Your Complete Guide to Board Meetings (Part 2): Meeting Materials & Templates

January's three part series on board meetings for tech startups

👋 Hi, it’s CJ Gustafson and welcome to Mostly Metrics, my weekly newsletter where I unpack how the world’s best CFOs and business experts use metrics to make better decisions.

Welcome back to our second post in our series on everything you need to know about board meetings.

As a reminder, here’s our syllabus:

Part I: Roles and Responsibilities (LAST WEEK’s POST)

CEO

CFO

CPO / CTO

VCs

Strategic Investors

Board Observers

Independents

Corporate Secretaries

Committees

Part II: Materials and Metrics (THIS POST!)

Templatizing your materials

The CEO’s Materials

The CFO’s Materials

Strategic Readout Materials

Reminders, Before You Hit Send…

Part III: Meeting Structure

Closed Door Session

13 Deadly Mistakes to avoid at your next board meeting

Subscribe now, or your net retention formula will erroneously pick up early expansion.

Templatizing

Templates Build Agreement:

In the words of the Great Dave Kellog, “Templates Build Agreement”.

So build agreement with your board on what they want

And then go and design a slide loop they’ve agreed to be trained upon

VC Seth Levine further opines on regularity in reporting:

The key here is consistency… the idea is to develop the outline of a board package that can be updated meeting after meeting.

It’s surprising how few companies actually do this and instead start from scratch for each meeting.

Not only is it not time efficient for you and your team, it’s hard on your board members – the lack of consistency in reporting makes it hard to compare board meeting to board meeting and hard to find the information you’re looking for meeting after meeting.

You Don’t Get Any Style Points

~1/2 of your deck should be the same, but updated for the latest information, from quarter to quarter

The sales and operational stuff is prime material to templatize - no sane person should need to reinvent the tried and true ARR Bridge

In fact, people are lazy when they don’t pick templates and cherry pick them from existing decks they have lying around from a recent operational update

It’s easy to tell when someone cobbled together a handful of slides from disparate decks

I see you, Jerry, tryin’ to repurpose that net retention slide with a random customer cohort called out. You lazy bastard, Jerry.

The Fear of Repeating Thyself:

Listen to any public company earnings transcript - to a certain extent, they are an exercise in repetition

There’s actually something beautiful in driving the same points home. It helps establish a theme and a consistent strategic narrative

I used to be afraid of repeating myself over and over. But then I realized that I think about this topic more than anyone else, so it probably just seems overly repetitious to me

"Three things you need to do: Tell them what you are going to tell them, tell them, then tell them what you told them” - Maybe Aristotle

CEO Materials

The CEO should present the following three slides up front

Splash Slide of Top Metrics

This is a tear away, or take home slide

I like the 3x3 tile format

It allows everyone to see the most important metrics on one page

Make sure to include the change period over period (e.g., y/y) in smaller font on each tile

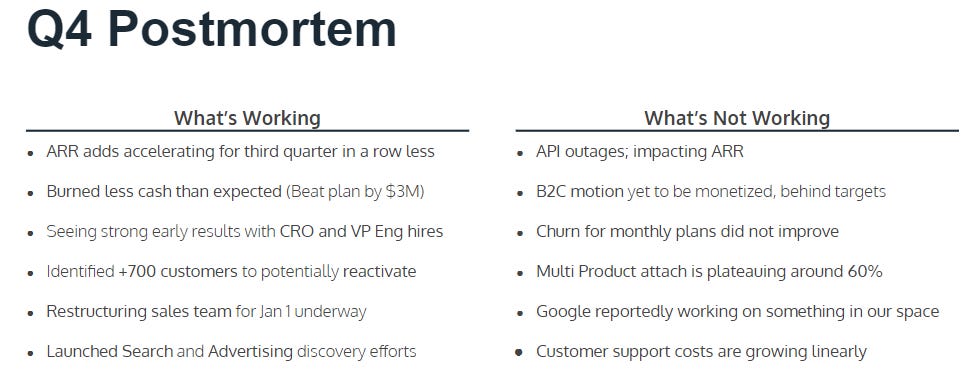

What’s working / what’s not working

A simple, two column slide

Bullet points on left of here’s what’s going well

Bullet points on right of here’s what’s not

Doing this honestly will t-up the other presenters and set the tone for the rest of the meeting

This is a 20 minute slide

It should take a while to get through because it consists of the highest level stuff affecting the company

“Every bullet is definitionally worthy of discussion” - Dave Kellogg

Another, very similar format from Jeffrey Busgang of Flybridge Capital:

I often suggest presenting this in a "Red/Yellow/Green" format – what's going well, what's making you nervous, and what's not going well.

The best one-page summaries are very brief – hence the one page rule – and help focus the board's energies as well as provide a window into the CEO's priorities, thinking and "stay awake" issues.

P&L and Cash Burn

Trailing 9 quarter format so you can see seasonality, and 2 full years of history

May include some of the operating metrics from the Splash Slide, like CAC Payback Period or Net Dollar Retention

CFO will usually repeat this slide and proceed to go a level deeper, later on