I’m just gonna be straight with you… there’s a TON of bad business advice flying around right now…

“Companies are only hiring AI engineers”…

“You need VC money to scale”…

“This economy is bad for starting a business”…

If you’ve fallen for any of these oft-repeated assumptions, you need to read Mercury’s data report, The New Economics of Starting Up. Mercury surveyed 1,500 leaders of early-stage companies across topics ranging from funding, AI adoption, hiring, and more, to set the record straight.

What they discovered is equal parts surprising and encouraging:

79% of companies surveyed, who have adopted AI, said they’re hiring more because of it.

Self-funding is the number one avenue for accessing capital — even for tech companies, with half likely to bootstrap.

87% of founders are more optimistic about their financial future than they were last year, despite prevailing uncertainties.

To uncover everything they learned in the report, click the link below.

*Mercury is a financial technology company, not a bank. Banking services provided through Choice Financial Group, Column N.A., and Evolve Bank & Trust; Members FDIC.

Want me to send you amazing jobs?

If you’re a finance brainiac who’s passively open to new opportunities and wants to be kept in a warm pool of talent CLICK HERE

Who we’ll place:

We’ll specialize in three levels: Manager, Director, and VP.

And we’ll focus on two core areas: FP&A and Accounting.

It’s all confidential. We’ll just float opps your way from time to time. Up to you if you take the call.

(Note: We work with a select few tech companies to fill high profile FP&A and Controller roles… if you are a top SaaS company looking to find talent amongst our readers, click here)

Polymarket went legit this week, landing a MASSIVE investment from the NYSE’s parent company, ICE.

Yes, the same NYSE that the most historic blue chip companies, like Johnson & Johnson, Coca Cola, and Berkshire Hathaway Trade on.

And yes, the same Polymarket that allows you to wager on how many times Elon Musk will tweet today, or if Taylor Swift will announce she’s pregnant before year end.

As someone who now makes a living analyzing company S1 filings to go public, and the implications of private market liquidity, this felt like a watershed moment.

My academic mind tells me there’s a broader shift in how companies and market participants navigate liquidity and risk exposure..

And the lizard brain portion of my head is telling me: dude it’s now legit to bet on anything. Including if Jerome Powell will say “Good Afternoon”.

And when it rains it pours! A couple of days later… Kalshi announces a $300M Series D led by A16Z, Sequoia, Paradigm, Coinbase Ventures, General Catalyst, Spark and CapitalG (source).

So I brought in an expert to help us make sense of the proliferation in trading platforms (from Robinhood to Coinbase, to Polymarket and Kashi) and the tokenization of private companies.

The following is written by Collin Cook. He’s a former buyside and sellside analyst with more than a decade covering exchanges, brokers and trading companies. He wakes up every day thinking about the business of market makers.

He writes The Diversified Fins Analyst, a newsletter highlighting proprietary analysis on the publicly traded retail online brokers, trading platforms and exchanges within the U.S. It also provides commentary / analysis on adjacent businesses and competitor industries (such as the prediction markets space).

Take it away, Collin:

On Tuesday, October 7, Intercontinental Exchange ($ICE), the owner of the New York Stock Exchange (NYSE), announced a $2B strategic investment in the prediction market operator, Polymarket, valuing the company at an $8B pre-investment. Considering this announcement and the continued meshing of traditional financial firm operators (TradFi) with decentralized finance operators (DeFi) I thought we should explore some of the recent trends that have gotten us here and look at what to expect going forward.

As a quick aside: the photo below is Terry Duffy (CEO of CME Group – ICE’s largest competitor) giving the bird to Shayne Coplan (CEO of Polymarket) with Jeff Sprecher (CEO of Intercontinental Exchange) sitting between them just 8 days before ICE announced its $2B investment in Polymarket. Maybe, if Terry had been nicer, he could have invested $2B in Polymarket 😊.

Source: Twitter

(Note: Terry and Shayne were joking around when this occurred. I watched the panel, and this was definitely all in good fun.)

The Proliferation of Trading Platforms – Both TradFi and DeFi:

Over the past several years there has been a proliferation of new trading platforms and trading products for participants to utilize to place bets on future outcomes of events, ranging from how well a company will perform, to who will win a government election or sports game. Much of this innovation has come as retail investors have become a far bigger presence in the markets due to technological advances (the ability to place trades from the small rectangle in our pockets) and the ease of access to information.

In the U.S., stock exchanges, arguably the most traditional of the TradFi marketplaces, have been around since the NYSE was founded in 1792. Even futures exchanges, such as CME Group ($CME), have been in existence since 1848 and other “newer” exchange operators such as Nasdaq ($NDAQ) and Cboe Global Markets ($CBOE) have been around since 1971 and 1973, respectively.

Meanwhile, retail brokerages have existed since the 1970s, with Charles Schwab ($SCHW) launching its discount brokerage in 1975 after the SEC mandated negotiated commission rates on securities transactions that year. Schwab’s discount brokerage launch was followed by companies such as E*TRADE (now owned by Morgan Stanley) in the 80s, and Interactive Brokers ($IBKR) in the early 90s.

Then in the mid-2010s companies such as Robinhood ($HOOD) and Etoro ($ETOR) entered the brokerage space with Robinhood offering, for the first time ever, commission free U.S. equity trading. This served as a massive disruption to the traditional online brokerage models as equities commission rates across the board were eventually cut to $0 by October 2019 (creating an incredibly stressful handful of weeks as a former online brokerage analyst).

Additionally, in the 2010s and early 2020s a number of “alternative” marketplaces launched, such as Coinbase ($COIN), Bullish Global ($BLSH), and Kraken, all with a primary focus on cryptocurrency trading, and Kalshi and Polymarket, both with a primary focus on prediction markets and event contracts.

The flurry of new entrants to the trading landscape drastically increased both the scope of products available for people to place bets on (within TradFi: equities, futures, options and within DeFi: cryptocurrencies, prediction markets, event contracts) as well as the scale with which they could place bets (with equity trading priced at $0 people can now trade in and out of shares without the cost of a trade eating into overall trading profitability).

This explosion of new entrants and activity also just so happened to preempt Covid-related lockdowns which allowed everyday investors a bit more free time to trade equity shares, completely for free, and explore trading new products or placing bets on the outcome of certain events, which led to rapid adoption of these new products and platforms.

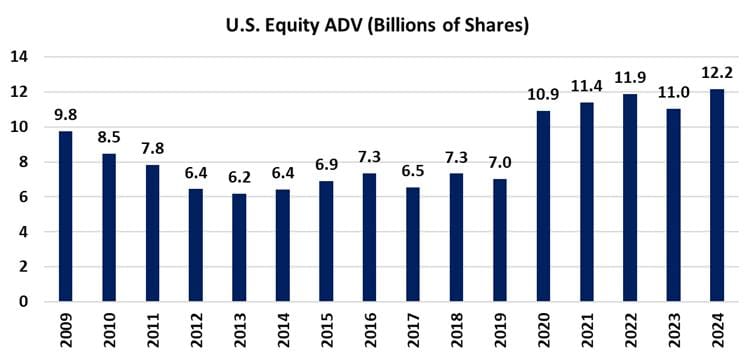

To exemplify the massive uptick in activity, the below graphs show the increase in U.S. equities and U.S. options average daily volumes (ADV) beginning in 2020.

Source: Options Clearing Corporation

Source: Cboe Global Markets

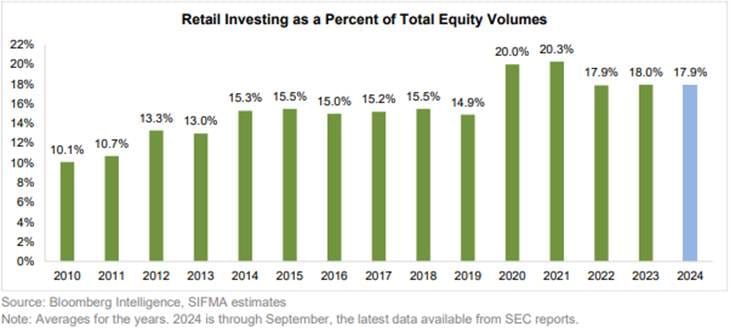

And finally, the below from SIFMA shows the increase in retail trading as a percentage of total U.S. equity volumes, though it is largely survey based and some estimates put retail trading as high as 45-50% of the overall market.

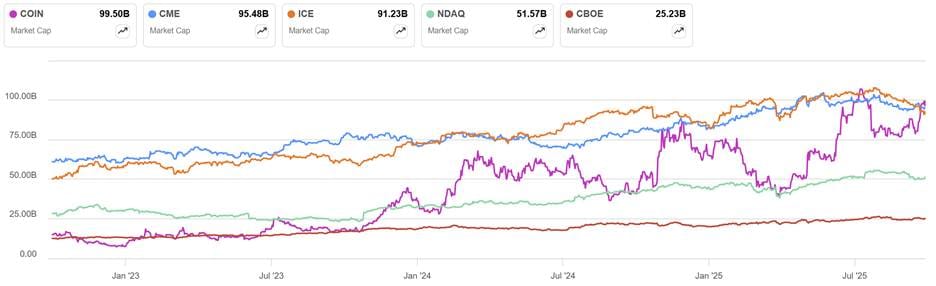

The rapid adoption of these newer players to the market has yielded astounding performance for their share prices over the past year as Coinbase (purple line in graph 1) now commands a market cap of $99B, exceeding that of the largest TradFi exchanges, CME and ICE, and Robinhood’s (orange line in graph 2) market cap at $134B has surpassed that of IBKR and is on its way to reaching SCHW at $170B.

Publicly Traded Exchange Company Market Caps

Coinbase has surpassed both CME and ICE, and is double NDAQ.

Source: Seeking Alpha

Publicly Traded Online Broker Market Cap

Robinhood has surpassed IBKR and is approaching SCHW in market cap.

Source: Seeking Alpha

Prediction Markets on the Rise:

Prediction market activity has risen dramatically over the past year. According to Dune Analytics from April through August 2024 (data isn’t available prior to April ’24), prediction market volumes averaged ~$100M per week. By November that figure had swelled to $1.0B, reaching a peak of $2.0B during the week of the U.S. presidential election (week of November 4).

While prediction market volumes have yet to eclipse election week levels, activity has remained strong in 2025, averaging $470M through August and rising rapidly through September to $1.5B during the week of September 29.

Prediction Market Weekly Volumes

Source: Dune Analytics

The recent rise in prediction market activity has been driven by three primary factors.

First, is increased trader comfort with these relatively nascent products. The two major players in the space were only just founded in 2018 (Kalshi) and 2020 (Polymarket), so traders have had to grow accustomed to the new products.

Second, is the easing regulatory environment, particularly in the U.S. with the current administration taking a much more friendly approach to crypto and other DeFi regulations. In fact, only recently, on September 3, did Polymarket receive regulatory approval from the Commodity Futures Trading Commission (CFTC) to resume operations in the U.S.

Polymarket had previously been banned from allowing access to U.S. customers since 2022 after the CFTC accused the company of failing to register as a Swap Execution Facility (SEF) or Designated Contract Market (DCM).

Additionally, in 2024 (right after the U.S. election and spike in prediction markets volumes) the FBI raided CEO Coplan’s apartment and seized his phone on suspicion that Polymarket had continued to allow U.S. customers to access the site, however that investigation was dropped in July of this year.

Third, is the combination of these more nascent markets with their TradFi peers. Robinhood has partnered with Kalshi (other retail brokers have as well) to offer prediction market trading directly through its prediction market hub and cumulative volume on Robinhood has grown to over $4B as of the end of September. Meanwhile, Interactive Brokers has launched its own prediction market and partners with CME Group to offer event contracts to clients. And obviously, ICE has now partnered with Polymarket.

Robinhood Cumulative Prediction Market Volume

Source: Twitter

Of note, the explosion of prediction market activity has not only disrupted the traditional marketplaces space but has also had an impact on sports betting. Below are the share prices of DraftKings ($DKNG) and Flutter Entertainment ($FLUT) showing a steep decline since the end of August as prediction markets volume exploded in September.

DraftKings YTD Share Price

Source: tikr.com

Flutter Entertainment YTD Share Price

Source: tikr.com

So what does ICE get out of its investment in Polymarket? Initially, ICE will become a global distributor of Polymarket’s data. It’s been shown that sentiment from prediction markets is often a better indicator of election outcomes than polling, so by plugging Polymarket’s data into ICE’s data business (data makes up about 30% of ICE’s $9B in 2024 revenue) it could potentially become a better indicator for ICE’s clients who are placing bets in the TradFi markets. Additionally, the two companies plan to explore other technological innovations, such as tokenization and integrating other blockchain protocols into ICE’s marketplaces.

Private (and Public) Company Share Tokenization – The Next Unlock in the DeFi Space?

More recently, due to the applications available through DeFi protocols, there has been discussion about tokenizing private company shares and making them available to the public to trade. In fact, at the end of June, Robinhood announced that it had tokenized “shares” of OpenAI and SpaceX and that it was giving away tokens backed by the valuation of these two companies to clients in the EU. And Rick Wurster, Charles Schwab’s CEO, has discussed providing further access to private companies to SCHW’s retail clients (though it remains to be seen how SCHW will approach this).

So, why the interest in private company access for retail investors? Primarily, this is due to the steep decline in publicly listed companies (the number of publicly listed companies has declined from about 7,000 in 2000 to 4,500 today, according to data from Nasdaq) and the massive valuation growth private companies are experiencing before they even enter the public markets (DataBricks and Stripe are each valued at over $100 billion, both ~2x the market cap of their nearest direct competitors, Snowflake and Adyen). Market observers view this as a huge disadvantage for everyday investors that are shut out from private investment rounds because they are not “accredited investors” and thus can’t take advantage of the increase in valuations private companies have been experiencing.

How does tokenization of private company shares work?

In the case of Robinhood’s OpenAI and SpaceX tokens (and very likely other private company tokens moving forward), the tokens are solely a derivative contract between the holder of the token and Robinhood. Robinhood backs the tokens and bases the value of them on its ownership stake in a special purpose vehicle (SPV) that holds the underlying shares in SpaceX and OpenAI.

Importantly, these private company tokens are very much not an equity stake in the businesses of OpenAI and SpaceX. However, the idea is that as the value of the private businesses rise, the value of the tokens will rise, and IF OpenAI and SpaceX eventually go public, the value of the tokens will eventually track the value of the companies seen in the public markets.

Of note, even when (if) OpenAI and SpaceX do go public, the tokens still will not represent an actual ownership stake in the underlying business and will remain a derivative between the holder and Robinhood.

What are the implications for private companies?

Does this change whether or not they consider going public?

The IPO process is in nearly all cases a fundraising event for private companies rather than a secondary share liquidity event. As mentioned above, the sale of private company tokens strictly creates a derivative contract between Robinhood and the retail investor and does not generate any additional funds for the company itself (those funds have already been raised through the share sale to the SPV that Robinhood has an ownership stake in). So, from a fundraising event perspective, I don’t believe this materially changes a company’s view on going public via traditional means versus staying private.

However, typically when a company does go public it generates buzz (sort of a “free” marketing situation) leading up to and following the IPO process. So, if a company has enough cash that it won’t burn through and is profitable, it may consider remaining private and allow these derivatives token contracts to trade in the public space continuing to generate buzz about the company (assuming a secondary market for private tokens is eventually established – Robinhood does not currently allow selling of the OpenAI and SpaceX tokens to anyone other than Robinhood). This potential secondary market idea becomes incredibly risky for the token investor though as any valuation mismatch between the token and the underlying asset could be wiped away completely in the event of a valuation re-rating of the business.

Now, could the tokenization option eventually become a different means to an IPO rather than a traditional share sale? Absolutely.

Nasdaq has already submitted a proposal to the SEC to allow tokens of equity securities to trade on the Nasdaq Stock Market. And the new chair of the SEC has committed to advancing tokenization efforts. These public company tokens would provide the holder with the same rights (and protections) as a typical stock sale but would trade using blockchain technology, allowing for faster settlement, an improved proxy process for issuers, and would allow issuers to manage corporate actions easier (dividend payments, share buybacks, etc.).

Things are moving fast. And while companies are staying private longer, it's never been easier to gain access to business (and non business) related outcomes.

Thanks to Collin for making us smarter on the rise of prediction markets, and the evolution of trading platforms. Please show him some love and sub to his newsletter (it’s free).

What you will get if you subscribe to Collin’s newsletter: Weekly updates on company specific news from the week and exchange trading volumes as well as non-company specific news highlights, monthly metrics recaps from each company, quarterly earnings recaps, and occasional longer form deep dives on subsectors and individual companies (Examples: MIAX Deep Dive, Exchange Overview, eBroker Overview).

TL;DR: Multiples are FLAT week over week.

The top ten is officially back up over 20x forward revenue. This is 4x the overall median of just under 5x.

Top 10 Medians:

EV / NTM Revenue = 21.7x (UP 0.9x w/w)

CAC Payback = 24 months

Rule of 40 = 49%

Revenue per Employee = $475k

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 147

Recent changes

Added: Bullish, Figure, Gemini, Stubhub, Klarna

Removed: Olo, Couchbase

Population Sizes:

Security & Identity = 17

Data Infrastructure & Dev Tools = 13

Cloud Platforms & Infra = 15

Horizontal SaaS & Back office = 19

GTM (MarTech & SalesTech) = 19

Marketplaces & Consumer Platforms = 19

FinTech & Payments = 28

Vertical SaaS = 17

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Sales and Marketing costs are measured on a TTM basis, but lagged by one quarter (so you skip a quarter, then sum the trailing four quarters of costs). This timeframe smooths for seasonality and recognizes the lead time required to generate pipeline.

Revenue is measured as the year-on-year change in the most recent quarter’s sales (so for Q2 of 2024 you’d subtract out Q2 of 2023’s revenue to get the increase), and then multiplied by four to arrive at an annualized revenue increase (e.g., ARR Additions).

Gross margin is taken as a % from the most recent quarter (e.g., 82%) to represent the current cost to serve a customer

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

OPEX

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.

Please check out our data partner, Koyfin. It’s dope.

Wishing you a forecast you can beat, and raise,

CJ