When I became an FP&A leader for the first time, I built our entire operating model from scratch. I had no context and no templates. And that blank workbook staring back at me was DAUNTING!

That’s why I’m excited to introduce our sponsor, Mercury.

Their VP of Finance, Dan Kang is sharing his personal template for building a financial forecast model.

Whether you’re preparing to fundraise, updating investors, or charting a new course for the company, you’ll likely reach a point where you’ll need to build a forecast model. It can help you align on clear business goals and understand why those goals matter.

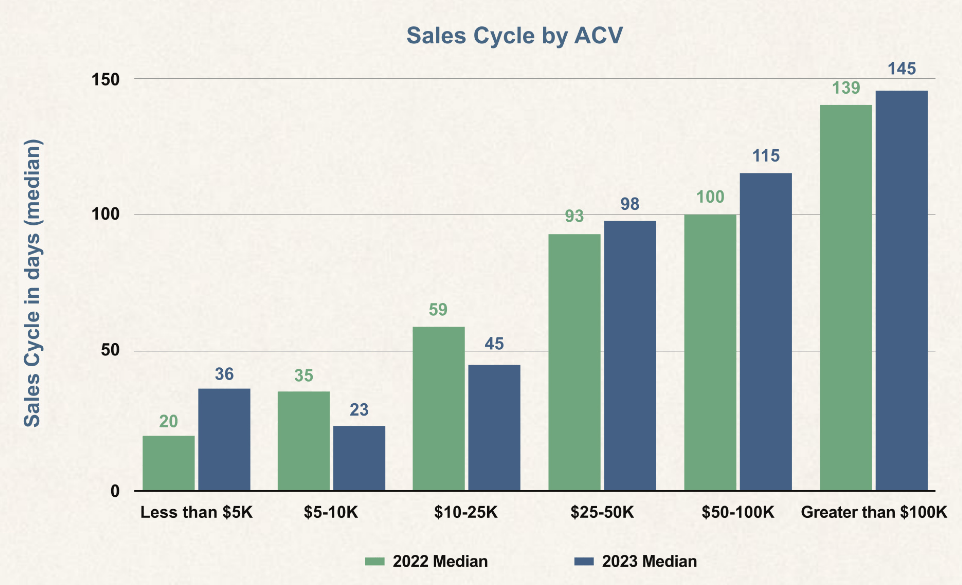

It’s a tough time to be a $50K deal.

If you’re slinging software lizzys for mid-tier ACVs (annual contract values), you best bring your helmet to work. Because you’re square in the cross hairs of every CFO looking to cut budget.

Put simply - the middle is a messy place to be right now.

When you look at the metrics, there’s a clear bifurcation in company performance across different deal sizes.

I spoke with Joe Floyd of Emergence Capital on why this is the case:

“If you're selling to the enterprise, it's generally speaking, a very considered purchase. If you're buying something over $250k, you probably have multiple people that are having to sign off and that implementation is probably really big and really painful, and therefore it's just stickier.

If you're buying something that's $50k to $100k, you historically probably didn’t need a CFO to sign off on it. It's probably a line of business leader or it's maybe even a team leader. And so they could have made those decisions quickly and then pulled back when they were told, “Hey, you've got to cut your budget.” So I think a lot of it has to do with that.

And then with SMB, a lot of it is individual users and they're just not as scrutinized. If your company needs to cut 10% of your budget, they're just not going to care about the $20 somebody spends on Evernote or something.”

Whew! Let’s unpack that a bit.

Implementation Scars

The sunk cost fallacy is real when you think about all the money and hours you spent implementing an ERP or procurement system. I remember at one company we dedicated probably a thousand man hours (and 1.7x the first year software cost) to rig up Coupa. The system implementers were so comfortable in our office they were drinking our Polar Spring seltzers out of the company fridge by the end of it. The office carpet had a better chance of being ripped out and replaced before that thing.

People don’t want to replace big, expensive items they put in. Inertia is real.

Will This Make a Dent?

If you’re spending $300K a year on NetSuite, Snowflake, or AWS - yes, it would make a huge difference to your P&L to remove it. But you’d also have a hard time, you know, running a business. These are critical workflows one does not just mess around with.

It's considered infrastructure, core infrastructure, and it's not going away. So the CFOs gaze continues down the neatly sorted excel export Jimbo the FP&A analyst pulled…

At the bottom you see stuff for like $5,000 or $10,000 a year. It might be Carta, which is both relatively inexpensive AND critical. No one’s got time to do cap table modeling in google sheets. So it stays.

Then there are a gaggle of note taking apps and project management tools PMs use. It costs $12,000 a year for a team of 20 people. Arrrghhh. OK, they enjoy using it, it makes them happy, it has some (?) benefit, and most importantly, it’s not going to move the needle if I’m trying to save a couple million bucks in OPEX this year.

But what’s that in the middle? What are these $45,000 (!?) video recording tools? What are these $97,000 UI / UX design things? What in tarnation is that $125,000 feature flagging (whatever that means) tool?

This is where the scissors come out - point solutions that can change the P&L in a real way, without disrupting the business.

A Victim of Consolidation

Many tools in this ticket range experienced a proliferation of competitors in the last few years, some of which were bought within the SAME org. This team likes SmartSheets, this team likes Asana, and that team likes Monday.

“And if you look at the sales or marketing stack, people would have 10 different software layers in it. And I think what you saw is a little bit of consolidation, as well as some of these platforms started offering or bundling like a free or cheap version of some other product in the stack. And then when it was time to cut budget, people were saying, “Okay, well I'm going to buy two or three things from one player and cut the other things and I'll save money.””

There’s no doubt that tools between $50K and $100K have been hit the hardest when it comes to vendor consolidation. Salesloft? Let’s use Salesforce’s tool. Clari? Let’s use Salesforce’s tool? Gong? Let’s use Salesforce’s tool.

I poke fun at sales tools here, but it’s happening across all departments.

FP&A: Does our ERP have a budgeting module we can tap into?

HR: Can I run both my HRIS and Recruiting system on the same vendor?

IT: Can I run a ticketing system out of google forms?

Seriously, though - can I?

It’s Not Your Fault

For those being consolidated or down sold, it’s not their fault (entirely). Software was overbought, without regard to ROI for a long time. You had layer three leaders making purchasing decisions that were not coordinated with other departments who could have used the same tool for tangential uses cases. And when the tide recedes, it’s unfortunately an incumbent’s market. The CFO doesn’t care as much about what the sales team “likes” to use. Dollars are the only thing that make sense.

For those $50K deals trying to make it out of the vortex, I wish you good NDR.

Run the Numbers Podcast

In this episode, Joe Floyd from Emergence Capital joined me to talk benchmarks and buying trends in the software space. We also touch on:

Are companies actually making revenue off AI yet?

Why the middle is so messy right now

How long are fundraising rounds taking to close?

Quote I’ve Been Pondering

“Never ask anyone for their opinion, forecast, or recommendation. Just ask them wha they have - or don’t have - in their portfolio”

-Antifragile by Nassim Taleb