What’s a “take rate”

A take rate / vig / rake / commission is the percentage a middleman receives for connecting two or more parties.

Take rate = Net Revenue / Gross Merchandise Volume

Begrudgingly agreeing upon a take rate

How are take rates determined?

Factors include:

Average transaction size

Grubhub’s average transaction is < $100, with a 20-30% take rate

Redfin’s average transaction size is >$300K, with a take rate of 1.5% - 2%

Transaction frequency

Uber may be used 5x per month while Cargurus may be used 1x every 5 years

Difficulty of curation

Stockx curates limited edition shoes, while Uber drivers are largely viewed as a commoditized supply

Technological improvements

Substack builds specific publishing capabilities for newsletter creators, compared to Wordpress which is more of a blank canvas

Additional verification and insurance

GOAT verifies all sneakers for authenticity before sending to buyer, allowing them to charge a premium to less secure marketplaces

In a vacuum void of competitive dynamics, intermediaries that facilitate frequent, lower-cost transactions tend to charge a higher take rate, like Uber. While intermediaries that facilitate infrequent, high-cost transactions, like RVshare, charge a lower take rate on a higher order value.

Nirvana is if you have a high cost and high frequency product. The potential dead zone is if you have a low cost and low frequency product.

For example, if you are a marketplace that specializes in premium vacation hotel rooms with an average of $500 per night, you can recoup your customer acquisition cost pretty easily. Now, the customer may not have a high lifetime value, because they only vacation 1x per year, and could forget about your service the next time vacation rolls around. But you’d still cover your CAC after a night or two.

However, if you’re a marketplace for tours and activities, meant to serve that same vacationer traveling at that same frequency, but you only make $50 a ticket, that’s less desirable - since you’re low cost, low frequency.

What are typical take rates?

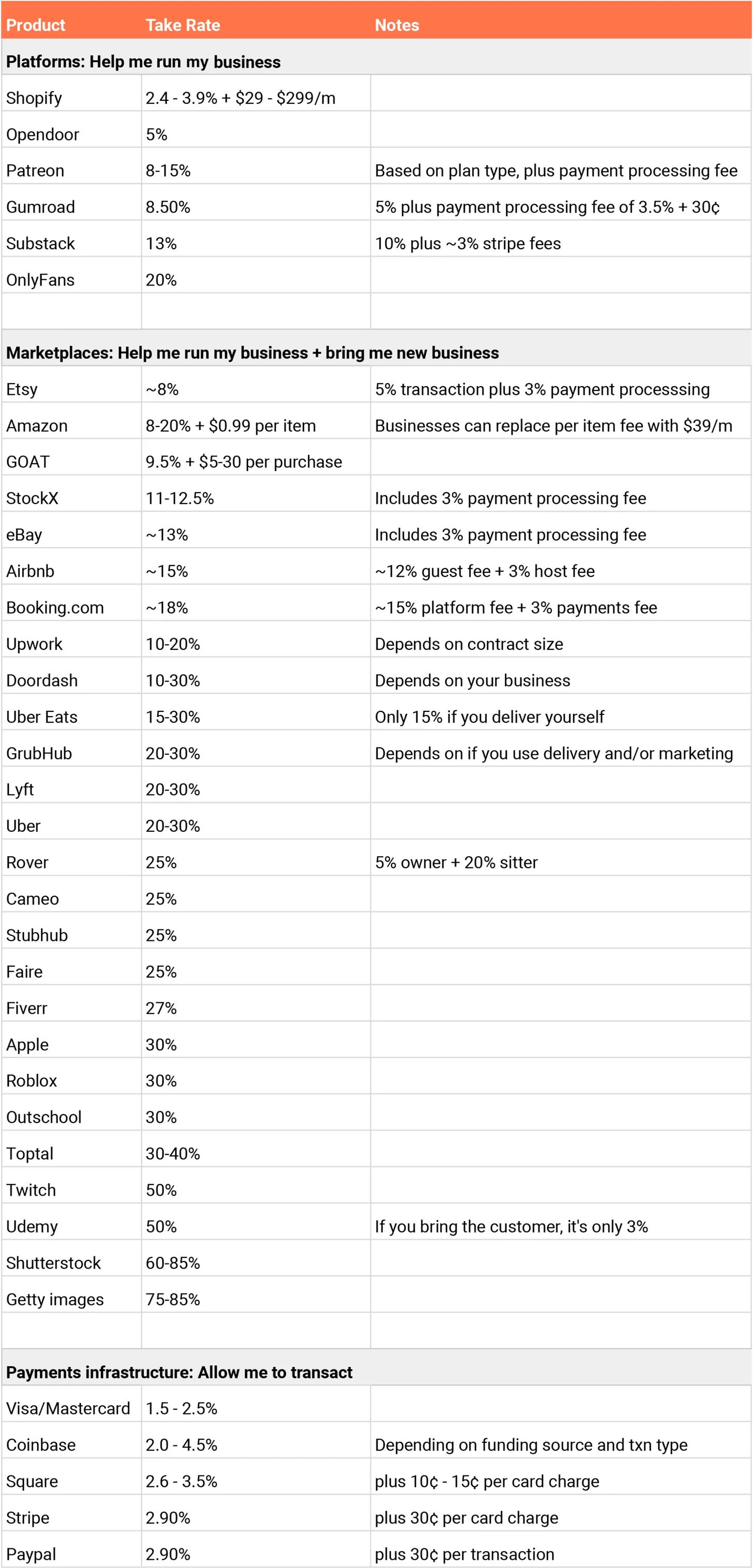

In general, Marketplaces charge higher take rates than Platforms, which charge higher take rates than Aggregators.

Take Rates: Marketplaces > Platforms > Aggregators

Before you scream - Yes, this is a generalization. I’m sure someone could find a Platform that charges more than a Marketplace. Actually, hold my beer - I’ll do it for you: OnlyFans, a Platform, charges ~20%, while Etsy, a Marketplace, charges ~8% . Boom.

But here are some general ranges:

Marketplaces generally charge 10% to 30%

Platforms generally charge 5% to 15%

Aggregators typically charge between 0.5% and 5%

The overarching point is you are rewarded for the level of work you have to do, the risk you take on, and the network effects you generate.

For example, Platforms generally drive less network effects, or demand, than Marketplaces. Patreon drives limited demand to their Suppliers - actors and musicians bring their fans (the demand) to the platform. Users don’t go to Patreon to browse around.

And Aggregators have lower payment risk than Marketplaces, since they don’t handle the final transaction. For example, Kayak.com will push you over to Delta to complete your flight purchase. They don’t have to deal with payment gateways, returns, or angry customer service calls.

It’s important to note that the labels “Marketplace”, “Platform”, and “Aggregator” aren’t binary or mutually exclusive. Substack is a good example of how the lines can get blurred. It started out as a publishing Platform, where writers brought their audiences. But later Substack added features to drive network effects, like their recommendation feature (which is how a few thousand of you found this newsletter). Now they’re something “more” than a platform but still “different” than a marketplace.

Lenny Rachitsky did the leg work to aggregate (HA!) take rates across Marketplaces and Platforms (and Payment Infra). Most of the take rate ranges I mentioned above hold true.

Who pays the take rate?

The majority of the time the End User pays the take rate. However, it doesn’t always look that way. Many times the middleman’s rake is disguised as a shipping fee, convenience fee, or cleaning fee (I’m looking at YOU Airnbnb). Or their vig is just passed along in the form of a higher, grossed up purchase price.

So, by hook or by crook, it’s usually passed onto the End User.

A word of caution…

Take rates are, at the end of the day, a form of friction. Charging too much pisses off customers, and they’ll leave you when another competitive option springs up.

We see inklings of take rate indignation with Airbnb.

And the same frustration with Uber.

Choosing a take rate is both art and science. You want to find a happy medium where you can optimize for the highest net revenue (GMV x Take Rate) over the lifetime of a customer. That’s done by simultaneously toggling:

Total Price (GMV)

Transaction Volume

Churn Rate

In fact, if you raise your take rate too high, it actually invites competition. Take it from JB:

“Your margin is my opportunity.”

-Jeff Bezos

Amazon’s ability to charge a lower take rate made it ubiquitous. People order literally everything from Amazon because the fees are so low that it just makes sense.

Being low priced makes it hard for everyone else to compete. It’s a lower barrier to entry for customers and a higher barrier to entry for competition. In the long term, that leads to scale, which leads to more procurement power, which leads to the ability to charge an even lower price, etcetera… a virtuous cycle.

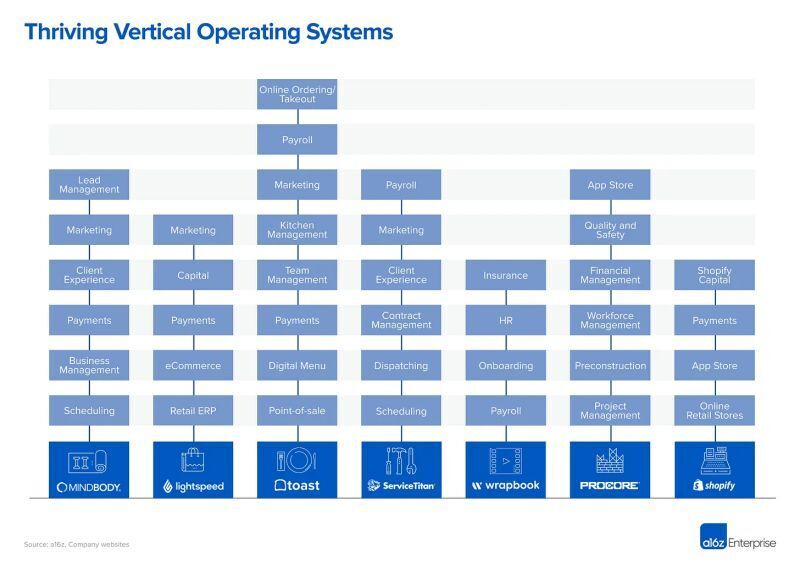

How do you increase your take rate?

Add more features (Patreon)

Drive more network effects (Substack)

Serve an underserved / specific niche (OnlyFans)

Offer a “luxury” version of a commodity product (StockX)

Expand to a geography that’s willing to pay more (Uber)

Orrrrr, you just fool everyone and quote your take rate in BIPS.

Smart stuff I read at 2AM:

Take rates - Lenny’s Newsletter

What’s a take rate - Applico

Are you a platform or marketplace - Fin

Ecommerce marketplaces vs platforms - Litcommerce

Types of aggregators - The Business Professor

Frequency vs Price - Airdev.co

Quote I’ve been pondering

“Billy Beane never won a world series.

But Theo Epstein did, using all the same strategies Billy came up with first.”

-Taylor Mason in Billions