50 has a 1 day CAC payback period

The Art

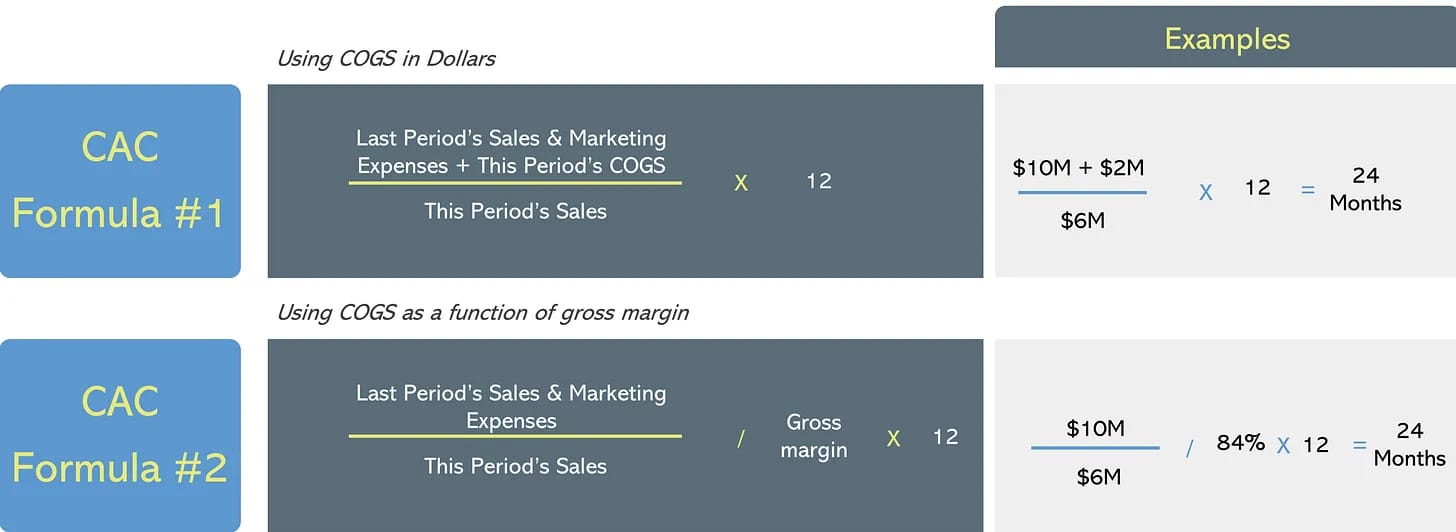

Customer Acquisition Cost (CAC) Payback period allows you to measure the efficiency of your business’ go to market machine. It effectively tells you,

“It takes me X months to break even on the Y dollars I spent to get a customer.”

The Science

The Breakdown

Let’s look at each component:

Sales and Marketing Expenses: S&M should be lagged according to the average sales cycle of the sales engine you’re measuring. The goal is to align the dollars you spent in the past to generate the sales you are finally seeing today. This is important if you are hiring really quickly. You don’t want the costs of new hires who haven’t sold anything yet (deadbeats!) to show up in the CAC Payback for today’s additions. Examples of lagging by segment:

Enterprise sales cycle of 180 days = 6 month S&M lag

Mid-Market sales cycle of 90 days = 3 month S&M lag

SMB sales cycle of 30 days = 1 month S&M lag

Cost of Goods Sold (COGS): This includes hosting costs, customer support, and customer success. It’s basically the ongoing costs you incur to keep your install base around. It’s taken from the period you are measuring, with no lag.

Sales: This is the period additions to your topline, preferably measured in MRR or ARR. It is not your total MRR or ARR, just net new. Also, it is not your gaap revenue, which is an accounting based measurement.

Generally all of these figures are best measured on a trailing twelve month basis to smooth for seasonality. When you look at it monthly or quarterly your graph might look like an EKG.

Heartrate, not CAC

What’s “good” look like?

The median CAC payback period for private software companies is somewhere between 12 and 15 months depending on your scale. Generally speaking, the smaller you are, the faster you need the money back, hence the need for a shorter CAC payback cycle. Openview breaks CAC payback period into Annual Recurring Revenue (ARR) cohorts below:

It’s important to note that “good” varies significantly for larger, public companies who tend to focus their resources more heavily on a prolonged Enterprise sales cycle and have better access to capital. Clouded Judgement crunched the numbers on what CAC Payback looks like for public companies:

So to net it out, anything under 12 is really good if you are private. And anything under about 18 months is really good if you are public, or aspiring to be public.

Can CAC Payback Be too Low?

Yes. It might indicate you are leaving money on the table and under investing in your go to market engine. The Mendoza Line for small private software companies is ~6 months and ~10 months for public software companies. At these points you start to blur the line between highly effective and under-investing in growth. It’s hard, since you want to feed the beast, not starve it…but also keep it kinda hungry.

Are there differences in CAC Payback by Industry?

Absolutely. Wealth management and insurance companies might be willing to wait up to three years given their retention rates. Think about it - how often do you shop for car insurance or move your 401K.

On the other side of things you have mobile phone developers who know you’ll get frustrated playing Words with Friends once you lose to your grandmother and require something closer to 30 days to break even on their app.

You see similar trends even within the software sector. Consumption licensing models, especially data infrastructure companies with longer deployment cycles, are often willing to wait a bit longer to return their customer acquisition costs than subscription licensing companies with potentially less stickiness and more frequent renewal cycles.

Anything else to watch out for?

Yes, there’s a nearly 100% chance that whatever CAC payback period a company self-reports is understated. Check to see if overhead (rent, office expenses, IT) and share based comp (often a massive non-cash charge for startups) are contemplated within S&M and COGS. Someone’s gotta foot the bill.