AI is everywhere—but is your team truly getting value? Planful’s 2025 Global Finance Survey uncovered that most teams are dabbling, not driving results. You’ve got a chance to lead smarter: automate what matters, tackle roadblocks like security and cost, and turn AI into ROI. The tools exist. The strategy? That’s where you come in.

Want to see what your peers are doing—and how to do it better?

Navan IPO: S1 Breakdown

The artist formerly known as TripActions has filed for an IPO.

This is a travel company that survived COVID, and during that time went back to the lab to build an expense offering. They came out the other side a full spend platform, with a new name, to boot.

As someone who tried to start his own company in the travel space (and fell flat on his face) I have a lot of admiration for how Navan has taken upon itself to build it’s own infrastructure, allowing it to tame the complicated web of Global Distribution System APIs that look kinda like this:

…and made it look like this:

Navan is an end-to-end, AI-powered software platform built to simplify the global business T&E experience, benefiting users, customers, and suppliers.

Key Stats

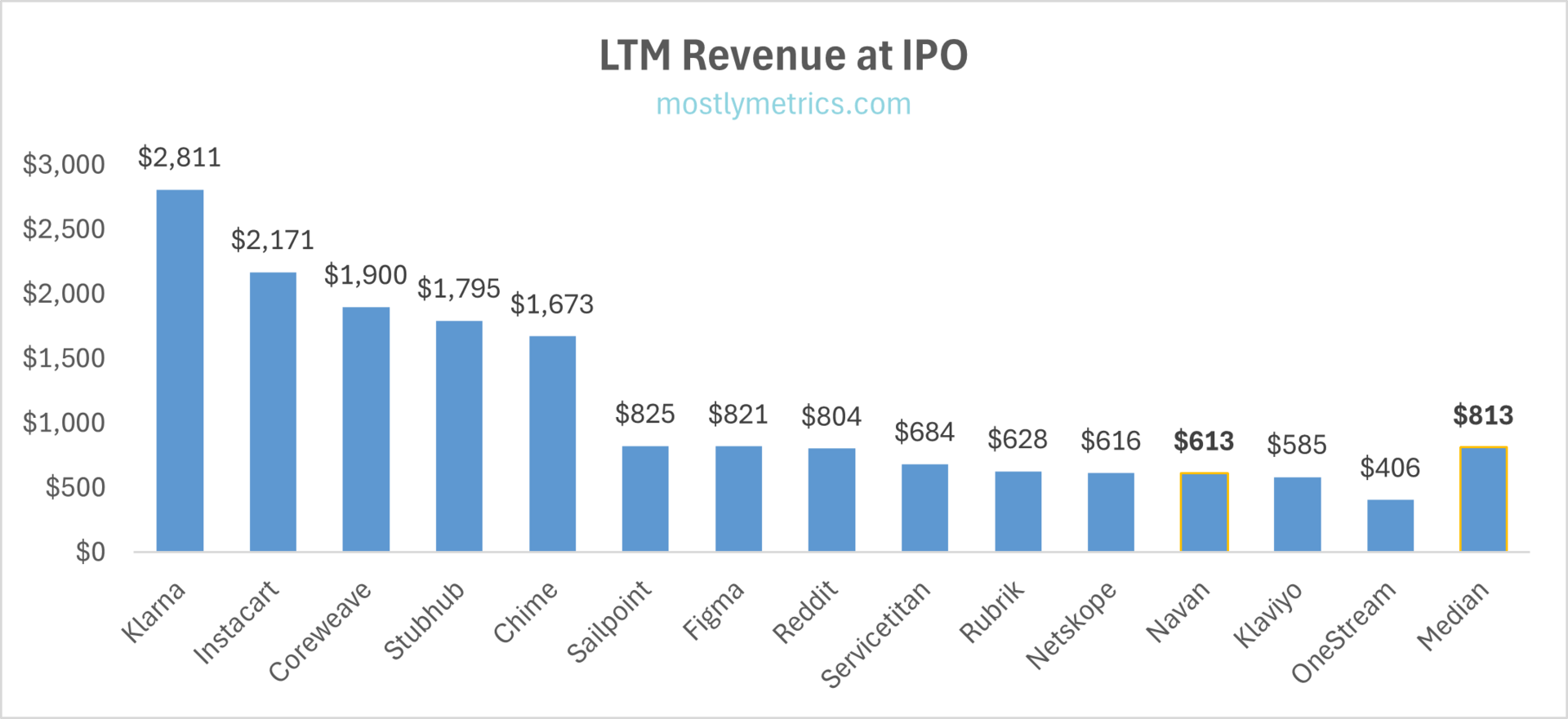

Navan is testing the lower end of the IPO market when it comes to scale, with revenues of $613M and growing at 32% over the last 12 months. For context, the last 14 IPOs have seen a median of $813M in revenue and growth of 31%.

Based on company S1 filings. This is NOT ARR. It is LTM GAAP Revenue so we can compare across business models.

Here’s the TL;DR on their metrics:

LTM Revenue: $613M (32% Y/Y)

On a fiscal year basis, revenue grew to $537M, up from $402M in the prior year (34% Y/Y).

Within this, Usage Based revenue is growing at 32% (representing ~90% of total revenue) and SaaS revenue is growing at 52% (representing ~10% of total)

LTM Gross Booking Volume (GBV): $7.6B (34% Y/Y)

This is the big number… total travel dollars booked through their system

Take Rate (Usage-Based Only): ~7.0%

This is what they make on each transaction.

This is solid for a travel platform, higher than traditional travel management companies

It’s also much higher than corporate card companies and traditional fintechs that they will inevitably be compared to, who monetize in the low single digits.

“Our revenue growth depends on our ability to convert GBV into usage-based revenue.

Usage-based revenue represented approximately 90% of our total revenue for fiscal 2025, fiscal 2024, and the six months ended July 31, 2025 and 2024. Our usage yield was approximately 7% in each of fiscal 2025 and fiscal 2024 and for the six months ended July 31, 2025 and 2024.”

LTM Gross Margin: 71%

And in the most recent fiscal year they achieved 68%, up from 60% the year prior.

For those keeping score at home, that’s a +10% improvement in 18 months…

This is driven by AI customer support leverage.

LTM Net Loss: ($80M)

(The image above uses Non Gaap and won’t tie)

This is a decrease of 76% on a like for like basis, a big improvement

And in the most recent fiscal year losses were $181M, an improvement of 45% from $332M in the year prior.

Navan is still burning, but they’re doing it more responsibly quarter by quarter.

Cash on Hand: $318M

While 1/3 of this is restricted, they have ample debt facilities to fund their sizeable working capital turnover.

Active Customers: +10,000

Don’t give a growth rate or a specific figure

However, they state that 36% are on 3 or more products

Net Dollar Retention (NDR): North of 110%

Don’t give a specific figure. Pretty healthy for a transactional business.

Total Employees: 3,400

Half are internationally based

Revenue per Employee: $180K

This is about half what you’d expect to see a public company achieving at scale

Rule of 40: 22% vs industry median of 38%

LTM Revenue Growth + Non Gaap Net Loss: 32% + (10%) = 22%

Product

Navan isn’t just stitching together a few tools; it’s building a full-stack platform designed to own the end-to-end experience of corporate travel and spend. Their product strategy leans heavily into vertical integration and AI-driven automation to not only solve customer support tickets, but get upstream in the process to ensure a smooth check in at one’s destination before something can go wrong.

“We saw firsthand the frustration of clunky, outdated systems. Travelers were forced to cobble together solutions, wait for hours on hold to book or change travel, and negotiate with travel agents. They struggled to adhere to company policies, with little visibility into those policies, and after all that, they spent even more time on tedious expense reports after a trip. We felt the pain of finance teams struggling to gain visibility into fragmented travel spending and to enforce policies, and the frustration of suppliers unable to connect directly with the high-value business travelers they sought to serve.”

Here’s a breakdown of each pillar:

Travel Booking

The core wedge. Navan acts as its own Travel Management Company (TMC), offering inventory from:

Global Distribution Systems (GDS)

Low-cost carriers

Hotel aggregators

Direct airline and hotel APIs

Imagine having to work with Spirit Airline’s and Delta’s APIs? Yikes!

Users can search, book, modify, and cancel directly in-app. Key features include:

Real-time availability & dynamic pricing

Policy-aware recommendations (based on role, location, preferences)

24/7 support via in-house agents + AI

Duty of care and safety notifications

Notably, Navan owns its own travel infrastructure. Unlike platforms that outsource to third-party agencies. This improves data access and margin control. Like a Brex in the expense management space, they rolled their own infra from the start, giving them more control over the experience, and the ability to monetize at a higher rate than traditional TMCs.

“Our proprietary infrastructure, which we call Navan Cloud, enables us to provide global, real-time inventory for users and forms the foundation of our platform. We aggregate supply through direct supplier relationships, real-time API integrations, and a robust network of partnerships.”

Navan Card

Navan offers corporate cards that are issued in partnership with a bank (unnamed in the S-1). These cards are embedded directly into workflows and support:

Multi-currency issuance

Dynamic spend controls (per policy, user, or department)

Instant reconciliation and merchant matching

Real-time alerts and fraud detection

The card feeds directly into Navan’s expense management engine, streamlining reconciliation and eliminating the need for separate card/ERP integrations.

Expense Management

This layer wraps around both card and travel. Navan’s expense suite includes:

Automated receipt capture and matching

Custom approval workflows

Multi-level policy enforcement

ERP integrations (NetSuite, SAP, Workday, etc.)

International tax compliance (VAT support)

The goal is to “eliminate expense reports altogether.” And with auto-categorization and pre-approvals tied to bookings and card swipes, they get close. Afterall, so much of a company’s expenses that are put onto cards result from traveling.

When the automated approval workflows shut down your first class ticket upgrade.

Unified Interface & Mobile App

Navan emphasizes a single platform UX, available across web and mobile, including:

iOS and Android apps with full booking and expense functionality

Mobile-first receipt scanning

Push notifications for travel changes and approvals

Support chat baked directly into the flow

They’ve invested in consumer-grade design, a real point of differentiation from legacy players like Concur.

Navan Cognition

Their AI engine, Cognition, is legit. Also, kinda meta that their agents are virtual travel agents. Just saying.

“From day one, Navan has leveraged artificial intelligence as a cornerstone of our platform. We built Navan Cognition, a new paradigm in AI-powered travel management. This proprietary framework enables us to create, train, deploy, and supervise specialized virtual agents that can handle many complex tasks previously requiring human intervention.”

It powers:

Personalized travel recommendations

Predictive alerts for delays, disruptions, and rebooking

Chat-based support automation

Anomaly detection in spend patterns

Fraud prevention and duplicate charge flagging

Cognition is like the glue that binds the whole stack together, and is a lever for gross margin improvement by reducing support and manual overhead.

How Navan Makes Money

Navan started with travel and now wants to own every aspect of T&E. The model is monetized through a hybrid of usage-based fees and recurring SaaS.

At its core, it’s a wedge play: land with travel, expand into card and expense, then grow wallet share over time.

“We categorize revenue earned as (i) usage-based revenue, which primarily represents fees from our platform customers earned on a per-booking transaction basis and fees from our travel supply and payment partners, which are generally earned on a per-transaction basis, and (ii) subscription revenue, which primarily represents revenue earned from subscriptions to our expense management platform.”

1. Travel Management

Navan earns usage-based revenue via commissions from suppliers and booking fees from customers. It integrates with global distribution systems (GDS) and direct suppliers, serving up a broad inventory of flights, hotels, and ground transport. This is where that total effective 7% take rate comes from.

“Our suppliers include airlines, hotels, rental car companies, rail carriers, and providers of GDS. We earn revenue from our suppliers in the form of commissions based on the dollar volume of bookings made by users on our platform and a commission rate for each supplier.”

2. Expense Management Software

This is sold on a subscription basis and includes approval workflows, policy enforcement, and ERP integrations. It’s a sticky add-on that becomes more valuable the more a company moves into Navan’s ecosystem.

“We also generate subscription-based revenue from customers who use our travel and expense management offerings. The majority of our subscription-based revenue is from our expense management product, which includes customers using the Navan card, or their own cards through Navan Connect, in addition to our expense reconciliation offering.

We typically enter into annual or multi-year subscription contracts for expense management, and we price contracts based on the number of users.

Subscription revenue represented approximately 10% of our total revenue for each of fiscal 2025, fiscal 2024.”

3. Corporate Card Program

Navan issues co-branded cards through a partner bank, monetizing via interchange fees. The card offering is tightly woven into the platform, allowing for automated reconciliation, spend controls, and real-time visibility. While the rate at which this stream monetizes relative to their 7% take rate on travel bookings is a lot lower (estimates would put it in the 1.5% to 2.5% range), it’s like double dipping when they’re also making money on the booking itself.

“We define payment volume as the aggregate dollar amount of spend through Navan issued cards, settled for a given period and net of any chargebacks, cancellations, or refunds. We grow our payment volume by increasing customer adoption and engagement with our Corporate Payments offering where we support and issue our own cards. We generated payment volume of $3.7 billion and $2.0 billion in fiscal 2025 and the six months ended July 31, 2025, respectively.”

Customer Ramp and Seasonality

Spend doesn’t just show up over night. Like most usage based models, customers first need to make a decision to change platforms. They then need to integrate from a technical standpoint, and then change employee behavior to capture that spend.

“There is a period of time between when we acquire new customers and when we begin to recognize ramped revenues from them. This period usually involves the time required to implement our platform technology, move travel budgets to our platform, and then launch initial bookings.”

Navan’s customers tend to follow a consistent path:

Starting Point:

Many migrate from unmanaged travel (employees booking directly on the web) or rip out legacy platforms like SAP Concur.

Initial Value:

They start with just travel. Navan offers a cleaner UI, embedded policies, and better service.

Expansion:

Over time, companies shift more of their total travel spend into Navan and adopt the expense and card products.

This ramp behavior bakes positive Net Dollar Retention (north of 110%) into the model. As spend consolidates and workflows get embedded, Navan becomes harder to rip out (and more lucrative per customer).

“Our business has historically been influenced by seasonality, primarily related to seasonal travel trends of business travelers, as our users typically travel less during holiday periods, though this effect varies regionally. As a result, our travel revenue has historically been stronger in the third fiscal quarter.”

Sales Motion: Outbound First

Navan runs a primarily outbound, sales-led motion, focused on displacing legacy solutions. Their reps actively target companies still booking manually or using outdated platforms like SAP Concur.

“We have historically focused our customer acquisition strategy on targeting mid-size and larger customers with a direct sales-led motion via our dedicated sales team.”

This strategy supports a land-and-expand model: start with travel, then grow into expense and card over time. While some inbound and mid-market self-serve may exist, the GTM is driven by enterprise reps and targeted outreach.

Given that most of revenue is sourced from an outbound motion today, if the marketing team can create a stronger inbound flywheel from the product, that would be a huge boon to the business.

TAM and Competitive Landscape

Navan claims its opportunity is massive… around $1.4 trillion globally. That figure bundles together corporate travel, expense management, and commercial payments. Is that aggressive? Definitely. But it’s also not outlandish when you consider how fragmented, outdated, and globally distributed this space is.

Market Components

Corporate Travel: ~$1.4T globally

A lot of this is still unmanaged. Employees booking direct via Expedia, Google Flights, etc. Navan sees greenfield here.

Expense Management: ~hundreds of billions

Dominated by legacy players like Concur and Expensify. Navan is going after this with a bundled pitch.

Corporate Cards & Payments: Multi-billion dollar interchange opportunity

With more spend running through Navan cards, they can tap into this fintech TAM as well.

Competitive Landscape

Navan isn’t operating in a vacuum. They’re sitting at the intersection of three noisy markets: Travel, Payments, and Expense Management.

As you must be when you’re a travel company, Navan is truly global. They support travel in over 100 countries, issue multi-currency cards, and offer localized inventory and booking options. This international readiness helps them win global enterprise accounts, where regional compliance, language support, and 24/7 service matter. Which makes sense… if you pay a lot for travel, your team is probably all over the world.

You can’t be a great travel company if you aren’t truly international yourself.

As Navan continues to push into full expense management, they take on a new competitive set, some of which they will partner with on the Travel side (like the ability to integrate Brex cards for a better enterprise experience), while others they will collide with head on, like Ramp.

At the end of the day, the real competitor is fragmentation. The majority of companies out there still let their employees book travel on this thing called the web. And many times they put it on a personal credit card and get reimbursed later.

“In addition, our expense management and corporate card offerings face significant competitive challenges from do-it-yourself approaches as well as companies that provide traditional horizontal platform solutions with expense management features, such as Expensify, Oracle, and SAP, corporate card providers, and expense management solutions, such as Brex and Ramp.”

Financials

Navan’s financial story is one of compounding top-line growth, paired with (kind of) controlled-but-still-significant losses. Think “aggressive, but getting more efficient.” They’ve clearly prioritized growth over profitability since their existence. But the trend is pointing in the right direction. But don’t expect a cash machine in the near term.

TL;DR: Revenue grew +32%, while COGS and S&M were flat. This contributed to net losses nearly halving.

Revenue Growth

LTM (Q2 FY24 – Q1 FY25): $613M (+32% YoY)

FY2024: $537M (+33% YoY)

“Revenue generated from customers and suppliers outside of the United States was $221.0 million, or 41% of our revenue, and $184.8 million, or 46% of our revenue, for fiscal years 2025 and 2024, respectively”

Growth is strong, but slowing. The post-COVID travel surge is normalizing, and comps are getting tougher.

Gross Profit & Margin

LTM Gross Profit: 71%

FY2024 Gross Profit: 68%

FY2023 Gross Profit: 60%

AI is helping them find leverage by not needing to add as many humans to support. Credit card fees and rebates will continue to pull it in the other direction though as that side of the business scales.

📉 Operating Loss

LTM: ($80M) —> 13% of revenue

FY2024: ($181M) —> 34% of revenue

FY2023: ($332M) —> 83% of revenue

Losses are trending in the right direction. But they are still losses.

“We were incorporated in 2015 and have incurred net losses in each year since inception and we may not achieve or, if achieved, sustain profitability in the future.”

You can adjust your way to two quarters of positive EBITDA

Cash Flow & Burn

Cash & Equivalents (as of July 31, 2025): $310M

FY2024 Operating Cash Flow: ($50M)

FY2024 Free Cash Flow: ($166M)

They have a number of working capital lines with lenders so the cash balance is less relevant.

Expense Breakdown (FY2024):

S&M is still the biggest line item. But it's growing slower than revenue and actually dropped in absolute terms Y/Y (and it wasn’t just a stock based comp mirage…). While not explicitly given, this signals improving CAC.

Ownership

Navan’s cap table is classic late-stage venture: stacked with institutional capital and structured for founder control. The S-1 confirms a dual-class share structure, where the CEO keeps voting control even without majority economic interest.

Dual-Class Structure

Navan has adopted a Class A / Class B share structure:

Class A: 1 vote per share (public investors)

Class B: 10 votes per share (insiders/founders)

This effectively cements co-founder & CEO Ariel Cohen’s control post-IPO. Even if he sells down, he retains outsized voting power.

Other investors include Premji (Series G) and Zeev Ventures (early investors)

Market Timing and Sentiment

Navan is stepping into a market that’s cautiously reopening for tech IPOs, but the bar is higher now. Investors want companies growing more than 30% with a path to $1 billion in the next twelve months.

(And operating cash flow (even a few bucks) is a plus.)

On that front, Navan is attempting to thread the needle:

LTM Revenue: $613M

YoY Growth: 32%

Still unprofitable, still burning

As mentioned before, the median of the last 14 tech IPOs (including Navan) come in around $813M in revenue and ~31% growth. That puts Navan below average in scale, even if their growth rate is on par.

They’re not a mega-decacorn like Stripe or a high-growth darling like Databricks. They’re testing the low end of IPO viability… just big enough, just fast enough to make a public debut plausible.

So why IPO now?

They’ve raised >$1.4B in VC and need an exit path

The cash burn is real, and a private market Series H would be far into the alphabet

They want to establish public market credibility before they’re flatlining growth

This is a prove-it IPO, not a puff-chest moment. The pitch to investors is simple: “We’re not huge, we’re not perfect, but we’re ready to grow up. And we own all our own infrastructure, which is a moat.”

Valuation

Navan’s most recent private fundraising round was in October of 2022, where they raised $300M at a valuation of $9.2 billion.

The company hasn't priced the IPO yet, but we can ballpark a likely range based on current growth and comps. They're at $613M in LTM revenue and if we’re assuming 25% forward growth, that puts their 12-month forward revenue at ~$765M.

My own math

Keep in mind that 90% of that revenue is usage based, and closer to transactional, fintech revenue in nature than pure play SaaS. That brings with it a different comp set, which trades at a high of ~8x. Someone like Affirm, trading at around 9x, would be an aspirational high end.

We’d expect the company to receive a valuation in the $8 billion range, with upside to $10 billion, depending on market sentiment.

Miscellaneous Stuff of Note

Started from the Bottom, Now we president

Talk about a come up. The president of Navan is just 33 years old, and started as a sales rep 9 years ago. I wanna be Michael when I grow up. Wait, shit, I’m older than him.

Listing on NASDAQ, despite management’s NYSE ties

They are listing on the NASDAQ. Which is ironic because CFO Amy Butte, was the CFO of the NYSE, and took the exchange public in 2005.

Just sayin’

Final Take

Navan is a classic wedge play: enter through travel, expand into expense and card, and win by making everything just a little bit less painful. It’s not revolutionary tech, it’s just a better experience. But to be honest, in T&E, that’s more than enough.

Keep in mind this isn’t a pure SaaS story. That is more and more the story as it expands it’s payments volume. That means the market will have to price this more like a modern fintech infrastructure play, not a high-margin software darling.

Still, there’s a lot to like: $600M+ in LTM revenue, decent growth (even if it’s slowing), +110% NDR, and real traction with enterprise buyers. You can squint and see the machine working, especially with a proven outbound sales motion and strong customer ramp dynamics.

And to channel my inner Mel Kiper, talking about 2028 draft prospects before the 2025 draft is even over, this is a nice test for other companies in the payments and expense management space, like Brex and Ramp, who are of a similar (if not slightly larger) scale.

Exciting times, as the CFO Tech Stack goes public.

Disclosures: Navan has sponsored podcast and event content of mine. None of this is investment advice, do your own homework.

The top ten is officially back up over 20x forward revenue. This is 4x the overall median of just under 5x.

Top 10 Medians:

EV / NTM Revenue = 21.4 (UP 1.8x w/w)

CAC Payback = 24 months (UP 4 months w/w)

Rule of 40 = 49% (DOWN 2% w/w)

Revenue per Employee = $575k (UP $36K w/w)

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 147

Recent changes: Olo removed, Bullish, Figure, Gemini, Stubhub

Population Sizes:

Security & Identity = 17

Data Infrastructure & Dev Tools = 13

Cloud Platforms & Infra = 15

Horizontal SaaS & Back office = 19

GTM (MarTech & SalesTech) = 19

Marketplaces & Consumer Platforms = 19

FinTech & Payments = 28

Vertical SaaS = 17

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Sales and Marketing costs are measured on a TTM basis, but lagged by one quarter (so you skip a quarter, then sum the trailing four quarters of costs). This timeframe smooths for seasonality and recognizes the lead time required to generate pipeline.

Revenue is measured as the year-on-year change in the most recent quarter’s sales (so for Q2 of 2024 you’d subtract out Q2 of 2023’s revenue to get the increase), and then multiplied by four to arrive at an annualized revenue increase (e.g., ARR Additions).

Gross margin is taken as a % from the most recent quarter (e.g., 82%) to represent the current cost to serve a customer

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

OPEX

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.

Please check out our data partner, Koyfin. It’s dope.

Wishing you an IPO with ample float,

CJ