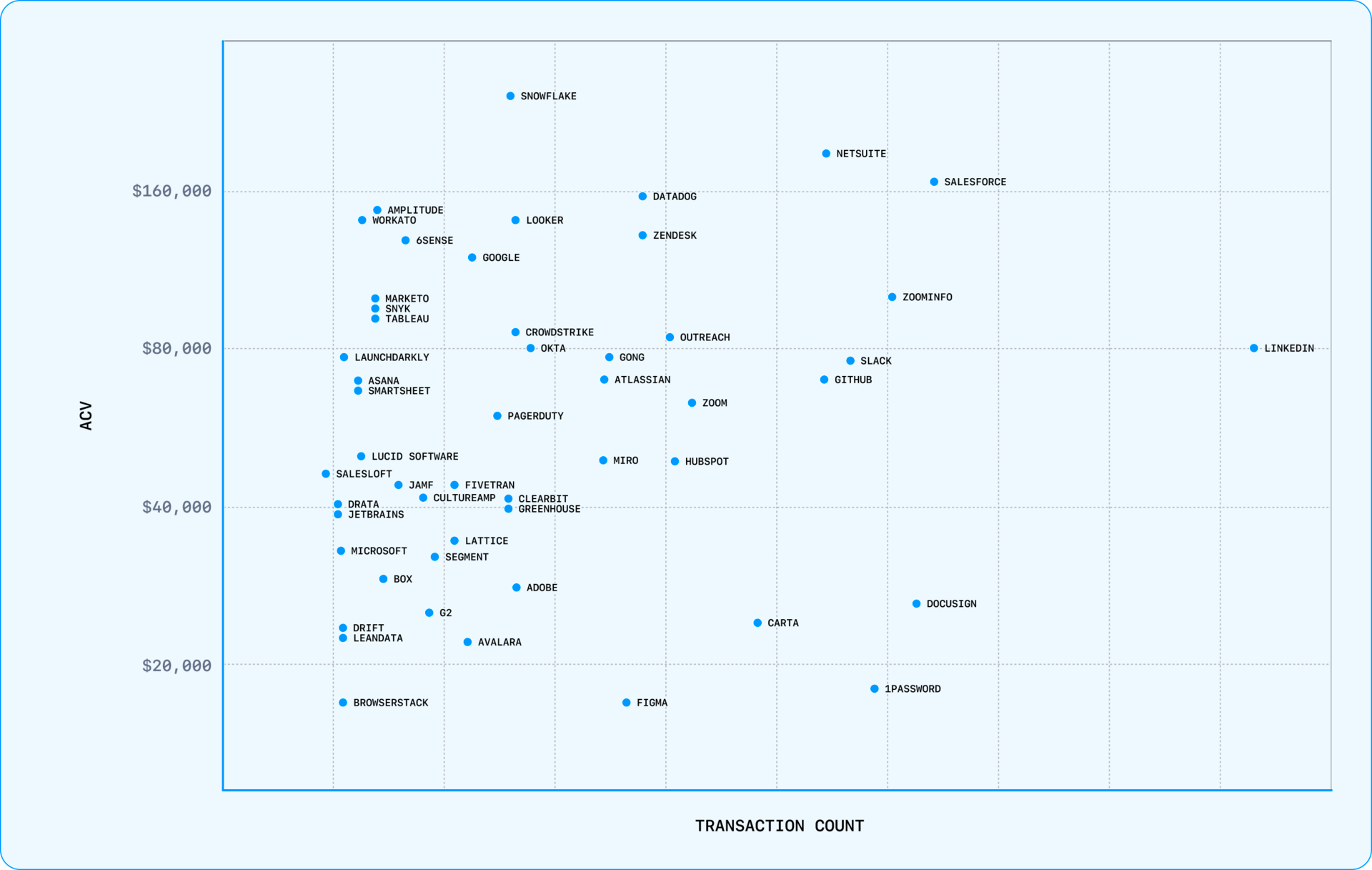

Vendr dropped a banger of a report on Q2 SaaS buying patterns. And the exhibit that caught my eye was the chart above, portraying average ACV (Annualized Contract Value) x Transaction Count across the SaaS universe.

Most software companies pick a lane, or decide what game they are playing, to increase either deal size or deal speed. They’re essentially deciding if they want to optimize for home runs or base hits.

Typically speaking, high velocity sales motions have lower ACVs but faster sales cycles, and correspondingly low CAC Payback Periods. In other words, they get their money back faster, striving for efficiency and pumping out base hits.

And enterprise field sales motions require long lead times with heavy investments in expensive sales reps (sluggers). This usually plays out in delayed CAC Payback Periods, but higher net dollar retention rates, as larger customers stick around longer and expand, subsidizing smaller, churning accounts that lose budget or go out of business.

Each strategy has its merits. But you’d totally take the best of both worlds if you could.

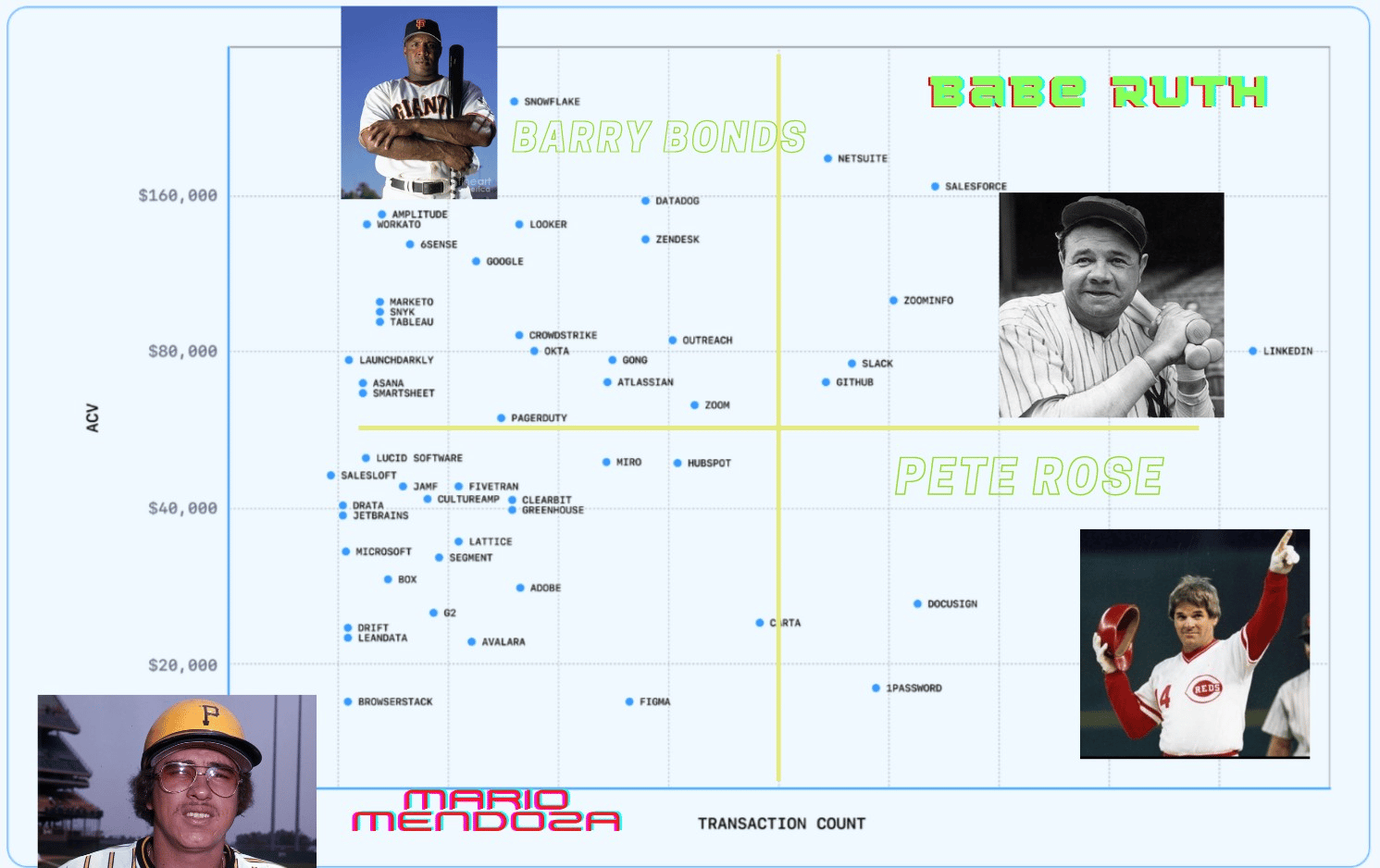

I’ve split Vendr’s graphic into four quadrants above, remixing it with MLB namesakes. Here are the quadrants, as I see them:

Mario Mendoza: A light-hitting shortstop in the late 1970’s who failed to achieve a batting average above .200 five times in his nine big league seasons.The “Mendoza Line” was named after him, representing the absolute bare minimum you need to stick around in the big leagues, or theoretically any endeavor.

Pete Rose: The all-time MLB leader in singles with 3,215 over his career. This guy got on base like an absolute banshee. He was a high velocity hitter who made first base his second home.

Barry Bonds: Hit a record 762 home runs in his career. That’s a lot of ding dongs. He was a power hitter, through and through. He also struck out a lot. And his head got really big after taking steroids.

Babe Ruth: Still has the best slugging percentage in MLB history at .6897%. Slugging percentage, for those who didn’t attend the MIT Sloan Conference, represents the total number of bases a player records per at-bat. In other words, he was the best mix of singles and homeruns. He also ate hotdogs and smoked cigarettes between innings, which has nothing to do with the case I’m making.

Some observations:

The Mario Mendoza Quadrant

What you don’t want to be is a low volume, singles hitter.

This will get you sent back down to the Pawtucket Red Sox (RIP).

It looks like Browser Stack, Lean Data, Drift, and Avalara are looking for one bedroom apartments in Rhode Island’s sixth favorite city.

The Pete Rose Quadrant

Docusign, 1Password, and Carta get on base at a remarkable clip.

They are grinding out base hits at a high velocity, becoming ubiquitous applications for all SaaS companies.

Although their deal sizes are smaller, they are table stake applications.

The Barry Bonds Quadrant

DataDog, Zendesk, and Looker are smashing shots over the fence.

Someone needs to check Snowflake for performance enhancing drugs.

The Babe Ruth Quadrant

This is the golden quadrant

Salesforce is closing DataDog sized deals at a Docusign velocity (nuts!)

LinkedIn is absolutely cookin’. They’re doing a buck eighty on the freeway, slinging licenses left and right to your favorite CMO, COO, grandmother; it don’t matter.

So how do I become Babe Ruth?

To get into the Babe Ruth Quadrant you need one or more of the following:

Quasi monopolistic powers for your product offering (Salesforce’s CRM)

Competitive moats (ZoomInfo’s deep data moat)

Critical infrastructure characteristics (Netsuite’s financial backbone)

Powerful Network effects (Each LinkedIn user makes the network incrementally more valuable)

When I look at Vendr’s latest report, I see competitive moats.

Use your moat to get on base this quarter. Best of luck.

Vendr clearly has a TON of SaaS pricing data. Now they're also releasing it at the supplier-level via SaaS Buyer Guides, which offer pricing benchmarks and negotiation insights to ensure a great outcome on your next purchase. Check them out here:

Quote I’ve Been Pondering

“There are only a few times in life when we think we are going to live forever. And I think one of them is when we are with our friends, laughing, eating, looking each other in the eye.”

-Frances Burnett, British-American novelist and playwright

What I’ve Been Listening to

I recently graced the airwaves of The Rebooting podcast with to talk about the next wave of B2B media, why media traditionally has a sucky business model, and growing Mostly metrics.

And it’s not often that CFOs get asked to talk about Media, so this was a fun trip to the cool kids lunch table.

What I’ve Been Reading

Looking to accelerate your career and grow your business leveraging strategic finance? Oana Labes is Linkedin’s #1 Corporate Finance creator, and her high growth weekly newsletter is read weekly by 30,000 of your peers.

Every Saturday The Finance Gem💎 delivers clever insights and beautiful visuals, to help you elevate your knowledge, impact and influence.