After years in tech finance, I’ve learned that great companies need more than capital – they need true partners who understand their DNA.

MUFG’s Growth & Middle Market Technology Banking practice is what happens when you bring together the most experienced, most connected tech bankers in North America in one room – with the generational commitment of a $3 trillion global powerhouse behind them.

From pre-IPO startups to scaled public companies, this team is structured to help your company keep pace with lending solutions, strategic advice, and risk management products tailored to tech CFOs.

Contact Group Head Bob Blee to discuss how MUFG is empowering a brighter future for the tech ecosystem.

If you read my stuff on Sundays, you’ll know I closely track the valuation and efficiency metrics of +100 of the top publicly traded tech companies (last week’s edition can be found here after the SailPoint S1 breakdown).

Now it’s time to take this to the next level.

This is our inaugural State of the Private Markets, a monthly series where we’ll deliver the most compelling valuation, hiring, and revenue insights on pre-IPO candidates. Think of this as your backstage pass to the companies shaping the future before they hit the public markets.

Today we will cover:

Valuation: The most valuable private tech companies

Hiring: The fastest hiring companies

Layoffs: The companies shedding headcount

Sector specific highlights: This month we check in on Foundational Models, Fintech, and Autonomous Driving

Company spotlights: This month we check in on DataBricks, Anduril, and Canva

Fundraising: Recent rounds you should know about

Execs: Pre IPO CFO hires

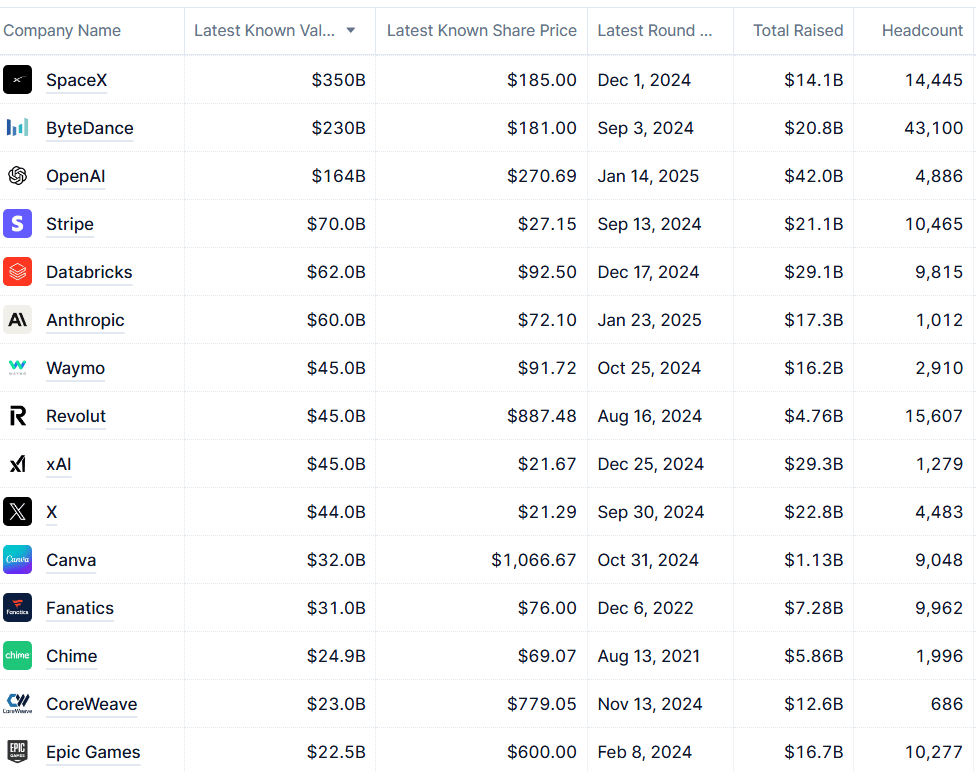

The Most Valuable Private Tech Companies

Let’s start with the leaderboard. SpaceX officially overtook ByteDance as the most valuable private tech company in the world. This latest milestone doubled the company’s valuation. Launching rockets is worth a lot. Catching said rockets is worth even more.

There are currently three private tech companies above $100 billion in valuation:

SpaceX: $350 billion

ByteDance: $230 billion

OpenAI: $164 billion

For reference, the following public tech companies currently trade at enterprise values BELOW $100 billion: PayPal, Crowdstrike, Coinbase, DoorDash, Airbnb, and Datadog.

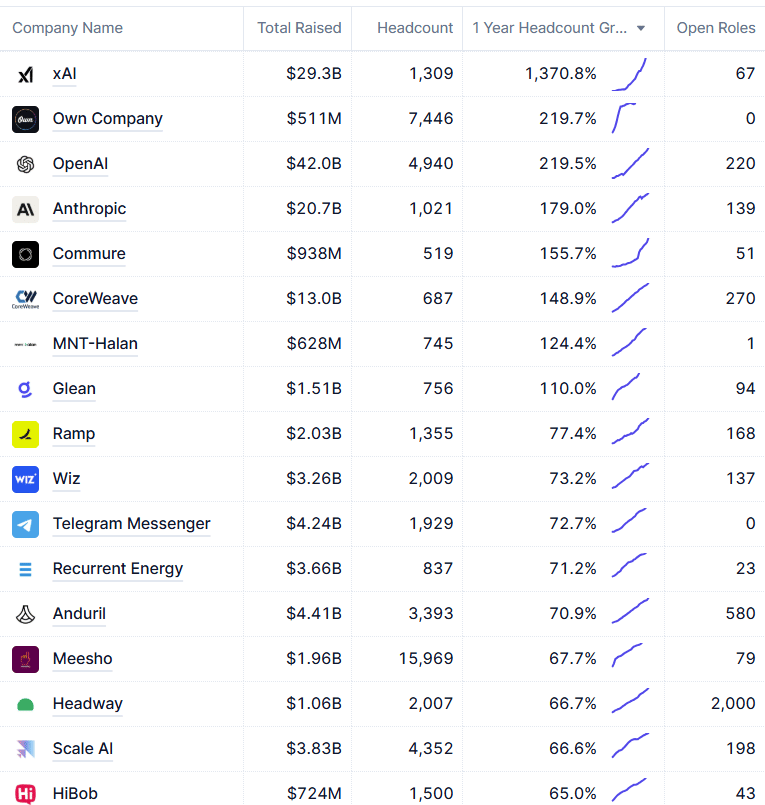

HC Trends

When it comes to tech businesses, people are the biggest investment. Over 70% of SaaS expenses go towards headcount, making hiring trends a leading indicator of future revenue growth (or contraction).

With Position (join waitlist) we tracked headcount across 5,000+ private companies to uncover the trends.

Fastest Hiring Companies

Filtering for companies with more than 500 total employees who have also raised more than $500 million in capital, the logos below increased total headcount at the fastest rate year-on-year:

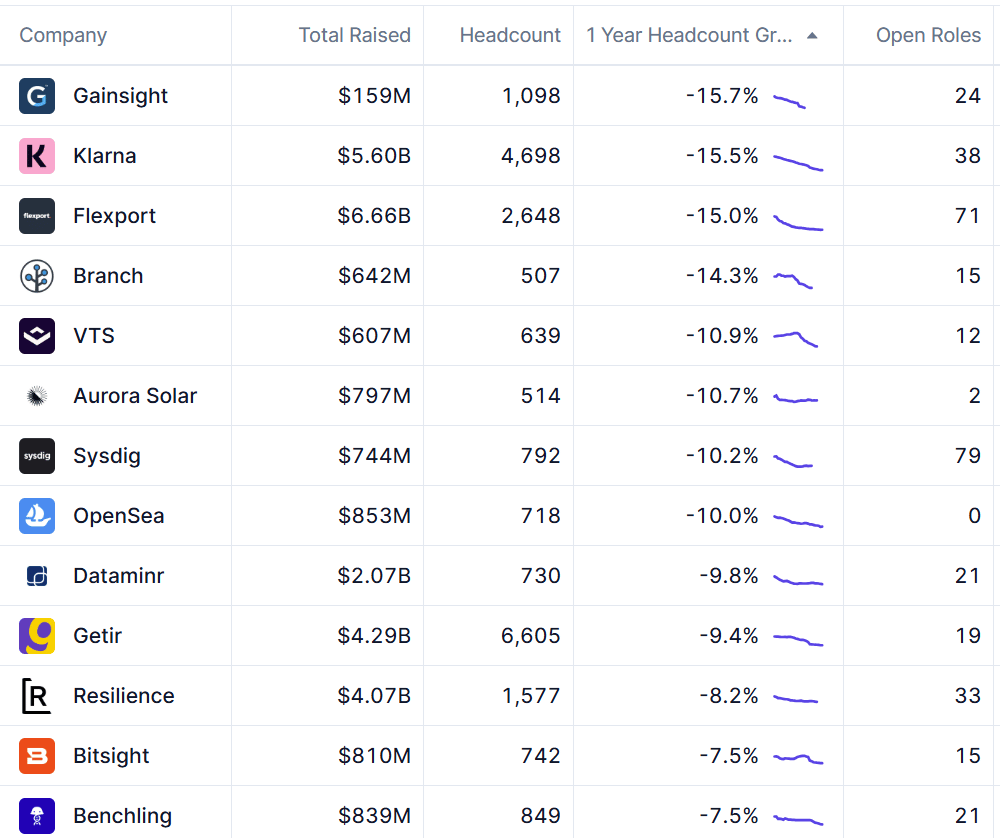

And here are the companies who pulled back most aggressively:

Notable callouts:

Gainsight: Owned by Vista Equity Partners, they’re under pressure to prioritize efficiency.

Klarna: Terminated Salesforce and Workday contracts under the guise of AI adoption, but also effectively downsizing.

Flexport: CEO Ryan Petersen returned to trim headcount, even rescinding 75+ job offers just before start dates.

Sector Specific Highlights

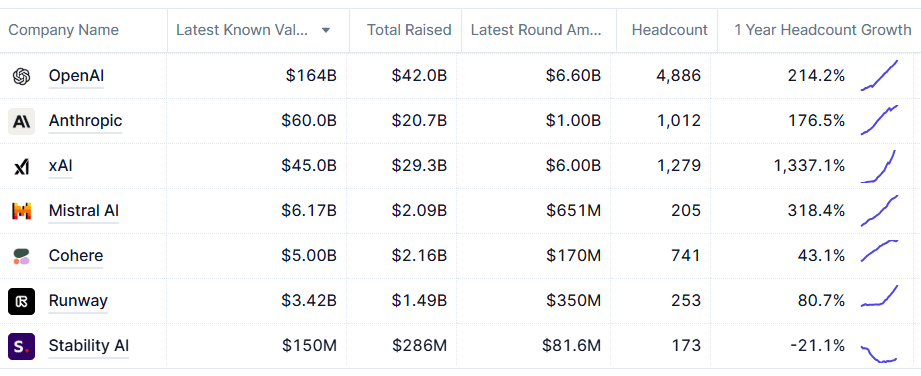

Foundational Models

The leading five private AI companies have raised a combined ~$100 billion. This pales in comparison to DeepSeek’s rumored $5.5 million in funding to spin up a worthy competitor.

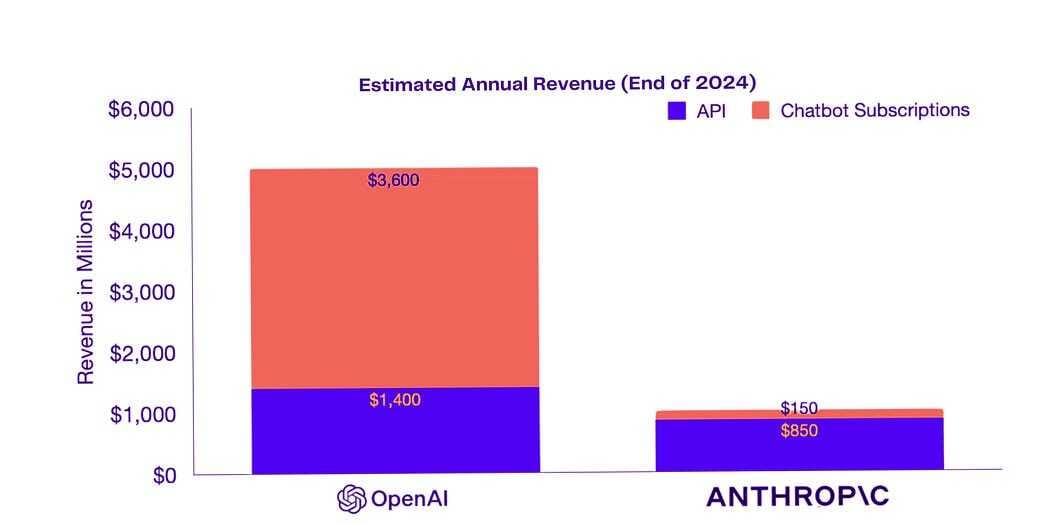

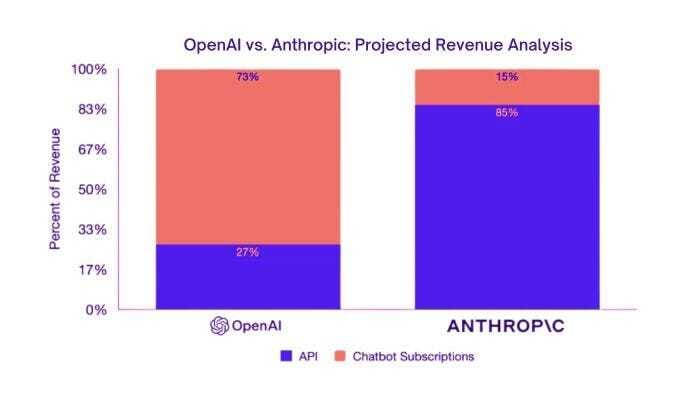

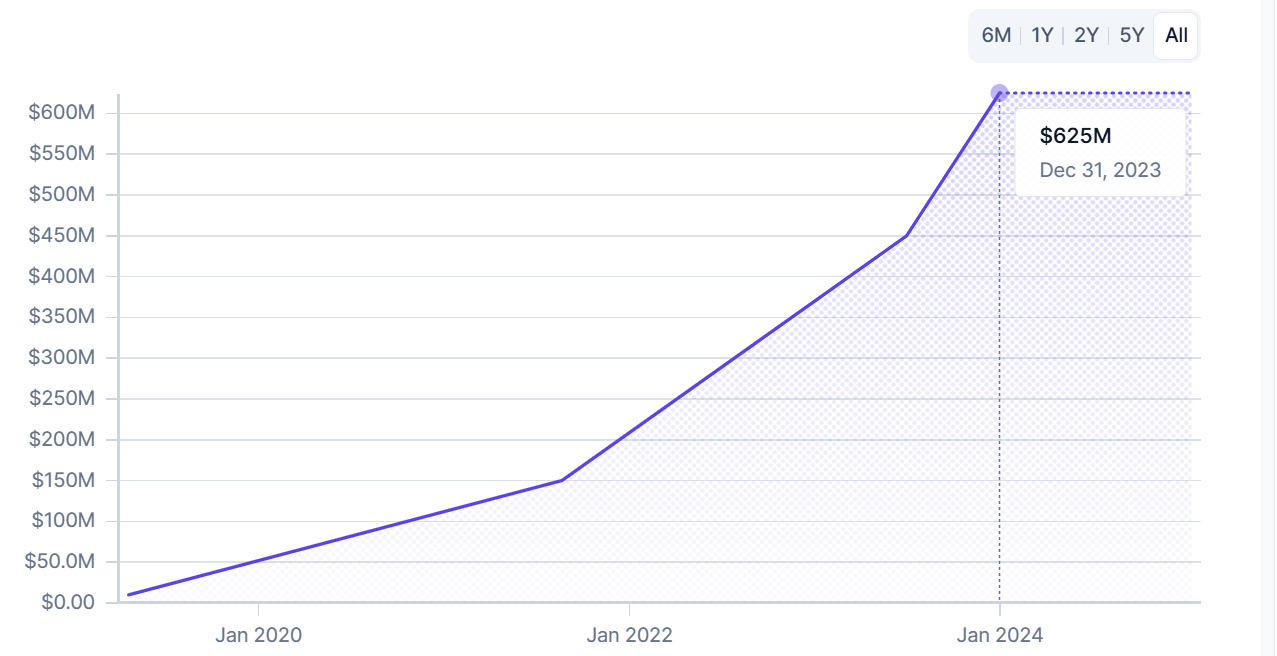

OpenAI’s valuation stood at ~9x Anthropic’s until mid January, when Anthropic raised at $60 billion, cutting the gap to less than 3x

While Anthropic may be closing the gap in valuation, OpenAI still generates a rumored 5x more revenue.

What’s perhaps even more interesting is their respective revenue mixes, with the latter relying more on API services that are less consumer facing.

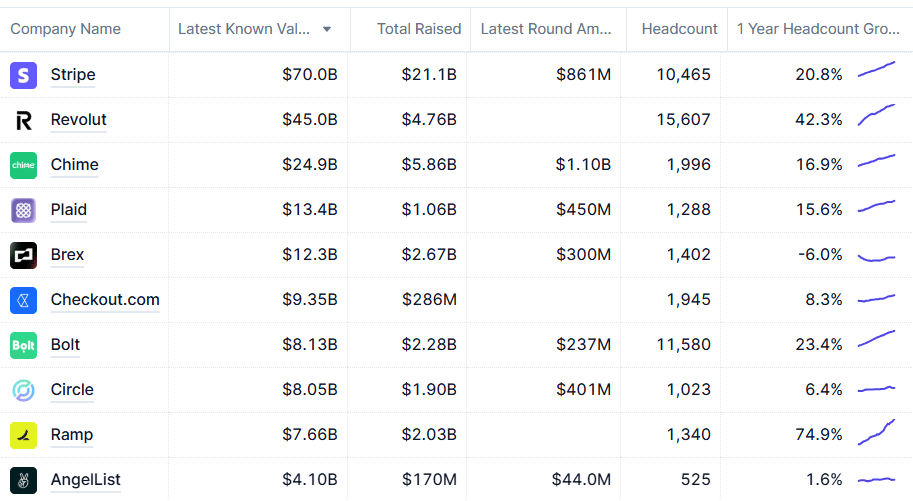

FinTech

There are five privately held fintech companies with valuations +$10B. Chime is the only one predominantly focused on B2C.

Chime is flying under the radar but is rumored to be IPO-bound in 2025.

Ramp is growing headcount the fastest among FinTech companies.

Revolut is Europe’s highest valued private FinTech.

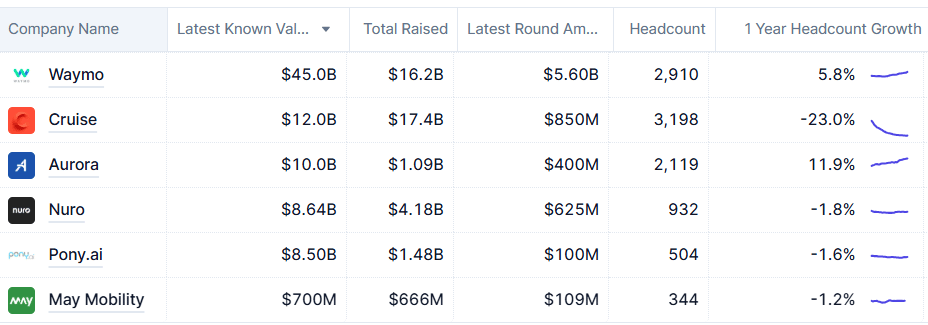

Autonomous Driving

The autonomous driving space is becoming increasingly crowded, despite a major player effectively dropping out.

Waymo: Recently surpassed Lyft in ride volume within San Francisco.

Cruise: General Motors announced it’s shutting down its Cruise robotaxi unit, ending the Cruise operation as it was previously known; the company will now focus on integrating autonomous driving technology into personal vehicles instead. The headcount declines reflect as much.

Company specific highlights

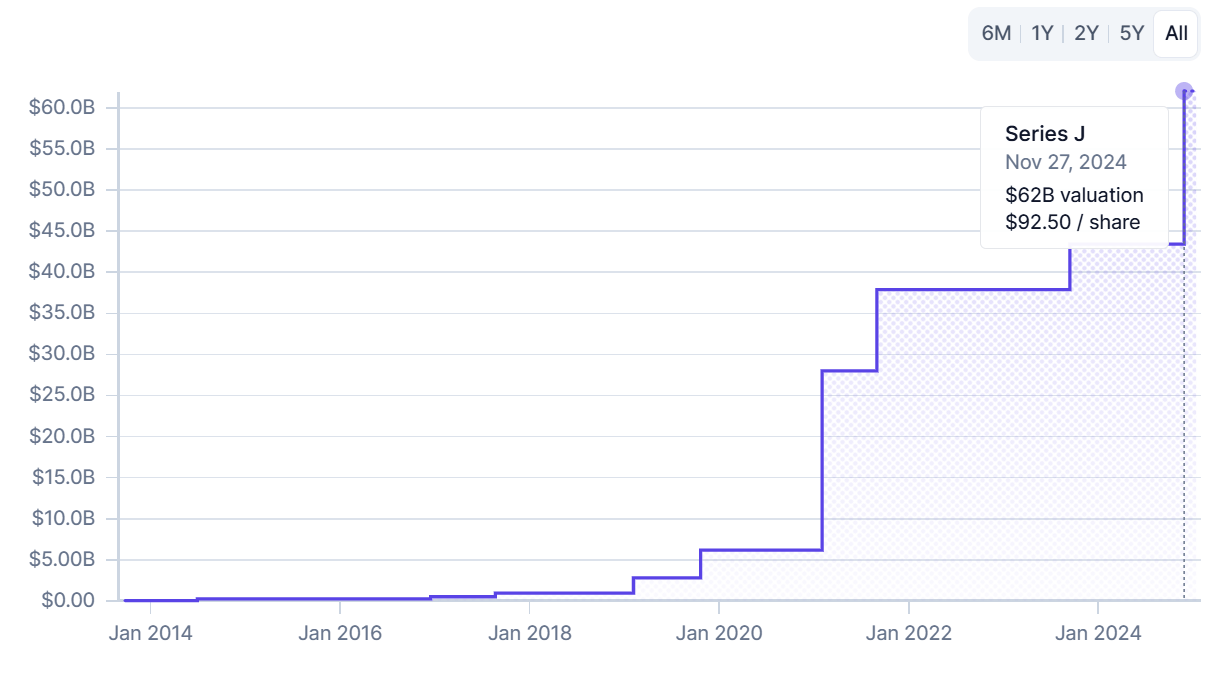

Databricks: Growth Over Cash Flow

Databricks is closing in on Snowflake’s $3.4 billion revenue, but at a higher burn rate.

Valuation: $62 billion puts DataBrick’s mark $5 billion higher than Snowflake’s current market cap of ~$57 billion. Private market investors still favor growth over free cash flow.

Revenue Growth: DataBricks is growing at ~2x Snowflake’s est. NTM 28% y/y growth rate.

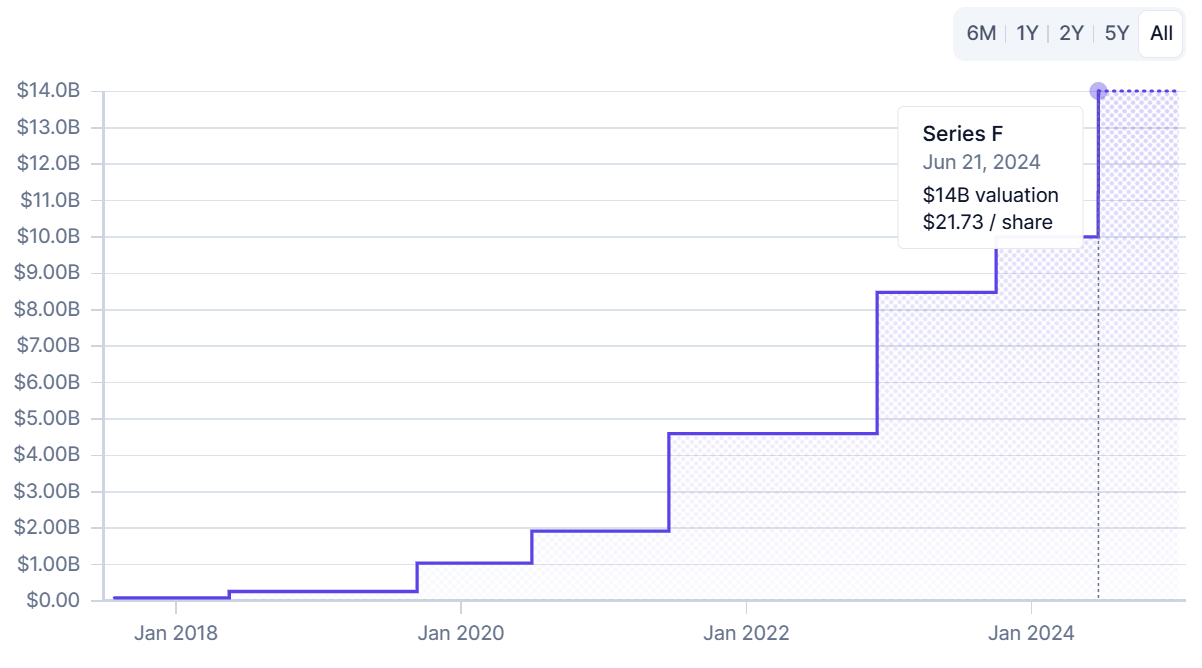

Anduril: From Battlefield to Boardroom

Anduril recently secured $450 million in 30 year tax credits to build a +$1 billion factory in Ohio.

Valuation: Series F brought them to $14 billion in valuation, making them the highest valued private defense company at the moment.

Revenue Growth: Continues to grow close to 100% y/y. On track to break $1 billion by end of 2025.

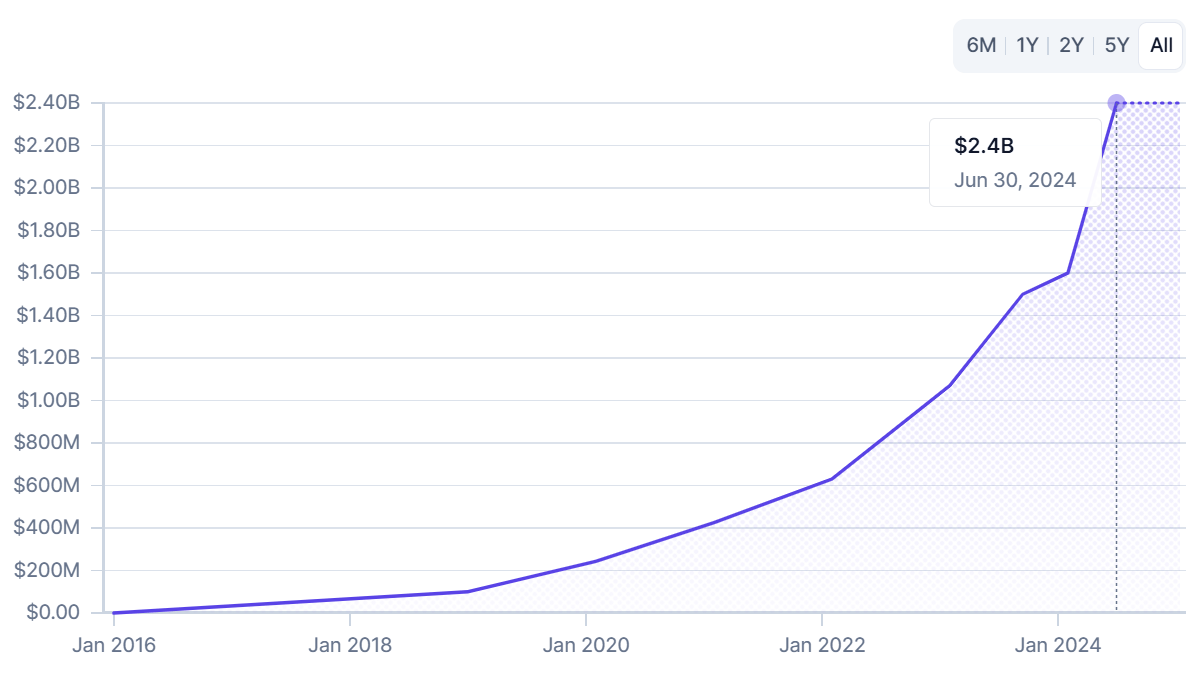

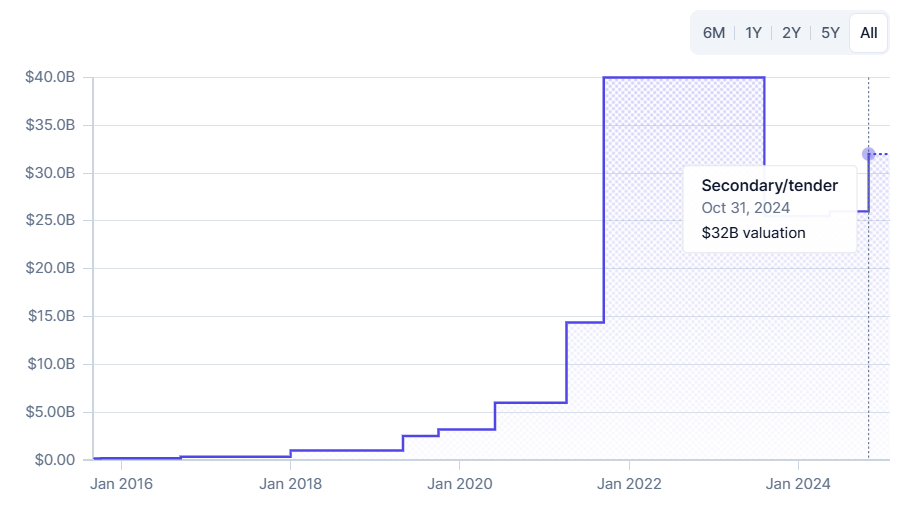

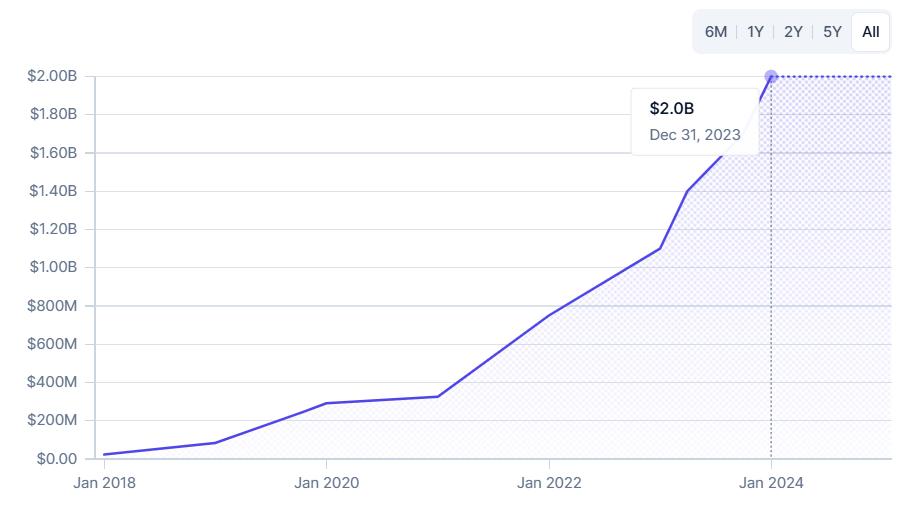

Canva: B2C goes Enterprise B2B

Valuation: Recent secondary traded down from $40 billion to $32 billion.

Revenue Growth: Well north of $2 billion, with a rumored $2.5 billion in run rate revenue to close 2024.

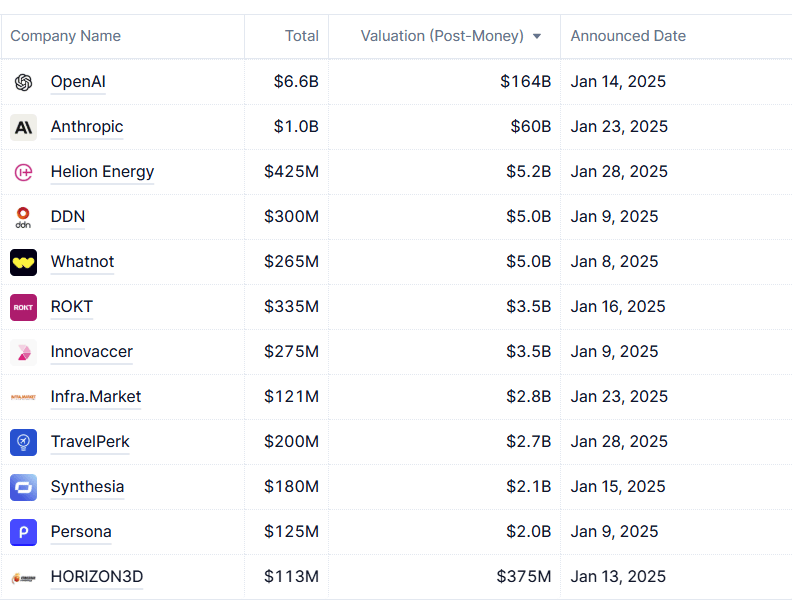

Notable Rounds this Month

Helion Energy, clean tech company building fusion generators, raises $425M to surpass $5 billion in valuation

Travel Perk, corporate travel and expense company, raises $200M to double valuation

Synthesia, AI video platform, raises $180M to place valuation above $2 billion

Executive hires

Wiz: Hired a CFO, signaling IPO prep is underway.

Ramp: Announced internal promotion of Will Petrie to CFO.

Hadrian: Hired West Owens as CFO.

This wraps up our first edition of State of the Private Markets. Stay tuned for next month’s deep dive into the companies redefining the private markets—and don’t forget to thank MUFG for making this possible.

Disclaimer: None of this is investment advice. Do your own homework.