Thanks to the data wizards at Virtua Research for taking me behind the curtain to pull some levers on their point in time SaaS time travel machine to write this piece! Check them out if you are in corporate finance and obsessed with benchmarking (like myself).

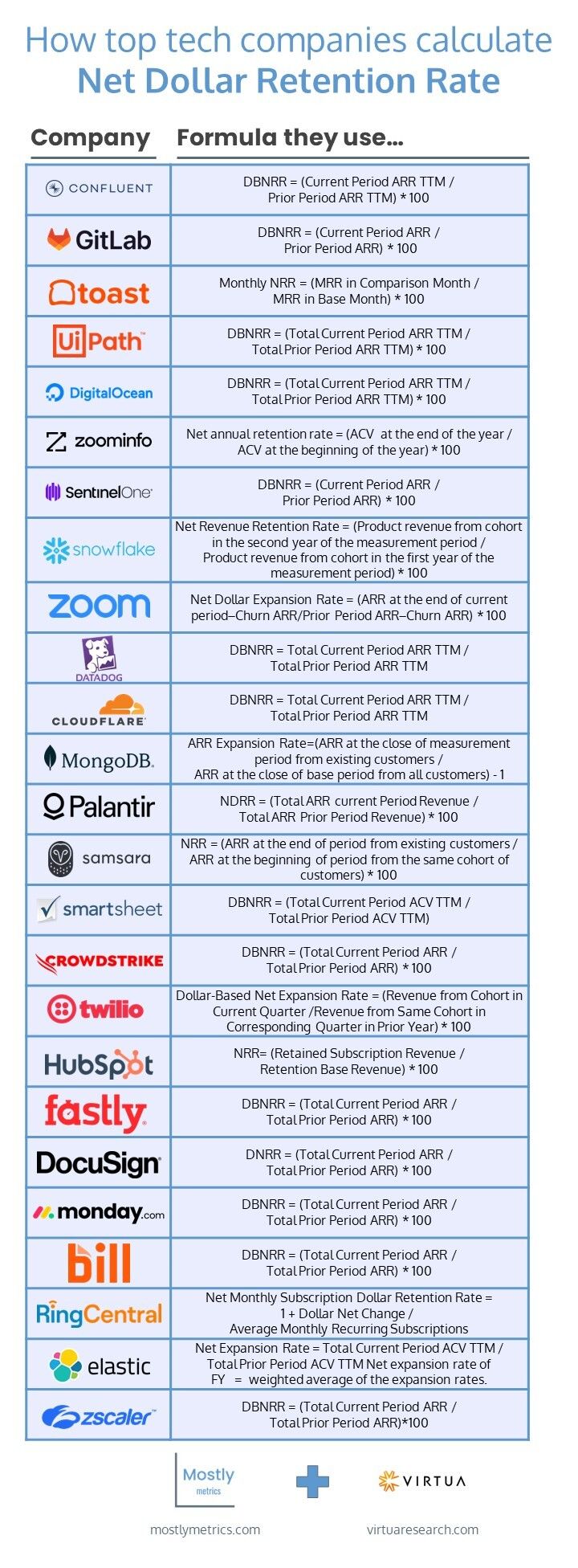

Below you’ll find the official definitions for Net Dollar Retention Rate (or some variation of it) from each of the 25 companies in the image above, with their nuances called out. You can rely on these real life examples for defining the metric at your own company.

1. Confluent:

Dollar Based NRR = (Current Period ARR TTM / Prior Period ARR TTM) * 100

We calculate our dollar-based NRR as of a period end by starting with the ARR from the cohort of all customers as of 12 months prior to such period end, or Prior Period Value. We then calculate the ARR from these same customers as of the current period end, or Current Period Value, which includes any growth in the value of subscriptions and is net of contraction or attrition over the prior 12 months. Services and pay-as-you-go arrangements are excluded from the calculation of ARR. We then divide the Current Period Value by the Prior Period Value to arrive at our dollar-based NRR. The dollar-based NRR includes the effect, on a dollar-weighted value basis, of our subscriptions that expand, renew, contract, or attrit, but excludes ARR from new customers in the current period. Our dollar-based NRR is subject to adjustments for acquisitions, consolidations, spin-offs, and other market activity.

2. Gitlab

Dollar Based NRR = (Current Period ARR / Prior Period ARR) * 100

We believe that our ability to retain and expand our revenue generated from our existing customers is an indicator of the long-term value of our customer relationships and our potential future business opportunities. Dollar-Based Net Retention Rate measures the percentage change in our ARR derived from our customer base at a point in time. Our calculation of ARR and by extension Dollar-Based Net Retention Rate, includes both self-managed and SaaS subscription revenue.

3. Toast

Monthly NRR = (MRR in Comparison Month / MRR in Base Month) * 100

To calculate our Net Retention Rate, or NRR, we first identify a cohort of customers, or the Base Customers, in a particular month, or the Base Month. For this purpose, we do not consider a customer as a Base Customer unless there is at least one location live on the Toast platform for the entirety of the Base Month. We then divide MRR for the Base Customers in the same month of the subsequent year, or the Comparison Month, by MRR in the Base Month to derive a monthly NRR. MRR in the Comparison Month includes the impact of any churn or contraction of the Base Customers, and by definition does not include any customers added to the Toast platform between the Base Month and Comparison Month. We measure the annual NRR by taking a weighted average of the monthly NRR over the trailing twelve months.

Breakdowns on the nuances of companies 4 through 25 are included for paid subscribers below:

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content.

UpgradeYour subscription unlocks:

- In-depth “how to” playbooks trusted by the most successful CFOs in the world

- Exclusive access to our private company financial benchmarks

- Support a writer sharing +30,000 hours of on-the-job insights