Heyooo….so on Thursday I’m doing a webinar with my friends at SecFi. If you’ve been granted equity at the company you work for, then get ya popcorn ready and come jam with us!

Why attend? Because knowing what to do with startup equity can be tough. That’s why I’ve become a vocal advocate of planning around equity. I’ll share my story, lessons learned, and humble recommendations for all those in the startup community. And the Secfi Wealth team will share how to take action today to make a plan for your finances, and be prepared for an IPO.

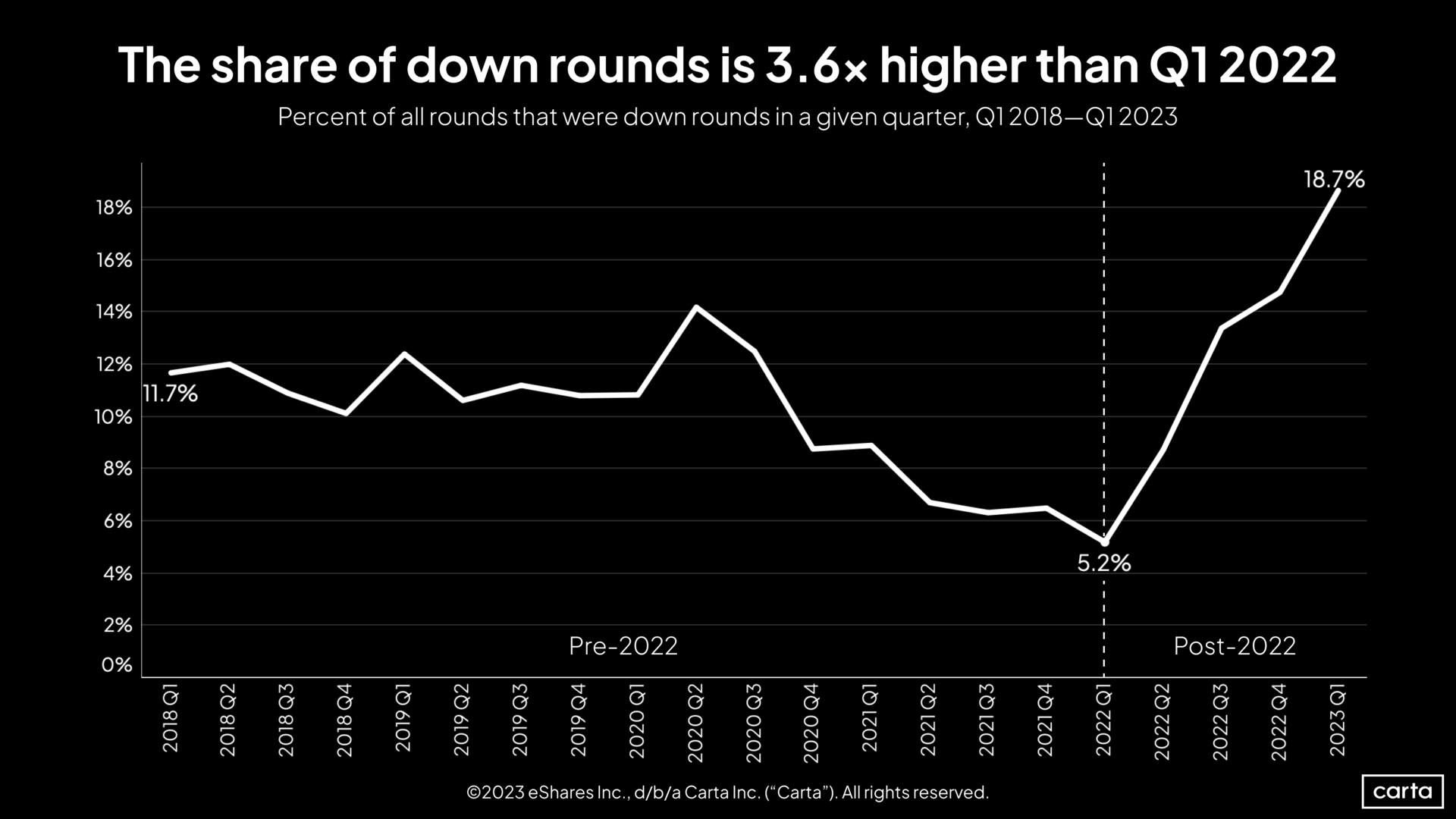

Yikes! This is one of the rare graphs where up and to the right is a BAD thing.

Oh - and keep in mind, this is just indicative of the companies who COULD raise... the reality is undoubtably much worse after you factor in the inherent survivorship bias.

Three high level takeaways from Carta’s State of Private Markets Q1 2023 Report:

Down rounds spiked in frequency: Just shy of 20% of all venture investments in Q1 were down rounds, the highest proportion since at least 2018.

This was only 5% a year ago.

So the proportion of down rounds has almost quadrupled…

More companies chose bridge rounds: For companies ranging from Series A to Series C, bridge rounds emerged as an increasingly attractive option. At least 40% of all investments in Series A and Series B companies were bridge rounds in Q1, the highest figures of the 2020s.

In my opinion, many of these bridge rounds are going to be expensive call options on COVID fundraising craziness coming back.

The sooner that founders accept that 2020 and 2021 were an aberration, not the norm, the faster they can go back to operating in reality.

Startup M&A bounced back: The number of venture-backed companies that were acquired or merged with another company increased by 20% in Q1 compared to Q4 2022, with 57% of those M&A deals valued at $10 million or less.

I read this as “a lot of early stage companies who were unable to prove product market fit are now looking for an acqui-hire off ramp.”

I predict there’s going to be a whole population of founders who are resting and vesting in new landing spots who will reemerge back on the market to build something new in the next 18 months

So the next natural question is… are we done yet?

Not quite. As you can see, the changes in valuation have only partially worked their way through the system.

You can think of the public markets as the fastest to react to changes in the macro environment. If you believe the market is efficient, changes should be priced in automatically.

But it takes longer for illiquid private companies to catalyze the reality of the outside world.

As a private company you have the luxury of delaying your date with reality by way of hiring freezes and layoffs to preserve cash, in addition to bridge loans and credit facilities to bolster your dying balance sheet. But eventually you have to go back out into the markets to refill the tank.

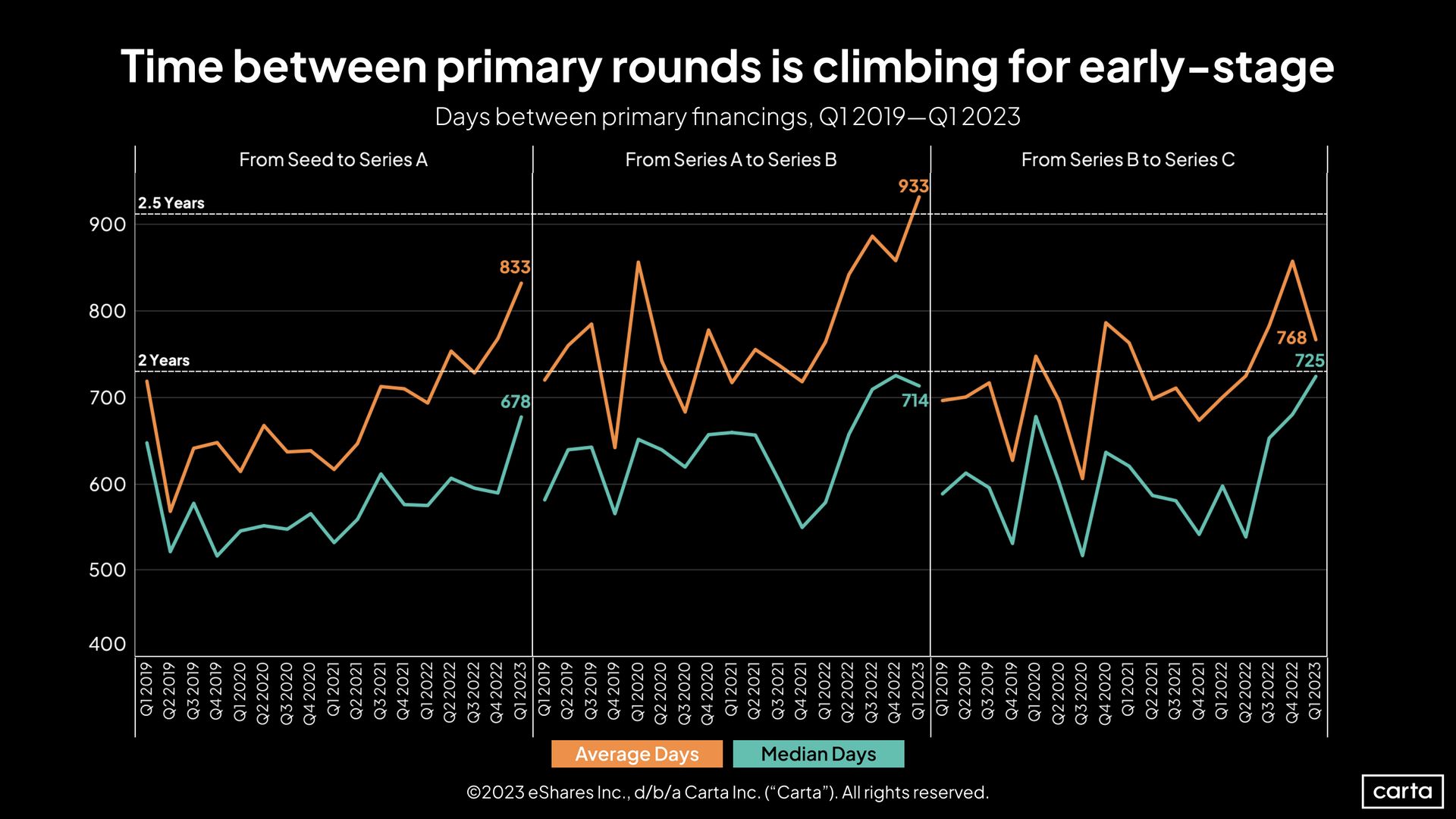

That delay in catalyzing the outside work plays out in the average time between rounds. You can see the stretching of the waist band below.

Now, the good news is it looks like late stage Series D companies have largely come around to accepting the new world order. But Seed and Series A companies are still jockeying for the few premium valuations that are up for grabs.

I think this is the best chart CB Insights has put out in a while.

Crazy to think some of these companies have been growing revenue 50%, even 75% or more y/y since ipo… But their valuations are going in the other direction. Very indicative of the loco times we were in (H/T @asanwal).

So at the end of the day… when we go back to normal?

Probably as soon as we choose to.

The problem is, it wont’ be “the normal” people want.

What I’ve Been Reading

Every week I tune into my pseudonymous friend OnlyCFO’s musing on:

Finance

SaaS

Operations

Startups

Public company learnings

If you work somewhere at the crossroads of finance, strategy and SaaS, this is where all the cool people hang out.

Mostly multiples

Janelle Tang (writer of ) shared the above graph on Twitter. As you can see, historically anything over 10x revenue is considered funny business.

Mostly hydrated

“There’s no such thing as the perfect water bott—”

-Walter