Reflecting on my CFO role, one of the crowning achievements is getting our monthly close down from 11 days to 5.

What could your team achieve with 6 days shaved off the month-end close?

Ledge saves Ampla 6 days a month by automating 99%+ of their transaction matching, and slashed Papaya Global’s manual reconciliation tasks by 90%.

Ledge automates cash reconciliation and journal entry creation, centralizes exception management, and delivers real-time cash flow analysis and forecasting.

With one-click integrations, Ledge automates workflows across your ERP, banks, payment processors, and more—without R&D or IT resources.

Is ESG Dying?

For those who didn’t listen to an earnings call in 2023, ESG stands for environmental, social, and governance.

ESG encompasses a set of standards that evaluate a company's sustainability and ethical impact. There’s been a push in recent years to incorporate an ESG lens when making investment decisions, positioning ESG companies as better candidates for securing capital and inclusion in the top mutual funds and ETFs.

It’s also been theorized that companies who lean into a clear and public ESG strategy have happier employees, more loyal customers, and as a result, perform better financially.

Flash forward to 2024 and there are rumblings that ESG is a ZIRP phenomenon - something “nice” to focus on when there was ample bandwidth and capital to do so.

According to Forbes:

“Amid a surge in scrutiny of so-called “woke capitalism,” U.S. mutual fund clients withdrew $13 billion from ESG funds last year, some 150 anti-ESG bills were introduced by U.S. lawmakers so far in 2024 and, according to a report from ISS-Corporate, 13% of shareholder proposals submitted for this year’s proxy season are focused on countering ESG initiatives.

As a result, many companies are adopting the practice of green hushing, whereby they de-emphasize sustainability initiatives in external communications, or green stalling, in which they defer any discussion of sustainability initiatives until it feels safer to do so – or at least until after proxy season.”

Yikes. So much for “doing well by doing good.”

I decided to check the metrics to see if companies were talking about ESG any differently than before. Was it still top of mind (and tip of tongue)?

Using the top ten EV / Revenue multiple companies this week, I analyzed their earnings transcripts from the most recent available quarter (Q1 of 2024) and compared ESG related mentions vs the prior year (Q1 of 2023).

The results were clear. All ten companies saw a decline in ESG related mentions.

In a future post we can dig into if ESG initiatives drive real financial outcomes or not (I, for one, hope they do). But for now, it’s clear that the companies garnering the most optimistic valuation outlooks are talking about ESG a lot less than they used to.

TL;DR: Multiples are trending slightly UP week-over-week.

Top 10 Medians:

EV / NTM Revenue = 14.2x (+0.4x w/w)

CAC Payback = 23 months (flat w/w)

Rule of 40 = 54% (flat w/w)

Revenue per Employee = $380K (flat w/w)

Figures for each index are measured at the Median unless otherwise stated

Average, Median, and Top 10 Median are measured across the entire data set, where n = 116

All margins are non-gaap

You can find the list of companies within each sector here.

All definitions and formulas can be found here.

If you’d like the specific company level performance benchmarks used in these reports book a benchmarking consultation with Virtua Research

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

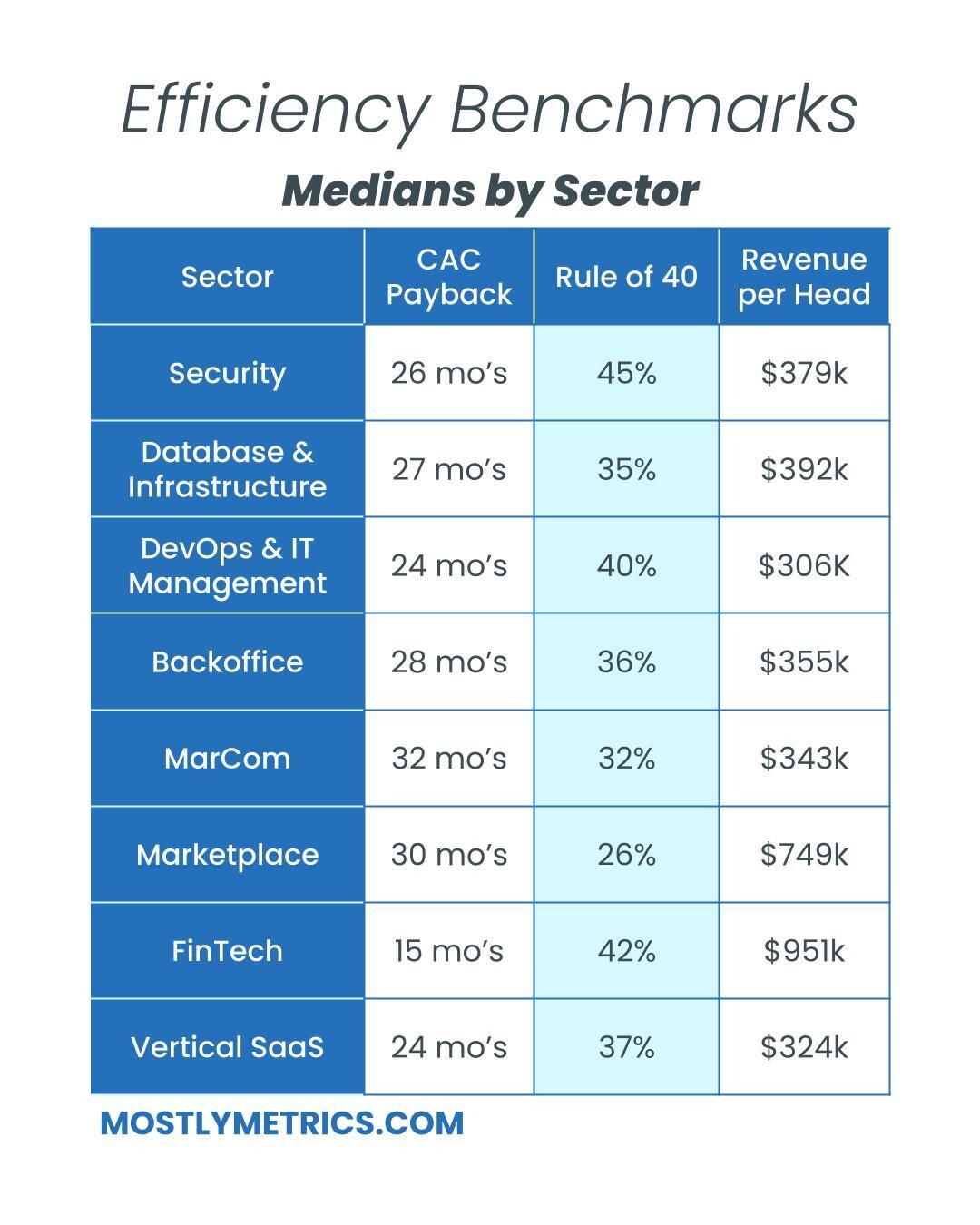

Efficiency Benchmarks

Companies that can do more with less tend to earn higher valuations.

Three of the most common, and consistently publicly available, metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Ratio is calculated as: (∆TTM Sales * Gross Profit Margin) / TTM S&M

CAC Payback Period is calculated as: (1 / CAC ratio) * 12

Note: Some may measure CAC Payback using the change in last quarter’s revenue x 4, but I believe this overstates a company’s progress if they are growing fast, and the output can be volatile due to quarterly sales seasonality. That’s why I look at it on a Trailing Twelve Month Basis.

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and free cash flow margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: Total Revenue Growth YoY % + Non Gaap Operating Profit Margin %

Non Gaap Free Cash Flow is calculated as: Net cash provided by operating activities, minus capital expenditures and minus capitalized software development costs.

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for marketplaces and fintechs to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m using annual change in TTM revenue timeframes as a proxy in my calculations. I admit this is a “stricter” view, as it is measuring change in net revenue, rather than gross revenue additions pre-churn.

Operating Expenditures

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The three most common buckets companies put their operating costs into are:

Sales & Marketing: Sales and Marketing employees, advertising, demand gen, events, conferences, tools

Research & Development: Product and Engineering employees, development expenses, tools

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead”

All of these are taken on a non Gaap basis and therefore exclude stock based comp, a non cash expense. SBC is still an important figure to track for total comp and dilution purposes, though.

All benchmarking data provided by Virtua Research.

Book a benchmarking consultation with them here.