If I could only choose one metric to evaluate a company... I'd choose Revenue per Employee. Full stop.

Why? It cuts through all the noise. There's nowhere to hide.

Revenue per employee carries high signal

This metric allows you to drill down to the core economics of any company - you can't drill down any further.

Can’t feel my passion? I wrote this ode to Revenue per Employee in haiku format:

You see it all the time - a company is doing $10M in revenue with 50 employees. They’re excited about the traction they’re seeing, so they go on a hiring spree to “double down on GTM and capture the market.”

But 12 months later, they’re stuck at $14M in total revenue with 130 employees.

When you take your eye off revenue per employee, there’s a proliferation of supporting functional heads that tend to get hired (finance, HR, legal, strategy, and anyone else telling the people who build or sell the products what to do).

Revenue per employee is the most honest metric in the world.

Yes, you can accept a few plateaus, and maybe even one or two dips along the way, but you don’t want to get stuck in a trough for a prolonged period of time.

Why does this metric carry so much signal?

According to equity analysts :

Revenue per employee is an underused metric that probably offers the best insight into a company's scalability, or eventual operating efficiency.

In other words, as your company grows it should demonstrate operational leverage - that means the ability to do more with less.

What does good look like?

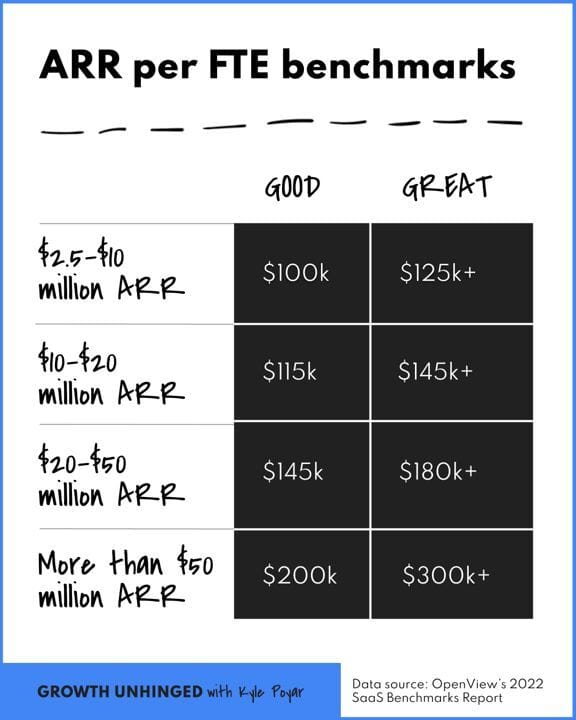

According to the fine folks at OpenView (h / t ), here’s a handy table to tell whether you’re on track:

In short, you should start tracking this metric in earnest after ~$2M in ARR. You should be approaching $150K in ARR per employee at around $20M in ARR. And you should be approaching $300K in ARR per employee at scale (+$50M in ARR).

Here’s another view of the same data to give you all the Revenue per Employee feels:

As eluded to above, the gold standard for “scale” or “IPO” is something north of $250K per person. This will get easier to hit as you add more products to sell into your existing customer base (sidenote - if you work at AWS or Salesforce and can’t hit your quota with the 1,987 products you have to sell, there’s always a job at your local airport’s TSA division for you).

Some real life examples:

I used Meritech’s operating metrics database to slice and dice implied ARR / Employee for 91 tech companies. I looked at the Top 20, Bottom 20, the PLG cohort, the fast growing cohort, and the slow growing cohort.

The median for the tech universe they cover was coming in at $284K per employee.

Top 20:

Expensify, Dropbox, Adobe, Shopify, and Palantir were incredibly efficient.

Bottom 20:

Freshworks, Blend Labs, Cvent, Sprinklr, and Paylocity were demonstrating the least leverage on a per employee basis.

PLG:

The median for PLG companies is higher than all other cuts, at $350K per employee.

In theory, PLG should drive revenue per employee higher, as the product shoulders a great deal of the go to market workload. Where this falls off the rails is if a company calls itself PLG, but also employs a full blown field sales assist. That can be double expensive.

It may also not show up in the numbers if the company reinvests the savings from PLG in more engineers to build more products.

But then again, more products should lead to more revenue, so it’s a bit of a circular reference.

To do some of the work for you: 12 of the Top 20 in total ARR / Employee were also PLG.

Companies growing >50%:

As you’d expect, of the 11 companies growing over 50% Y/Y, only 3 are in the top 20 in Revenue per employee. The median in this high growth cohort is lower than the overall median, as companies are investing ahead of future growth. This makes sense in markets where growth is valued more than profitability and efficiency.

Companies growing <30%:

What struck me here is the median for the lowest growers is below the median for the overall data set. There’s a mix of companies who have chosen to grow slower, and be incredibly efficient, like Expensify and Dropbox. And there are others caught up in this data cut who are growing slower (probably not by choice), and are also not reaping the benefits of efficiency, like New Relic (interestingly enough a rumored target for take privates).

A few words of caution:

You can’t divide by zero: This metric isn’t very useful if you aren’t selling a product yet. More broadly, it’s more indicative once you’ve reached Product Market Fit and / or have exceeded $2M in revenue. Before that, forget about it.

You should still try to use a bottom line efficiency metric: This metric also goes out the window if you are burning so much cash that you won’t stay in business.

Prioritize comparability: Benchmarks are only as good as the cohort or population you are comparing to. Try to match up your go to market motion, industry, and growth rate for relevance.

What I’ve Been Listening to

Paddle was kind enough to invite me on their podcast, where we talked all things SaaS metrics and my personal road to CFO (the good, the bad, and the funny). Some of the things we touched upon:

Finding the right benchmarks

Having an underdog mentality

My dedication to writing as a way to get better at my day job

Challenging the common assumptions about CFOs

Involving customers in your story

Listen to the podcast and tell me how weird my voice is. And no, I don’t sound like Roman Roy.

Quote I’ve Been Pondering

“Do I really look like a guy with a plan? You know what I am? I’m a dog chasing cars. I wouldn’t know what to do with one if I caught it. I just do things.

-Heath Ledger as the Joker in Batman