Oprah slinging SaaS dizzys

Opportunity in a Tweet:

If you’re a startup negotiating a software purchase, there’s no quick and easy way to validate if you’re getting a good discount. Specific data is gated behind very expensive consulting memberships. And any data you can find with a google search is either too generalized or too biased to be useful. Build what Glassdoor is to salary reviews for software pricing.

The Problem:

After salaries and marketing programs, software tools are often the most expensive line item in most tech company budgets. In some cases it can be as much as 15% of overall operating expenditure. When contemplating a purchase, procurement professionals often ask themselves,

“What discounts do companies like us get when buying this tool?”

Which roughly translates to,

“I really hope I don’t get ripped off and then canned for buying this thing”

Buyers have historically relied on Gartner and Clear Edge (now owned by Accenture) to figure out if they’re getting a fair shake. But they get hosed in the process, as the consulting contracts can be upwards of a hundred thousand dollars per year and require a significant investment of time to get an answer.

What This Is:

Glassdoor (employee salary data) meets Lease Hackr (car leasing data) meets Vendr (procurement as a service)

A website with software discounting data anonymized by license type and volume

A snapshot of approval matrixes within organizations

What This Isn’t:

Procurement as a service

Consulting

Linked back to the buying company in any way

tell em, Uncle Tony,...

Thesis:

The same types of contracts are negotiated every day

The following tools are negotiated over and over again by companies of the same size and shape:

Productivity (Monday, Asana),

Dev Ops (Gitlab, Atlassian),

Security (SentinelOne, Okta)

Finance (Netsuite, Xero, Quickbooks),

R&D (Grafana, Jetbrains)

Sales (Salesforce, Salesloft, Gong),

Marketing (Hubspot, Marketo, Mixpanel),

Hosting (AWS, Azure),

Workforce (Workday, Bamboo, Greenhouse)

But most companies wander into the proverbial lion’s den blind as to what to ask for off the list

Glassdoor’s model for data submission works

Remember the time you had to submit your salary data to see more data on GlassDoor? Kinda like that

Free to view a few jobs (discounts in this case), but need to give data to get data after your allowance is up

Creates a self-perpetuating network effect where data drives more data

Software companies will pay for hot leads

Despite being “exposed” from a discounting standpoint, the leads would be extremely valuable - it’s a highly targeted audience with intentions of purchasing

Back of the Napkin Market Sizing

*Note: # of eligible companies (150K) pegged to Salesforce’s total customer count as a conservative starting point

To Get the Ball Rolling, Sisyphus Says

Seed the site with initial data on a few of the most commonly purchased tools

Concentrate on software with very straightforward licensing models (annual, one year, subscription, paid up front)

Offer gift cards to sales reps who recently left a company to discuss common pricing practices at their former employer - it’s easier to go to one rep that did 50 deals than finding 50 different procurement professionals who purchased from that individual

How did Glassdoor get their first 1,000 reviews?

We had them call every software engineer in Silicon Valley and offer the chance to win a free iPod if they would tell us what their salary was and what it was like to work at their company. That's how we got our first thousand Glassdoor reviews.

-Robert Hohman, Founder and CEO

Kinda Biased Competitive Landscape

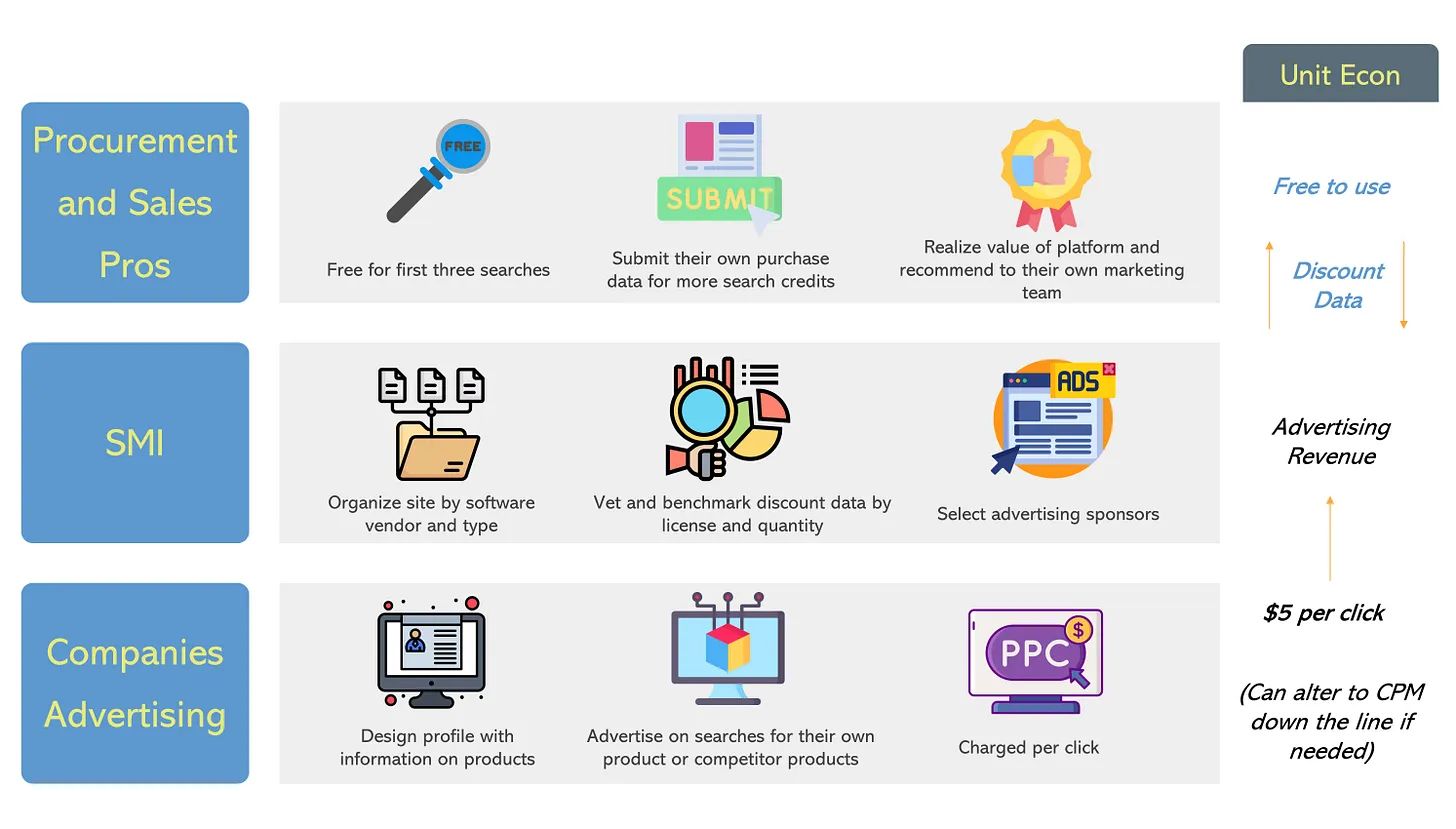

How It Makes Money

Why This Might Fail

The companies getting their pricing “reviewed” may try to spread FUD

Companies will either want to advertise, and pay up, or want to shut you down

Pricing may change too often to keep track of

Perhaps, but I doubt the relative discounting off list will…

Potentially Reliable Stuff I Read at 3 AM

Irrelevant Post Script No Reputable Business Publication Would Allow

Get Hyped

Get Loud

Get Wise

“Time and money are largely interchangeable terms.”

-Winston Churchill