When I became an FP&A leader for the first time, I built our entire operating model from scratch. I had no context and no templates. And that blank workbook staring back at me was DAUNTING!

That’s why I’m excited to introduce our sponsor, Mercury.

Their VP of Finance, Dan Kang is sharing his personal template for building a financial forecast model.

Whether you’re preparing to fundraise, updating investors, or charting a new course for the company, you’ll likely reach a point where you’ll need to build a forecast model. It can help you align on clear business goals and understand why those goals matter.

Active user count is often put on a pedestal. While it’s not inherently a bad metric, the way it’s applied can lead to misguided conclusions.

Typically, “active user” is defined by the bare minimum activity—like logging in. But DAU (Daily Active Users) and MAU (Monthly Active Users) are almost useless without context or precise rules to quantify them accurately. For instance, if a user logs into an app monthly without meaningful interaction, they might be counted as active, but this doesn’t reveal much about the product's value. Such arbitrary definitions can lead product teams to make poor decisions over time, and for finance teams to forecast revenue inaccurately.

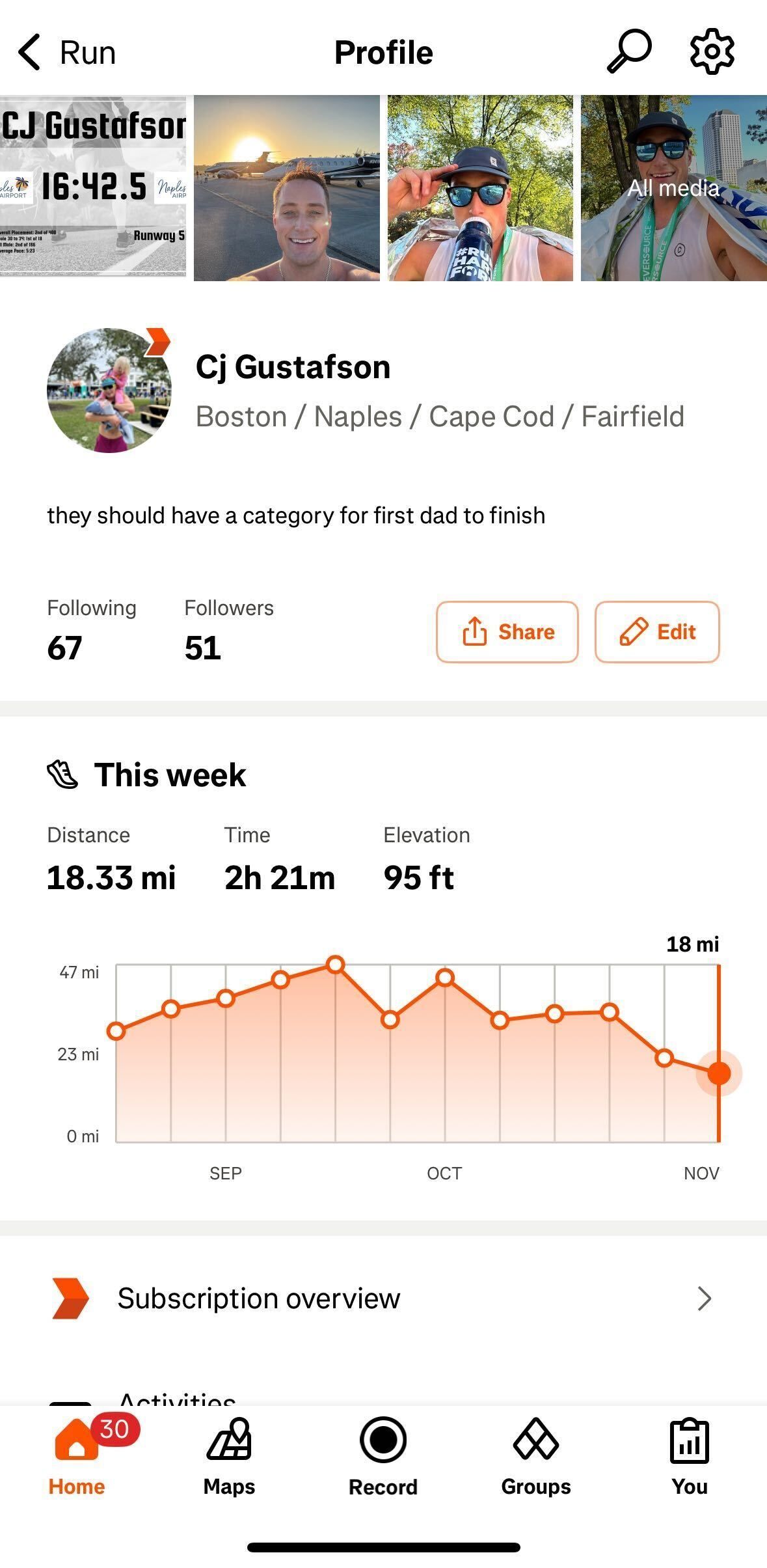

I recently discussed the nuances inherent in defining “active users” with Strava’s CFO, Lily Yang, on the Run the Numbers Podcast. We started by examining what qualifies as an “active” user at the fitness tracking company:

Lily: “A monthly active user is anyone who’s logged into the platform in the past 28 days and taken one of the actions of viewing their activity, the feed, or uploading an activity.”

First takeaway: Strava’s definition of an active user doesn’t stop at a simple log-in. Instead, it requires the user to engage with the app’s core value.

Second takeaway: Strava measures activity on a monthly (28-day) basis, which aligns with user behavior.

CJ: “I noticed you track monthly active users, even though Strava has a social aspect. Some platforms focus on daily active users. How do you decide which timeframe is the best signal?”

Lily: “That’s a great question. For our community, we monitor churn and activity daily, weekly, and monthly. For comparability, investors often look at daily or monthly figures, so we track those, but since most of our users engage weekly, we prioritize weekly active users and use the others as sense checks.”

Unlike Netflix or Facebook, which users might check daily, Strava’s users don’t necessarily run or cycle every day. The measurement period reflects their product’s normalized usage pattern, and the cadence at which you’d expect users to get value.

Where it gets really interesting is how Strava segments “active” users. Not all active users are created equal—you have “new” active users and “existing” active users, each with different paths to realizing value and different revenue potential.

Lily: “This year, we pivoted to common industry metrics like NURR (New User Retention Rate), CURR (Current User Retention Rate), and RRR (Reactivated User Retention Rate). We monitor reactivations based on users who return within 28 days versus those who’ve been inactive longer, as these groups have different profiles and motivations.”

Third takeaway: Strava’s team identifies if a new user retains within the first week, moving them to the CURR bucket if they do. If a user churns, they go into the RRR bucket, allowing the team to target each cohort with tailored actions.

This approach captures what’s at the heart of growth accounting: understanding not only how many active users you have, but also who they are, how long they’ve been active, and how many are returning after periods of dormancy. These details are invaluable.

This framework helps Strava to customize re-engagement strategies, increasing retention and engagement. Lily explained that tracking behaviors, like how many kudos (Strava’s version of a “like”) a user gives or how many connections they make, has major implications for retention.

At my own company, a car parts marketplace, we know that if an auto garage completes five orders within seven days, retention jumps to more than 98%; if it takes them more time to get to that order threshold, retention drops meaningfully. Therefore, we’ve implemented targeted actions to encourage that first five-order milestone, knowing it directly impacts retention. And on the flip side, we use different tactics—like phone calls and in-app messages—for previously active but now dormant shops to encourage reactivation.

This is really about ACTIVATION and knowing what things you need people to do from the time they sign up / start using your product to the time they’re “hooked.” There are some fairly “famous” examples — I remember Dropbox saying early on that they knew someone would stick around forever if they put one file in Dropbox within a specific period of time. That’s how low the bar was for driving stickiness through activation. Facebook had another heuristic - 7 friends in 10 days…

If we viewed all active users the same, we’d miss out on key retention strategies and make inaccurate revenue forecasts.

Which brings us to a final point: active users aren’t just a “product” metric. They’re atomic units of revenue. Accurately defining and segmenting active users becomes crucial when your revenue relies on smaller deal sizes, B2C growth, or product-led growth motions.

By segmenting active users and understanding their specific behaviors, companies can quantify the growth loops—acquisition and engagement loops—that fuel product growth. This, in turn, leads to healthier revenue and a clearer picture of long-term growth.

Thanks to my friend for reading drafts of this post. I encourage you to checkout . In particular his pieces on Time to Value and Building Sticky Products are highly relevant to the topics today.

Run the Numbers

I had the chance to sit down with Lilly Yang, the CFO of Strava. We touched upon:

Strava’s business model and demographic expansion

The importance of retention in B2C models

Defining active users

Forecasting future revenue for B2C models