The Art

A Net Retention of 130% essentially tells you,

“If I packed up shop and didn’t sell another thing for the next year, I’d still grow by 30% ”

That’s pretty powerful. Anything over 100% is future growth embedded into your business model. Net retention plays itself out as either a dividend or a tax on every customer you acquire, and the more customers you acquire over time, the more this stacks up.

The Science

Net Retention is a measure of how much your existing customers expand in a given period, net of any churn or down sell. It basically throws all of your existing customer dynamics into a pot, mixes them up, and spits back out how much your business will grow or decline by, absent any net new business activity.

Net retention, it’s what’s for dinner.

Let’s jump into the fiery water and see how the math works.

How Do You Change Net Retention?

There are three levers you can pull to impact Net Retention.

You sell more of the same product (more licenses to more people)

You sell more of a new product (product upsell)

You decrease churn (don’t lose them)

How Does Net Retention Vary?

It varies based on industry, revenue model and who you are customers are.

Industry: Software companies selling mission-critical products like security and infrastructure score high, followed by software companies selling productivity tools, followed by hardware companies on regular refresh cycles, followed by any industry providing professional services.

Revenue Model: If I were to rank which business models are best geared to benefit from net retention, Consumption based models would take the cake. Once you have the customer signed up, all they have to do is keep using the product. The skids are greased. After that I’d say Subscription, followed by anything with regular Maintenance contracts, followed by One-Time Sale revenue models. Consumption business models, like an Amazon Web Services or Snowflake, increase net retention as user data increases. This is pretty much the holy grail, as the only certainties in life are death, taxes, and data growth.

Note that marketplaces for any sort of frequent product or service (think Grubhub, Uber) break the mold and score well, too. They might be subject to multihoming (e.g., using both Uber and Lyft) but since the customers come back over and over again for small purchases the company’s growth is very highly correlated with existing user activity. Linking together topics we’ve discussed in the past (buckle your seat belts) - the CAC (customer acquisition cost) for new users may be relatively high, but each user’s LTV (lifetime value) is high due to their stellar net retention (low churn and growth in volume and size of purchases).

Customer Type: Small businesses are the worst when it comes to Net Retention. They don’t spend a lot, frequently run out of budget, and sometimes go out of business all together. AKA churn by way of bankruptcy. However, there’s a super long tail of them out there. So it is indeed possible to just “Make it up in volume!” Companies like HubSpot, SurveyMonkey, and Shopify struggled with net retention at times, as their core customers were smaller businesses and entrepreneurs who were relatively fickle by nature. Shopify, in aggregate, experienced 100% net retention, since a lot of one man (or woman) shops shut their doors. However, if you carve out their top tier of customers, net retention is 140%. Boomshakalaka. Shopify didn’t really stress about their overall net retention because it wasn’t what they were trying to optimize for. They cared more about the absolute volume of customers and the total expansion revenue from the top 10%. Net Retention isn’t the north star for every company. Especially when you can make up for all that churn in volume. Speaking of making it up in volume…

“All the time our customers ask us, how do you make money doing this…The answer is…volume”

-First City Wide Change Bank - SNL

What’s Good Net Retention Look Like?

In terms of what Good looks like, anything above 100% means at least you aren’t growing in reverse (the proverbial “leaky bucket”). OpenView says that regardless of customer type, anything from 110% up is generally good. From my perspective, top tier net retention in software is anything above 130%. Gitlab recently reported Net Retention of +152%, which is pretty astounding. That means absent any new customers, they’d grow more than 50% year over year. BONKERS.

For a more nuanced take on the benchmarks, within SaaS (software as a service), Lenny Rachitsky of Lenny’s Newsletter did the heavy lifting of surveying experts in his network. The results are as follows:

GOOD and GREAT Net Revenue Retention

Consumer SaaS: ~55% is GOOD, ~80% is GREAT

Bottom-Up SaaS: ~100% is GOOD, ~120% is GREAT

Land and Expand VSB SaaS: ~80% is GOOD, ~100% is GREAT

Land and Expand SMB / Mid-Market SaaS: ~90% is GOOD, ~110% is GREAT

Enterprise SaaS: ~110% is GOOD, ~130% is GREAT

You can see the bar is raised as you go “up-market”, something we’ll discuss in next week’s newsletter.

In Summary…

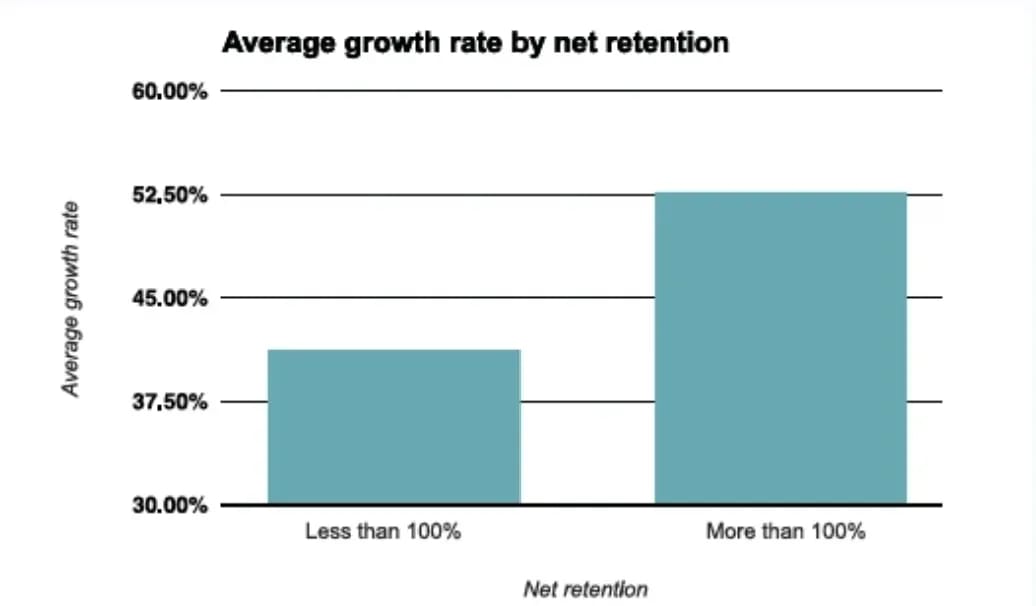

It’s liberating to realize how high net retention frees you up to invest more in sales and marketing, as you’ve already got some extra growth and cash flow coming your way. It typically takes less effort (read: money) to grow an existing customer than to go out and land a net new one. In fact, according to Zuora, there’s a direct correlation between fast growing companies and companies with high net retentions.

Net Retention is a way to build “free” growth into your sales motion. I say that partly in jest, because you do still need to treat your customers right and make sure they are implementing your services to get value (which does cost something). All in all, the easiest path to growth is to not lose the customers you already have, and then make them more successful. That way you don’t have to “make it up in volume”.