I have a love-hate relationship with spreadsheets.

Love the flexibility to build any analysis in an infinite canvas.

Hate the time-consuming manual updates.

Love the instant familiarity when sharing analyses with others.

Hate the limitations that force me to turn to BI tools.

That's why I'm so excited about Equals.

It's the best of both worlds.

You can instantly turn any spreadsheet analysis into a BI-grade dashboard powered by live data from Stripe, Salesforce, HubSpot, and more.

And you can auto-distribute that dashboard to your team in Slack or email in a few clicks.

No more CSV downloads, stale data, or copy-and-pasting between tools.

Taking a company public is daunting under normal circumstances. Doing it when the market is in a freefall? That’s another level entirely. Yet, Bill Koefoed, CFO of OneStream Software, led his team through their IPO during “the worst day on the Nasdaq in two and a half years.”

Despite the chaos, OneStream’s stock rose 34% on its debut, trading up from $20 to $27 per share. How did they achieve this remarkable success against a series of bad hands? Here are the key strategies Bill shared during his Run the Numbers interview.

1. Don’t Wait for the Perfect Market Conditions

After closing their 2023 numbers in February, OneStream began preparing for their IPO. But by spring, the markets were rife with uncertainty: Salesforce and Workday reported weak results, and broader tech stocks were slumping. Instead of retreating, OneStream doubled down on preparation.

Bill shared their mindset:

“You make a couple of decisions. One is, do you flip public? We felt like we were well-prepared and decided to go for it.”

Their roadshow kicked off right after a turbulent weekend of political and market news, capped by Friday’s CrowdStrike incident, which disrupted travel.

“We started our roadshow the Monday after Donald Trump was shot. And during our roadshow on that Friday the CrowdStrike incident happened. We couldn't get into our hotel room because the electronic door locks didn't work.

And then, of course, Joe Biden decided not to run for president again that weekend.”

Lesson: No market is perfect. Timing an IPO is as much about preparation as it is about courage. If your fundamentals are strong, the right investors will see past market noise.

2. Build Relationships Before You Need Them

OneStream invested years into building its reputation with potential investors. This included quarterly “momentum” press releases and proactive meetings with funds like T. Rowe Price, which ultimately became an anchor investor.

“T. Rowe generally never does cover, but they committed to 15% of our IPO because they liked our story and saw our progress over time.”

Their careful selection of investors paid off: their IPO was 20x oversubscribed.

Lesson: Show them your company’s progress consistently and transparently, even when you’re years away from going public.

3. Master the Art of IPO Pricing

IPO pricing is a delicate balance. Bill described the decision to set their range at $17 to $19 and then price at $20.

“We could have priced higher, but we wanted to ensure we attracted patient money—investors who would stay with us for the long haul.”

On the day of the IPO, Bill waited anxiously as Nasdaq officials and bankers signaled when they’d open trading. When it finally started at $26, emotions ran high.

Lesson: Pricing isn’t just about maximizing proceeds; it’s about setting the tone for long-term success. A controlled first-day “pop” builds goodwill with investors and reflects confidence in your business fundamentals.

4. Prepare for Chaos, and Stay Agile

Bill’s roadshow anecdotes paint a picture of organized chaos: delayed flights, last-minute changes to the prospectus, and pizza ordered from the tarmac. Through it all, his team stayed focused.

“You make decisions with limited information under tight deadlines. You just have to stay calm and adapt.”

Lesson: Expect the unexpected. A strong team, trusted advisors, and a sense of humor can help you navigate the inevitable curveballs.

5. Celebrate Your Wins

For Bill, the most poignant moment came when their IPO officially opened for trading. After months of preparation and a grueling roadshow, the stock’s rise on a bloody market was validation of their hard work.

“The day that we went public was the worst day on the NASDAQ in two and a half years. So it was a roller coaster, but we felt well prepared and obviously, we had a good reception at the end of the day.

“It’s still emotional. Everything we did, all the investor meetings, the pricing— it all came together in that moment.”

Lesson: The IPO is just the beginning. But taking time to recognize the milestone reinforces your team’s resilience and sets a positive tone for the next chapter.

Listen to the full IPO journey here:

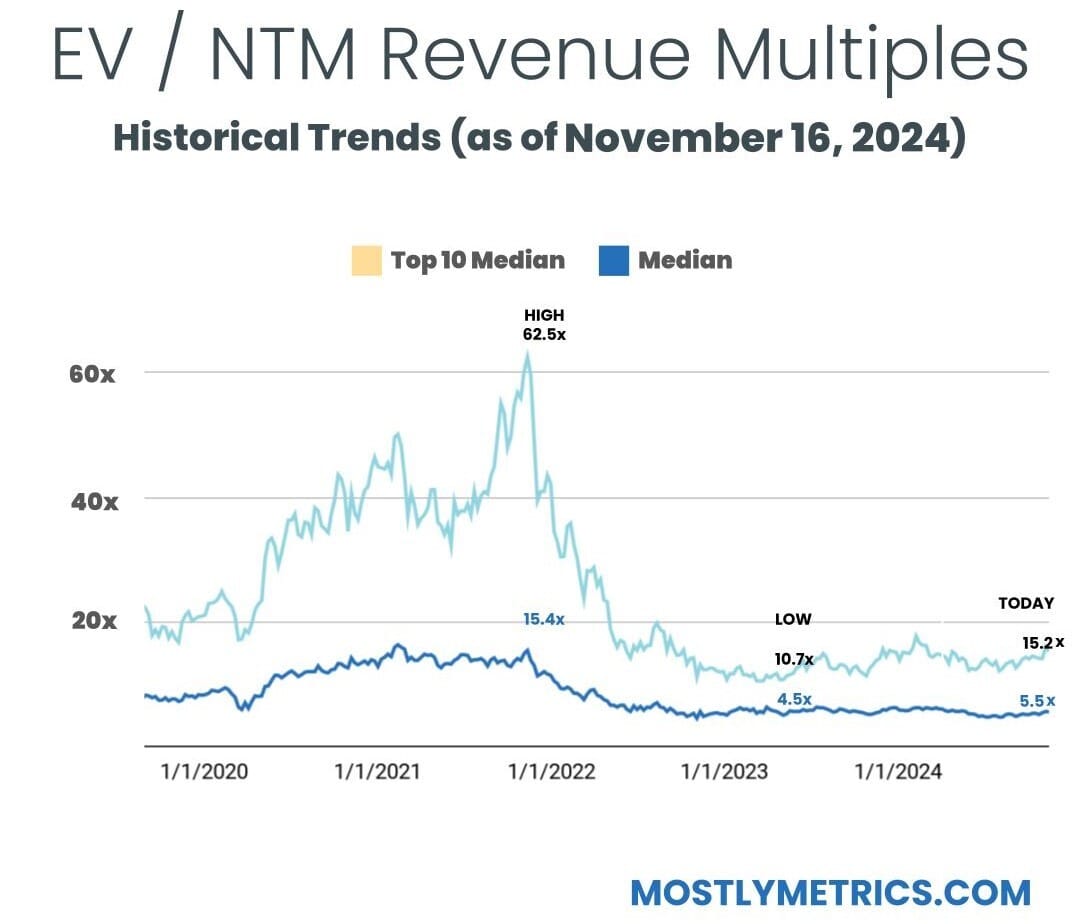

TL;DR: Multiples are DOWN week-over-week.

Top 10 Medians:

EV / NTM Revenue = 15.2x (-0.8x w/w)

CAC Payback = 15 months (-1 month w/w)

Rule of 40 = 50% (-2% w/w)

Revenue per Employee = $573K (+$70k w/w)

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 110

Population Sizes:

Security: 17

Database and Infra: 14

Backoffice: 16

Marcom: 16

Marketplace: 15

Fintech: 16

Vertical SaaS: 16

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency Benchmarks

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

Operating Expenditures

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.