After multiple requests from the likes of Satya Nadella, Lloyd Blankfein, and a few other business luminaries, we’re back with a tasty one. Now hopefully I don’t immediately throw three picks and get benched. BALL SECURITY!

Opportunity in a Tweet:

Angel investors often make their way onto cap tables with the illusory promise of sage wisdom and advice. But the reality is, they are spread too thin to be much help outside of some spicy email intros. Somewhere in the depths of corporate America, there’s a population of young, driven professionals would love to get their hooks into companies they very well may end up working at, but have yet to build enough wealth to cut checks for $50K to $200K a pop.

What This Is:

An angel fund who’s LPs are working class professionals under 40

A database for portfolio companies to browse and potentially interview as they scale and require new roles

Built around capital calls of $5K to $10K per person per quarter (or $20K to $40K per person total per year)

A pipeline for great candidates who will soon be in leadership roles

What This Isn’t:

Focused on growth, late stage, or public investments

An angel fund with LPs who look like Vin Diesel from Boiler room / have a twitter following espousing their Robin Hood investment strategies / were tangentially involved in a multi level marketing scheme

An angel fund made up of retired professionals who sit on boards to get out of the house

Thesis:

A pipeline for future talent

Other than capital, the greatest asset for scaling startups is people

Give young professionals an opportunity to participate both financially and professionally in a company’s growth

CTC (cut that check)…just not like too big of a check

Angel investing is perhaps the last asset class to to be fully “democratized” (leading candidate for 2021’s TOP BUZZzz WORD)

Yes, crowdfunding has grown to an extent, and you can always get in on your cousin Larry’s sketchy ass ICO, but it’s hard to get into hot companies as an angel investor without a robust network of experienced business titans with the social (and real) capital to muscle in

Date before you get married

Would provide front row seats to a company while it’s finding product market fit, and usually before they have grown to a point to need more senior talent

Young investors will feel more emotionally attached to help the company succeed, since they have Skin in the Game (side note: I made it to page 73 in this book before getting sleepy and giving up, which won’t stop me from quoting it profusely at my wife’s upcoming holiday party)

Back of the Napkin Market Sizing

To Get the Ball Rolling, Sisyphus Says

What do we have here!? Ah, a classic chicken or the egg dilemma. First concentrate on building up a quality investor list so you can sell the talented database to potential portfolio companies and get access to better deal flow

Give yourself flexibility by establishing a rolling fund without a definite timeline or hard cap commitments; this will give you more time to take on more investors (ahem, add more candidates) and eventually write more meaningful checks

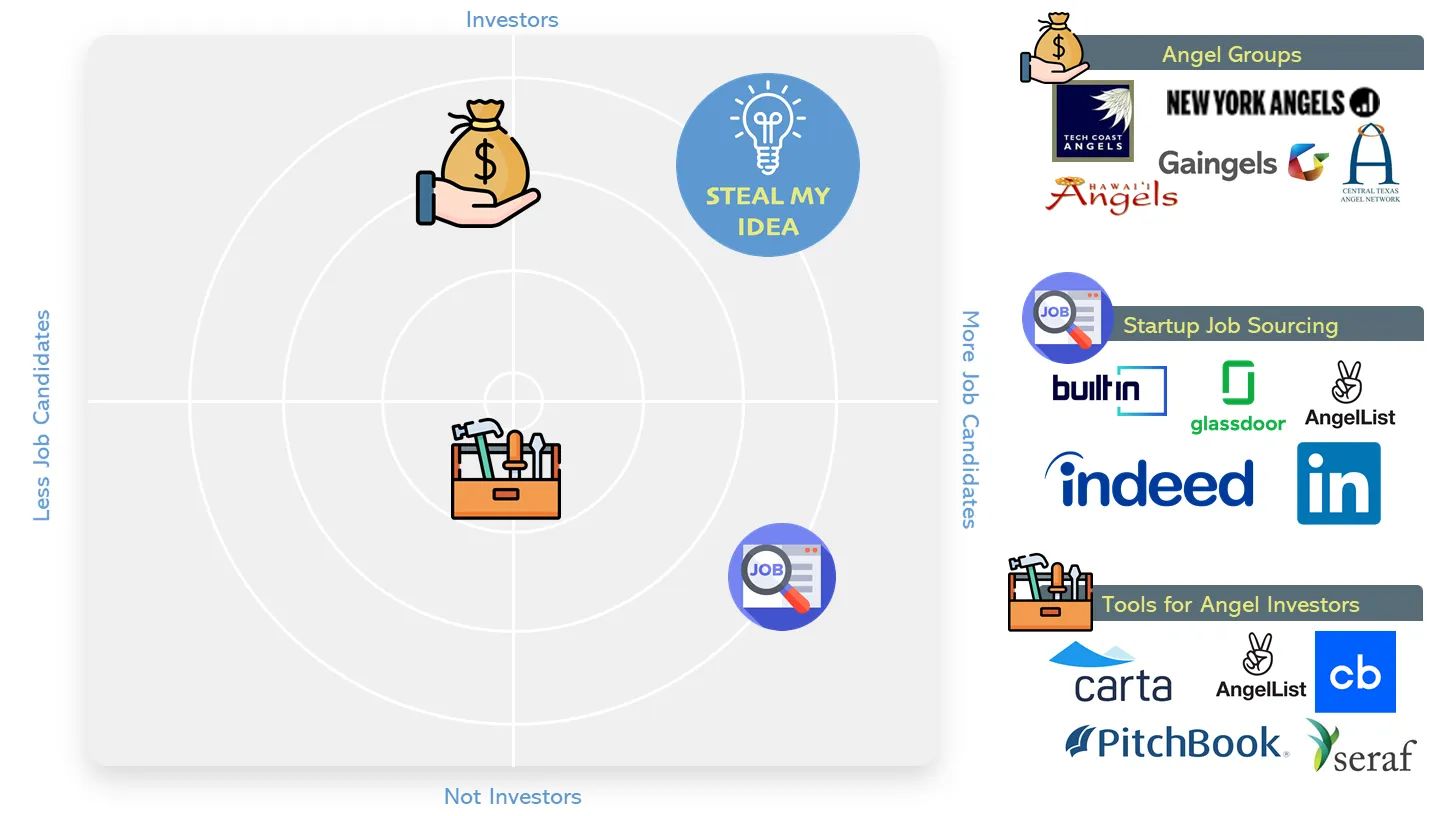

Kinda Biased Competitive Landscape

How It Makes Money

Waves This Rides

The rise of the mercenary millennial

Smart people rarely stay at the same company for more than four years anymore

Facebook and Google, once thought of as the cutting edge, rebellious companies are now more analogous to the Johnson and Johnson’s and General Electric’s of this generation…or where people go to clip fun coupons

Non-traditional “recruiters” monetizing job postings

Chances are your favorite publication (Pomp, Lenny’s Newsletter, Surf Report) are (wisely) shilling job postings that will hit squarely with their readership

Everyone owns pipeline, baby

Get in early, get in often

We are witnessing something that amounts to the death of the classic investor deal cycle

You’re seeing hedge funds lead what were typically private growth stage deals, growth investors lead mega seed rounds, and VC’s create cross over funds to trade stocks publicly

There’s no reason for investors with less money (at this stage of their careers) to sit on the sidelines if they have a different type of capital to bring to the table (labor)

Why This Might Fail

Less money per check means more cap calls

To raise a $5M fund at $20K annually per person, you’d need 250 (qualified) people

And collecting a ton of checks won’t be easy

I’m currently trying to coordinate Venmo payments for 20 jack rabbits to attend my brother’s bachelor party at the Kentucky Derby and it’s like nailing jello to a tree. Dave, if you’re reading this, you still owe me $300 big dog

Potentially Reliable Stuff I Read at 3 AM

Irrelevant Post Script No Reputable Business Publication Would Allow

Get Hyped

Get Loud

Get Wise

“Man, Money Ain’t Got No Owners. Only Spenders.”

-Marlowe Stanfield, The Wire