Two years ago, MUFG made a bold move — expanding its Tech Banking group to back the next generation of high-growth companies.

Since then, the team has committed more than $6 billion in debt capital to leading VC-backed, PE-backed, and public tech companies across SaaS, cyber security, fintech, and beyond.

Built for companies scaling fast, MUFG Tech Banking brings together seasoned bankers who think like operators and the strength of a $3 trillion global platform. The result: relationships that move fast, deliver impact, and last.

Bank at Growth Speed.

Contact Group Head Bob Blee ([email protected]) to discuss how MUFG can empower a brighter future for you.

Hit the Road, Jack

6 days. 36 investor meetings. 4 states in 48 hours. 6,600 miles on a plane together.

Yesterday I caught up with Amy Butte (CFO) and Michael Sindicich (President) of Navan, fresh off their IPO roadshow. Their voices were kinda hoarse, and their suitcases probably weren’t unpacked.

24 hours out from ringing the bell, we sat down to talk about the journey. I asked them to give me the human side of what goes into the moment.

BC here’s the thing about roadshows: most people think it's just a fancy pptx tour. Show up, pitch the company, maybe grab lunch, move to the next city. But that's not it at all. The roadshow is where your order book gets finalized and your valuation gets cemented. It's a week of back-to-back-to-back meetings where institutional investors are deciding whether to buy, how much to buy, and what price they're willing to pay. By meeting 36, you better have the energy to make it feel like meeting number 1.

Navan is fascinating as a case study here. They're an all-in-one travel, payments, and expense management platform doing $613M in revenue and growing at 32% year-over-year.

Not too shabby. But they're also testing the lower end of the IPO market when it comes to scale. Recent tech IPOs have averaged north of $800M in revenue and +30% growth. Navan survived COVID (as a travel company!), went back to the lab to build out their expense offering (pandemics are the mother of all invention), and came out the other side as a complete spend platform with a new name to boot (remember: they used be called TripActions… I can feel people connecting the dots as they read this).

And today… they're going public.

So what does it actually take to get from "we're thinkin’ about going" to doing the damn thing? Let's break it down.

IPO Process 101: The Six-Month Gauntlet

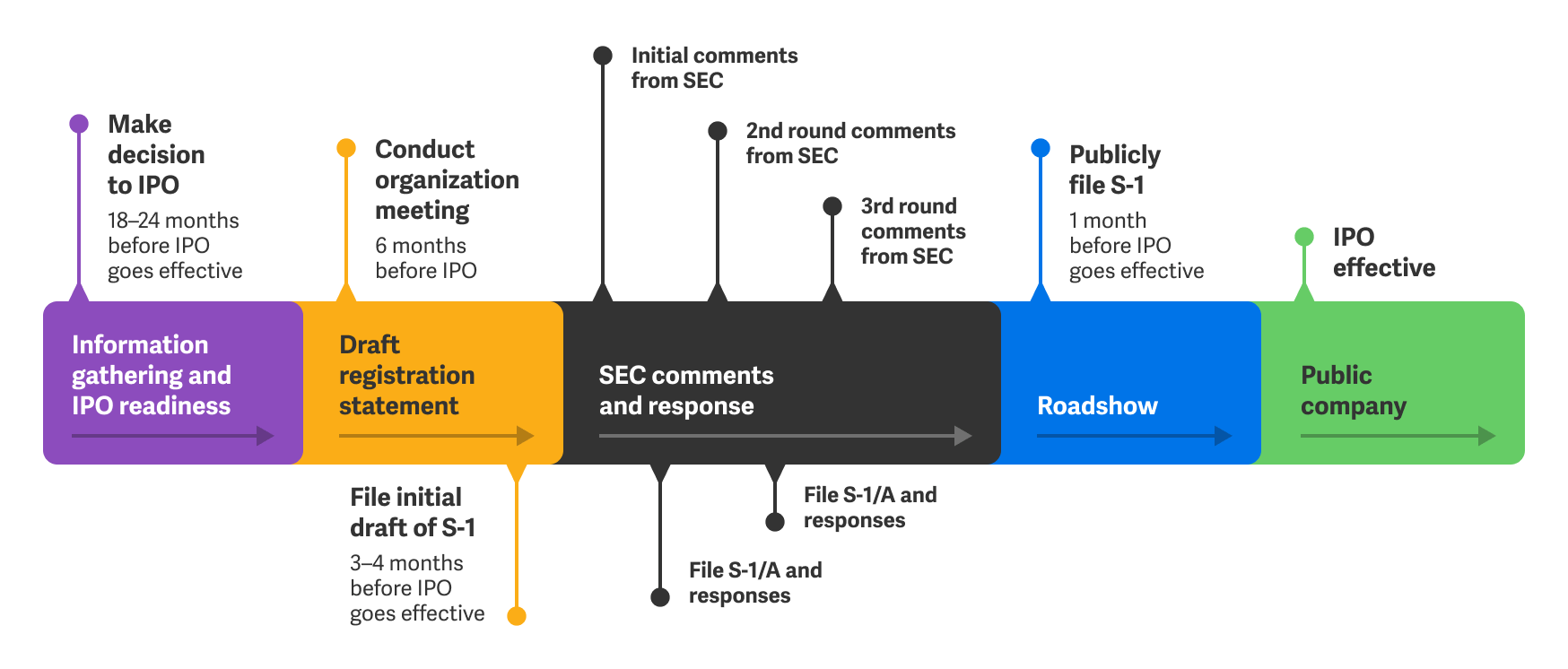

Before we zoom in on the roadshow, let's set the stage. Going public isn’t something you just wake up and decide to do. It’s a six-month (minimum) process with a bunch of distinct phases. Here's how it typically breaks down:

Step 1: The Bakeoff

First, you pick your investment banks. This happens privately, and multiple banks pitch you on why they should lead your offering. It’s kind of like speed dating with your advisors. You select a "Lead Left Underwriter" (the main bank) plus a handful of other banks who'll help sell shares and publish research on you after you're public (what we call sell-side analysts).

Step 2: IPO Prep (4-6 months)

This is where the real work happens. You're drafting the S-1 document (hundreds of pages about your business, financials, risks, cap table…etc. ). Every single number gets fact-checked by lawyers. Every claim gets scrutinized. You're also preparing audited financials, building a forward beat and raise model, and creating the investor presentation you'll use on the roadshow. Companies can "confidentially file" with the SEC during this phase to get feedback privately before going fully public.

Step 3: Public Filing

About three weeks before your roadshow, you file the S-1 publicly. This is when the press writes headlines like "Company X files for IPO" and ya boy stays up wicked late to write about it. Everyone can see your numbers for the first time. Interestingly, the initial filing often leaves out key details like the exact price range and share count; those get added in amendments over the next few weeks.

Step 4: Roadshow Launch + Pricing Range

Next, you file an amendment with your proposed price range and kick off the roadshow (typically on a Monday). You spend the next six to ten days flying around and meeting institutional investors - mutual funds, hedge funds, anyone who might buy a meaningful chunk of shares. During this time, you're watching demand and potentially adjusting the price range up if there's strong interest.

More on this in a sec…

Step 5: Pricing & Allocations

Wednesday night (usually 11 days after the roadshow starts), you lock in the final IPO price and decide which investors get how many shares. This is where things get political; you're trying to maximize price while also building a strong base of long-term holders (aka the ones who won’t panic sell you during a down quarter).

Step 6: Day 1 Trading

Thursday morning, you ring the bell; but your stock doesn't actually start trading at 9:30am with everyone else. There's no historical market for your stock yet, so a "market maker" has to spend the morning building an order book, collecting buy and sell orders from retail and institutional investors, and coming up with an opening price that balances supply and demand. Only then, often mid-morning or later, does your stock actually start trading publicly.

The Roadshow: Where It Actually Happens

Alright, let’s revisit the fun part. The roadshow is where all that prep work meets reality. Here's what Navan's actually looked like:

A Quick Geography Lesson

Six days on the road. Four states overall. Three states in just two days. 6,600 miles on a plane together.

The standard playbook is hitting New York, Boston, Baltimore, and San Francisco, then filling in the gaps with virtual meetings. Back in the day, companies would also hit Europe and Asia, making the whole thing even longer (typically two weeks). During COVID, it was all Zoom. Navan did a hybrid… some in-person, some virtual, but the core of it was face-to-face.

Like I said, a crazy 36 investor meetings in that span. Doing the math, that's six meetings a day, every day, for nearly a week straight. You're not lingering over coffee.

The Pitch Evolution

Here's something interesting: by the end of the roadshow, Navan's team wasn't even doing the full presentation anymore. They'd shifted almost entirely to Q&A.

Why? Because by week two, everyone's already watched the public video they posted and read the S-1 filing. Investors don't need you to walk them through slide one again; they want to dig into the details. Amy said it was "way more fun" for them internally. "The analysts want to get their questions answered. We really embraced the Q&A part."

There's something pretty real about that. Early in the process, you're performing. Late in the process, you're just having conversations.

The Killer Slide

Every good roadshow deck has a slide that makes the room lean forward. For Navan, it was their AI story… And they had the receipts (pun intended).

Amy's favorite part of the pitch was showing how they're not just talking about AI, but demonstrating its impact in their actual numbers. Gross margin expanded from 60% in fiscal 2023 to 68% in fiscal 2024 to 71% in the most recent twelve months. That's a ten-point improvement in eighteen months.

What's driving it? Their AI chatbot Ava now handles over 50% of customer support tickets. They built a proprietary AI framework called Cognition that's baked into the platform. This isn't a ChatGPT wrapper, but rather infrastructure they own.

Amy put it perfectly:

"It's fun as a CFO to demonstrate the impact of AI on the numbers."

The Live Demo Moment

But my favorite detail from the roadshow wasn't planned at all (they almost didn’t want me to use it, but I pleaded bc it was too good).

So it’s standard for the banks to book the travel for the clients they are taking public. They handle all logistics.

On one leg of the trip, the investment bank had used a legacy travel competitor to book the team's stay. When they arrived at the hotel, they thought the pricing looked high. So everyone pulled out their phones, checked the same rooms on Navan's app, and realized the price the bank had been charged was 30% higher than what Navan would've given them. LMAO.

This happened again in New York.

In each case the exec team told the bank to cancel the reservations and just booked on their own phones (using Navan) from the lobby.

I’ve Heard that Question Before

Michael and Amy said similar themes came up in almost every meeting:

How does your proprietary AI actually work, and is it defensible?

How big is the TAM really, and how much can you capture?

What does the vertically integrated platform enable that competitors can't do?

This last one is key for Navan. Unlike platforms that stitch together third-party services, Navan built its own travel infrastructure. They own the connections to airlines, hotels, rental cars. That gives them more control, better data, and higher margins. It also means they can move faster; they're not waiting on someone else to integrate a new feature.

Get Ya Head in the Game

Okay, real talk: how do you give the same pitch nearly forty times and still bring energy on round thirty-eight?

I have a hard enough time asking the same question on a podcast three times.

Michael's take:

"They are all one of the most important meetings you will have in your career and for the company. You gotta show up."

Michael’s been at the company for nearly a decade. This is his Super Bowl.

"It's an important milestone. It's a big one. Easy to amp yourself back up."

Plus, he was all hyped up on candy.

The Snacks

Because we need some levity: Michael survived on Sour Patch Kids and burgers. Amy subsisted on air, crudité (had to look up this word) and cashews.

Amy said one of the real treats was listening to Ariel (the CEO) and Michael keep that enthusiasm going meeting after meeting.

"The more you say it, the more conviction you have."

Also, at some point Ariel made Michael laugh so hard he spit champagne all over Ryan, the IR guy. IR is a tough job.

What Actually Gets Decided

While you're doing all these meetings, there's a whole process happening behind the scenes. Investment banks are keeping an "order book"… basically a running tally of every investor who wants to buy shares, how many they want, and what price they're willing to pay.

These orders come in two parts: the number of shares a firm wants to buy, and their limit price. So a big fund like Fidelity might say "we want x million shares at a limit price of $xx." If they really want in, they set that limit price high. If they're on the fence, they keep it low.

Throughout the roadshow, you're watching that order book build. If demand is strong enough they say the IPO is "oversubscribed"… more demand than shares available. In that case, you might raise the price range. Of the last 45 SaaS IPOs Jamin Ball analyzed, 69% raised their pricing range before going public. The median raise was 16%.

Then comes Wednesday night. About ten days after the roadshow kicks off, the company, the bankers, and the board get in a room and make two big decisions:

1. The final IPO price

You're trying to maximize the price while also making sure you don't overprice it and watch the stock tank on day one. This is harder than it sounds, because the "best" institutional investors (the big, stable, long-term holders) know they have leverage. They'll often come in with lower limit orders, betting you need them more than they need you.

2. Who gets allocations and how much

Not everyone who wants shares gets them. You're picking which investors to give shares to, and you're optimizing for a mix. You want long-term holders (so the stock stays stable), but you also need some short-term sellers to create liquidity. If everyone holds forever, there's no trading volume. If everyone sells immediately, the stock crashes.

By Thursday morning, it's done. The price is set, the shares are allocated, and the stock starts trading.

Asking for a Friend

I asked Amy and Michael what they'd tell a first-time CFO or President about to hit the road. Their answer was pretty simple:

"It's all about the team."

They had their internal team at Navan, plus their partners, advisors, and legal counsel helping them prep. Other than the government shutdown (which, to be fair, nobody could control), they hit every deadline they set for themselves. They worked together, they trusted each other, and they actually enjoyed it.

Michael's advice:

"Have a lot of fun."

These are rare moments in a career. You spend years building toward something like this; don't just white-knuckle through it.

But he was quick to add that while they’ll celebrate over the weekend, they’re not treating this as a finish line. They scheduled a management meeting for 8am on the Monday after pricing.

That’s hardcore!!! I joked that they earned at least moving it an hour to 9am. But alas.

He said it was very intentional. The point is to remind everyone that there's still work to do. They have millions of frequent travelers who aren't on the platform yet. The company's still being built.

So to sum it up…

The preparation phase is months. The roadshow is days. But you’ve been building the company for years… all to culminate in a week of intense meetings where your valuation gets set. Show up ready, bring energy to every meeting, and then get right back to work.

None of this is investment advice. I write this from a non descript hotel room in SF drinking a $8.42 iced coffee (inflation is real). Do your own homework and be smart.

Wishing you an IPO with ample float,

CJ