A messy or missing cap table might not just slow you down, it could cost you your next fundraising round.

VCs get flooded with pitches, and if your equity is confusing or missing, they’ll move on fast.

Fidelity Private Shares is an all-in-one equity management platform that helps you maintain a clean cap table, an organized data room, and a clear equity story.

I’d like to buy my SF peeps a beer

If you’re a finance leader in the SF area, I’d love to buy you a Miller Lite or three on Thursday February 12th. I’m hosting it at an undisclosed Bay Area location, guarded by a squad of ferocious miniature Bernedoodles.

Seriously though, let’s all have a fun night of “networking” (ugh I hate that word).

RSVP below to meet fellow nerds.

Customer Success Benchmarks

Harold is comp’d on NPS

The Mostly Customer Success Survey

The #1 question I got from people during annual planning season was:

“How the hell do I plan for customer success?”

How should I pay the CS team?

Where should it go on the P&L?

What ratio should I use to staff it?

How big should the team be?

So I figured screw it, let’s solve it together.

And you answered the call!

Below are the results…

But before we dig in… I’d like to thank the following legends for helping me ask the right questions:

Kyle Poyar, GTM expert, writer of Growth Unhinged and my co host of Mostly Growth

Cassie Young, General Partner at Primary Ventures, and seasoned Chief Customer Officer

John Gleeson, Founder & GP at Success Venture Partners, and tenured Customer Success leader

A special thank you to John for distributing the survey to his readers via his newsletter Success VP.

Customer Success lives in a weird place (both philosophically in our minds, and geographically on the P&L). Everyone agrees it matters (or we wouldn’t keep staffing it). Fewer people agree on what it actually owns. And almost no one feels great about how it’s paid.

Let’s explore what companies are currently doing, and if incentives (as murky as they be) are driving any better of outcomes.

Part 1: A Crisis of Confidence

Part 2: The Fragmentation

Part 3: The Incentive Mess

Part 4: Does Any of This Actually Matter?

Part 5: What CFOs Should Actually Do

Part 1: A Crisis of Confidence

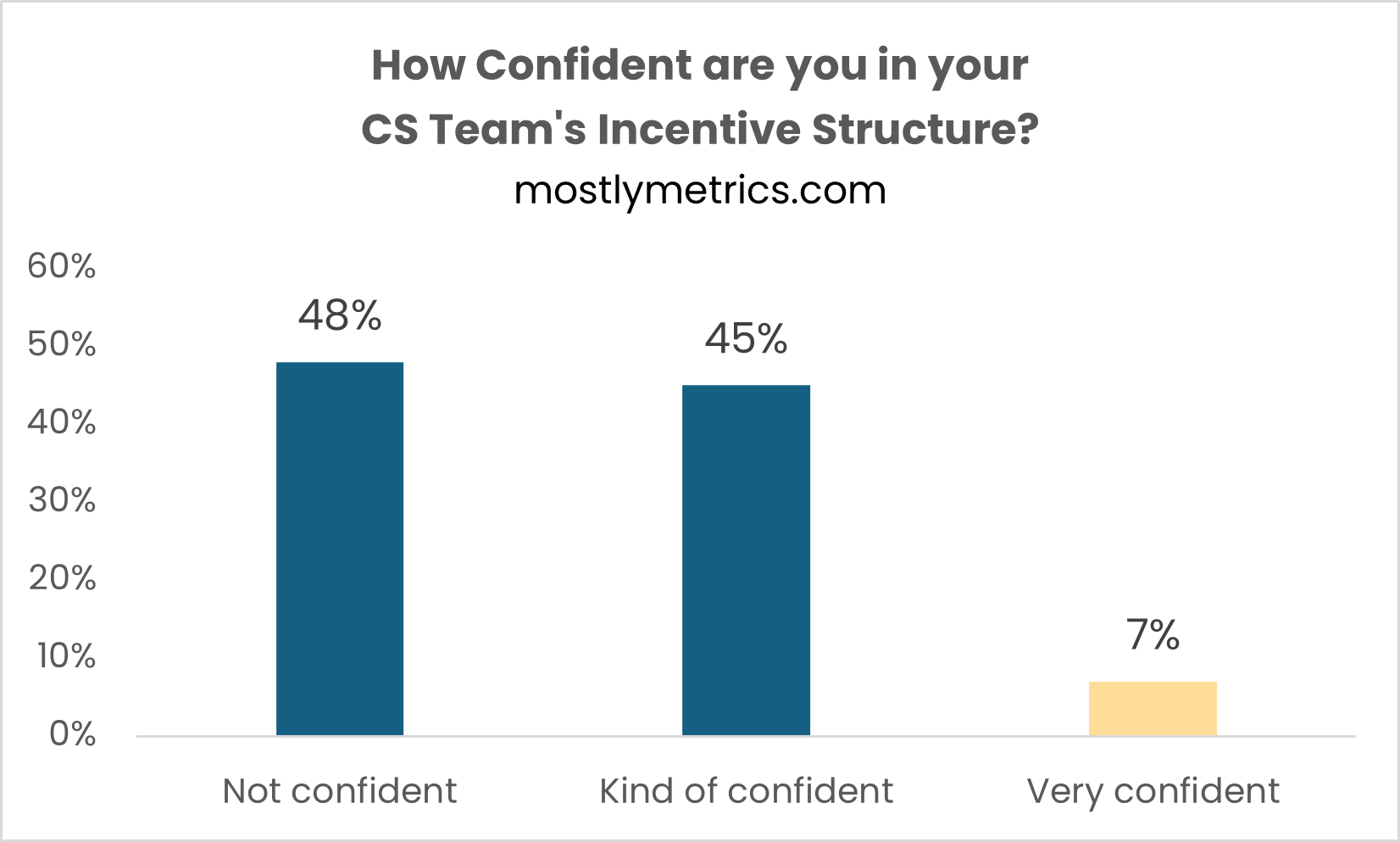

I surveyed 132 tech companies about how they staff, structure, and pay their Customer Success teams.

And almost nobody believes they've got it right.

In other words:

Yikes.

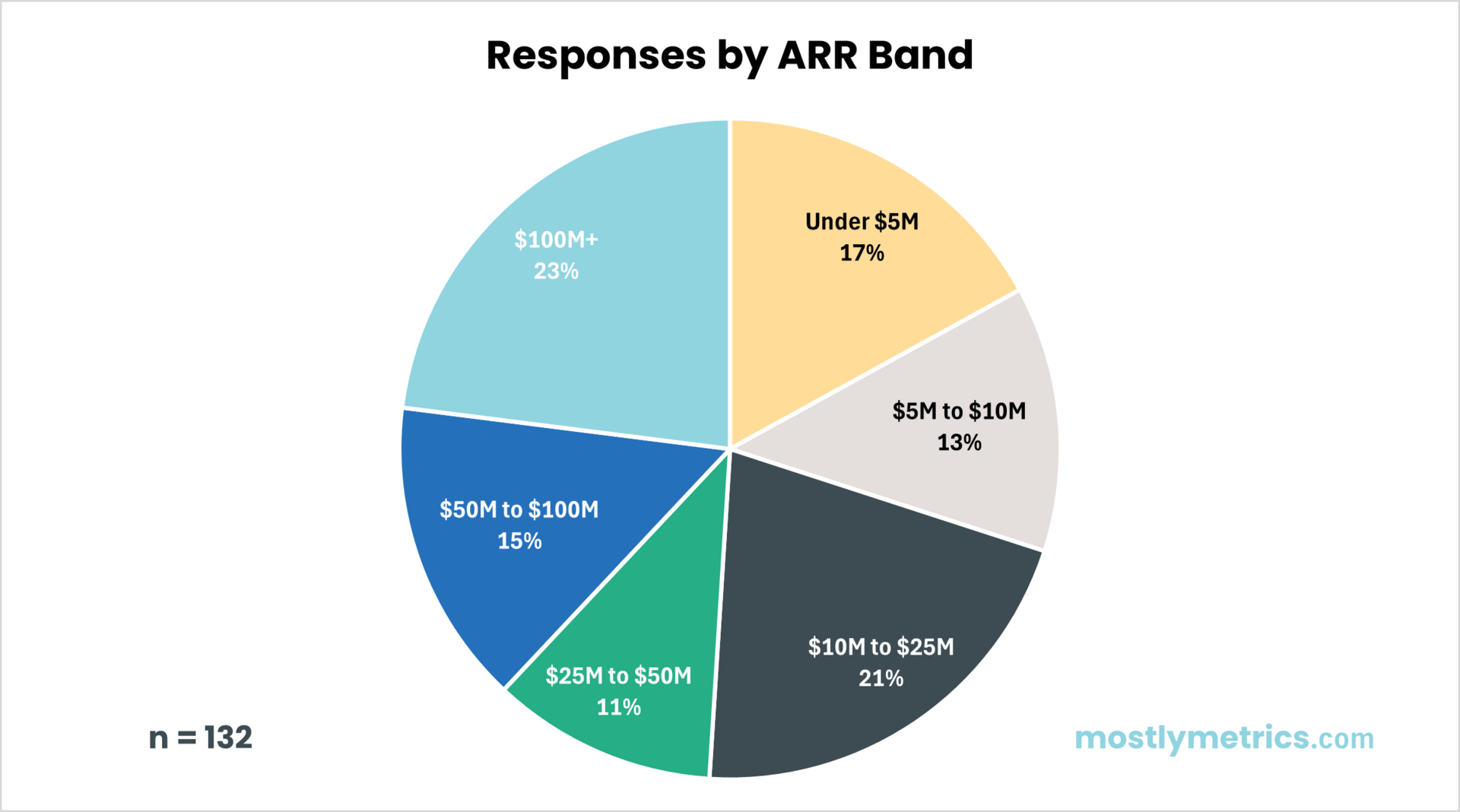

You might expect this from early-stage startups still figuring things out. But this was a battle tested squad.

Who Took the Survey

The required n equalz slide.

TL;DR: ~50% above $25M ARR, ~50% below

Nearly a quarter are north of $100M in revenue. These are legit companies with real renewal cycles, an actual expansion motion, and incentive plans someone actually had to defend before they went to print.

“Defend yourself: Why giveth our CSMs a bullshit MBO?”

So are these teams any good?

Yeah. Mostly.

Most respondents report annual renewal rates in the high-80s to mid-90s.

Bottom quartile: ~84%

Median: ~91%

Top quartile: ~95%

Part 2: The Fragmentation

When you look at how companies actually structure CS, you see the same pattern over and over: No consensus.

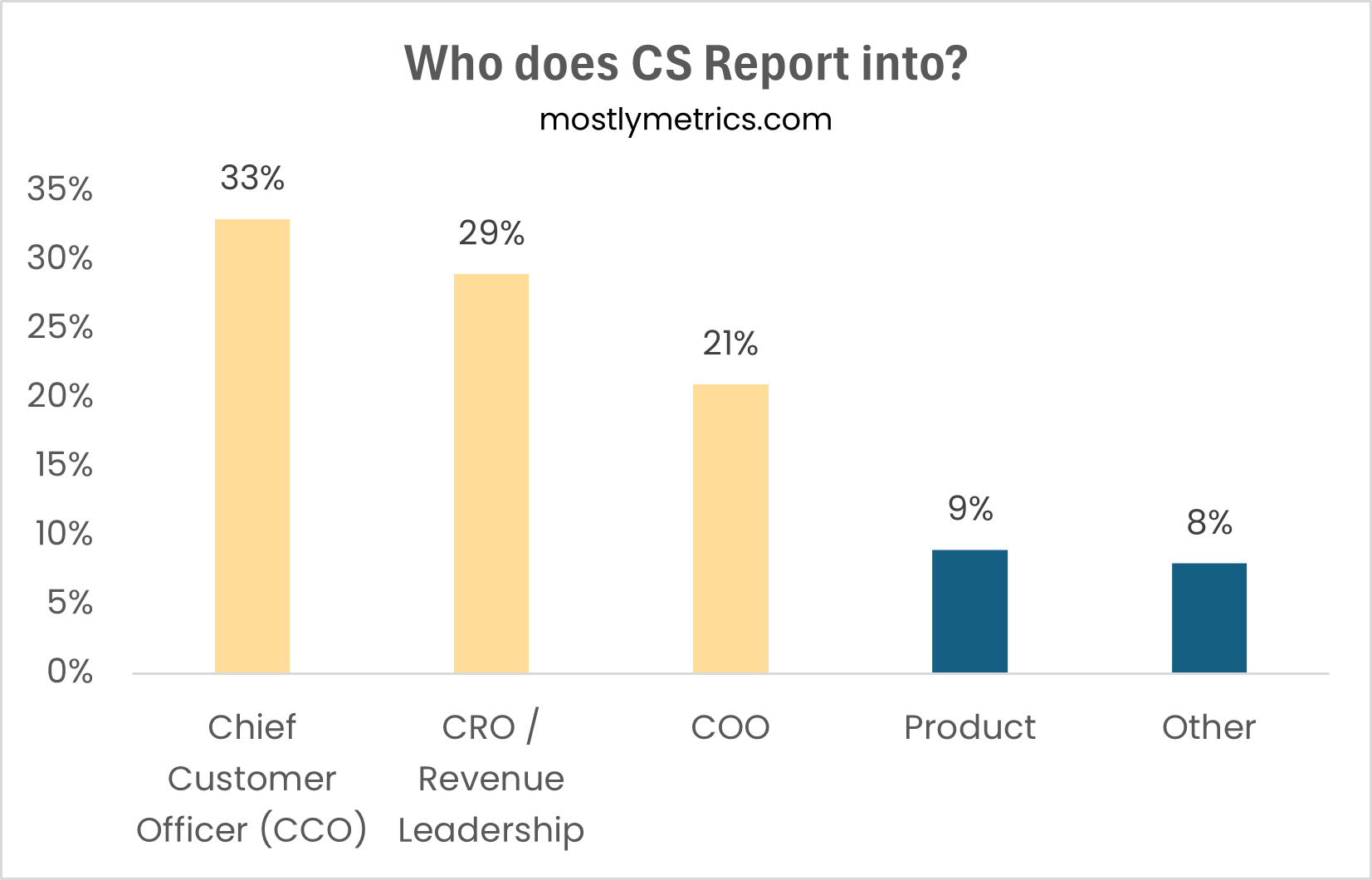

Who does CS report into?

Could be you, depends on the day.

Which is also why we see a variation in incentive structures, which we’ll get into below. Incentives tend to rhyme with org structure.

Three-way split. CS rolls up to the Chief Customer Officer, the Chief Revenue Officer, or the COO…. probably depends on who the CEO thinks is the strongest leader… or just based on where the last CS leader came from.

If you are in CS but roll up to Product, congrats, you’ve joined the Island of Misfit Toys

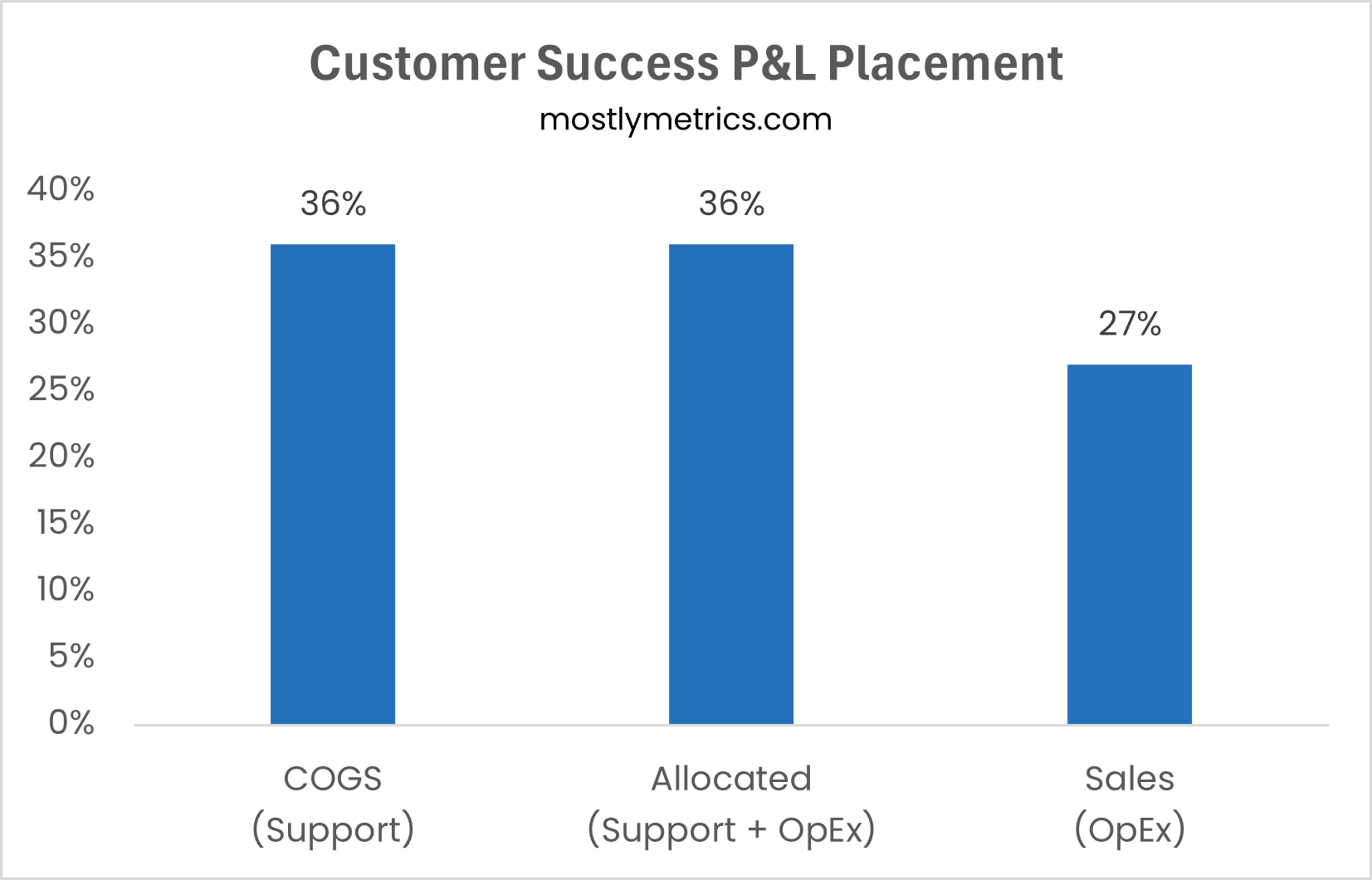

Where does CS live on the P&L?

Another three-way split. Some companies treat CS as a cost of delivering the product. Others split it across functions. Others drop it into Sales and try to play it off as a revenue team.

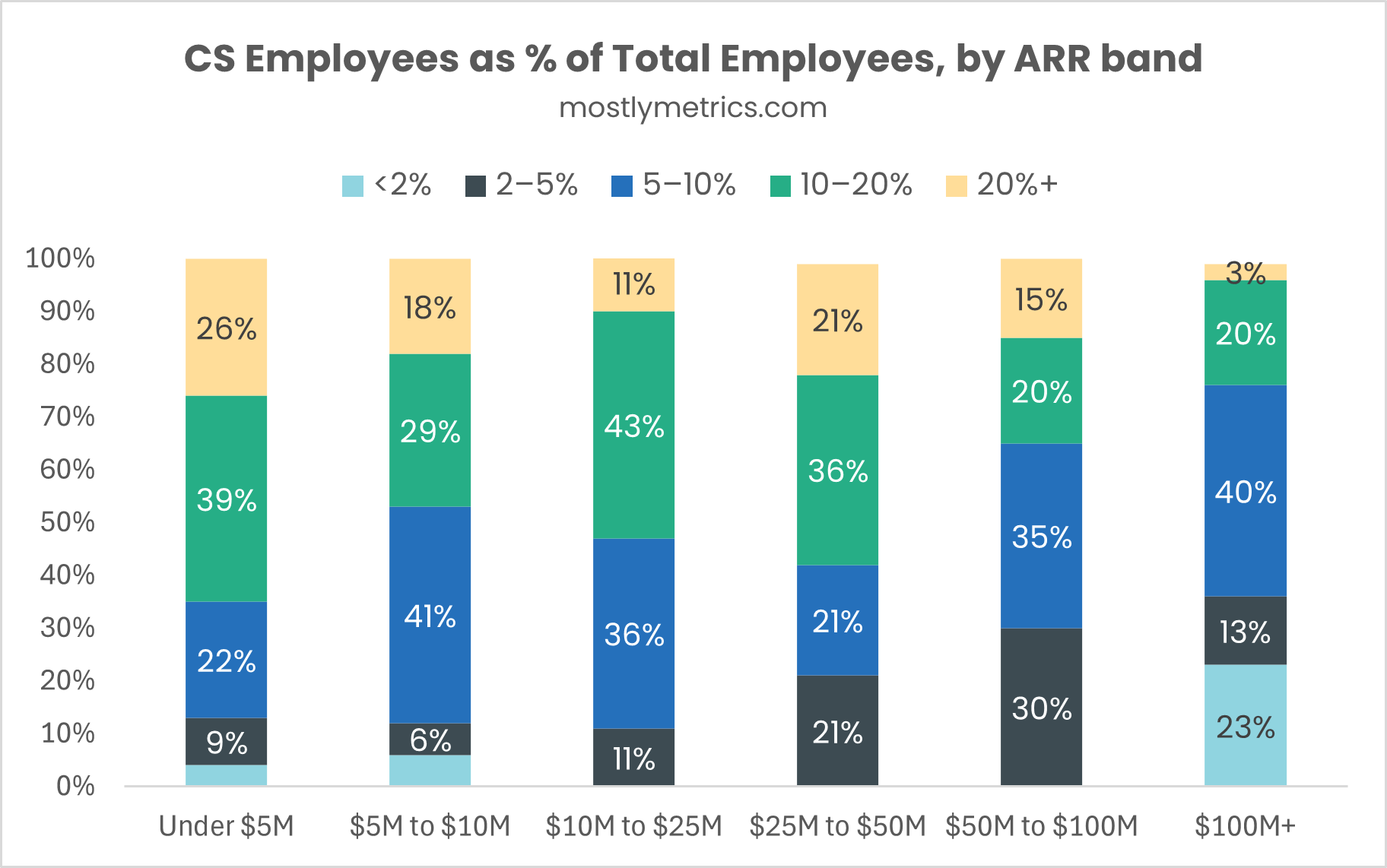

How Big are CS Teams?

Relative to total employees, CS teams start in the high teens and grind down to mid single digits

When you look at CS headcount as a percentage of the company, a pattern jumps out.

CS intensity peaks between $10M and $50M of ARR.

Then it starts to come down.

At most companies:

<$5M ARR: Founders start to over-invest early because churn feels existential, and honestly the product doesn’t work as fully intended yet.

$10M–$50M ARR: CS gets big. High-touch coverage props up product gaps as companies go multi product and up market.

$100M+ ARR: CS compresses as a share of headcount. Segmentation, tooling, and discipline (to an extent)

Early on, you hire CS because things feel wicked busy. Later, you hire CS when the CFO says the math works.

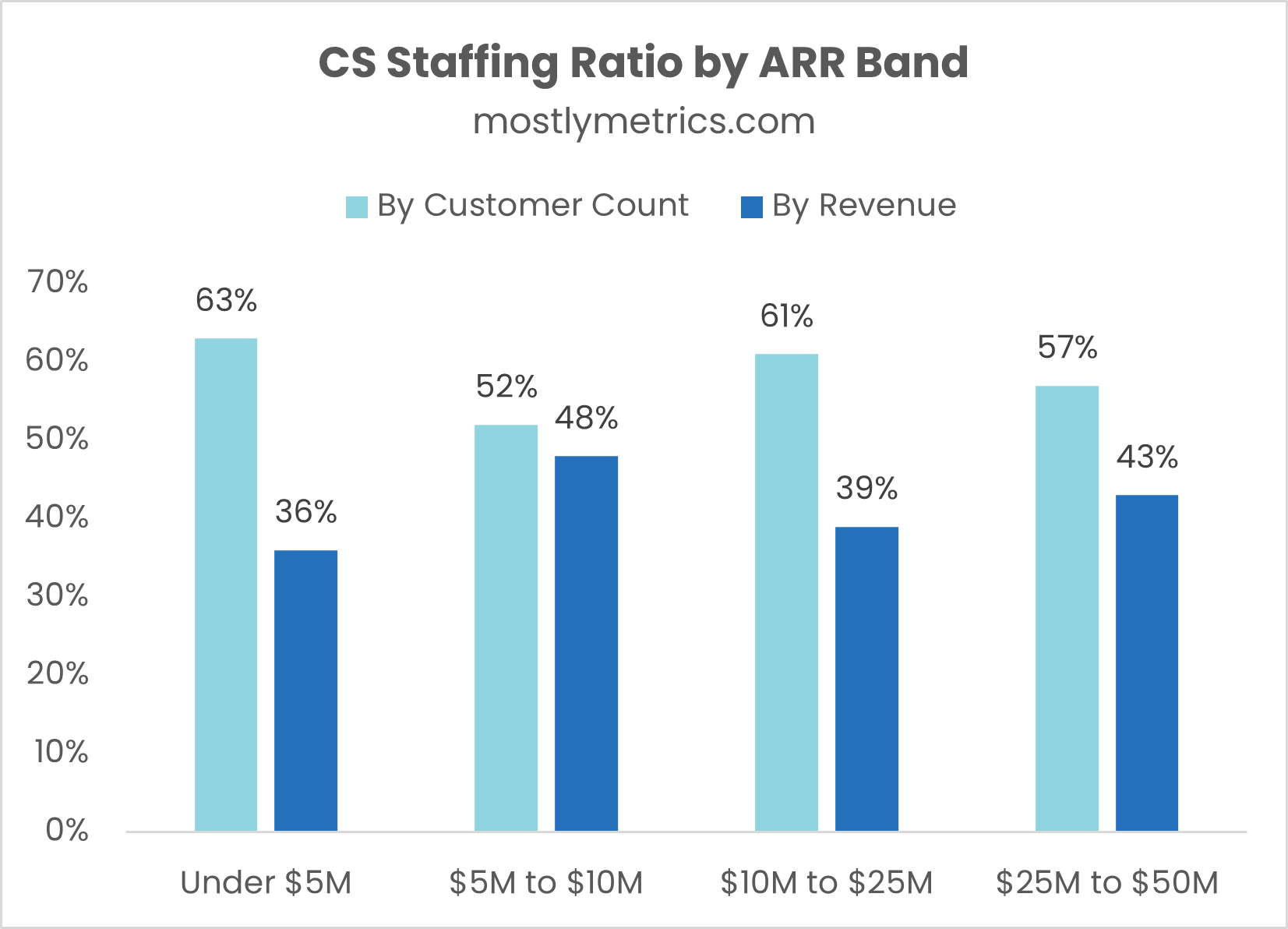

How do companies staff?

Even as companies scale, most CS teams are still staffed by customer count, not revenue.

That tells you CS is being treated as more of a coverage problem, and less a revenue optimization exercise.

And according to the numbers: There was no meaningful correlation between staffing ratio and revenue retention or renewal rate.

So just to recap where we are so far…

The org charts don't agree, the P&L doesn't agree, and the staffing models don't agree.

Which brings us to the real issue: how CS gets paid.

Part 3: Incentive Structure

As you’d assume, if the org structure is fragmented, and the P&L is a choose your own adventure type of deal, the comp plans are inevitably chaos.

But within the madness, a fact emerges:

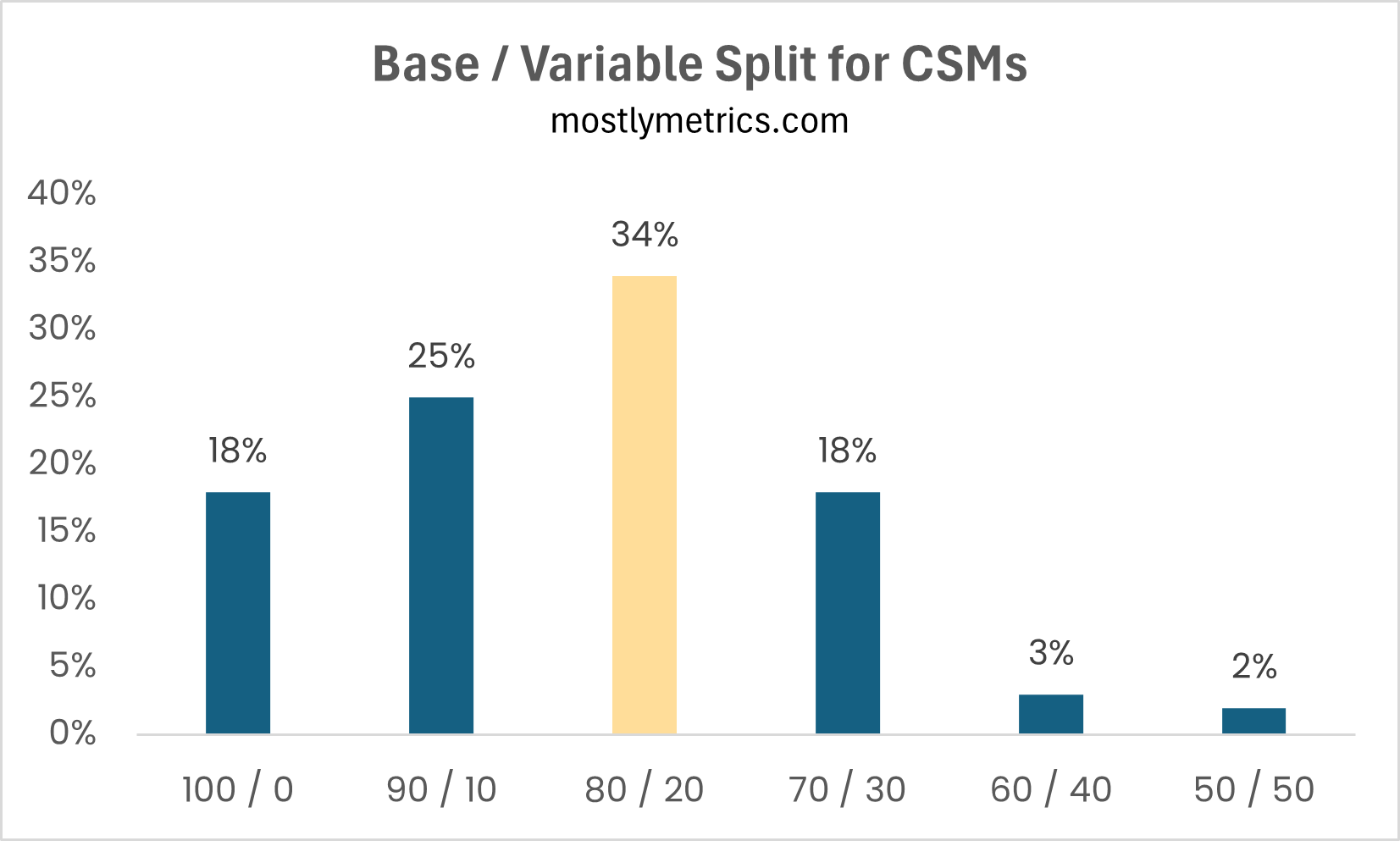

CS is not paid like sales

Say it with me: CS is not paid like sales.

The VAST majority of CSMs are on plans where 20% or less of their comp is variable. Almost no one pushes beyond that. For comparison, most sales reps are on a 50/50 plan.

Only 5% of respondents paid CS at a variable split of 40% or more.

Any position with less than 40% variable is not how you pay a revenue owner.

So what is the variable component tied to?

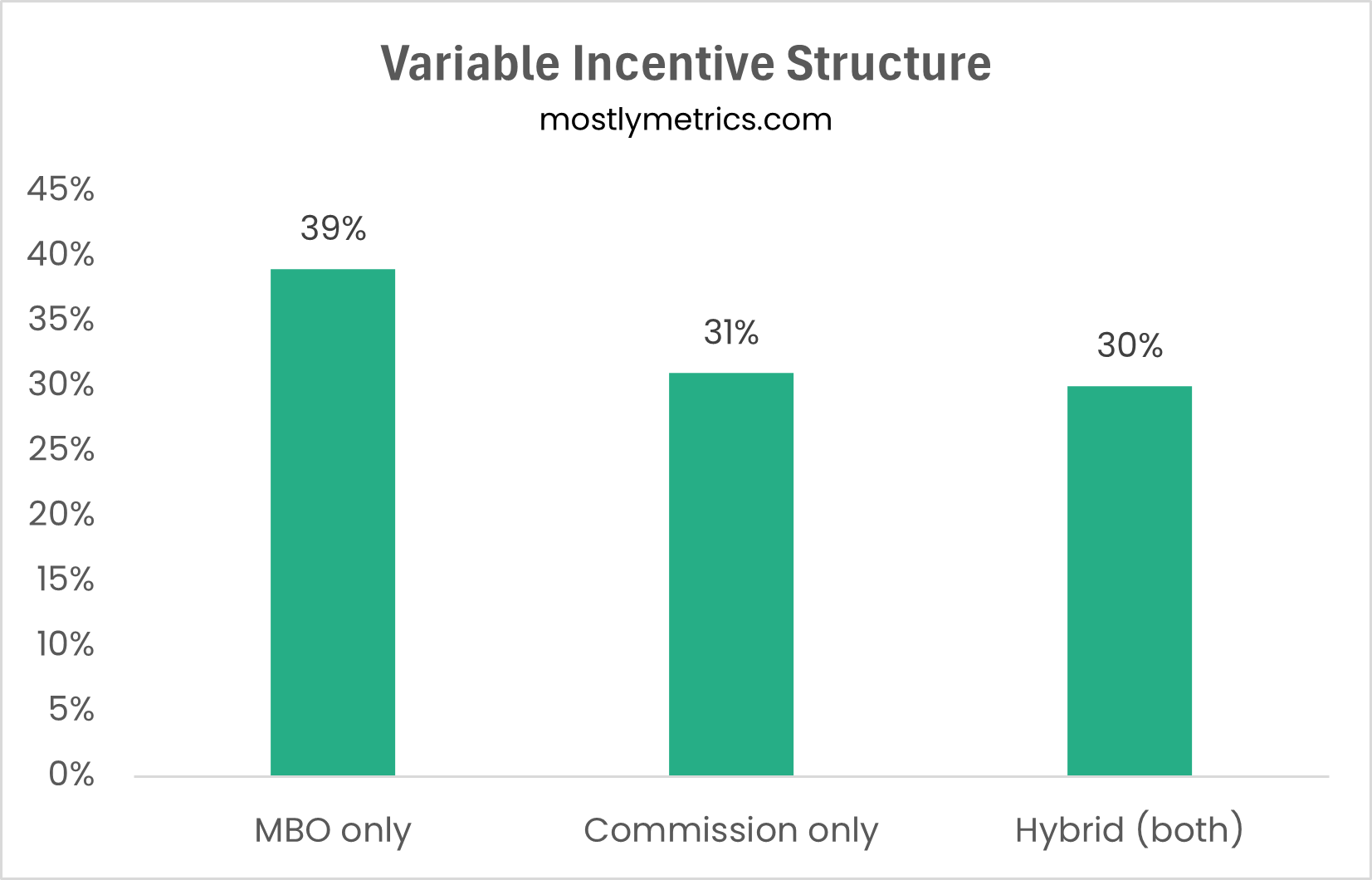

Our THIRD three-way split. This is getting tiring.

While light, companies are torn between:

Paying CS for outcomes (commission)

Paying CS for activities (MBOs)

Hedging because they're not sure which is right

Live look at a CFO making a CS comp plan

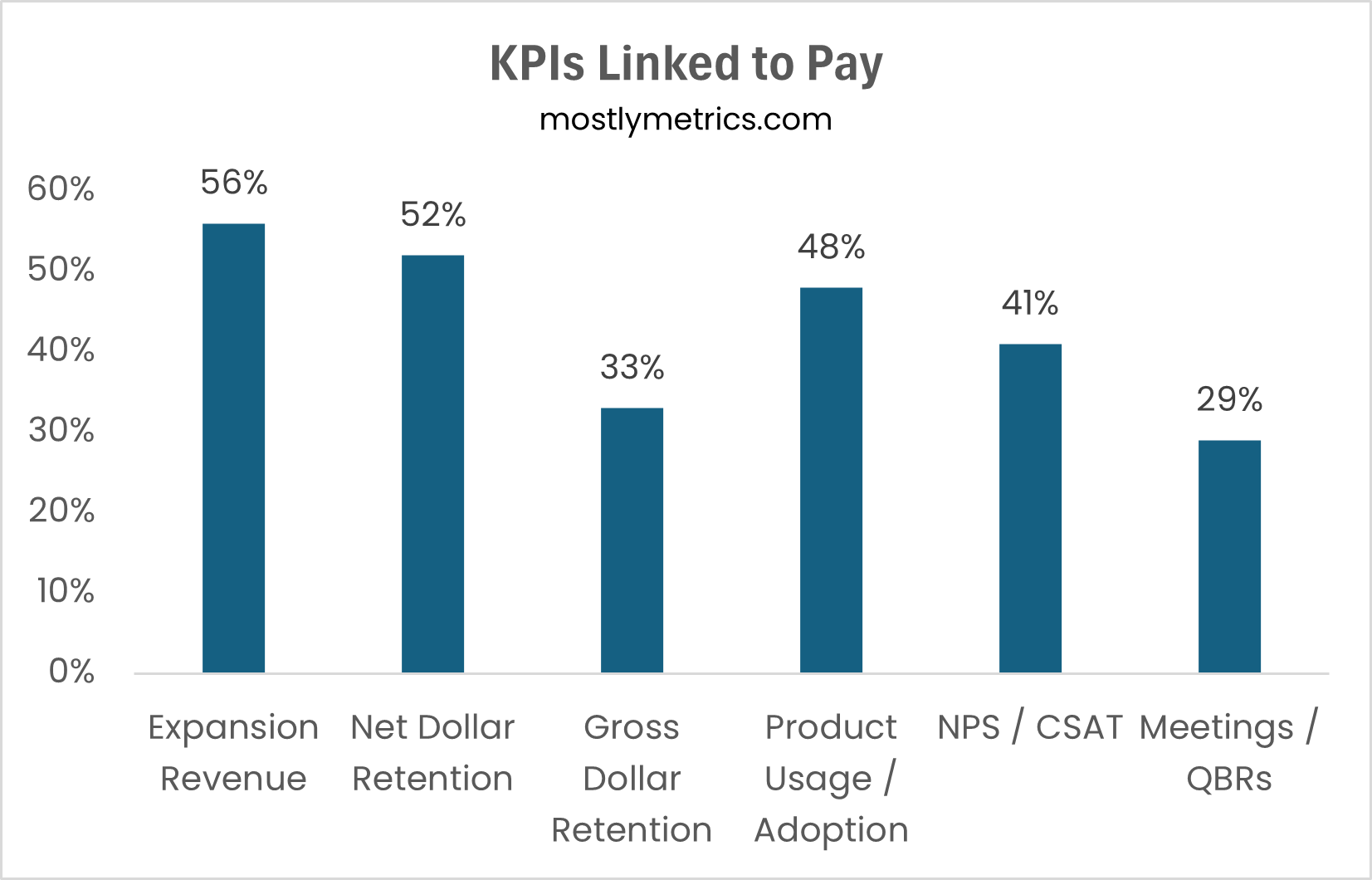

Let's drill deeper. What metrics actually show up in comp plans?

Note: This question allows multiple selections, so percentages do not sum to 100%. Don’t @ me.

CS incentives feature a long list of proxy metrics.

Those include:

Usage.

Retention signals.

Engagement.

NPS.

Number of Wednesdays in March.

Which brings us to the real problem.

Control vs. Accountability

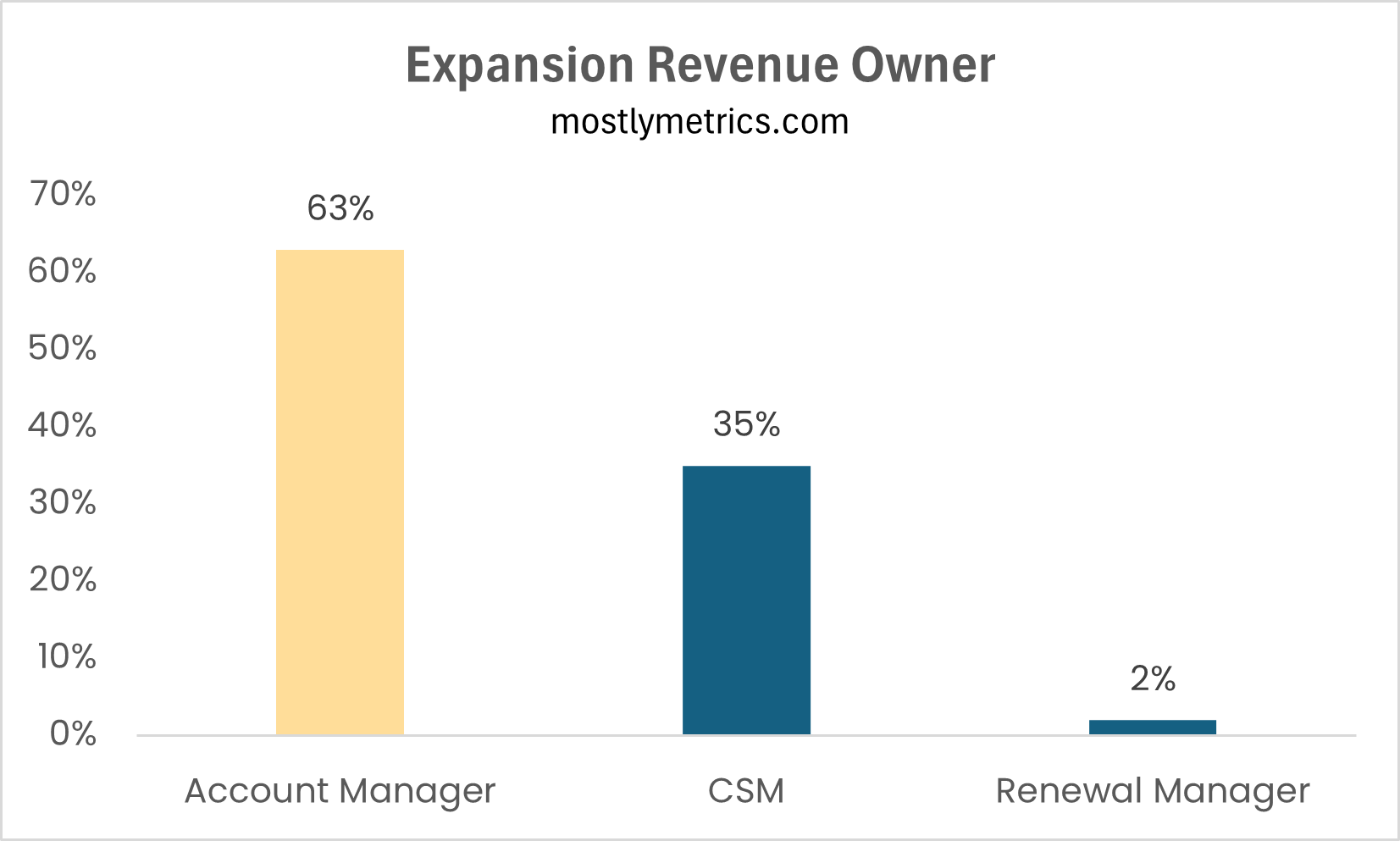

In most companies, expansion is owned by Account Managers, even when CS is measured on renewal rate or net dollar retention.

That creates incentive exposure without control.

It's like holding a defensive coordinator accountable for points scored on offense. They don't have the rock.

“Throw me the keys to expansion!”

The survey told us that 56% of CS teams are paid on Expansion Revenue. But 63% of the time, Expansion sits with someone else.

That's the big time mismatch. CS does the work to keep customers alive and healthy. AMs show up to close the upsell. And then everyone argues about who deserves credit at comp review time.

Total Sidebar: 84% of respondents do NOT charge customers extra for CS access.

That's another data point. If CS were a revenue product, you'd price it like one. Most companies don't. They treat it as included; a cost of doing business, not a line of business.

Part 4: Does any of this actually matter?

The existential angst started to set in as I realized:

Commission-heavy CS teams don't renew better than MBO-driven teams.

Teams that report to a CRO don't outperform teams that report to a CCO.

Staffing by revenue vs. customer count? No meaningful difference in retention.

Live look at Jackson Pollack staffing CS teams

But here's what the data does suggest:

Renewals are driven by product quality and customer fit, much more than by how you pay your CS team.

So why does everyone keep tinkering?

Because paying 100% base doesn't feel right. Leadership wants skin in the game. We want CS leaning into outcomes, not just punching the clock.

So we add a little variable. We sex it up a little.

We tie it to something… NDR, usage, QBRs, continued employment. We manifest it into creating alignment.

And then, a year later, we’re still in the 93% who aren't confident we have it right (rise and repeat each annual planning cycle).

CS clearly influences revenue. But it doesn't control it. And the data doesn't show that cranking up variable pay moves the needle on retention.

That's not satisfying. But it's consistent. And logical if the team in question doesn’t own revenue.

So what should we actually do?

Part 5: What CFOs Should Actually Do

If incentives don't drive retention, what's the point of this whole exercise?

The point is alignment, rather than motivation. You're not going to comp your way to better renewal rates based on how CS teams are set up and tasked with today. But you can design a structure that's honest about what CS actually controls, and stop creating frustration with misaligned incentives.

Here's what I'd recommend:

First: Decide if CS is a cost center or a revenue influencer. Then design accordingly.

If CS doesn't own expansion, stop pretending it's a revenue role. Pay it like an operational function: mostly base, maybe a small MBO tied to onboarding velocity or adoption milestones. Things in their control.

If CS does own expansion (and you're willing to give them the keys), then pay them like it. Commission on expansion revenue. Real variable. Actual upside (and downside).

The worst outcome is the middle: treating CS like sales in the org chart but like support in the comp plan. Pick a lane, my G.

Second: Don't pay CS on numbers they can't control.

Kind of addressed in my first point, but it’s so important that it merits repeating. If expansion sits with Account Managers, don't backdoor NDR into CS comp. That creates frustration without a realistic path to changing outcomes.

Incentives should map to levers the team actually pulls. If CSMs control onboarding, usage, and risk identification, pay them on those. If they don't control the commercial conversation, don't pretend they do.

Third: Use variable comp to shape input metrics, not revenue related output metrics.

The data is pretty clear: incentives don't magically fix churn. Product quality and customer fit do.

So use comp to reinforce the activities that lead to healthy customers: onboarding speed, time to value, adoption milestones, early risk flags.

Those are input metrics and leading indicators that show up before churn ever does. Have Customer Success linked to the upstream metrics within the customer journey.

Fourth: Let accounting tell the truth.

The comp plans already know what CS is.

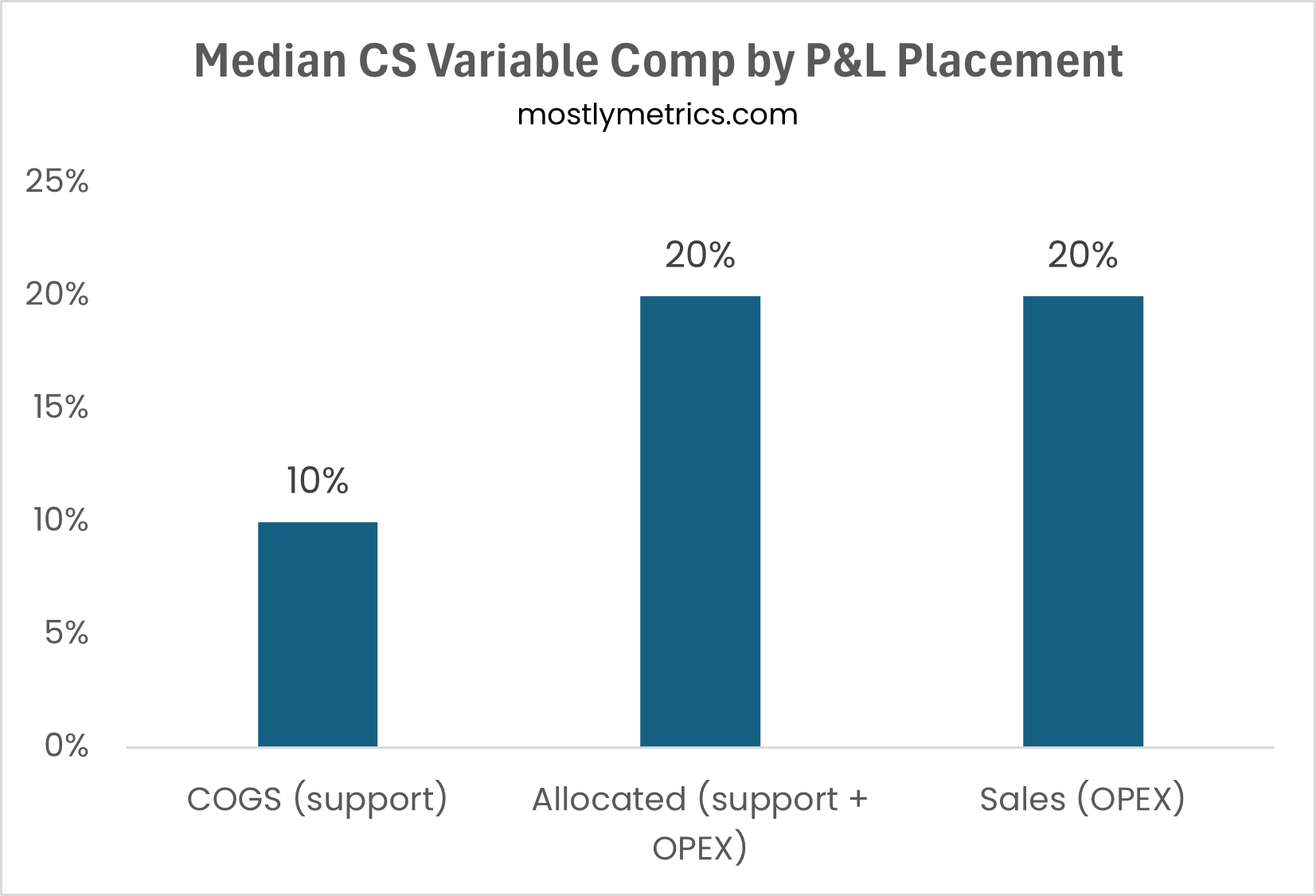

The median CS variable is 20% whether you stick the team in Sales or split it across functions. The only time it drops is when you book CS in COGS, where median variable is 10%. But still… we aren’t talking a difference of 50% based on P&L geography. These figures are in the same ball park.

TBH the comp plans already know what CS is. The P&L should match. And many of us are being dishonest with the sales classification because it makes us look better.

If CS is booked as support, own it. Align headcount planning, coverage models, and expectations with that reality, instead of quietly hoping CS behaves like sales when you're not looking.

Final Thought

Customer Success doesn't need to be paid like sales to be valuable. We all agree on CS importance… after all, we keep staffing these teams, in some cases to the tune of +10% of our total headcount at scale.

But CS does need incentives that reflect what the role actually controls. Clarity is kindness and we’ve been wishy washy for too long.

Oh, and yea, it should show up in the right place on the P&L. T’s and P’s to gross margins everywhere.

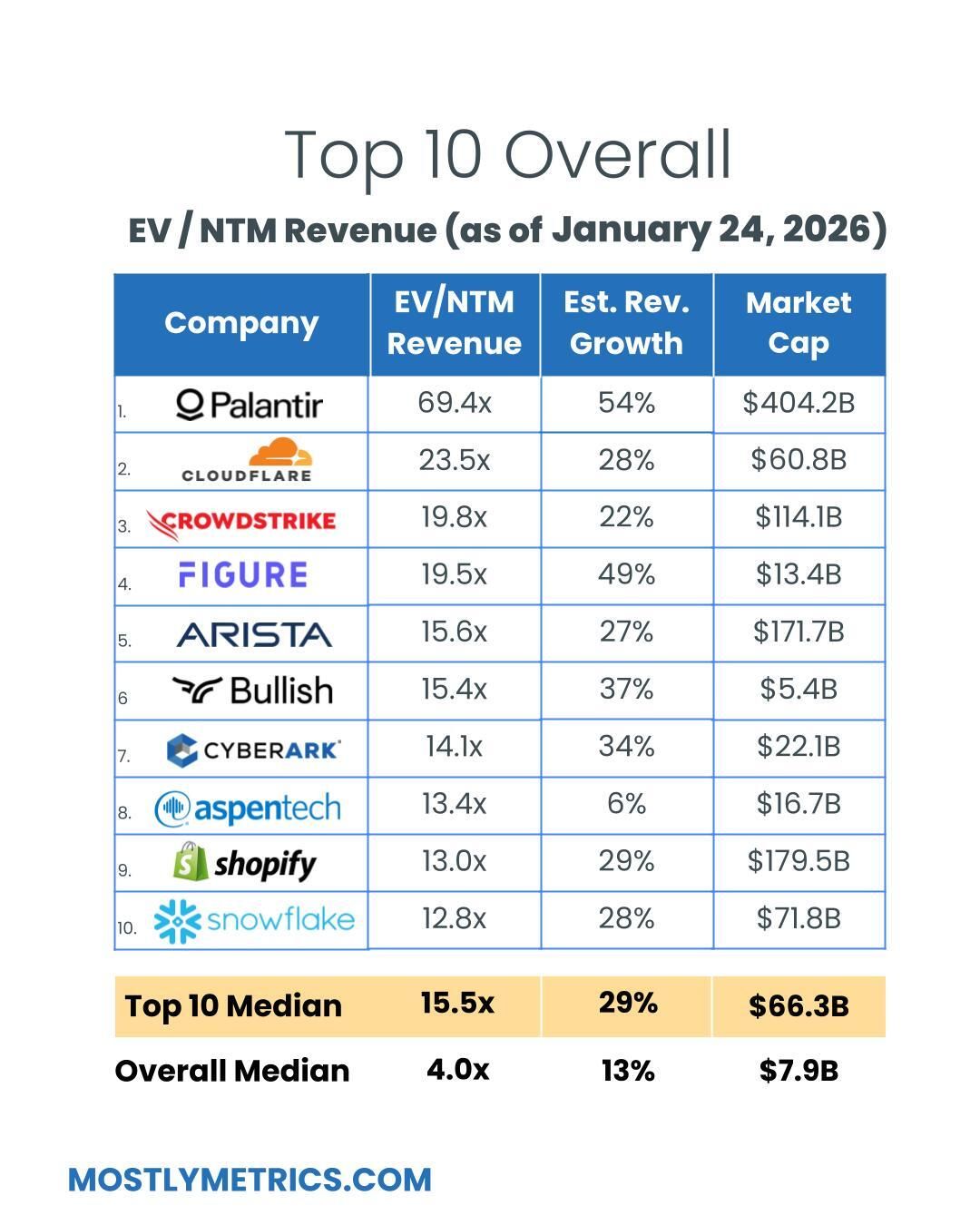

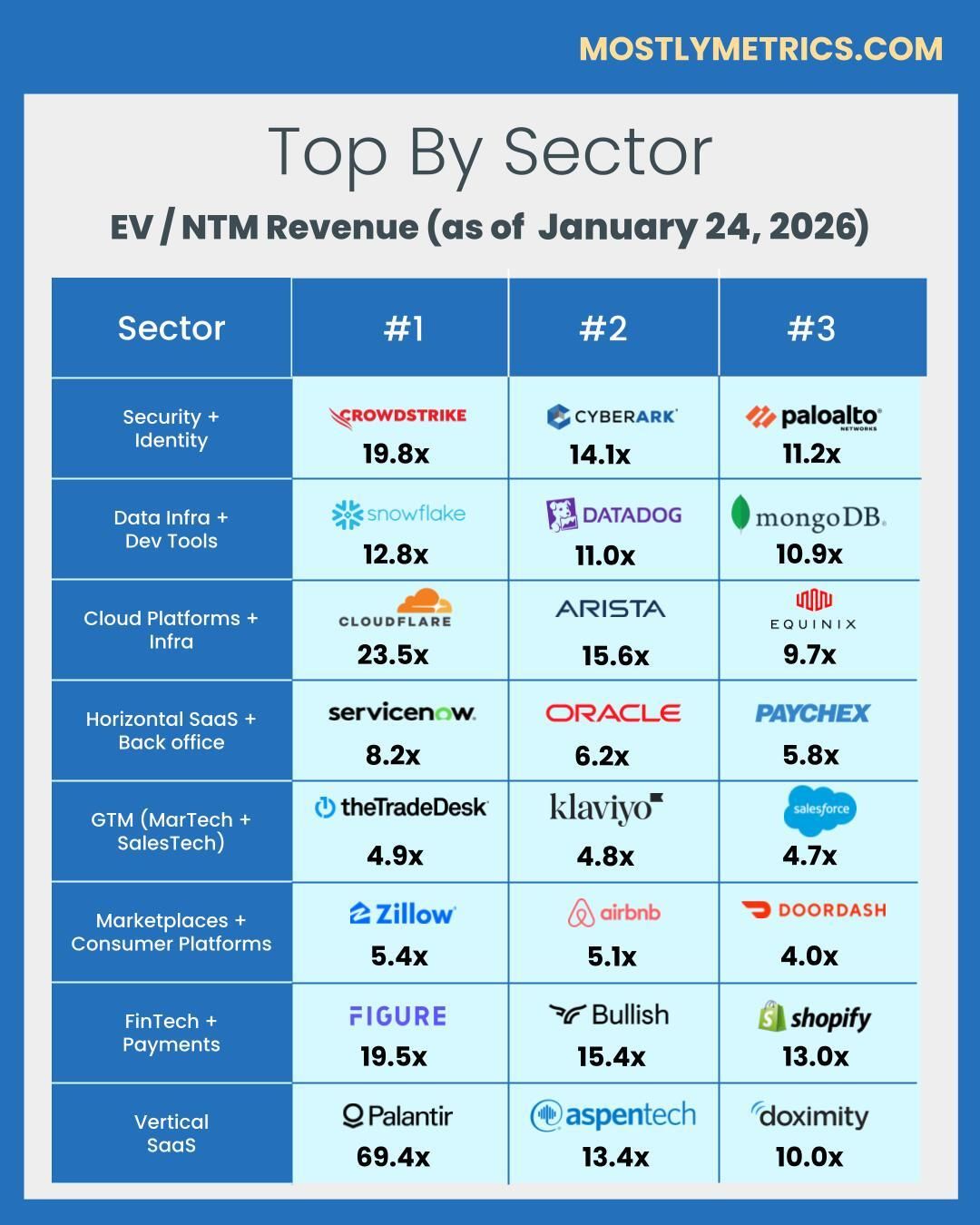

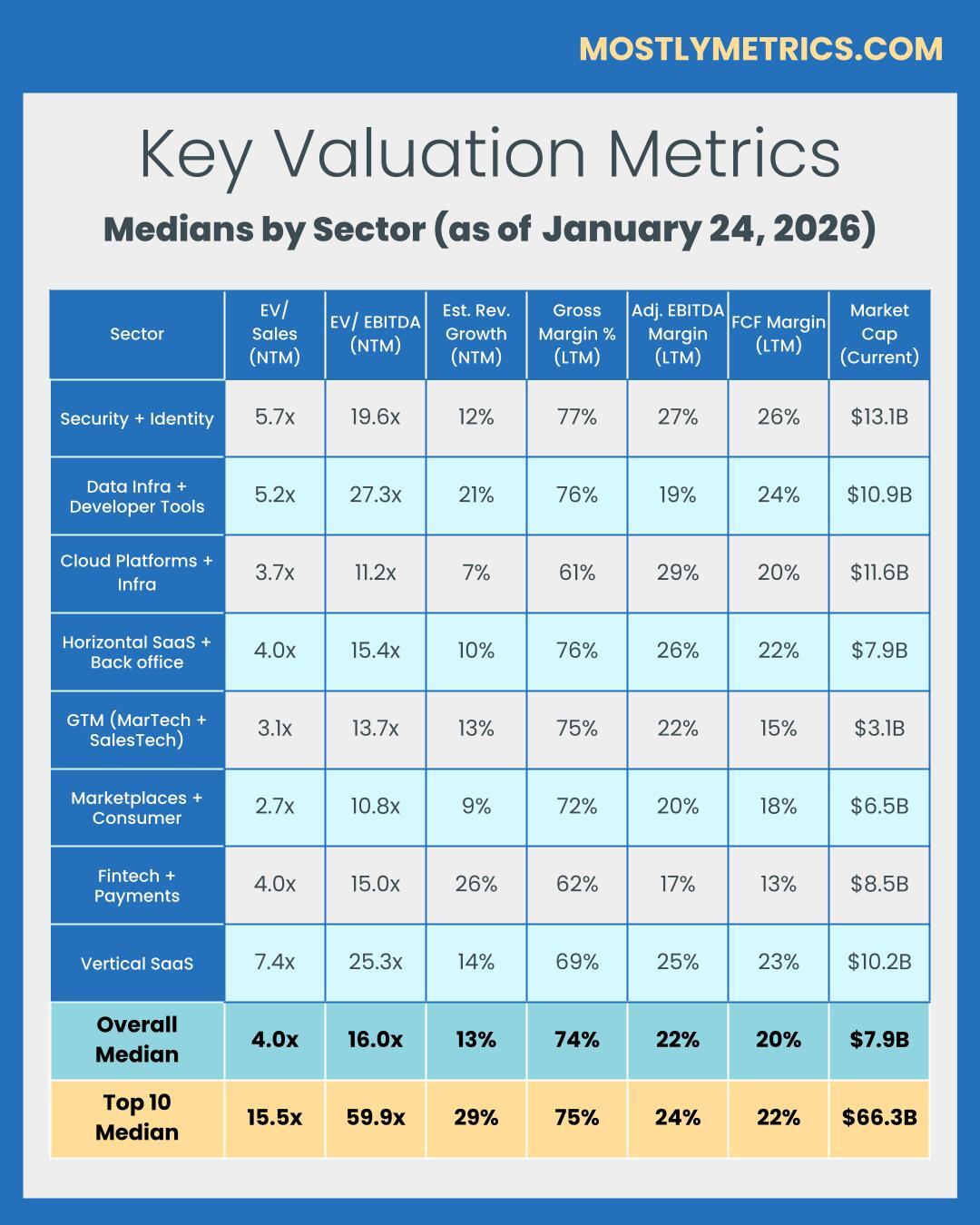

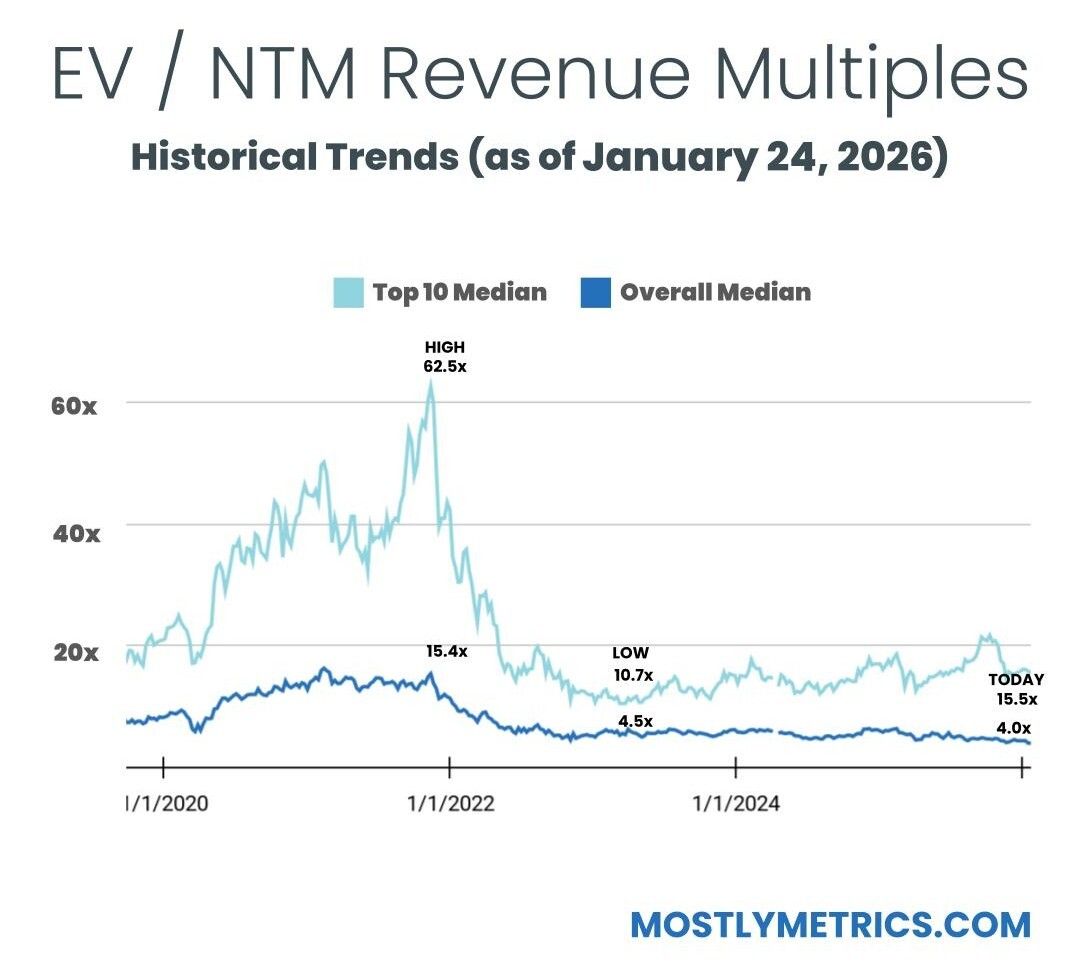

TL;DR: Medan Multiples are FLAT week over week.

The overall tech median is 4.0x (FLAT 0.0x w/w).

What Great Looks Like - Top 10 Medians:

EV / NTM Revenue = 15.5x (DOWN 0.3x w/w)

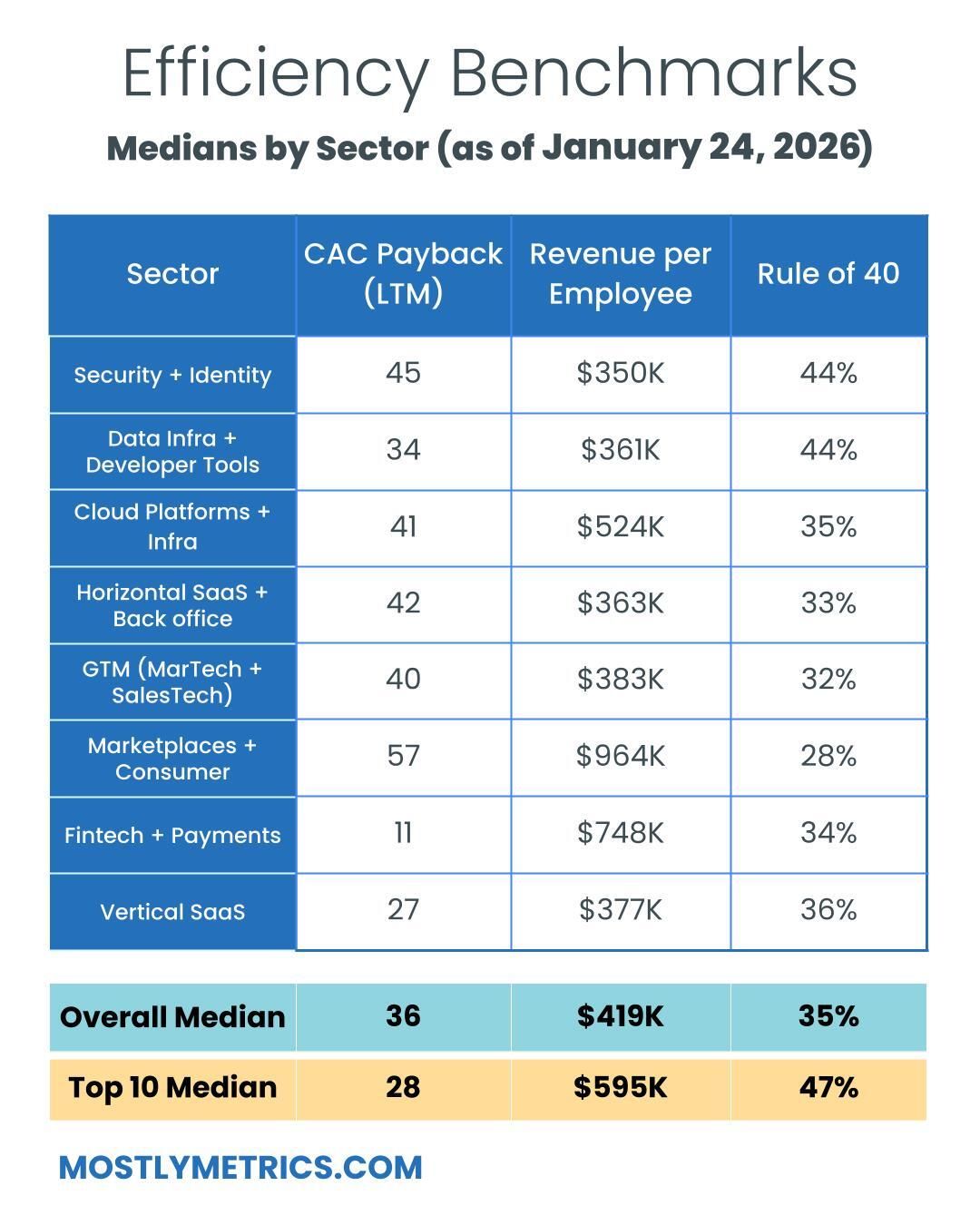

CAC Payback = 28 months

Rule of 40 = 47%

Revenue per Employee = $595k

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 146

Recent changes

Added: Navan, Bullish, Figure, Gemini, Stubhub, Klarna, Figma

Removed: Olo, Couchbase, Dayforce, Vimeo

Population Sizes:

Security & Identity = 17

Data Infrastructure & Dev Tools = 13

Cloud Platforms & Infra = 15

Horizontal SaaS & Back office = 19

GTM (MarTech & SalesTech) = 18

Marketplaces & Consumer Platforms = 18

FinTech & Payments = 28

Vertical SaaS = 17

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Sales and Marketing costs are measured on a TTM basis, but lagged by one quarter (so you skip a quarter, then sum the trailing four quarters of costs). This timeframe smooths for seasonality and recognizes the lead time required to generate pipeline.

Revenue is measured as the year-on-year change in the most recent quarter’s sales (so for Q2 of 2024 you’d subtract out Q2 of 2023’s revenue to get the increase), and then multiplied by four to arrive at an annualized revenue increase (e.g., ARR Additions).

Gross margin is taken as a % from the most recent quarter (e.g., 82%) to represent the current cost to serve a customer

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

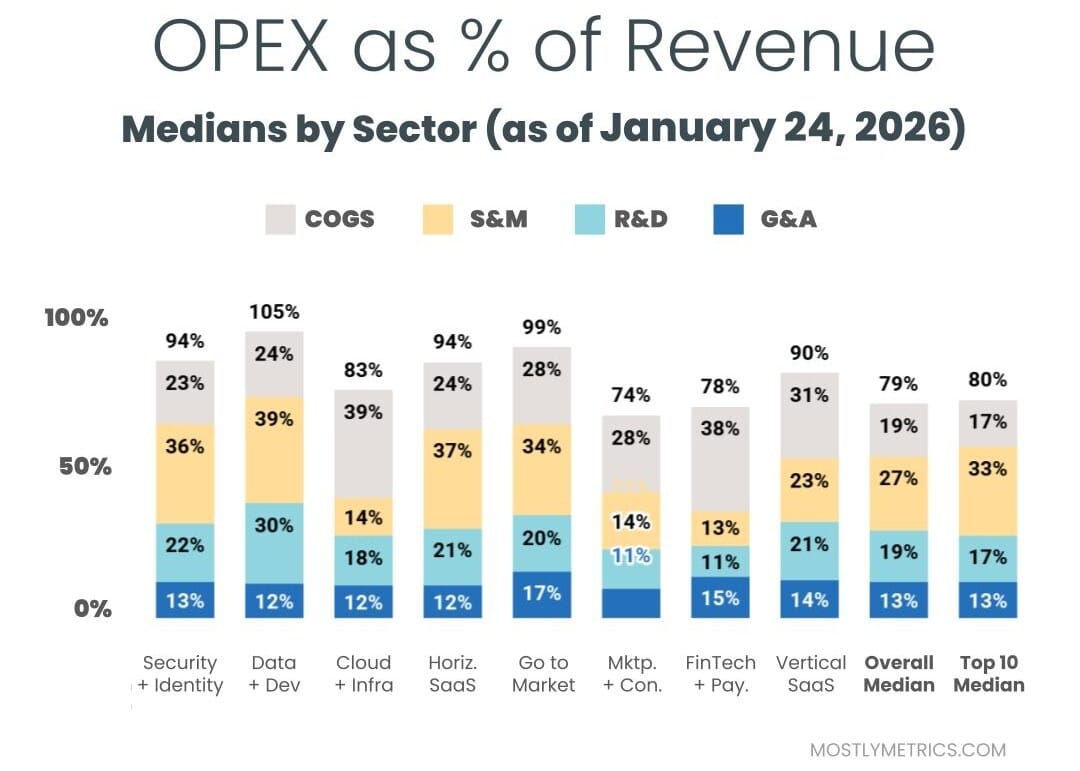

OPEX

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.

Please check out our data partner, Koyfin. It’s dope.

Wishing you a CS team with appropriate incentives,

CJ