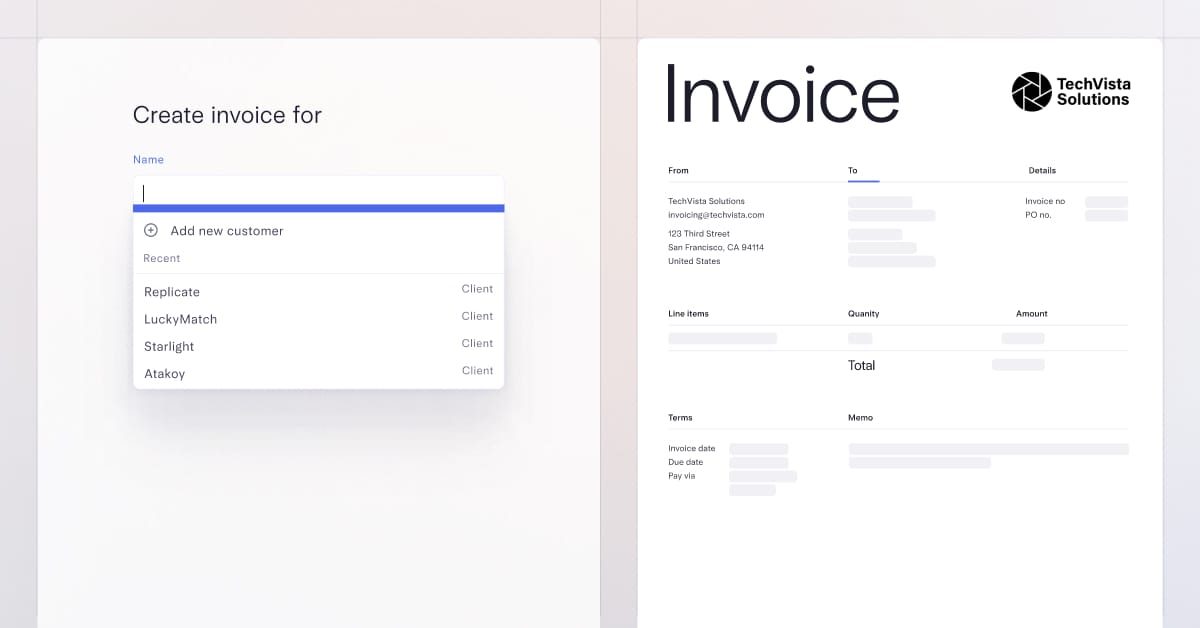

Mercury simplifies your financial operations by powering them from the one thing a business needs: a bank account.* And now, Mercury offers Invoicing so you can send invoices, track what you’re owed, and get paid the way you want — all in one place.

Customize your invoices by adding your logo and preferred color scheme, view who owes you what and take action from there, and get paid via credit card, Apple Pay, Google Pay, wires or ACH.

(And that’s good news… because while I won’t judge a book by its cover, as a SaaS CFO, I’m a bit of an invoice snob.)

*Mercury is a financial technology company, not a bank.

Banking services provided by Choice Financial Group and Evolve Bank & Trust; Members FDIC.

Don’t Call it a Come Back

Financial analysts have long turned their noses up at professional services revenue.

It’s (usually) one time

It’s (often) sold at cost or heavily discounted

It’s (reluctantly) purchased by the customer who wishes this damn thing would just work out of the box

Professional Services are a necessary evil.

I spoke to Jeff Cooper, CFO of Guidewire, one of the most valuable vertical software companies. They serve the insurance industry, and are trading at more than 10x forward revenues. They successfully incorporate professional services into their offering.

He explained how it’s a tightrope walk, where you need to ensure your customers are successful, especially when there's a CIO betting their career on the outcome of an implementation, while also thinking about the long-term durability of your revenue.

“These programs are super complicated, and literally the landscape is littered with failed core system modernization projects. And one of the things that has differentiated Guidewire over the years is this commitment to “no customer left behind: 100% success on successful projects.” We don't have 100% success, but we have bar none the best track record in the industry, and that was critical to building our momentum and building our market leadership position. So services for us are highly strategic.”

While Cooper's insights focus on traditional software implementations, there's a clear parallel to be drawn within the AI space, where professional tuning will be required to realize better efficiency.

Similar to how you have an implementation specialist configure your NetSuite or Workday integration, you’ll need an AI specialist to configure your LLMs.

Remember - these models can get extremely costly if you don’t set them up right…

Cloud and Compute Costs

Data Storage and Management

Energy

And not to mention the people who run them.

You can already tell there will be a plethora of AI integrations that result in organizational concussions.

Unlike traditional one-time software integrations, AI implementations require continuous recalibration. As models evolve, their performance can degrade, making regular adjustments necessary. This recurring need for services to optimize models could blend into more predictable, maintenance-like revenue streams.

(Sound familiar to a largely extinct era of software sales?)

And metrics to track how much revenue comes from one-off services vs. recurring value vs re-ocurring calibration will be crucial for understanding the sustainability of revenue streams, and therefore valuations.

Calling in Reinforcements

But this isn’t to say that AI companies themselves will be responsible for rigging stuff up to spec. They’ll most likely rely upon an army of third party system integrator partners (SIs for short) who will take on that work.

In Guidewire’s case, third-party SI’s play a crucial role in their professional services model, and allowing them to sell more software. Their approach to using SIs offers a useful analogy for how AI companies might scale their implementations without becoming overly reliant on their own services teams (which are expensive to staff, and can fluctuate with demand).

“The other thing that is a core principle of ours is that we're a software company. And if you claim to be a software company, but only you can implement your software, then you're kind of a services company, not a software company. And so this focus on building software that can be implemented by third parties is a big part of how we think about it.

So our services organization is highly strategic and really important to our long-term success. We think about ourselves as a software company first, and we want to have a robust ecosystem that we partner with to modernize this industry”

And it stimulates the economy too, because there’s this whole cottage industry. When I implemented NetSuite, we used a third party. Same with Workday. It's not uncommon to buy the software from the vendor and then either tap into their own implementation teams or go with one of their partners.

But how much is too much?

If you’re an AI company looking to benchmark how much of your revenue should be wrapped up in professional services, what’s a good target to strive for (or rather, stay under)?

Well, first and foremost, you don’t want to throttle ARR growth from your core offerings just because you want your revenue lines to look clean.

But if you run the line out long enough, probably sub 20%.

“I think as we think about long-term, we talked about this a little bit on the earnings call, getting to sub 20% of total revenue coming from services, is kind of a nice benchmark. And we expect our services revenue to grow slower than our overall software revenue so that number should continue to decline, but we have the capacity to do in the range of $200 million of services revenue, and we want to make sure that our teams are operating at full utilization. And so that's how we think about it.”

Why aim for sub-20% services revenue? For many investors putting a price on your company, professional services are seen as a low-margin, non-recurring business, which can drag down overall margins and obscure the core recurring revenue streams. This balance helps maintain a higher valuation multiple, as investors are more confident in your long-term, predictable (and higher calorie) revenue.

But maybe we won’t discount the value of professional services revenue as deeply as we’ve historically done.

Investing (and Betting) on Success

Similar to buying an ERP, a lot of CIOs will be betting their careers on AI projects. It only makes sense that they get professional services support to ensure they aren’t left behind. After all, early adopters are not just wagering money, they’re also betting their reputations.

And on the valuation front, I think we’ll be more forgiving of AI related implementation and professional services revenue because it will prove to be a massive accelerant to overall ARR. And isn’t that the end goal?

Plus, the tuning maintenance may be packaged to look like traditional ARR if it needs to be done a few times a year (similar to buying packages of penetration testing, which I’ve never really thought was ARR, but people will argue otherwise).

In addition, the fact that a customer paid for a lengthy and expensive implementation taps into their sunk cost fallacy - they don’t want to get rid of something they’ve put so much effort into standing up in the first place. There’s a reason why some companies are still using ERPs from the 1980s.

OMG, are We Now Putting Services in ARR?

Psych. We won’t go that far. Professional services have long been viewed as a necessary evil in the world of software, but for AI companies, they may play a more strategic role in ensuring early success and building trust with customers. As the AI landscape evolves, companies will need to carefully balance their reliance on services with their pursuit of scalable, recurring revenue. And while professional services may not be glamorous, they could prove essential in cementing long-term relationships and laying the groundwork for sustained ARR growth in this next wave of tech adoption.

Run the Numbers

I spoke with Naeem Ishaq, CFO of Checkr. We covered:

What CFOs should aim to accomplish in their first 100 days at a company

Forecasting revenue in subscription vs usage based models

Using LLMs for revenue forecasting

Quote I’ve Been Pondering

“I did learn a good lesson that day, though.

We have to prepare to have freedom.

We have to do the work to then do the job.

We have to prepare for the job so we can be free to do the work.

Knowing my man does not mean I know Spanish.”

-Greenlights by Matthew McConaughey