After years in tech finance, I’ve learned that great companies need more than capital – they need true partners who understand their DNA.

MUFG’s Growth & Middle Market Technology Banking practice is what happens when you bring together the most experienced, most connected tech bankers in North America in one room – with the generational commitment of a $3 trillion global powerhouse behind them.

From pre-IPO startups to scaled public companies, this team is structured to help your company keep pace with lending solutions, strategic advice, and risk management products tailored to tech CFOs.

Contact Group Head Bob Blee to discuss how MUFG is empowering a brighter future for the tech ecosystem.

This is State of the Private Markets, a monthly series where we deliver the most compelling valuation, hiring, and revenue insights on pre-IPO candidates. Think of this as your backstage pass to the companies shaping the future before they hit the public markets.

Today we will cover:

Seeking Arbitrage: Has all the alpha been competed away?

Valuation: The most valuable private tech companies

Hiring: The fastest-growing teams

Layoffs: Companies making cuts

Sector Highlights: A deep dive into Data Infra, Design Tools, and Direct to Consumer sectors

Company Spotlights: Updates on ScaleAI, SSI, and Revolut

Executive Moves: Pre-IPO CFO hires

Alpha Is Dead (Long Live Alpha)

Lately, a lot of folks — operators and investors alike — are feeling like the Alpha has been sucked out of the room.

Here’s a recent text exchange with a buddy of mine, a partner at a growth equity firm:

In his words: “It’s like trying to find an edge in a room full of mirrors.”

As a refresher, Alpha is the edge you create — the extra return you generate above a market benchmark without taking on extra risk. And it doesn’t just live in a hedge fund’s spreadsheet.

You used to find it in marketing channels that outperformed their spend. In recruiting pipelines that quietly landed top-tier talent before the market caught on (a chief product officer with AI experience!?!). In product decisions that leapfrogged user expectations.

Alpha was everywhere — if you knew where to look.

But not anymore.

Andrew Chen recently observed, “Every marketing channel sucks right now.” SEO, Google Ads, viral loops — all saturated. $100K doesn’t get you what it used to.

And over in venture, State of the Future dropped a bomb: “data-driven VC is over.” AI has leveled the playing field. Deep research that used to take a team of seven and a year to perform? Now one person with the right tools can get there in hours.

Information asymmetry — the lifeblood of venture, marketing, building product, even hiring — is quietly dying.

Everyone’s seeing the same signals, running the same plays, chasing the same deals.

So what now?

The Only Edge Left Is Being More… Human?

AI makes you faster. No doubt.

But if it flattens the playing field, the only real edge left is what makes you irreplaceable: trust, intuition, taste, creativity, patience.

Soft skills are having a moment.

Because if everyone has the same tools and the same inputs, your output depends on what only you can bring to the table.

Based on convos I’ve had this month, the best operators and investors I know are doubling down on this. They’re looking for ways to combine deep AI leverage — for research, writing, analysis — with deeper human capabilities — judgment, empathy, and long-term thinking.

Patience Is the New Moat

One more thing no one’s talking about: patience.

In a world where everyone’s sprinting, patience isn’t slow — it’s a moat when applied correctly.

Yea, I know it’s hard to slow down when all the stories are about six dudes in a garage with a pre revenue startup worth $32 billion. But…

Patience lets you:

Build trust instead of blasting template emails (the twitter DMs promising to build me a landing page (for what???) or get me 200 leads (again, for what??) are getting out of hand)

Spot non-obvious patterns before they trend

Bet on contrarian markets 12–18 months before the crowd arrives (I’m long car washes)

As the old surf saying goes:

"Slow is smooth. Smooth is fast."

If you rush the wave, you wipe out. If you flow with it, you fly.

(I’ve surfed exactly three times in my life. But it’s the same deal here.)

Alpha isn’t gone. You just have to be willing to take the long way there.

The Most Valuable Private Tech Companies

With Position, we tracked valuations, ranking, headcount, and other datapoints across 5,000+ private companies to uncover the trends.

OpenAI officially joined the $300 billion valuation club, cementing its status as one of the most valuable private tech companies on the planet. For context, that’s approx 2x the current enterprise value of publicly traded Adobe. That’s a 245% jump in the past year—proof that foundational models are foundational to investor optimism, too.

Meanwhile, xAI, Elon’s AI moonshot, seemingly came out of nowhere—leaping nearly 2,000 spots to debut at #7 with an $80B valuation. Whether it’s real traction or just Tesla-style aura, investors are clearly betting big. There’s also a combination play with the social media network X going on behind the scenes (TBD on how shareholders of xAI take that one).

Then there’s SSI Inc., an enigma of a company. With no revenue and a team that could fit in a Yukon Denali, they now sit at a staggering $32B valuation. In this market, narrative can still outpace fundamentals.

Scale AI continues to defy gravity. For a company with a services-heavy model, its $25B valuation and 242% YoY growth (up 107 spots) show that the market is willing to treat infrastructure and outsourcing as one and the same—if the margins are right.

Not every story was up and to the right. X (formerly Twitter) fell 8 spots with a 27% drop in valuation, as questions around monetization continue to linger. Flipkart also slid 4 places, with growth seemingly plateauing.

And then there’s Stripe—quietly holding its ground at #6, still worth $91.5B, up a respectable 41% YoY. In a sea of volatility, that kind of durability says something.

HC Trends

When it comes to tech businesses, people are the biggest investment. Over 70% of SaaS expenses go towards headcount, making hiring trends a leading indicator of future revenue growth (or contraction).

Fastest Hiring Companies

Filtering for companies with more than 500 total employees who have also raised more than $500 million in capital, the logos below increased total headcount at the fastest rate year-on-year:

🧑💼 Headcount Is the New Heat Check

OK, we’ve talked enough about xAI.

Vanta (+75%), Anduril (+74%), and Tenstorrent (+71%) all clocked in major growth—each adding hundreds of new roles. Notably, Anduril is also leading in open roles with 804 positions live. For a defense tech company, that signals both government momentum and investor patience.

Scale AI, which just made waves in the valuation rankings, is also scaling people—47% headcount growth YoY, now at 4,600+ employees, with 312 open roles. Despite the services DNA, they’re staffing like a product-first org.

Other notable additions:

Remote: Distributed work is alive and well—just maybe less buzzy than last year.

Deel and dbt Labs are pacing the middle of the chart, with solid hiring curves and strong capital positions.

And yes, The Boring Company is hiring too—albeit modestly. With 537 employees, they're the lowest on the list, but it’s still a real company (not just a flamethrower meme) with over $1B raised.

And here are the companies who pulled back most aggressively:

Notable callouts:

Brands like Harry’s, Noom, and Bitsight are quietly trimming staff as growth gives way to margin discipline.

With 21,000+ employees and only one job posting, BYJU’S isn’t just slowing hiring—it’s in full freeze.

Sector Specific Highlights

Data Infra

Data Infra: Quietly Powering the AI Boom

Databricks is the clear giant, now at a $62B valuation with over 10,000 employees. It’s trading at a higher valuation in the private markets than Snowflake is in the public sphere. With MosaicML under its belt, it’s the de facto AI infra layer for the enterprise.

dbt Labs is growing fast—47% headcount growth and a $4.2B valuation. Transform is no longer the middle child in the ELT flow (I have blown a couple monthly budgets on this tho)

Fivetran keeps things efficient with a fresh $125M and a steady climb, while Census is in reset mode, trimming headcount but holding onto a $630M valuation.

Bottom line: The data layer isn’t going anywhere—it’s just getting more disciplined, more embedded, and more essential.

Design

Design Tools: Finding Their Post-Zoom Era Footing

It’s been a mixed bag for design platforms as they navigate the post-remote boom and shifting enterprise budgets.Bottom line: The category isn’t dead—but the bar’s higher. To keep growing, these tools have to prove they’re essential beyond product and design teams.

Canva still leads the pack at a $32B valuation, but it’s down 20% from its peak. Modest headcount growth (+3.7%) suggests they’re focusing on efficiency over expansion.

Figma, meanwhile, is riding a post-Adobe-breakup bounce—$12.5B valuation (+25%) and nearly 20% headcount growth. They’ve stayed sticky, even without that $20B buyout. And they have confidentially filed for an IPO that will value them close to that failed M&A mark.

Miro’s $400M round shows there’s still appetite for visual collaboration if you’re entrenched in the workflow. They’ve clearly pulled away from InVision, in fact acquiring some of their assets in 2023.

Direct to Consumer

DTC: Back to Fundamentals, With a Side of Growth

The DTC crowd is back in growth mode—but only if they’ve nailed margins and moved beyond one-hit SKUs.

Ro leads the charge at a $7B valuation, with 22% headcount growth and another $150M raised. They’re proof that vertical health plays still scale—if you can manage both prescriptions and logistics.

ŌURA, WHOOP, and Eight Sleep are riding the wellness wave. Each saw 25–33% team growth, with valuation momentum to match. The quantified self movement is alive—and investor-backed.

The Farmer’s Dog is now worth $2.7B, and recently exceeded the $1B revenue mark. Pet spending is proving recession-resistant. It’s what I feed our editor in chief Walter (other than ice cream, which I’ve told them they should expand into multiple times. If someone from TFD product team is reading this, we’d be happy to help you promote the new product line)

On the flip side, Harry’s saw a 23% headcount drop, likely rightsizing after ambitious omni-channel expansion. Glossier, meanwhile, looks to be holding steady after its own recent reset.

Bottom line: The best DTC brands now look more like full-stack platforms than single-product shops—and those are the ones investors are still betting on.

Company specific highlights

ScaleAI

If AI is oil, ScaleAI is the oil refinery. And they aren’t afraid to get messy.

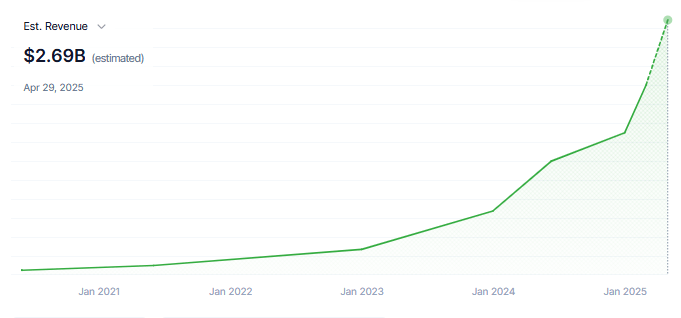

Scale AI is having a moment. The company’s reportedly on track to hit $2.7B in revenue this year, and is now shopping shares at a $25B valuation through a tender offer. Not bad for a startup that started out labeling cat pics.

Led by Alexandr Wang, Scale has morphed into something much more strategic: a core vendor for anyone trying to train serious AI models. They’re working with the likes of OpenAI, Microsoft, and even the U.S. Department of Defense, helping deploy AI agents that can (literally) make battlefield decisions. Boom chakalaka.

They’ve raised over $1.6B, with backers like Accel, Nvidia, Amazon, and Meta all on board. And while they came up a little short of their $1B revenue target last year, they’ve clearly course-corrected. And from a recovering FP&A leader, it’s like really hard to forecast anything that’s growing at warp speed.

But it hasn’t been all sunshine and neural nets. Scale is currently under scrutiny from the U.S. Department of Labor and facing lawsuits over wage classification and pay practices for contract workers. It’s a reminder that rapid scaling sometimes outpaces internal ops. Def some Uber vibes here.

Still, if data is the new oil, Scale is running the refinery—and they’re building a moat around the messy, unglamorous work of structuring the world’s data.

SSI (Safe SuperIntelligence)

The modern day Bell Labs? Or an expensive group project?

Safe Superintelligence Inc. (SSI) is maybe the most paradoxical name on the April leaderboard. Founded in mid-2024 by Ilya Sutskever (ex-OpenAI co-founder), Daniel Gross (ex-Apple AI), and Daniel Levy (ex-Meta), the company has rocketed to a $32B valuation—without shipping a product or booking a single dollar of revenue.

Their mission? Build a safe artificial general intelligence (AGI)—emphasis on the “safe.” It’s part of a deliberate “scale in peace” strategy that favors focus over fanfare. The goal isn’t to commercialize fast; it’s to ensure AI doesn’t run off the rails before it gets built.

Despite being stealthy, SSI’s backers are anything but quiet: Nvidia, Alphabet, and Greenoaks led a $2B round, betting that deep research and a tight team (barely enough to run a pickup basketball game) can still move the AGI ball forward.

They’re running dual HQs in Palo Alto and Tel Aviv, and with Ilya’s departure from OpenAI last year centered on safety concerns, SSI is clearly taking a principled—if high-risk—approach.

Whether this ends up being a modern-day Bell Labs or just a well-funded science experiment remains to be seen. But with that kind of valuation and that kind of brain trust, the market’s already listening.

Revolut

Revolut: from FX to full Fintech domination

Revolut has evolved from a currency exchange app (I was using it back then!) into a global financial super app, and its recent numbers are turning heads. In 2024, the company reported a £1.1 billion pre-tax profit, a 149% increase from the previous year, on revenues of £3.1 billion—a 72% jump. This growth was fueled by a surge in crypto trading, interest income, and card fees.

The company's customer base expanded to 52.5 million, up from 38 million in 2023, and its workforce grew to over 10,000 employees. CEO and co-founder Nikolay Storonsky increased his stake to more than 25% following a corporate restructuring .

Revolut finally secured a UK banking license in July 2024 after a three-year wait, allowing it to offer credit products like personal loans and overdrafts. The company aims to start its UK banking operations in 2025.

You gotta wonder if the US is next?

Despite its success, Revolut has faced scrutiny over its internal practices. The company implemented a points-based "Karma" system to track employee behavior and compliance, influencing bonus payouts. This initiative aims to foster a healthier work culture and address past criticisms .

With a valuation of $48 billion, Revolut stands as Europe's most valuable fintech, rivaling major banks like Deutsche Bank and Barclays.

Fundraising Rounds of Note

The checkbooks are open again. April saw a surge of late-stage funding rounds, signaling that while IPOs remain scarce, private capital is flowing—especially if you're building something AI-adjacent or infrastructure-heavy.

Here’s what stood out:

Anthropic led the charge with a $3.5B Series E, now valued at a whopping $61.5B. Not to be outdone, OpenAI did, of course, say hold my beer and rally the troops at $300B.

Neuralink and Nuro pulled in $500M and $2.2B respectively, with $8.5B+ valuations. If it moves (or thinks), it’s getting funded.

SandboxAQ, Chainguard, Celestial AI, and Together all raised sizable rounds in April, with valuations between $2.5B and $5.7B. Infrastructure is hot again—as long as it’s paired with machine learning.

Harvey and Runway hit identical $3B valuations, showing there’s room for both legal AI copilots and generative video platforms in investor decks.

Mercury (Series C, $3.5B) and Supabase (Series D, $2B) continue to scale the modern backend for startups. Fintech infra and dev tools are alive and well.

Tailscale, Temporal, and Replit each locked in fresh capital while doubling down on developer-first ecosystems.

Adam Neumann’s Flow ($2.5B) is taking in more money. No word on if they are cash flow positive on a community adjusted EBITDA basis or not yet

Executive hires

Jenny Decker (one of the first ever RTN podcast guests!) takes the CFO reins at Tempo, a portfolio software management provider. She previously served as CFO at Engine and Front.

Scott Buxton joins Supabase, an opensource dev tooling company, as CFO. He previously worked at DataDog and Github.

This wraps up our latest edition of State of the Private Markets. Stay tuned for next month’s deep dive into the companies redefining the private markets—and don’t forget to thank MUFG for making this possible.

Disclaimer: None of this is investment advice. Do your own homework.