Two years ago, MUFG made a bold move — expanding its Tech Banking group to back the next generation of high-growth companies.

Since then, the team has committed more than $6 billion in debt capital to leading VC-backed, PE-backed, and public tech companies across SaaS, cyber security, fintech, and beyond.

Built for companies scaling fast, MUFG Tech Banking brings together seasoned bankers who think like operators and the strength of a $3 trillion global platform. The result: relationships that move fast, deliver impact, and last.

Bank at Growth Speed.

Contact Group Head Bob Blee ([email protected]) to discuss how MUFG can empower a brighter future for you.

Merry MUFG’ing Christmas.

Are you sitting on your semi estranged aunt’s couch right now, having scrolled to the end of the inter web?

Would you welcome something novel to pass the time? Like you’d literally read anything to avoid talking conspiracy theories with a crazy relative?

last night my cousin from Texas tried to convince me that Google glasses were a government to go Big Brother on us

Hell, you’d even go so far to read about the unit economics of software for truck drivers?

Ho ho ho, me and Billy Bob come bearing S1 breakdowns.

Motive IPO: S1 Breakdown

If you liked Samsara, well you’re absolutely probably gonna kinda like Motive.

Motive is a vertical software company for the physical economy (people out in the field, driving trucks and keeping track of their employees and machines). They install hardware to generate first-party operational data, and then monetize that data through high-retention software subscriptions.

Key takeaway is they just eclipsed $500m in ARR but are far from profitable. Also, remember this holiday season - friends don’t let friends drive drunk, or mix customer segments on a splash slide.

Key Metrics

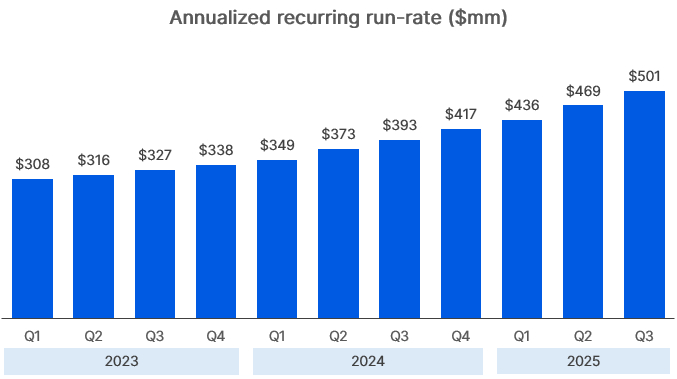

Annual Recurring Revenue (ARR): $501M as of Sept 30, 2025 (+28% y/y)

97% of their total revenue is recurring

Revenue: $429M on an LTM basis (last twelve months) (+21% y/y)

$370M in FY2024 (+19% y/y)

90% of revenue is US based

Gross Margin: ~70%, holding steady despite a meaningful hardware component

Core Customers (>$7.5K ARR): 9,201 (+17% y/y)

TBH feels like a cherry picked cutoff for NDR reasons; most software companies who draw a line pencil it in at $5,000 or $10,000

Large Customers (>$100K ARR): 494 (+49% y/y)

Net Dollar Retention:

110% for Core Customers

126% for Large Customers

Net Losses: On pace to burn $100M in cash this year

-23% FCF margins, -17% non gaap operating margins YTD

This is a ~6% to 7% improvement y/y

Cash on Balance Sheet: $128M

Also have term loans with capacity of ~$250M to $300M they can tap

Rule of 40: <10% no matter how you slice it (EBITDA, FCF, Net Income)

Revenue per Employee: $95K

This is way way way below what you’d want to see at IPO (more in line with a Series B company)… ideally this approaches $350k for their stage and scale

However, they have a large international presence so many employees are at a lower cost base than the US

“Our employees are based in locations around the world, including key hubs in the United States and Pakistan. As of September 30, 2025, we had 4,508 full-time employees, including 3,520 employees outside of the United States.”

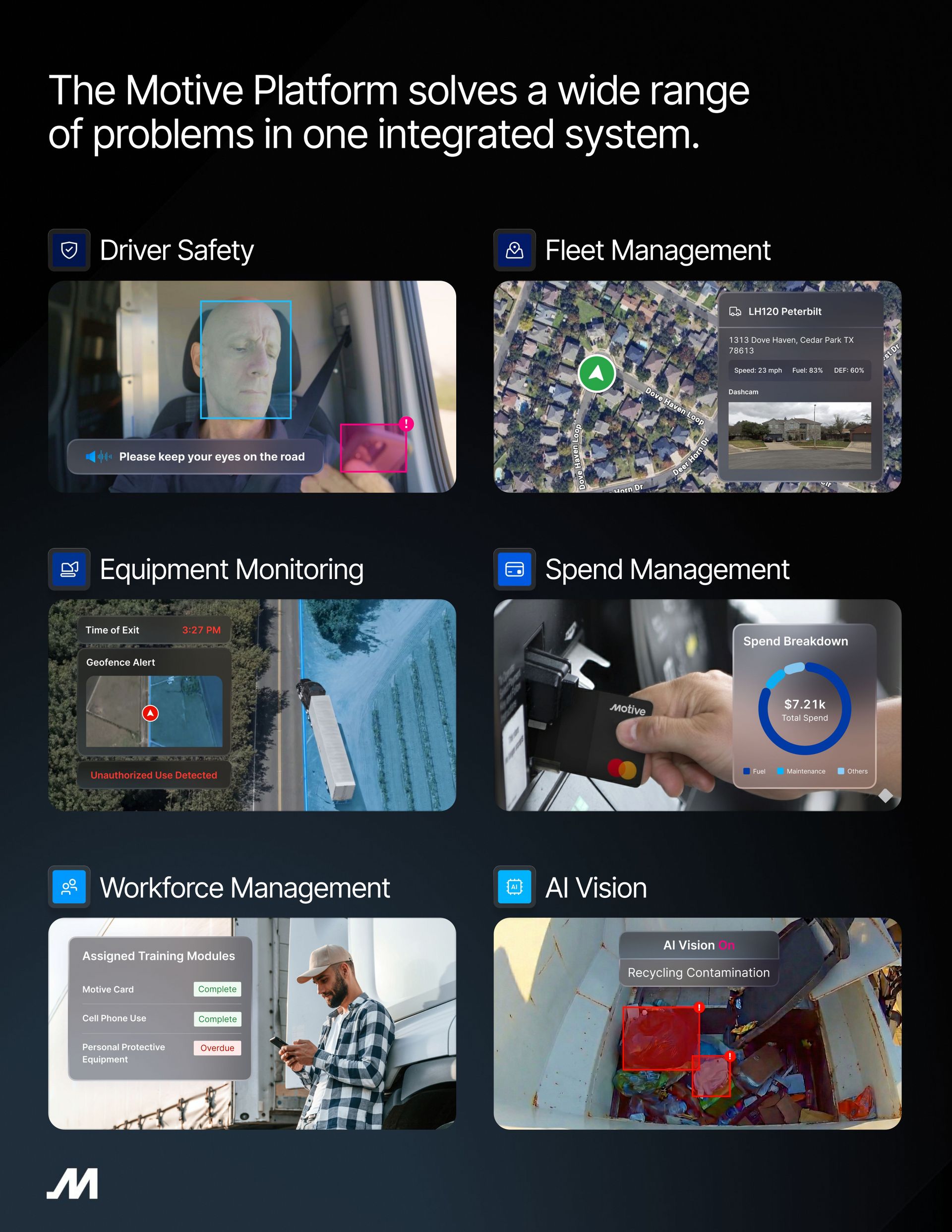

What Does Motive Do?

At the most basic level, Motive sells software to vehicle fleets. Software for 18 wheelers, delivery vans, tow trucks, you get it.

Motive prides itself on building a platform for the physical economy, which they define as the people who don’t work behind computers all day, and find themselves driving somewhere to climb a ladder or deliver a pallet to a warehouse. While they aren’t office workers, they still need software to stay organized and compliant. Their core ICP is closer to that of Samsara or ServiceTitan than it is to ServiceNow.

Their platform connects four things that historically lived in separate systems (or on a piece of paper stuck to a bulletin board in a warehouse):

Vehicles – dashcams, GPS, fuel usage

People – drivers, operators, safety managers

Equipment – trailers, heavy machinery, assets in the field

Spend – fuel, maintenance, repairs, insurance, and downtime

Motive calls the connective tissue across all of this the Physical Operations Graph: a unified data layer that tracks who did what, with which asset, where, and at what cost (or ROI).

It’s reminiscent of what Rippling calls their “employee graph” and what Ramp calls their “spend graph”.

The concept is the same - if you have data at the atomic unit level, like the truck or driver, you can do a lot more for the customer.

How Does Motive Make Money?

Motive sells hardware combined with software through a direct field sales motion.

“We sell subscriptions to our Integrated Operations Platform primarily through our direct sales organization, consisting of a field sales team and an inside sales team.

The field team employs a value-based motion focused on solving real-world customer problems.”

The cool term for this used to be Internet of Things, but for some reason we stopped calling it that, right around the time AI became big (and conveniently when I finally figured out wtf IoT stood for)

We have dedicated teams for the public sector and international markets, identifying prospective customers, managing accounts, and finding expansion opportunities.”

Most customers adopt Motive to solve a narrowly defined, operationally mandatory problem: staying compliant with regulations and reducing safety risk across a fleet (i.e., are drivers falling asleep, stop texting while driving, and where is my shit?). What’s nice is driver monitoring and incident visibility are non discretionary budgeted line items.

This all shapes how they expand within a customer account.

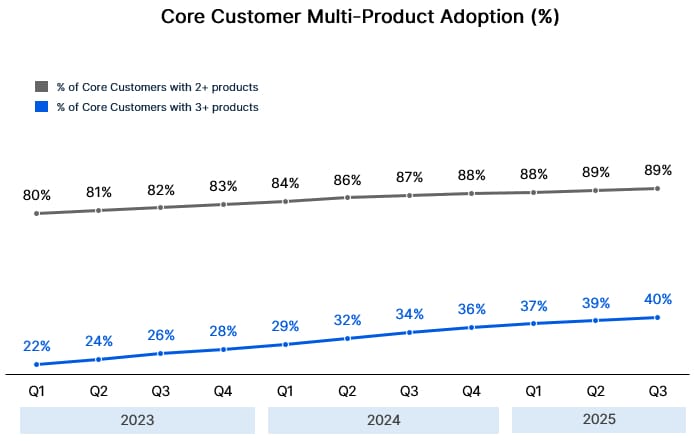

Land and Expand

“We land through products that serve strategic use cases in Driver Safety and Fleet Management and expand within existing customers by selling additional products or by widening our footprint within the same organization, growing along with our customers.

We provide existing customers with a low-friction, self-service online store that accelerates time to value.”

The most direct driver of expansion is fleet growth. Motive’s core products are priced around vehicles, drivers, and assets. As a customer’s fleet expands, recurring revenue increases. Simple.

A second driver is product expansion. Customers typically start with compliance and safety, then add additional software modules over time as operational needs evolve. Because these products sit on top of the same installed hardware and data streams, incremental adoption does not require additional deployment effort. This helps with improving gross margin, which we’ll touch on later.

Source: S1 Filing

The third driver is operational complexity. Larger fleets tend to standardize tooling as they scale. As organizations add locations, asset types, and management layers, they consolidate more workflows into a single system to maintain visibility and control. For example, finance starts to want better expense visibility to see what drivers are expensing at mini marts or what fuel they’re buying, and adopts that platform.

These dynamics show up clearly in retention metrics. Smaller customers expand modestly, while larger customers expand materially faster. Customers with more vehicles and assets generate more data, adopt more products, and remain on the platform longer. The result is 126% net dollar retention among large customers, driven by increased usage rather than periodic contract re-negotiation.

Hardware’s Role in the Economics

Hardware is not an ancillary part of Motive’s business model, but it is also not the business.

For Motive, hardware serves a specific economic function: it is the mechanism by which first-party operational data is created. Cameras, sensors, and in-vehicle devices are how Motive establishes a persistent data stream tied directly to physical activity. Like I said, this is was called “internet of things”.

That distinction matters, because it reframes how to think about margins.

From a pure accounting perspective, hardware pulls down consolidated gross margin. Based on the S1 filing, hardware comprises 78% of their COGS burden. Which actually makes it impressive that Motive’s overall gross margin profile still sits around ~70%.

Once installed, the hardware does three things simultaneously:

It makes Motive the system of record for safety and compliance.

It creates continuous, proprietary operational data.

It raises switching costs meaningfully, both technically and operationally.

In other words, the hardware is not optimized for gross margin in isolation. It is optimized to anchor the customer relationship and enable downstream software expansion.

“Our contract terms vary, but typically span three years, and are generally noncancellable with automatic renewal for subsequent one-year terms.”

This also changes how to think about customer acquisition cost. A portion of what looks like lower margin revenue up front is effectively underwriting long-term software value, which typically lasts three or more years. The payoff shows up later, as additional software modules are layered onto the same installed base.

This is why Motive’s economics don’t map cleanly to either SaaS or hardware comps. The hardware is neither a loss leader nor a profit center in the traditional sense. It is the data capture layer that makes the rest of the revenue model work.

The Market

Source: S1 filing

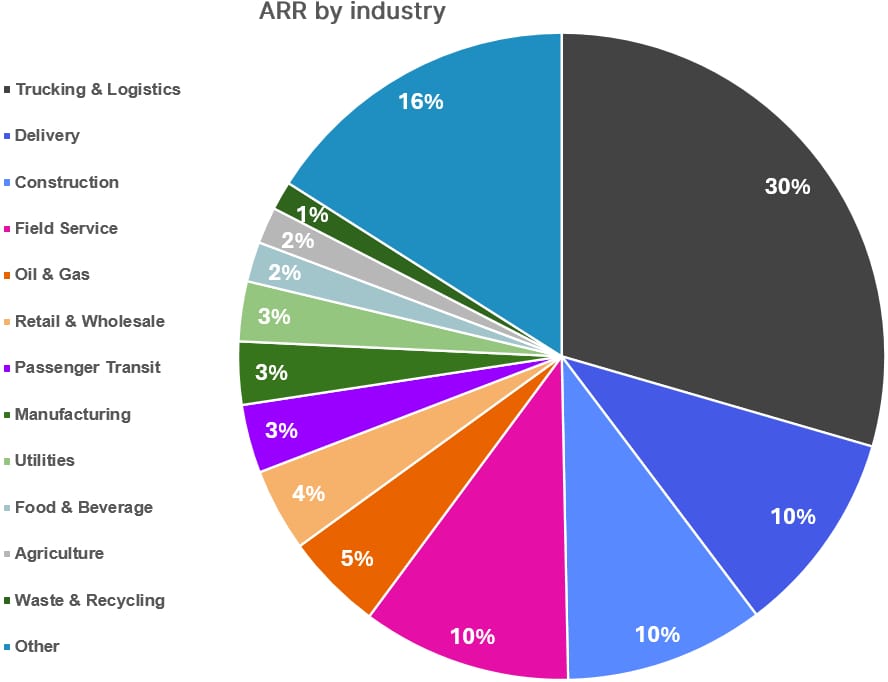

Today, Motive serves 9,201 Core Customers and 494 Large Customers, with Large Customers growing ~49% y/y versus ~17% y/y for the broader base.

The common denominator across these customers is not really industry, but fleet complexity. Motive’s buyers operate regulated, asset-heavy businesses where safety, compliance, and utilization have direct financial consequences (fines, crashes, injuries). These customers already spend money (through labor, insurance, downtime, or legacy tools) to manage these problems. Motive is consolidating that spend rather than inventing new budget categories.

A practical way to think about the market is along two dimensions:

Number of fleets Motive can serve, and

Revenue captured per fleet as complexity increases.

Smaller fleets tend to adopt Motive narrowly, often limited to compliance. Larger fleets standardize more aggressively, expanding into safety, asset tracking, and operational analytics.

This implies a market that is concentrated but deep. Motive does not need universal penetration across the physical economy to sustain growth. It needs continued upmarket penetration within industries where fleet operations are mission-critical and expansion per customer is driven by scale.

The Competition

“Motive is the only platform that enables safety, operations, and finance teams to manage their workers, vehicles, equipment, and spend in one system.”

Motive competes in a crowded ecosystem, but most alternatives fall into a few predictable categories.

In-House and Fragmented Tools

For many fleets, the primary alternative to Motive is still internal processes:

spreadsheets for tracking vehicles and hours,

homegrown, janky compliance workflows,

disconnected point tools for safety, fuel, or maintenance.

From a competitive standpoint, this matters because Motive is not always displacing a single incumbent vendor at land. It is often displacing process (or lack thereof), not software, which lowers initial switching friction but raises the importance of training, implementation, and proving ROI immediately post-install.

The 800 Pound Gorilla: Samsara

The most direct and unavoidable comparison for Motive is Samsara, the largest and most established platform in fleet telematics and connected operations.

And that’s a tough comp, because Samsara is the cream of the crop, growing at ~30% y/y, with revenue eclipsing $1B and 18% EBITDA margins. They’re battling a rule of ~50 company who’s growing faster and actually profitable (at +2x their scale).

The two companies overlap materially in core use cases: compliance, safety, vehicle tracking, and fleet visibility.

Samsara has historically emphasized breadth across connected operations, with a strong focus on cross-industry applicability and horizontal expansion. They serve more use cases and industries.

Motive, by contrast, has remained more tightly scoped around fleet-centric, regulated physical operations, with expansion driven primarily by fleet size, asset count, and operational depth rather than adjacency.

From a competitive standpoint, this implies that Motive does not need to “beat” Samsara everywhere to succeed. It needs to continue winning within a subset of fleet-based customers where deep operational embedding, usage-based expansion, and retention matter more than category breadth.

Profitability (or Lack Thereof)

The company is clearly operating at a loss, and not in a transitory, quarter-to-quarter way. Losses are structural at this stage.

Non Gaap loss from operations for 2024 was (24%), improving slightly to (17%) in the last nine months.

Sales & marketing and R&D represent the majority of operating expenses. Those costs are not one-time investments; they scale with the company’s ambition to continue landing new fleets, moving upmarket, and expanding product breadth.

Their S&M is growing at 16%, lower than the 19% they grew revenue at in 2024. A similar case with R&D, which grew only 11% y/y. So that does demonstrate some leverage. But it’s not like they are attempting to sprint to profitability.

Don’t hold your breath for breakeven in their first (or maybe even third) year public.

3 Potential Red Flags

1) Lawsuits and Patent Infringements:

Buried in the footnotes is a company paying multi-million-dollar legal settlements, sitting on nearly $30M of accrued legal liabilities.

Summary of Allegations

Samsara alleges: Motive employees used fake customer accounts to access Samsara's systems to steal technology and copy product designs, a scheme allegedly orchestrated by Motive's leadership. Yikes!

Motive alleges: Samsara filed lawsuits as an anti-competitive tactic after a third-party study found Motive's AI dashcams outperformed Samsara's. Motive claims its success is due to its own innovation, not copying.

Samsara and Motive do not like each other. Like they really don’t like each other. It’s like if Deel and Rippling were fighting over Hess fleets.

This is the year I finally get one of these bad larry’s from Father Christmas

2) Non Cancelable Commitments

Likely for hardware and cloud costs, they’re locked into $45M of non-cancelable multi year commitments

3) Founder / CEO control

Dual-class structure with Class B shares carrying super-voting rights

CEO Shoaib Makani retains effective voting control post-IPO.

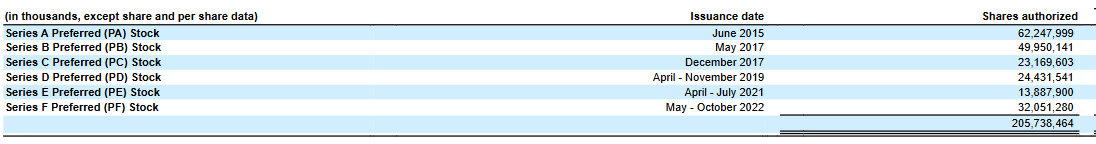

Ownership

Investors with more than 5% (in approx order, multiple participations)

Seed: Addition Capital

Series A: Index, Icon Ventures, Base10 Ventures

Series B: Scale Ventures, Google Ventures

Series C: Kleiner Perkins, IVP

Series D: GreenOaks

Series E and F: Insight, Alliance Bernstein

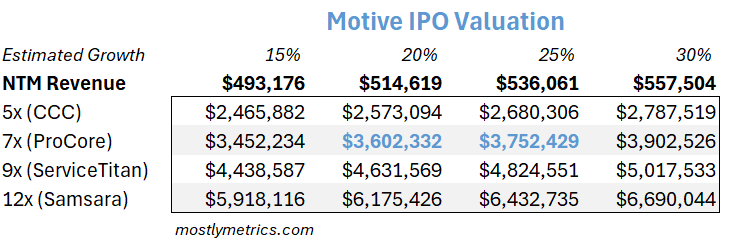

Valuation

The company’s May 2022 Series F was done at $2.85 billion. They raised an additional $150M in a Series G around July 2025, led by Insight Partners with participation from Kleiner Perkins and Alliance Bernstein (a signal that the massive HF will buy again at IPO). The valuation from that round was previously undisclosed but based on the S1 filing it appears it was done at the same $7.80 per share as the Series F in 2022. Shares in the secondary market are trading closer to a $1.6 billion to $1.9 billion valuation. They’ve raised $713M to date.

If we look at comps in the vertical software space, particularly software companies that serve either the trades (ProCore, ServiceTitan), transportation (Samsara), or automotive (CCC), Motive may see a valuation approaching $4 billion on the higher end. This would imply sustained GAAP revenue growth of +20% over the coming 12 months (I’m using their LTM revenue of $429M as a jumping off point).

On the low side you could see this slide back to its last priced private round, or even below $2 billion if it’s a broken IPO.

Miscellaneous

Listing on NYSE under ticker MTVE

The company’s original name was KeepTruckin, arguably cooler

Employee lock up of 180 days (typical)

The co founders are also brothers in law

5% directed share program, also known as a friends and family program; could also include key customers. Always cool when companies do this.

JP Morgan is lead left bank, which is a total zig to Goldman + Morgan Stanley running the table in 2025

A very merry Xmas to the hard working folks at Society general (which sounds like a band my hipster college roommate Dylan would listen to)

None of this is investment advice. I write it while watching the Grinch (the 2000 version with Jim Carey, of course) with my kids. There are remnants of marshmallows on my keyboard. Please do your own homework. This is for information and entertainment purposes only.

Run the Numbers Podcast

Earlier this year I had the pleasure of interviewing Motive’s CFO, Chirag Shah, on RTN. Our convo covered:

Scaling from $30M to $1B in ARR at Cornerstone OnDemand

Taking companies public (and private again)

Building sales capacity

The biggest headaches on the road to IPO

This was one of our top episodes from a listener perspective this year. Enjoy and happy holidays.

Wishing you an IPO with ample float,

CJ