The Finance Tech Stack

QuickBooks rules ERP until $25M, then it’s all NetSuite and Intacct.

NetSuite is the gold standard at scale, with companies switching post-$25M ARR. Sage maintains a strong midmarket position with robust offerings.

Workday is making a real push into ERP. Several $1B+ companies in the survey cited Workday as their ERP of choice.

Homegrown invoicing tools just won’t die.

At the enterprise level, homegrown tools were the second most common invoicing solution after NetSuite and Intacct—yes, even at $500M+ ARR

Spreadsheets still run FP&A, for better or worse (def. worse)

The FP&A space is highly fragmented, and companies don’t cross the 50% adoption threshold for dedicated tools until after $100M in revenue.

Planful, Aleph, and Abacum are gaining traction as midmarket alternatives to Adaptive Insights and Anaplan (which still dominates at $1B+).

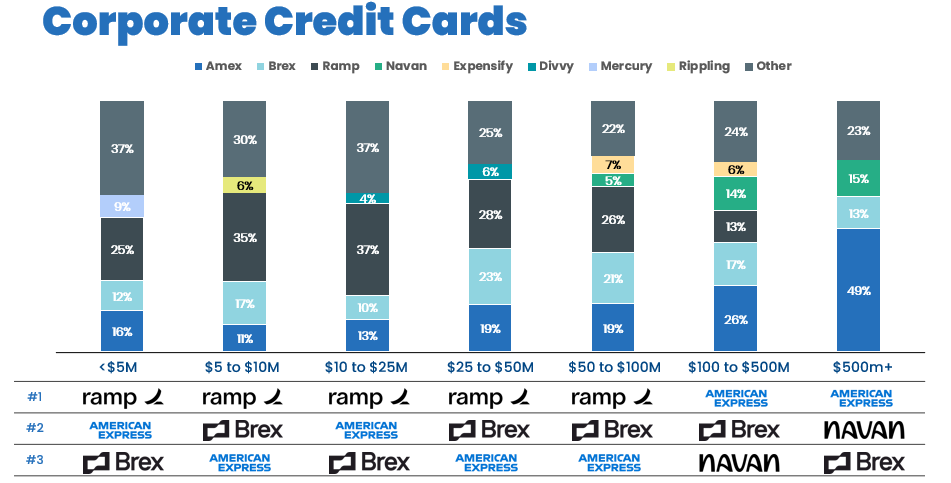

Ramp vs. Brex: The Corporate Card and Expense Managment Wars Rage On

Ramp is winning companies up to $100M ARR. But post-$100M, Brex is making a serious push into the enterprise, challenging the 800-pound gorilla: Amex.

Brex and Ramp are reshaping Expense Management

Ramp is beating Expensify below $100M, while Brex is displacing legacy players in the enterprise.

Travel is the Wild West

45% of $50M–$100M companies and 28% of $100M–$500M companies let employees book travel on their own.

Winners? Navan and TravelPerk, offering easier, cheaper alternatives to legacy platforms like Amex and SAP Concur.

Carta has private cap tables on lock.

Carta controls 43%–60% of private cap table management across all revenue bands up to $500M ARR—then companies transition to Morgan Stanley Shareworks.

Also, there are MULTIPLE $1B+ revenue companies managing cap tables on spreadsheets. That is psychopathic behavior.

That’s just the start… Download the report for results across more categories, including:

Accounts payable

BI & Analytics

CRM

Sales Compensation

Procurement

Sales Tax

Revenue Recognition

Close Management

Download the report here: