How Lovable is writing the new playbook for AI pricing

When I first tried to price AI features, I quickly realized the old SaaS models don’t fit. That’s why I’m excited about this upcoming session with Elena Verna, Head of Growth at Lovable.

On December 10th, she joins Metronome to unpack how Lovable is approaching one of the toughest challenges in modern software: pricing AI. You’ll learn how they’re balancing self-serve and enterprise motions, why usage-based pricing is just the start, and how they’re moving toward true value-based monetization.

The Marketplace 'Plus' Model

Not many people know this, but OpenTable started as a single-player tool.

I miss OpenTable. My wife got kicked off for no-shows, and then selfishly commandeered my account to besmirch my name.

Restaurants would use it as a digital seating chart; a visual representation of where parties would sit across time blocks. And it had the ability, of course, to take reservations over the phone or in person (imagine walking into a restaurant to make a reservation today? Psychopathic behavior).

OpenTable elevated restaurants from using paper and pen as their system of record to a web based tool.

This gave them a wedge to eventually open the platform up to the demand side and allow consumers to book online. By providing software that served as the system of record for guests, they had an unfair advantage when it came to creating a two sided online booking platform.

This is an example of the marketplace 'plus' model: the strategy of providing either the supply or demand side something useful as a hook to enter (and be more successful on) the network.

80% of the time, this value add takes the form of a software scheduling tool, given away for free or at an attractive price for the supply side. This elevates how they book appointments and manage customer communications. Colin Gardiner was the chief product officer at Outdoorsy, the largest peer-to-peer RV rental marketplace. He told me how they built a SaaS product that turned a clipboard into a system of record for people renting out their RVs to campers.

Like OpenTable, they targeted a professionalized supply side before turning on the network.

Walter White: the world’s most famous ‘professional’ RV owner.

What do I mean by professionalized?

For Outdoorsy, there were already people out there renting RVs as a form of employment. However, they were still running their businesses using pen and paper.

The big unlock was targeting these business users, rather than the side hustlers, because they were determined to get high utilization rates. This cohort of users was looking to maximize revenue.

The knock on benefit is when you distribute professional inventory on your marketplace, it's a better experience for consumers, since it usually comes with instant bookability. It elevates the experience and the platform’s overall connect rate.

Similarly, I spoke to Chuck Fischer, CFO of Turo, a peer-to-peer car rental marketplace. Going to Miami? You can rent some dude's Lamborghini Urus.

While the majority of the supply side consists of normal individuals who realize their cars sit in the driveway for 99% of the time when they could be making money, there's a special 1% who are actively building businesses on the platform (or would if it brought them more business and made their logistics easier).

Chuck shared a story about a guy out in California who literally had thousands of cars on Turo. He was running less a car rental business and more a fleet management operation.

Turo gave him the network, demand, and tools to be a pro at scale.

Does the ‘plus’ have to come ‘before’?

So far the examples have been related to providing something of value before a transaction takes place. But it can also happen after the fact.

At PartsTech where I was CFO, we served as a three-way marketplace between auto manufacturers who make car parts, auto suppliers who sell car parts, and garages who fix cars. Once we had a garage ordering parts on our platform from the suppliers (like AutoZone), we'd offer them a SaaS product to estimate the labor hours that go into completing a job.

It was free for them to buy parts (we made a small percentage off the suppliers), and SaaS was a way to directly monetize the shop.

The real ones know who’s car this is.

Once again, you had to already be using the marketplace to buy parts to even be eligible to buy this. But it served two purposes:

It tripled ARPU (average revenue per user). We not only made a percentage on each transaction (reOcurring revenue), but we also now earned a valuable monthly SaaS fixed fee (recurring revenue).

It increased our retention rates. We were deeply embedded into how the garage did business each day, and more essential to their workflows, making us harder to rip out.

Are there any examples of the marketplace plus model on the demand side?

The most obvious one is Amazon Prime. You get your stuff way faster. And you can stream a ton of shows.

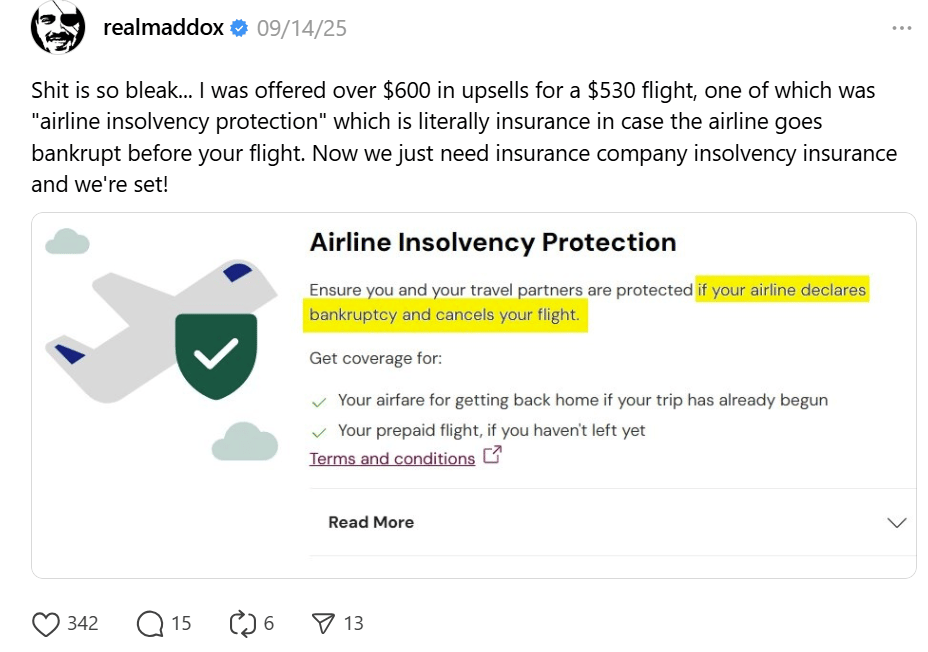

Another example is when you book a flight and at the end they ask if you want to add insurance.

I always decline the insurance, despite the wording being so apocalyptic “Click here if you’re a big dummy who doesn’t want to protect your $782 super expensive flight to California during wild fire season”

And finally, if you’ve ever purchased sneakers on StockX (fun fact: that’s where all Mostly Metrics paid subscription dollars go) you can get shoes authenticated before they arrive.

Not just for marketplaces

The marketplace 'plus' model is great for companies who are trying to either overcome the cold start problem of standing up both supply and demand, or trying to increase revenue and retention after initial activity.

But it's also a powerful lesson for any business trying to build an unfair advantage. The core insight is simple: solve adjacent problems for your customers before, during, or after they use your core product.

If you're selling B2B SaaS for accountants, maybe you create a community for your ideal customer profile (ICP). Brex has done a great job of this for controllers. They provide educational content and networking opportunities, and in the process get unfair distribution to their target user.

Another approach is providing a free "tool" that can be used in isolation before buying the product, like Snyk, a cyber security company, offering a free vulnerability database to scan your code. Developers use the free tool, get value immediately, and naturally graduate to the paid product when they need more sophisticated security management.

The pattern works across industries.

Home Depot goes beyond just selling you lumber; they offer craft classes for parents to take their kids to on weekends (I built a ratchet bird house)

Shopify doesn't stop at websites; they handle payments, inventory, shipping, marketing, and even business loans.

Peloton doesn't just sell bikes; they created a fitness community and content library

In each case, they're embedding themselves deeper into their customer's world by solving problems adjacent to the core transaction that brought the buyer there in the first place.

You don’t have to be a chief product officer to participate in this discussion. As a finance person, the next time you look at your customer lifecycle, ask:

What does my customer do right before, during, or right after they use my product? And how can I make that easier for them?

That’s the key insight at the heart of the marketplace plus model. And it puts you even more in the way of the money… which is where we all want to be.

Run the Numbers Podcast

On this episode of Run the Numbers, I sit down with Colin Gardiner, General Partner at Yonder VC and former Chief Revenue and Product Officer at Outdoorsy. We unpack what really drives successful marketplace businesses.

This episode covers:

Lessons from scaling a peer-to-peer RV platform

How the biggest unlock came not from power hosts optimizing utilization and yield through the SaaS tools they built

The “Marketplace Plus” framework: how layering SaaS and professional tools can transform a platform into an operating system

Where founders risk breaking their marketplace model by taking on inventory or managing supply too tightly

How AI and the decline of SEO are reshaping marketplace discovery.

Looking for Leverage Newsletter

Overcoming Post-M&A Paralysis

Let me know if you’ve ever been here before…

Your finance team doesn’t have access to the acquired company’s systems, so they’re asking for screenshots of monthly bank balances like it’s 2006.

You’re 17 days into month-end close and still chasing minor professional services revenue data from three different systems.

You’re paying for Zoom on fourteen different credit cards, but also at the company level through a negotiated MSA

You have three definitions of “customer”

Meanwhile, the one person who actually understands how their home-grown commissions system works just gave notice.

This is what post M&A paralysis looks like. Here’s a three part framework to cure it.

Mostly Growth Podcast

Me and Kyle welcome Brian Balfour, CEO and Co Founder of Reforge, onto the pod to discuss the fleeting nature of product market fit, how AI changes discovery and distribution, and if you should list your max lifts on your work resume (answer: yes).

Wishing you a balance sheet that foots,

CJ