AI is everywhere—but is your team truly getting value? Planful’s 2025 Global Finance Survey uncovered that most teams are dabbling, not driving results. You’ve got a chance to lead smarter: automate what matters, tackle roadblocks like security and cost, and turn AI into ROI. The tools exist. The strategy? That’s where you come in.

Want to see what your peers are doing—and how to do it better?

Your Weekly Benchmarks Just Got Better

July serves as half time in most fiscal years. So in between Miller Lattes, 5K Road Races, and eating way too many chicken wings, I took this opportunity to reconstitute our benchmark population to create a cleaner, more representative, and mutually exclusive set of publicly traded technology companies across EIGHT key categories.

Security & Identity (n=17)

Data Infrastructure & Dev Tools (n=11)

Cloud Platforms & Infra (n=15)

Horizontal SaaS & Backoffice (n=19)

GTM (MarTech & SalesTech) (n=18)

FinTech & Payments (n=24)

Marketplaces & Consumer Platforms (n=18)

Vertical SaaS (n=18)

The previous population grew organically over time, but as the landscape evolved, with new IPOs, M&A activity, and companies going private, we realized it was time for a refresh.

We also brought in 22 under-the-radar but relevant players like Sezzle, Arista Networks, Adyen, and The Trade Desk to reflect where innovation and capital are flowing today. This gets us up to a total n of 140.

As a reminder, the data set continues to exclude mega caps, like Google, Meta, and Microsoft, who play in multiple categories and distort medians and averages.

Always Iterating

I called this Operator Equity Research because that’s what it is: equity research, retooled for the people operating a damn business; not just selling one.

If there’s a name we missed, or one you think doesn’t belong, let me know. This whole project is about scratching my own itch, and yours too.

Total n = 140

Security & Identity (n=17)

Tools that protect infrastructure, data, and user access—spanning network, endpoint, and identity layers. Buyer: CISO, Security Ops, IT

CrowdStrike Holdings, Inc.

Zscaler, Inc.

Okta, Inc.

SailPoint Technologies Holdings, Inc.

Palo Alto Networks, Inc.

Fortinet, Inc.

CyberArk Software Ltd.

SentinelOne, Inc.

Check Point Software Technologies Ltd.

Qualys, Inc.

Rapid7, Inc.

Tenable Holdings, Inc.

Varonis Systems, Inc.

Rubrik, Inc.

Cisco Systems, Inc.

OneSpan Inc.

Mitek Systems, Inc.

Data Infrastructure & Dev Tools (n=11)

Software-layer tools used by engineers, analysts, and DevOps teams to move, monitor, and manage data and code. Buyer: CTO, VP Eng, Data Teams, DevOps

Snowflake Inc.

Confluent, Inc.

MongoDB, Inc.

Datadog, Inc.

JFrog Ltd.

GitLab Inc.

Elastic N.V.

Dynatrace, Inc.

PagerDuty, Inc.

Teradata Corporation

Atlassian Corporation Plc

Cloud Platforms & Infra (n=15)

Providers of the underlying compute, storage, and networking fabric—including cloud, colocation, and CDN players. Buyer: CIO, IT Infrastructure, Cloud Architects

Dropbox, Inc.

Box, Inc.

C3.ai, Inc.

DigitalOcean Holdings, Inc.

Fastly, Inc.

Akamai Technologies, Inc.

Equinix, Inc.

Hewlett Packard Enterprise Co.

Lumen Technologies, Inc.

Nutanix, Inc.

Arista Networks, Inc.

NetApp, Inc.

CoreWeave, Inc.

Cloudflare, Inc.

Rackspace Technology, Inc.

Horizontal SaaS & Backoffice (n=19)

Cross-functional workflow tools that power finance, HR, legal, and internal ops across industries. Buyer: CFO, CHRO, COO, CIO

ServiceNow, Inc.

DocuSign, Inc.

RingCentral, Inc.

Zoom Video Communications, Inc.

UiPath Inc.

Asana, Inc.

monday.com Ltd.

Workday, Inc.

Paycom Software, Inc.

Paylocity Holding Corporation

BlackLine, Inc.

Workiva Inc.

Jamf Holding Corp.

8x8, Inc.

OneStream Software, Inc.

Oracle Corporation

Ceridian HCM Holding Inc. (Dayforce)

Automatic Data Processing, Inc.

Paychex, Inc.

GTM (MarTech & SalesTech) (n=18)

Platforms that enable companies to find, convert, and retain customers—from email to CRM to ad tech. Buyer: CMO, CRO, Revenue Ops

Adobe Inc.

Amplitude, Inc.

Twilio Inc.

HubSpot, Inc.

Salesforce, Inc.

ZoomInfo Technologies, Inc.

Vimeo, Inc

Wix.com Ltd.

Sprout Social, Inc.

Klaviyo, Inc.

Five9, Inc.

Semrush Holdings, Inc.

ON24, Inc.

Yext, Inc.

Braze, Inc.

The Trade Desk, Inc.

Criteo S.A.

Freshworks Inc.

FinTech & Payments (n=24)

Companies that move money, extend credit, or manage financial data and workflows, serving both consumers and businesses.

Block, Inc.

PayPal Holdings, Inc.

BILL Holdings, Inc.

Blend Labs, Inc.

Marqeta, Inc.

Affirm Holdings, Inc.

Lightspeed Commerce Inc.

Flywire Corporation

Coinbase Global, Inc.

MoneyLion Holdings, Inc.

Remitly Global, Inc.

Chime Financial, Inc.

Circle Internet Financial, Inc.

Intuit Inc.

Clearwater Analytics Holdings, Inc.

Robinhood Markets, Inc.

SoFi Technologies, Inc.

Upstart Holdings, Inc.

Sezzle Inc.

LendingClub Corporation

Adyen N.V.

Shift4 Payments, Inc.

Fiserv, Inc.

Shopify Inc.

Marketplaces & Consumer Platforms (n=18)

Two-sided platforms that match buyers and sellers, monetized via transactions or take rates. Most are consumer-facing.

Airbnb, Inc.

BigCommerce Holdings

Udemy, Inc.

Uber Technologies, Inc.

Lyft, Inc.

DoorDash, Inc.

Etsy, Inc.

eBay Inc.

Upwork Inc.

Fiverr International Ltd.

Redfin Corporation

Zillow Group, Inc.

Opendoor Technologies Inc.

CarGurus, Inc.

Maplebear Inc. (Instacart)

MercadoLibre, Inc.

Rakuten Group, Inc.

Newegg Commerce, Inc.

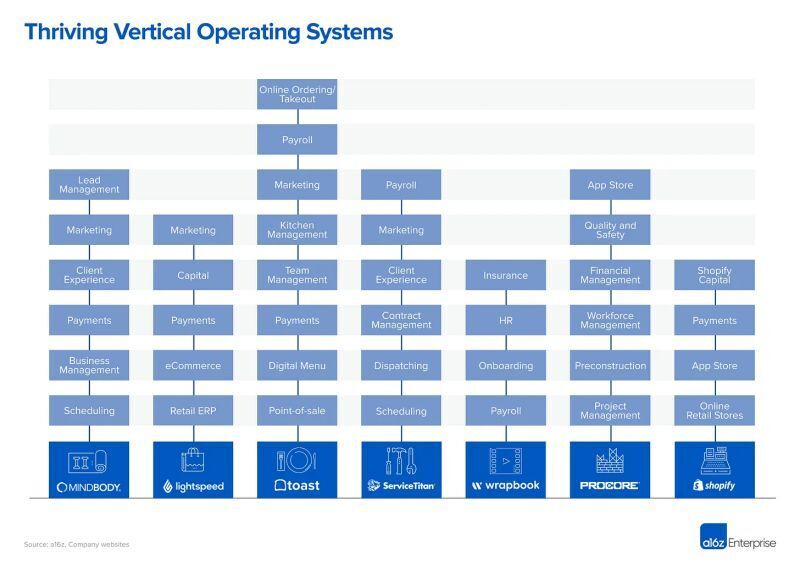

Vertical SaaS (n=18)

Industry-specific software built around deep domain workflows and compliance (e.g. healthcare, construction, insurance).

Palantir Technologies Inc.

ServiceTitan Inc.

Samsara Inc.

Procore Technologies, Inc.

Doximity, Inc.

CCC Intelligent Solutions Holdings Inc.

Veeva Systems Inc.

Olo Inc.

Toast, Inc.

AppFolio, Inc.

Tyler Technologies, Inc.

Guidewire Software, Inc.

Aspen Technology, Inc.

Blackbaud, Inc.

nCino, Inc.

CS Disco

CareCloud Corporation

Autodesk, Inc.

TL;DR: Multiples are UP week-over-week.

Top 10 Medians:

EV / NTM Revenue = 15.9x (UP 0.6x w/w)

CAC Payback = 30 months

Rule of 40 = 51%

Revenue per Employee = $418k

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 140

Population Sizes:

Security & Identity = 17

Data Infrastructure & Dev Tools = 11

Cloud Platforms & Infra = 15

Horizontal SaaS & Back office = 19

GTM (MarTech & SalesTech) = 18

Marketplaces & Consumer Platforms = 18

FinTech & Payments = 24

Vertical SaaS = 18

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency Benchmarks

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

Operating Expenditures

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.