn’t just UX anymore—it’s who owns the context and intelligence layer of your workflows.

Company specific highlights

Plaid

The fintech giant’s valuation falls from $13B to ~$6B in secondary transactions.

Plaid was once crowned a $13B fintech darling, riding the wave of open banking hype, and its nearly-closed $5.3B acquisition by Visa in 2020.

Fast forward to 2024, and the company is now trading at a more grounded $5.8B valuation, nearly a 55% markdown from its peak.

But don’t call it a fall from grace—Plaid’s revenue tells a different story. The company is pulling in an estimated $417M as of March 2025, with steady year-over-year growth.

The takeaway? Plaid didn’t collapse—it recalibrated. In a market that’s punishing inflated fintech multiples, Plaid is proving it can be a durable, infrastructure-first business.

It’s grown into the default API layer for financial data, and even with a lower sticker price, it’s still one of the most strategic companies in fintech. Think less "next Stripe" and more "AWS for money movement."

Figma

Still going strong after Adobe fallout.

Key Stats:

Figma’s $13B valuation, confirmed in a May 2024 secondary/tender round, is the same number it carried back in 2021—before Adobe’s $20B acquisition attempt got blocked.

But this time around, the business fundamentals are catching up. Figma’s revenue is projected to hit $989M by March 2025, nearly doubling in just two years.

The dotted line in the revenue chart shows an estimated acceleration post-Adobe deal fallout, as the company leaned into shipping new products (Dev Mode, whiteboarding tools, AI-enhanced design features) and doubling down on enterprise expansion.

The key insight? While the valuation hasn’t moved, Figma is rapidly growing into its multiple. That’s a bullish signal in today’s compressed multiple environment—especially when most late-stage SaaS players are seeing flat or declining valuations.

With an estimated ~$1B in ARR and a still-loyal design/dev community, Figma is back in control of its narrative—and now it's got the financials to match the hype. If the ~50x revenue bid was crazy before, it’s only half as aggressive now.

Rippling

Rippling Is Winning the HR Tech Arms Race—And Deel May Know It

Rippling just raised at a $14B valuation and is tracking toward an estimated $1 billion in revenue in 2025.

That’s not just momentum—that’s category leadership. But as Rippling scaled its all-in-one workforce OS, rival Deel allegedly sent a mole to lift pricing data, sales strategy, and even private Slack convos.

According to Rippling’s lawsuit, the plot unraveled when the mole fell for a honeypot channel—then tried to delete evidence while hiding in a bathroom.

In a space where product velocity and platform depth are king, Rippling is clearly winning. Deel’s alleged espionage doesn’t just reek of desperation—it suggests they know it, too.

Fundraising Rounds of Note

Island secures $250 million as valuation continues to soar to nearly $5 Billion (source)

Ramp announced a $150M secondary sale at a valuation of $13 billion

Turing, an AI engineer HR platform, raised $111m in Series E funding at a $2.2b valuation

Executive hires

Greg Henry takes the CFO reins at 1Password after steering Couchbase through its IPO.

Dan Chen is now CFO at Gemini. He was previously at Affirm, heading capital markets and bank partnerships.

John Verkamp becomes CFO of Wheels Up on March 31, bringing two decades of GE aviation and power experience to the cockpit.

This wraps up our latest edition of State of the Private Markets. Stay tuned for next month’s deep dive into the companies redefining the private markets—and don’t forget to thank MUFG for making this possible.

Disclaimer: None of this is investment advice. Do your own homework.