After 15 years in tech finance, I've learned that your banking partner can make or break your growth strategy.

MUFG — the $3 trillion Japanese bank —has purpose-built its Growth & Middle Market Technology Practice to deliver strategic banking for ambitious tech companies that need more than a transaction. These are 50 of the best tech bankers in North America and Europe who speak the language of high-growth companies, with a mission to support them no matter how global and complex they get.

Global resources. Startup-caliber insights.

Contact Group Head Bob Blee ([email protected]) to discuss how MUFG is empowering a brighter future for the tech ecosystem.

Back in college, I spent hours reading Bill Simmons’ Grantland mailbags and Drew Magary’s stuff on Deadspin. I practically memorized them. Then I’d recite them to my roommates like they were scripture.

And honestly? That’s how I think of all of you. Roommates.

But we’ve been missing something: a mailbag of our own.

So let’s change that. Starting now, we’re doing this once a month.

Got a banger of a question? Just reply to this email.

I’ll answer the best of them to wrap up June.

-Matthew from CO

I was in Zug, Switzerland on a business trip. We went there just about every quarter because our company was domiciled abroad for strategic reasons (read: we paid zero taxes). I was habitually invited as a comfort blanket of sorts, a junior lackey to build slides if anything came up before the board meeting (which was kind of an exercise in futility, considering the company was majority founder owned and they never made it past slide four in these things before veering off into parts unknown).

Nonetheless.

So like cattle we boarded the Swiss Air redeye from Boston to Zurich. Me and my distinguished colleague Bres had this ritual where we’d down exactly three to seven pints before boarding, camping out at this dumpy little restaurant in Logan called Durgins Pub (which always smelt like stale milk). We’d consume just enough to lull our bodies into submission at 8:30 PM EST so we could half sleep in coach and arrive extremely dehydrated in the Nordics.

And so we get there in the morning and roll straight into a full day of meetings (miserable).

I get a second wind in the evening, because jet lag and all, and we have this hour and a half break before a team dinner, where some of the execs would be in attendance.

I decide to go for a run to try to reclaim my humanity. And fun fact about me: I have a TERRIBLE sense of direction. Like, get lost in mall parking lots bad (which, to my defense, can be rather expansive depending on where you’re shopping).

Fast forward an hour later and I’m somewhere between an industrial park and a cow pasture, with no idea how to get back. I keep jogging for like another 20 minutes before I’m dead tired, and try to summon an uber. Keep in mind it was like 2016 and there were like 2 in the whole country.

I finally wrangle one, and get back to the hotel.

Except it’s the wrong hotel. Apparently there were two hotels with the same Swiss-German zero syllable name.

So here I go again, sweaty and tired, trying to hail the only Uber in Zug.

By the time I roll into dinner, sporting a sweat soaked blazer, they’re on dessert. I think it was Carac, a tart-like pastry filled with chocolate ganache, often topped with green icing or fondant.

I regale them with my trek, which exactly no one seemed to find funny, merely puzzling. They looked at me like, “Oh YOU DIDN’T KNOW there were two Hotel ‘Lowen am See Zug’ in town?”

Yea ok. Go choke on your Carac, Harry.

Then I went to bed.

The end.

Put the feet pics and NSFW content aside for a second - this business absolutely rips.

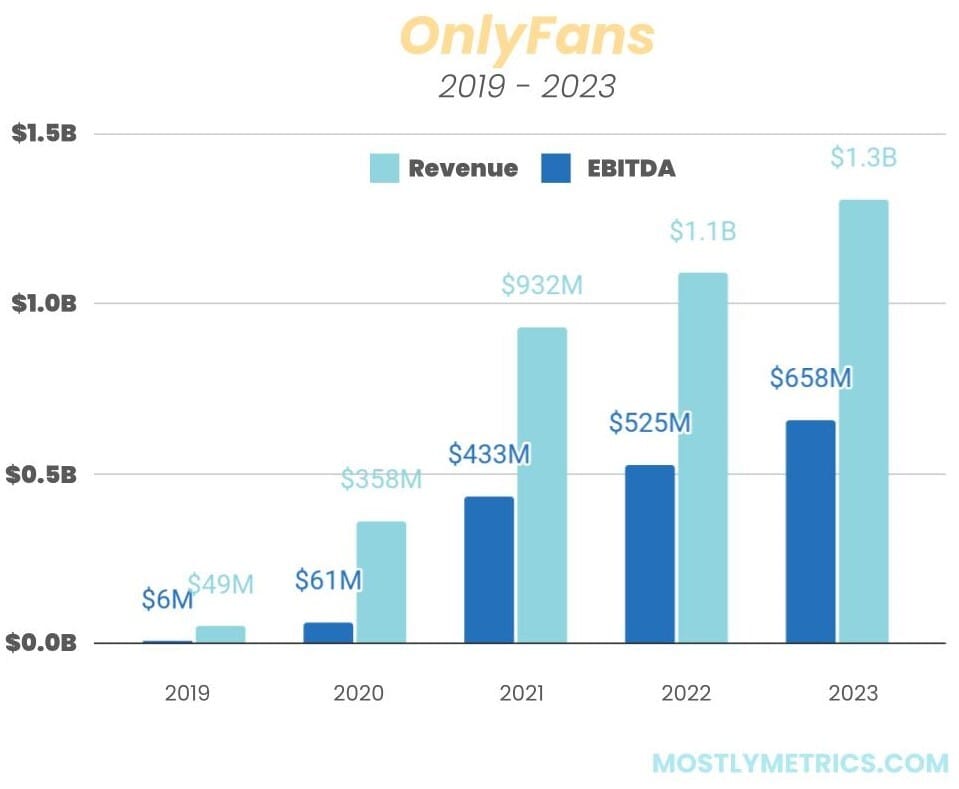

No matter how you slice it - marketplace or social media network - $8B would be a bargain. In 2023 OnlyFans did $1.3B in revenue (yes, revenue, NOT GMV). That represented year on year growth of 20%. And in doing so they produced nearly $700M in profits!?!

The top valued marketplaces today (DoorDash, Zillow, AirBnb) trade at between 5.5x and 6.0x forward revenues. The median trades at less than half that.

Extrapolating their growth out, and I assuming in mid 2025 they are approaching $2B in revenue, they’d be selling for only 4x revenues.

And given their cash flows, they’d be selling for something close to 8x PROFITS!

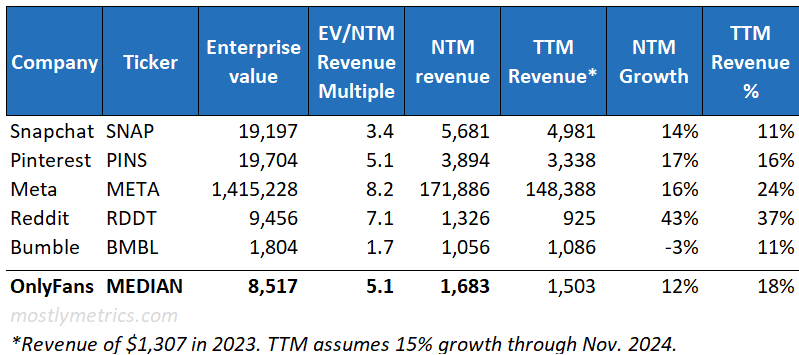

If we were to put them up against social media giants, it’s still a bargain (I did this analysis back in October):

Real revenue. Real margin. Real cash flows.

And still, half the investor class reacts like someone just offered them equity in a haunted strip club.

And it’s a paradox… OnlyFans has the kind of revenue, retention, and cash flow most B2C platforms would kill for. But it’s still viewed like a punchline in some investor circles—despite having better margins than half the enterprise SaaS universe.

My POV: If this deal gets done near that number, it’s going to reset how people think about "vice-adjacent" platforms. The infrastructure is sticky, the take rate is high, and the optionality is wide open—if a buyer can reframe the brand.

-Rebecca from MA

Just texted my old team to check. It was v147.

The thing took so long to open that we would click the file before lunch, take 45 minutes to go get a meatball sub across town, and then come back to see if it was alive.

It was over 200 MBs and got the wheel of death every fourth time.

(Forecast was still 97% on point tho.)

-Justin from FL

It all goes back to doing things that seemingly don’t scale, in the real world.

Ramp’s growth guy was on 20 minute VC - great episode - and he said they sent physical mailers to people. Yea, like those annoying real estate cards you get to “sell your house”.

And… it worked!!!!

Why?

1.) Sending a piece of paper isn’t that costly when you compare it to fighting for expensive google ad words like “mesothelioma attorneys tx”

2.) There are still a TON of industries, especially family owned ones, where checking the mail is more normal than checking email.

I learned that first hand working at a marketplace for car parts. Our return on Microsoft BING ad spend was way better than Google because, get this… the auto mechanics using the computers never went and updated their browsers to Chrome after buying their desktop - they just used whatever was pre installed, which was Microsoft Edge.

BING IS ALIVE AND WELL MY FRIENDS!

At PartsTech we found we could get a marketing qualified lead (MQL) for the price of a branded Yeti tumbler.

Needless to say, we became really BIG yeti customers. So big I once thought we were embroiled in an elaborate red neck phishing scheme when I saw our six figure Q3 credit card bill.

And I found out we weren’t alone in our industry when it came to creative, cost effective CAC. I was having dinner with another auto tech CFO last week. He said one of their best marketing campaigns was just randomly sending pizzas to truck fleet HQ’s that said “from your friends at Company XYZ”. Their BDRs would follow up with a call the next week to make sure they got the pizza, and BOOM! Easy way to kick off a convo.

Pepperoni and brake pads. That’s what pipelines are built on.

So there is hope that reasonable customer acquisition costs exist. You just have to get creative and think about what people want. Hell, how many customers did Marlboro attract with those cool red leather jackets back in the day? That’s a high LTV to CAC (up until the customers died from Cancer, but hey that’s probably not what you were asking.)

-Jackie from NY

In 2021, Tiger Global invested in 315 startups. In the first five months alone, Tiger Global led or co-led deals totaling $10.5 billion and participated in rounds totaling a further $11.5 billion.

So like at least that many.

It all depends on what your definition of “dead” is. Like literally going to be wound down? Far less. Maybe 20% of that number. Lacework is the most notable name I can remember being wound down.

Far more will be quietly sold for 40 cents on the last fundraising dollar to vultures professional opportunists who can smash seven firms in tangential spaces together, lever that puppy to the tilt, and flip the cluster in 18 months for 1.5x MoM (4.3x cash on cash returns).

So yes, they are “default” dead from the perspective of their most recent investors, and probably in the eyes and pockets of employees who are underwater, which is what happens when you are $30M to $50M in revenue, growing 10%, and raised at $3 billion. But they are still pretty sweet assets to someone else who didn’t make that foot fault.

-Tyler from MA

“PETER - DON’T TOUCH”

Tangent: I once saw a sign in a Quiznos bathroom that said:

“Employees must wash hands before returning to work.”

Under it, someone had scribbled

“ESPECIALLY YOU, DALE”

-Rob from SF

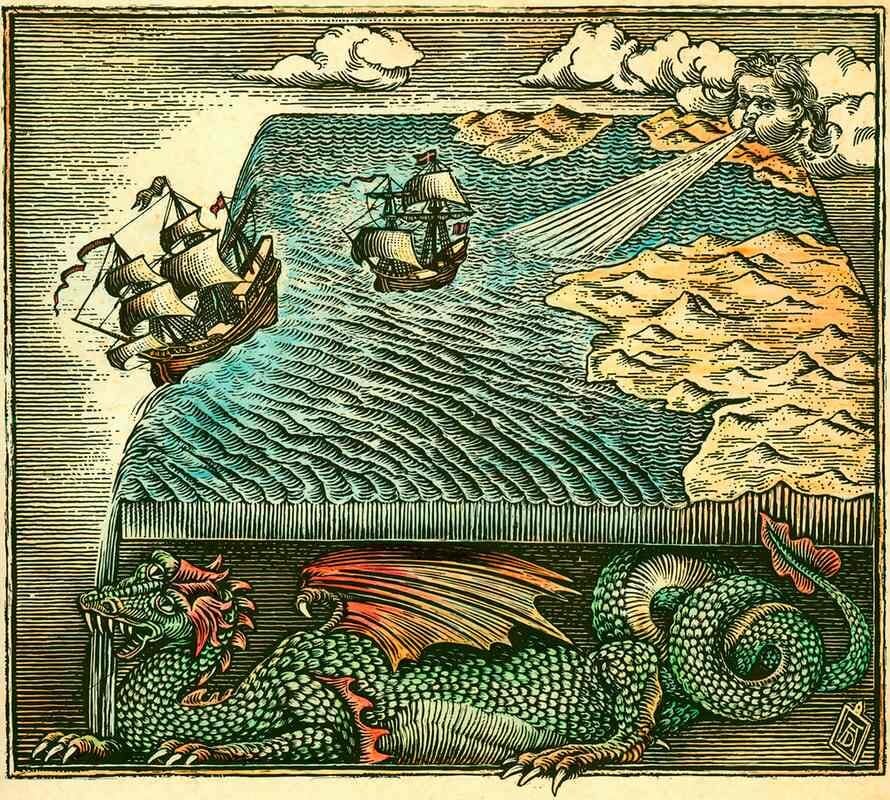

Gross margin. Like literally no one outside of the finance team understands what goes on up there. It’s like one of those maps from pre Christopher Columbus times where people thought you’d fall off the edge of the earth if you went too far. That’s gross margin to most.

Yet people talk about “expanding gross margins” and “finding leverage in our operating model” like they personally installed a fulcrum between revenue and OPEX.

Any time someone makes a hand wavy, buzz wordy reference to a section of the P&L, run.

-Collin from SF

Weekend print runs. It’s happened way too many times for my liking. I wasn’t on a first name basis with the guy at FedEx Office in Boston’s Back Bay, but he was certainly on one with my dog, Walter.

Sometimes I’d actually have to go into the physical office (sigh).

There was this one project I got stuck on in Syracuse, NY. The only restaurant within five miles still open by the time we wrapped most days was this disgusting Red Lobster, conveniently sandwiched between the Fairfield Inn I stayed at and a nondescript rug warehouse. I ate there (alone) too many times than I care to admit.

I digress.

I had to leave each Sunday night in order to get there in time for an 8AM start on Monday (shoot me now). And the partner I was working with wasn’t done with the deck we were walking the client through until Saturday morning. Which meant I had to lug my hung over corpse from Friday night back into the office on Saturday afternoon to battle the printer.

I can still feel it — the office was pushing 100 degrees. It was July. Sunbeams scorched through the magnifying-glass windows on the ninth floor. They’d turned the AC down over the weekend to save a few bucks on energy. Meanwhile, the industrial-grade printer blasted heat like an Ecuadorian summer. And just to complete the torture, the lights were on an impatient motion sensor, probably set to 3.4 seconds, plunging me into darkness every time I sat still long enough to melt.

So there I was, sweating my ass off, going in and out of darkness, trying to print double sided copies of a 37 page deck on glossed paper using a machine that took a PHD in computer science to operate.

It was at that moment I made the sobering realization that I was a high paid Kinkos worker and not the “management consultant” I told my relatives at Christmas parties.

GET THE SHREDDERS! HE’S ONTO US!

Don’t you hate it when people have the nerve to remind us that the point of business is to make money? Yuck.

First off, Gregg with two G’s, thanks for reading my man. I love that our audience is not just tech folks. There’s real value in having a diversity of experiences.

And you’re totally right. It reminds me of my favorite scene from Silicon Valley.

Russ Hanneman says it well - the moment you have revenue, and especially the moment you have profits, you trade on reality, not expectations.

Six months before we sold my last company we were thinking of going into payments. It was going to be a slog. Yes, it was a valuable “layer” to stack on our existing infrastructure, but it would take a while, and we didn’t have the capabilities in house to do it.

What was seemingly more valuable was to sell the “concept” of payments as a lucrative revenue stream for someone else to build.

It worked.

This is a microcosm of a larger structural issue - I’ll call it the next buyer’s theorem. What will the next person want to see or believe to find this valuable?

“To the venture capitalist, and often to the startup itself, profit is a means to another end: A blockbuster IPO or a big acquisition. Though the point of that is still to make money, it’s to make a bunch of money all at once, instead of a little bit every quarter.

In other words, despite the lofty language that people use to talk about Silicon Valley and its ambitions to build enduring companies, very few startups are, or even aspire to be, businesses that make money. Instead, they are assets that are meant to be sold.”

So ask yourself: are running an “asset” or a “business”. Known the game you’re playing. They are not always the same, and neither should be the way you run them.

Got a question you’d like us to answer in next month’s mailbag? Simply reply back to this email with your best.