Free cap table template for CFOs who like to plan ahead

Even the cleanest spreadsheet can hit its limits. This free cap table template by Fidelity Private Shares can help early-stage teams track equity clearly and correctly, while setting the stage for a seamless transition to a more scalable solution when needed.

Pre-formatted for equity events (ex: SAFEs, options, dilution)

Audit-friendly and investor-ready structure

Fully editable, built for early-stage use

Easy migration to the Fidelity Private Shares (FPS) platform when you’re ready to scale

This Thursday… Drinks on me if you’re in SF

If you’re a finance leader in the SF area, I’d love to buy you a Miller Lite or three on Thursday February 12th. I’m hosting it at an undisclosed Bay Area location, guarded by a squad of ferocious miniature Bernedoodles.

Seriously though, let’s all have a fun night of “networking” (ugh I hate that word).

RSVP below to meet fellow nerds.

Watching SaaS sell off and the Patriots return to the Super Bowl

Can You Measure the ROI of a Super Bowl Ad

Every year a CMO asks if they can run a Super Bowl ad, and every year a CFO says no.

It’s an American tradition of sorts; the business equivalent of hot dogs on the 4th of July and Apple Pie on Thanksgiving.

The attribution is murky AF. The amount of money you're pushing into the middle of the table and saying well shucks, let’s see where the chips land, is hard to stomach.

And you'd be surprised how many of these companies running SB ads are not as big as you'd think. It could be a big risk (maybe even existential) if it doesn't go well.

And I'll be honest, part of me always assumed it was just pride. We put it in the brand marketing bucket, but how much is really chest puffing for the founder and CMO (and employees)? Look, Ma! I work at a place that has a Super Bowl ad!!!

So that was my starting position. Then Kyle and I dug into the economics of Super Bowl ads on the Mostly Growth podcast (and he changed my mind… hate when he does that).

Who Should Even Consider This?

Let's start with who this ISN'T for. Not everyone watching the Big Game is in the strike zone for ServiceNow or DataDog. While everyone can buy Doritos, not everyone watching needs an observability platform at that very moment, or even has the authority to say "we're changing our systems."

So what types of B2B companies are good candidates?

B2B companies with a consumer entry point. Kyle reminded me about Expensify's 2019 Super Bowl ad. Remember the 2 Chainz bit? Adam Scott plays the head of finance for the record label, asking them to organize their expenses.

Expensify actually wasn't that big at the time. They were still earlier-ish stage and VC backed. They wouldn’t go public until 2021.

Expensify didn't have much marketing, relying completely on PLG. And the first big marketing move they made was the most (no pun intended) expensive thing they could do. Ballsy.

But they were really clever in their approach. Their competitors, like Concur, were focused on the finance persona… the control tower processing the reports. Expensify took a counterintuitive angle. For every one person processing expense reports, there are a couple hundred people submitting them. Their thesis was to reach the submitter, make the product brain dead simple, and let the consumer BRING YOU into the business. Trojan Horse type shit.

Ramp ran the next evolution of this playbook last year with Saquon Barkley. Same concept, updated slightly for the times. And this year, OpenAI and Anthropic are both running ads, leaning hard into the consumer angle (IDK what OpenAI is going to put out, but these Claude ads prematurely bodied them).

Once again, the bet is that consumers adopt the product personally, upgrade to a pro tier, then bring it into the workplace. There's a path.

Westworld feels more and more real with each passing day

Software serving people in the trades. Companies like ServiceTitan or Procore or Samsara make a ton of sense when you consider how many people running an HVAC business or roofing company are watching the Super Bowl. Samsara serves 70% of the GDP out there that's long been underserved by tech. This is a chance to move them along their technology adoption cycle.

Tax and Accounting: Quickbooks and TurboTax are no brainers with tax season in full swing. If the technology has winter or spring seasonality, it makes sense.

Companies with scale and cash. The large language model companies aren't exactly hurting for cash. There's a scale component in terms of how much money you've raised and how much capital you have. This shouldn't be your Hail Mary. It should be one bet in a portfolio of bets. Which brings me to the maths.

The Maths

OK, so now the fun part. For those following along at home, grab you TI-83 plus.

It's about $8M this year for a 30 second ad buy.

Yikes.

But that’s not even fully burdened. You also need to pay for production, talent (celebrities), and the supporting ads (we’ll get to that).

Net net: It’s minimally 2x, maybe even 3x the initial sticker price on the airtime.

Ro pulled back the curtain on their economics with Serena Williams this year, and their co-founder Zachariah Reitano broke the whole thing down. I'll borrow some of their framework because it's the best I've seen.

Here's the fully loaded cost: about $20m…

The additional media spend is the component nobody talks about (I was today’s years old when I learned follow-on network commitment was a thing).

Basically, when you buy a Super Bowl slot, the network requires you to commit an equivalent amount to their other programming over the course of time. They know they can sell out all the Superbowl specific ads, so they use at as forcing function to buy more.

So we're talking $20M all in. That's a big number. But I think the risk profile behind that $20M is more nuanced.

Asymmetric Upside (I think it’s called Portfolio Theory)

Here’s where I started to see the light.

If you're budgeting for this correctly, the Super Bowl ad should only be a single digit portion of your total marketing programs budget. It shouldn’t be 150% of what you planned to spend this year. It should be sub 8%.

So what's the actual downside? The ad completely flops… hard to imagine given 100M people are watching, but let's say it goes to zilch. You've decreased your overall marketing efficiency by under 10% for the year. That sucks, but it's not existential.

Now the upside. A great Super Bowl ad can:

Compress years of brand building into one night: The Super Bowl is the only event where people WANT to watch the ads. They rank them. They rewatch them. I just went down a 25 minute rabbit hole on the Betty White Snickers ad and Bud Light WAZZZZUP. There is no other moment where 100 million people share the same bubble and want to see the ads.

Drive immediate customer acquisition: Expensify put QR codes in their ad that drove a massive spike in app downloads. That's hard, measurable CAC you can calculate in real time. I’m sure a lot of people buy Doritos within the next 48 hours, too.

Make everything else in your marketing budget more efficient: This is the biggest unlock. And unfortunately it’s the hardest to measure. Let’s dig in.

ROI (Radio On Internet)

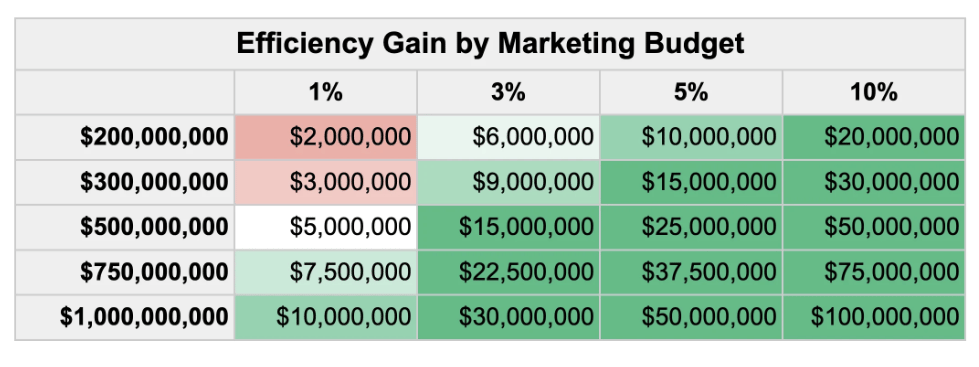

The long-term efficiency math is where it gets interesting. What if the Super Bowl ad makes your ENTIRE marketing budget just a little more efficient? Better brand recognition leads to cheaper CPMs, higher conversion rates, more word of mouth.

Look at the $300M row. A 5% efficiency gain over 12 months is a $15M gain. Now layer on even modest direct acquisition from the ad itself and you're at breakeven or better. And 12 months is probably conservative. Brand gains compound like an interest rate…they aren’t linear.

To put it another way… A company spending $500M annually on marketing only needs a 3%-ish improvement sustained over a year to cover the full cost of a Super Bowl ad, without counting a single direct customer who bought on sight.

The Hard Parts and the Squishy Parts

So some of this hurts my brain as a CFO who wishes it was as cut and dry as "I put in a quarter and I get four back." (And I’d prefer to get said quarters back tonight, before the confetti comes down and they start talking about going to Disney World.)

But this is how I'd frame it if I were advising a CEO, CFO, CMO, or board:

The hard (measurable) parts:

Immediate traffic spike.

App downloads.

QR code scans.

Direct sign-ups in the first 7 days.

You can calculate a short-term CAC on these and it's a more “real” number.

The squishy (but possibly more valuable) parts:

A reduction in Customer Acquisition Costs over the medium term.

Awareness greasing the skids for other things to happen.

The goal is to earn a spot in the consideration set when someone is finally in the market for what you're selling. I talk about this with sponsors of my own podcast all the time… you're laying groundwork for trust so you have a position in the conversation when it is time. You aren’t giving them a flashy “BUY NOW” button. You’re earning the mindshare.

When you think about it like this, you start seeing it as a (large) bet within a portfolio of bets.

When Should a CFO Say Yes?

So back to our annual tradition… the CMO asks, the CFO says no.

I think the CFO should say yes when:

You have a product with broad consumer appeal (or a consumer entry point to a B2B sale).

Your marketing budget is large enough that the Super Bowl is single-digit percentage of total annual marketing spend.

You have a story worth telling to 100 million people at once.

And you're not trying to win the game on one play; you're trying to make every play after it a little more efficient. You can afford for this to be a total zero and still hit your annual plan.

It's hard to math your way to a definitive answer. And that’s why marketing is more art than science. But this is really just another resource allocation bet. It’s less a binary ROI question and more "how does this stack rank within a portfolio of bets seeking a proper risk-adjusted return?"

Sometimes the right answer is still no. Actually, most of the time it’s still no. Like, absolutely not.

But if the math is good enough and the upside is asymmetric? Maybe next year you let the CMO cook.

Kyle and I get into all of this and more on the Mostly Growth podcast. Worth a listen as you get hyped up for the game, or are coming down after the Patriots - ok I won’t jinx it… You can totally watch it after too

TL;DR: Medan Multiples are DOWN week over week.

The overall tech median is 3.6x (DOWN 0.3x w/w).

What Great Looks Like - Top 10 Medians:

EV / NTM Revenue = 13.0x (DOWN 2.1x w/w)

CAC Payback = 28 months

Rule of 40 = 47%

Revenue per Employee = $595k

Figures for each index are measured at the Median

Median and Top 10 Median are measured across the entire data set, where n = 146

Recent changes

Added: Navan, Bullish, Figure, Gemini, Stubhub, Klarna, Figma

Removed: Olo, Couchbase, Dayforce, Vimeo

Population Sizes:

Security & Identity = 17

Data Infrastructure & Dev Tools = 13

Cloud Platforms & Infra = 15

Horizontal SaaS & Back office = 19

GTM (MarTech & SalesTech) = 18

Marketplaces & Consumer Platforms = 18

FinTech & Payments = 28

Vertical SaaS = 17

Revenue Multiples

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

Recurring mix of revenue

Stickiness of revenue

Average contract size

Cost of revenue delivery

Criticality of solution

Total Addressable Market potential

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt - Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

Efficiency

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period: How many months does it take to recoup the cost of acquiring a customer?

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Sales and Marketing costs are measured on a TTM basis, but lagged by one quarter (so you skip a quarter, then sum the trailing four quarters of costs). This timeframe smooths for seasonality and recognizes the lead time required to generate pipeline.

Revenue is measured as the year-on-year change in the most recent quarter’s sales (so for Q2 of 2024 you’d subtract out Q2 of 2023’s revenue to get the increase), and then multiplied by four to arrive at an annualized revenue increase (e.g., ARR Additions).

Gross margin is taken as a % from the most recent quarter (e.g., 82%) to represent the current cost to serve a customer

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise - there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40: How does a company balance topline growth with bottom line efficiency? It’s the sum of the company’s revenue growth rate and EBITDA Margin. Netting the two should get you above 40 to pass the test.

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

OPEX

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

Cost of Goods Sold: Customer Support employees, infrastructure to host your business in the cloud, API tolls, and banking fees if you are a FinTech.

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools.

Research & Development: Product and Engineering employees, development expenses, tools.

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead.”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.

Please check out our data partner, Koyfin. It’s dope.

Wishing you a Superbowl ad with both immediate and long tail payoff,

CJ