The roles and responsibilities of boards are often spoken about in the same hushed tones as the Illuminati. To most employees below the C-level, boards are shrouded in mystery, referenced with hand waves as shadowy figures pulling levers—kind of like the Wizard of Oz.

Today’s post is the grand finale of our three-part series on making the most of your board meetings. What better way to wrap it up than by breaking down what boards actually should and shouldn’t do?

Think of this as your “Ten Commandments” for boards—except there are 14. Why? Because this is my newsletter, and I’m not bound by arbitrary numbers. (Mount Rushmore has four heads. Why not three? Or five? Ridiculous.)

What Boards Should Do

Biz Dev: Find Me Customers

Recruiting: Find Me (Great) Employees

Pattern Recognition: Souvenirs from Past Rodeos

Encourage Decisions: Push Them into a Cul De Sac

Set the Guardrails: Approve the Operating Plan

Pay Me: Compensate Execs

Spot the Exit Ramp: Validate Valuations

What Boards Should NOT Do

Operate: Hands off the wheel

Snoop: Hire babysitters for the CEO

Solicit Bids: Try to sell the company

Show up unprepared: Derail meetings

Nepotism: Force you to hire anyone

Be Unreachable: The 24 hour rule

Eat First: Company > Share Class

Biz Dev: Find Me Customers

Surprise! Board members often have portfolio companies or professional networks that can buy your shit!

Open Doors to Customers:

Prep the CEO for warm intros by providing context: What problems can your company solve for them?

BTW: A warm introduction beats an Excel dump of contacts every time. I’ve been on the receiving end of that a few times and the conversion rate is LOWWWW

Open Doors to Partnerships:

If your board member has lengthy experience in a particular sector (e.g., cybersecurity) or with a particular business model (e.g., marketplaces) they can broker intros to partners so you can either get better rates or tap into their customer bases.

I had a board member introduce me to someone they knew at a reputable payment processing company who was able to get us better rates on our payment volume. This wasn’t a new customer, but it helped improve our gross margins in a big way.

Recruiting: Find Me (Great) Employees

VCs as Talent Scouts: VCs keep a rolodex of talented execs warm at all times. Most modern VC firms either die investors or live long enough to see themselves become in-house recruiting firms.

Plus, the best ones actually exit companies. That means top performers from previous portco’s could be on the market now or in the very near future (HOT LEAD!)

Ask them to own the first outreach

A call from a board member signals importance and urgency, and also lends credibility that your company is legit.

Interview candidates

Ask your board members to be a part of the interview process for key hires. I’ve been interviewed multiple times by board members.

There’s this funny inflection point where it goes from you selling them on your skills to them selling you on their portco.

The Hollywood Analogy:

Build relationships with VCs early in your career. Think Scorsese casting DiCaprio—once you’re trusted, you’ll get recurring roles in the “portco” talent roster.

Pattern Recognition: Souvenirs from Rodeos

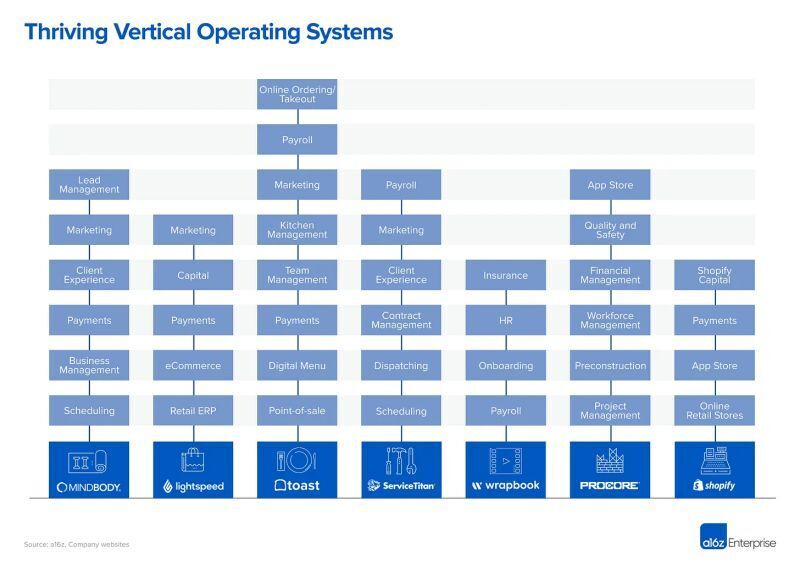

Learn from Mistakes (Not Just Yours): A board member with SaaS experience might point out a pricing tweak or business model shift that worked elsewhere. Use these insights to leapfrog mistakes others have made.

Encourage Decisions: Push Them into a Cul De Sac

Run Critical Issues to Ground: Use your board to pressure-test big decisions, giving the CEO cover to push through tricky conversations.

While it’s ultimately the CEO’s responsibility to own big decisions, the board can be a mysterious and illusive “bad cop” for the CEO to reference on occasion for air cover

Clarify Priorities: They aren’t personally attached to the inbound opportunities you are getting.

Success brings distractions—board members can help identify which shiny new partnership requests or roadmap ideas are worth pursuing.

Set the Guardrails: Approve the Operating Plan

Approve the operating plan: Validate the guardrails you should stay within.

“The role of management is to run the day-to-day business and make key decisions within the framework agreed between management and the board” - Mark Suster

“The role of a board is to agree an annual operating plan (budget) and strategy and to periodically (usually quarterly) review progress and make adjustments when necessary” - Mark Suster

Pay Me: Compensate Execs

Run the Comp Committee: Select members of the board will create a sub committee that determines the comp packages of the CEO, CFO and other C level execs

They also approve management’s proposed budget for company wide merit increases (e.g., 3% cost of living increases per year) as part of the operating plan

Spot the Exit Ramp: Validate Valuations

How does this end?: Your board should help you think through the next financing round as well as potential exit strategies

Valuation validation: Go have their quant run the numbers and tell you what it’s worth. They can form a viewpoint on:

Today vs tomorrow’s price

How the markets will receive this

What multiples other portfolio companies sold for

What Boards Should NOT Do

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content.

UpgradeYour subscription unlocks:

- In-depth “how to” playbooks trusted by the most successful CFOs in the world

- Exclusive access to our private company financial benchmarks

- Support a writer sharing +30,000 hours of on-the-job insights