Mostly metrics

In 2023, MUFG made a bold move to expand its Growth & Middle Market Tech Banking group — a team built to deliver more than just capital to ambitious, high-growth companies.

In just two years, the group has committed over $4 billion in debt capital to leading VC-backed, PE-backed and public Tech companies across subsectors including Enterprise SaaS, Cyber Security, Fintech and more.

Backed by the global strength of a $3 trillion institution, MUFG’s team brings startup-caliber insight and institutional-grade execution to every relationship.

MUFG Growth & Middle Market Tech Banking Global resources. Startup-caliber insights

Contact Group Head Bob Blee ([email protected]) to discuss how MUFG can empower a brighter future for you.”

Nantucket’s sidewalks are notoriously anti-stroller.

I think this is what the pros call “writing on a deadline.”

I’m typing this from the island of Nantucket, where the iced coffee runs $7 and my family is unabashedly “screen time, all the time.”

Judge me if you want, Karen; it’s either Miss Rachel counting to potato, or your mashed potatoes are getting a side of Play-Doh. So here we go… two Cisco brews deep… on the Figma IPO.

Feature Story

YES, IT POPPED. NO, THAT’S NOT ALWAYS GOOD.

Figma went bonkers yesterday. But that doesn’t make it a win for tech.

Figma went public and the stock absolutely ripped—closing at $115.50, more than 250% above its IPO price of $33. It’s the kind of pop that grabs headlines, but raises eyebrows for anyone who’s done the math.

The first-day trading gave Figma a market value of $56.3 billion, based on outstanding shares in its filings. Fully diluted (accounting for options, RSUs, and Dylan Field’s restricted stock) that number creeps past $65 billion (Yahoo Finance).

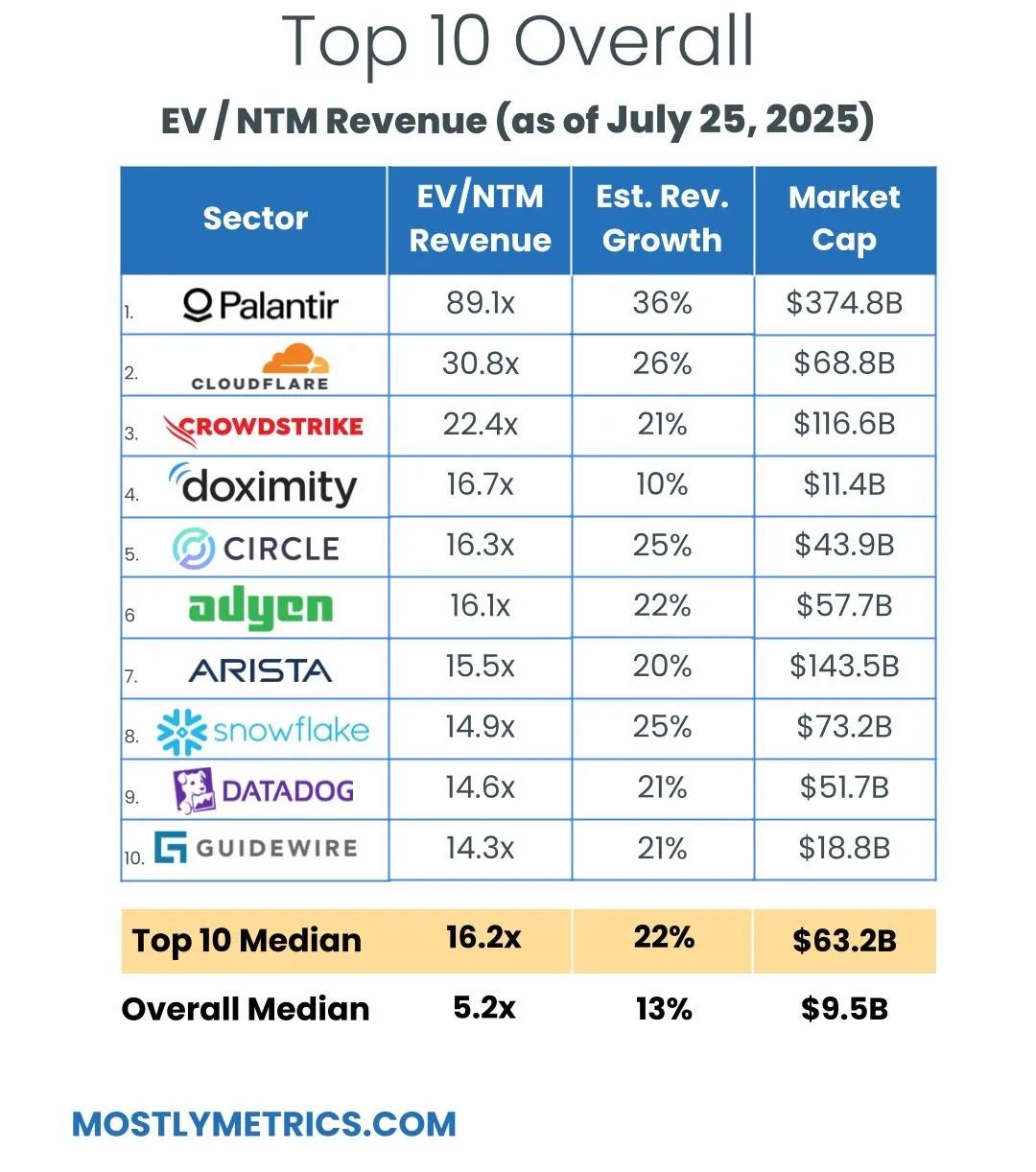

Even assuming Figma grows 50% over the next twelve months to hit $1.2 billion in revenue, that implies an EV/NTM revenue multiple of +50x. That’s rare air. Outside of Palantir (which makes as much sense as the plot of Hot Tub Time Machine), no top-10 public tech company touches that.

THE ART AND SCIENCE OF DAY 1 POPS

Figma sold 12.47 million new shares, raising $411.7 million that went straight to the company’s balance sheet. That’s real capital to fund ops, expand headcount, and ship product. After all, IPOs are supposed to be fundraising events.

24.46 million shares were sold by early investors at the IPO price of $33. That haul—roughly $807 million—went to them, not the company. It was a liquidity event, not operating capital.

And look, much of that is expected. It’s been a decade in the making. Rent’s due.

So did those sellers benefit from the pop? Not directly; they sold at the issue price. But they didn’t need to top tick the $115 close to win. It’s unlikely they dumped their whole position. Founders and VCs still hold massive stakes that exploded in paper value.

But a pop like this? That’s just bad detective work by the bankers.

(The bankers who’s institutional clients get to ride the wave up.)

There’s a big difference between a healthy day-one pop… and engineering something to rip people’s faces off.

It makes you wonder if there was any price discovery on the roadshow? Did anyone check what those few shares floating in secondary were going for?

We knew the market was thirsty AF. But this pricing? Greedy AF.

“This IPO was so obviously mispriced it should be considered the equivalent of investment banking malpractice.”

QUICK FLIP MATH

Let’s say an institutional investor was allocated 100,000 shares at $33. That’s a $3.3M buy-in.

If they flipped those shares at the $115.50 closing price?

Proceeds: $11.55M

Profit: $8.25M

Return: 250% in a single day.

Multiply that by dozens of firms with allocations and you're looking at hundreds of millions in instant upside… risk-free, just for having access.

Meanwhile, employees? They’re locked up for six months, watching from the sidelines as their equity rides the emotional rollercoaster.

WHY THIS ISN’T ACTUALLY GOOD

Employees Are Mentally Anchored at $115

Lockups don’t expire for 180 days. So no one working at Figma got to sell into that 250% pop. They’re sitting on paper gains, staring at a chart that might not look the same in January.

If history is a guide, stocks that rocket on day one tend to come back to earth. Snowflake IPO’d at $120, closed day one at $254. Today, five years later, it still trades below that mark (despite more than 7x’ing their revenue since then).

Figma’s new hires, tenured engineers, everyone… they’re all now mentally benchmarked to $115. That’s their floor. And unless Figma absolutely crushes future earnings, there's more room for disappointment than upside.

And Let’s Be Real—They Didn’t Have to Do It This Way

Figma has been profitable. They didn’t need the cash. They could’ve gone the direct listing route like Spotify or Coinbase. Or carved out shares for actual users—designers, startups, superfans—like Airbnb did with its community allocation.

Instead, they chose the traditional path. The people who got access weren’t power users or loyal customers. They were institutional whales and private wealth clients. And even some of them got shut out. (Probably the same folks angrily glaring at my family at this Nantucket restaurant.)

Meanwhile, Robinhood traders were flexing screenshots showing they got one share. Not 100. Not 10. One.

THE BOTTOM LINE

The IPO is dressed up as Figma raising $1.2 billion. But Figma itself raised less than half a billion. Wall Street extracted 2x that in day-one gains. The people who built the company (employees) are now mentally pegged to a $115 stock they can’t touch for six months. Meanwhile, institutional allocators made more in one trading session than Figma will invest in product all year.

Valuation is supposed to reflect a company’s future cash flows. Not artificial scarcity. Not a chart that opens at $85 just because you only sold 3% of your float. Not a pop that plaster’s people’s inners to the wall.

If this is the model for IPO 2.0, it’s no wonder companies are waiting as long as possible to go public. Because the “market” isn’t really discovering price. It’s just redistributing access. And hate to break it to you, but folks like me, you, Dale, or Brennan ain’t gettin’ in.

THE BOTTOM LINE

Only one-third of IPO proceeds went to Figma.

Two-thirds went to selling insiders at the low $33 price.

The price exploded

The valuation eclipsed more than 50x forward revenue

Employees are locked up, mentally anchored at $115.

Retail investors got scraps.

The pop looked aspirational, but it warped reality more than it helped.

None of this is investment advice. It’s for informational and entertainment purposes only. I write this from a cottage with broken AC, shoddy wifi, and heartburn from eating bad calamari.

Wishing you realistic day one pops,

CJ