How Anyscale scaled AI billing across PLG, enterprise, and marketplaces

As someone who’s seen billing teams juggle self-serve, enterprise, and marketplace contracts at once, I know how quickly complexity becomes a tax on engineering.

That’s why this Anyscale case study stood out to me.

As they expanded into PLG and cloud marketplaces, their homegrown billing system just couldn’t keep up. By moving to Metronome, Anyscale unified every revenue motion on one platform—launching AWS, GCP, and Azure billing in weeks, not months… while freeing engineers to focus on product. If you’re scaling usage-based or AI infrastructure, this story is worth a read.

Your Guide to Negotiating Multi Year Deals

Are you in the midst of negotiating some meaty Q4 deals right now?

Are any of them multi year?

You’re in the right email, at the right time!

I pinged my buddies Justin Etkin and Russell Lester over at Tropic with a question that’s been bouncing around in the back of my CFO noggin for a long time:

How much should I get off for each additional year I commit to?

I was determined to find a "rule of thumb" that would express the tradeoff between term and price. Like, do I get an additional 10% off for each additional year I sign up for? I figured it would only make sense that as I signed up for more years with a vendor, I should get more pricing relief.

Asking this question inevitably led to more questions we'd need to answer in the process:

Do you get a better or worse discount on renewal?

Does buying more products and bundling help you secure better discounts?

Are we in a buyer's or seller's market?

The answer led us down a twisty, turny, windy path.

Well, I've emerged from the discounting data darkness of tornado charts (a sleeper pick for most underrated chart design, btw) with some takeaways:

I’m back. And I come bearing discounts.

TL;DR:

Signing for 2+ years gets you ~2-3% more off than signing for one year. Not life-changing, but it's real, consistent, and growing.

But there’s a twist: you don't get the discount just for signing multi-year. You get it for switching from single-year to multi-year at renewal.

Multi-year is the price of admission to discounting. Once you're already getting a discount, single-year buyers actually get slightly better rates. Multi-year gets you access to discounts, not bigger ones.

Volume beats term. Buying more seats, users, or credits moves the needle more than adding years. Term is kinda like an entry ticket; volume is the actual lever.

Staying multi-year forever actually hurts you. Customers who start multi-year and stay multi-year see their discounts erode over time (-1.3%).

This all depends on the vendor. Some reward the upgrade path generously. Others penalize it. Know which camp your vendor is in before you sign.

Let's explore the dark arts of discounting.

Why Now?

From 2020 to 2023, SaaS vendors tightened up on discounts. The value you could capture shifted from "how long you sign" to "how much you buy."

Buying more seats or bundling products got you a deal. Simply extending from one year to two? Not so much. BC we built this city bubble on rock and roll unrealistic ramping deals.

Presenting the annual plan to the board next week like

Then came 2023 and 2024. Buyers got cautious. Nobody wanted to lock in for multiple years when layoffs were looming and budgets were getting deleted. Flexibility in the face of the unknown mattered more than a few bips of discount.

But… that changed in 2025. Multi-year deals are back… and vendors are actually rewarding them again.

The numbers:

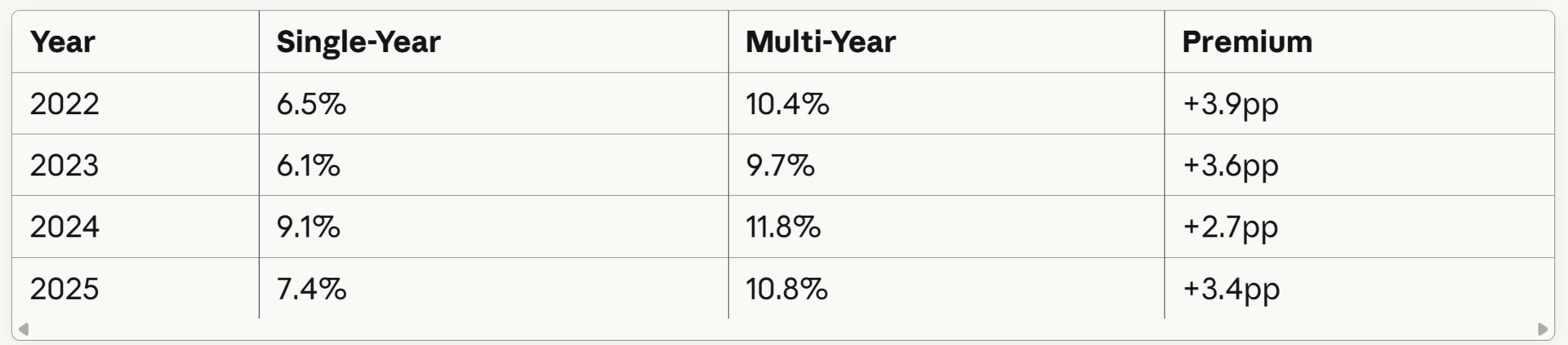

Looking at 15,000+ contracts across 2,600+ suppliers from 2022-2025:

That +2.6pp premium in 2025 is the largest gap we’ve seen in recent memory. Multi-year is getting more valuable.

And we're yanking on the multi year lever more frequently. Multi-year incidence has grown from ~25% of contracts in 2022 to ~30% in 2025. Both sides are leaning in.

So What's the Actual Rule?

Here's the honest answer to my original question:

Signing multi-year instead of single-year is worth ~2-3 percentage points of extra discount.

That's not the "10% per year" format I was hoping for (sad face). Because you can’t even place a consistent value on committing to two years vs three. There’s not a statistical difference.

But reaching past 12 months is real, and it adds up. On a $100K contract, that's $2-3K. On a $1M deal, it's $20-30K.

You can see the shift in the distribution below. On initial deals, single-year buyers cluster heavily in the 0-10% discount bucket (over half of them land there). Multi-year buyers spread out more, with a fatter tail into the 10-30% range.

This graph shows Initial purchase. The same pattern holds at Renewal.

It's not that multi-year guarantees you a bigger discount. It's that multi-year improves your odds of escaping the "barely any discount" zone.

But here's where it gets super weird.

When I looked at the overall averages, multi-year clearly wins. But when I broke it down by lifecycle stage (initial land deals vs renewals) the picture got murkier.

At each stage, multi-year doesn't automatically get you more discount.

So how can multi-year win overall if it doesn't win at each stage?

The answer is embedded in the customer journey.

The premium doesn't come from multi-year being universally better. It comes from a specific path: starting single-year and upgrading to multi-year at renewal.

As Yung Joc aptly stated in 2006, that’s where “It’s going down”.

To verify, I looked at what happens when organizations change their term pattern over time. Start single-year, go multi-year at renewal. Or start multi-year and stay there. Or switch back and forth (switcherooo).

The winner: start single-year, upgrade to multi-year at renewal.

Starting single year and upgrading to multi year at renewal gets you the best discount improvement (+2.5pp). You prove the value on a shorter commitment, earn your leverage, then negotiate a better multi-year rate. Both sides of the table have essentially derisked and lean in.

But that wasn’t the biggest surprise…

Making sure my reality is still intact

The biggest surprise was how staying multi-year forever actually costs you.

If you start multi-year and keep renewing multi-year, your discount erodes over time (-1.3pp). Vendors aren't rewarding your loyalty; they're taking you to the cleaners.

The "always single-year" crowd does okay (+1.0pp improvement), but they're leaving money on the table by not upgrading. But, like, kinda understandable, given the macro uncertainty we just came out of.

And going from multi-year back to single-year? Dead flat (+0.1pp). You don't get punished, but you don't gain anything either. No harm, no foul.

And If You Remove the Zeroes

I can hear the analytical crowd now: "You cite averages, but if there's skew to the data, you should have used medians."

Fair. So we ran the medians.

Multi-year wins handily. Case closed?

Not so fast. A lot of deals — especially single-year deals — get 0% discount. They're paying list price. That's skewing the results.

So we ran it again, excluding 0% discounts:

Wait — single-year wins?

Yes. Once you're already in "discount territory," single-year buyers actually get slightly better rates at the median.

The insight: Multi-year doesn't get you a bigger discount. Multi-year gets you access to discounting at all.

For many suppliers, earning a discount requires more than a single-year commitment. Multi-year is the price of admission. But once you're in, the volume of what you're buying matters more than the term length.

Volume Beats Term

This brings us to the most important insight in the whole dataset: volume discounting has a massive benefit over term discounting.

There is definitely still discounting to be had. But it requires volume commitments — not just time commitments.

Think about how most SaaS is priced today: users, seats, employees, credits, consumption units. These volumetric levers allow for embedded, natural expansion. Vendors want you to buy more. That's where they're willing to give on price.

Term? That's about risk transfer and revenue predictability. Vendors will trade some discount for multi-year commitment, but it's modest. The big discounts come from committing to more stuff, not just more time.

Practical implication: If you're negotiating and only have one card to play, play volume. Commit to more seats, more licenses, more credits. That moves the needle more than adding a year to your contract.

Which Vendors Reward This Path?

As we established, going from Single to Multi year is the best path in aggregate. But it differs by vendor. Some will reward you handsomely. Others will actually penalize you for it.

The vendors climbing to the right side of the chart give you a bigger discount when you "graduate" from single-year to multi-year:

You can go and buy a new boat with the discounts from Asana and Gong.

But there’s also a cohort of vendors who punish you when you try to upgrade.

Those are those climbing the left side of the chart, including the likes of Cloudflare and ZoomInfo.

Netsuite be like

With these vendors, the Single → Multi journey doesn't pay. Either stay single-year and focus on unit pricing, or if you're going to go multi-year, do it from day one. Because big dog don’t play that game.

On the flip side, you can get a great discount from some vendors by downshifting from multi to single. You have them shaking in their boots that you may leave all together.

Pendo punishes you for increasing term at renewal but rewards you for shortening term… you’re in the driver’s seat when you act like you’ll leave.

Hidden Value: Uptick Avoidance

One thing the data doesn't fully capture: the value of avoiding price increases.

At renewal, the "discount" you negotiate may not look that impressive on paper. But the real win is often avoiding the 5-10% uptick that would've hit you otherwise.

The most disciplined SaaS providers with mature markets regularly enact annual price increases as an expected reality for buyers. So when you negotiate a renewal and your discount looks flat, you may have actually won — you just avoided a price hike that would've made your effective rate worse.

This is especially true for multi-year deals. You're not just locking in a discount. You're locking in protection from future increases.

Looking Ahead: The AI Tax Is Coming

My biggest prediction for 2026: AI is going to blow up SaaS pricing.

At Tropic, they call it the "AI Tax." Some suppliers are already embedding this into their pricing with automatic uplifts. Others are bolting on new AI SKUs with opaque pricing — credits, tokens, enrichments, agents.

If you think your SaaS bill is confusing now, wait until every vendor has an AI add-on with its own consumption model.

If too many CFOs get surprised by bills that are higher than they expected, it's going to create retention risk, budget-busting bombs, and a lot of hard conversations between buyers and suppliers.

If there's a risk of future AI Tax, upticks, or the likes thereof, it could benefit customers to lock in pricing for a longer time horizon. The discount on the multi-year deal might be modest, but the predictability is worth something.

I expect we'll see shifting sands moving away from historic pricing norms and toward something that balances predictability with upside potential. The volumetric pricing models (seats, users, credits) that dominate SaaS today may evolve as AI makes "per-seat" less meaningful and "per-outcome" more relevant.

Stay tuned.

Getting Your Money’s Worth:

Ok so that’s a lot of data points. Here's how to put all of this into practice:

1. Multi-year is worth ~2-3% more than single-year overall.

It's not huge, but it's real and consistent. The premium is growing.

2. But multi-year is the price of admission, not the lever.

Multi-year gets you access to discounting. Once you're in discount territory, volume is what moves the needle.

3. The premium comes from the journey.

The magic path is: start single-year, upgrade to multi-year at renewal. That's where the +2.5pp improvement lives.

4. Don't start multi-year and stay there.

Customers who stay multi-year forever see their discounts erode (-1.3pp). Vendors take your loyalty for granted. If you're already multi-year, consider going single on your next renewal to reset your leverage.

5. Volume beats term.

If you only have one card to play, commit to more volume — more seats, licenses, credits. That's where vendors are willing to give.

6. Know your vendor before you sign.

Some vendors (Asana, Gong, Google Workspace, Looker) heavily reward the Single → Multi upgrade. Others (Cloudflare, Twilio, 1Password, Pendo) penalize it. Check the list before you commit.

7. Don't forget uptick avoidance.

The discount on your renewal might look flat. But if you avoided a 5-10% price increase, you actually won. Multi-year locks in protection, not just rate.

8. Watch out for the AI Tax.

Pricing is about to get weird. If you can lock in rates before AI SKUs proliferate, it might be worth the commitment — even if the discount isn't huge.

Vendors in the Dataset:

Reward Single → Multi: Asana, Gong, Google Workspace, Looker, Zendesk, Lattice, Greenhouse, Fivetran, Snowflake, Tableau, Adobe, Salesforce, CrowdStrike, Datadog

Penalize Single → Multi: Cloudflare, Pendo, Twilio, 1Password, NetSuite, Segment, ZoomInfo, JAMF, Okta, LinkedIn Sales Navigator

Biggest Multi-Year Premiums (2024-2025): Fivetran, Looker, Avalara, CrowdStrike, CDW, 1Password, Greenhouse, Google Workspace, GitHub, Tableau

Me and Russell Celebrating Deep Dish Pizza Discounts

Source: Russell

Run the Numbers Podcast

On this episode of Run the Numbers, I sit down with Cassie Young. She brings lessons from a career spanning CRO roles, customer success leadership, turnarounds, and now investing as a General Partner at Primary Venture Partners.

This episode covers:

Rebuilding go to market teams

Why sometimes you should fire customers

How churn is a lagging indicator that hides deeper retention issues.

The dark arts of measuring NPS

Looking for Leverage Newsletter

The Private Equity CFO’s Guide to Sale-Leasebacks

Imagine if you could free up capital to operate your business by selling, and then leasing back, the land it sits on?

It’s a common, but very misunderstood, concept in the private equity world. And when done right, it can help you stretch to buy stuff that’s out of your original purchase price range. For all those thinking of doing a roll up strategy where there may be land involved, this is a must read.

Mostly Growth Podcast

Me and Kyle talk about the recent software mergers of world of Superhuman + Grammarly + Coda as well as Fivetran + DBT Labs, trying to come up with dream combos of our own. We also discuss why PE portfolio companies are becoming a top channel for AI companies to sell their software into. Finally, we discuss the Michael Jordan of Y Axis crimes.

Wishing you a multi year deal with incremental discounting,

CJ