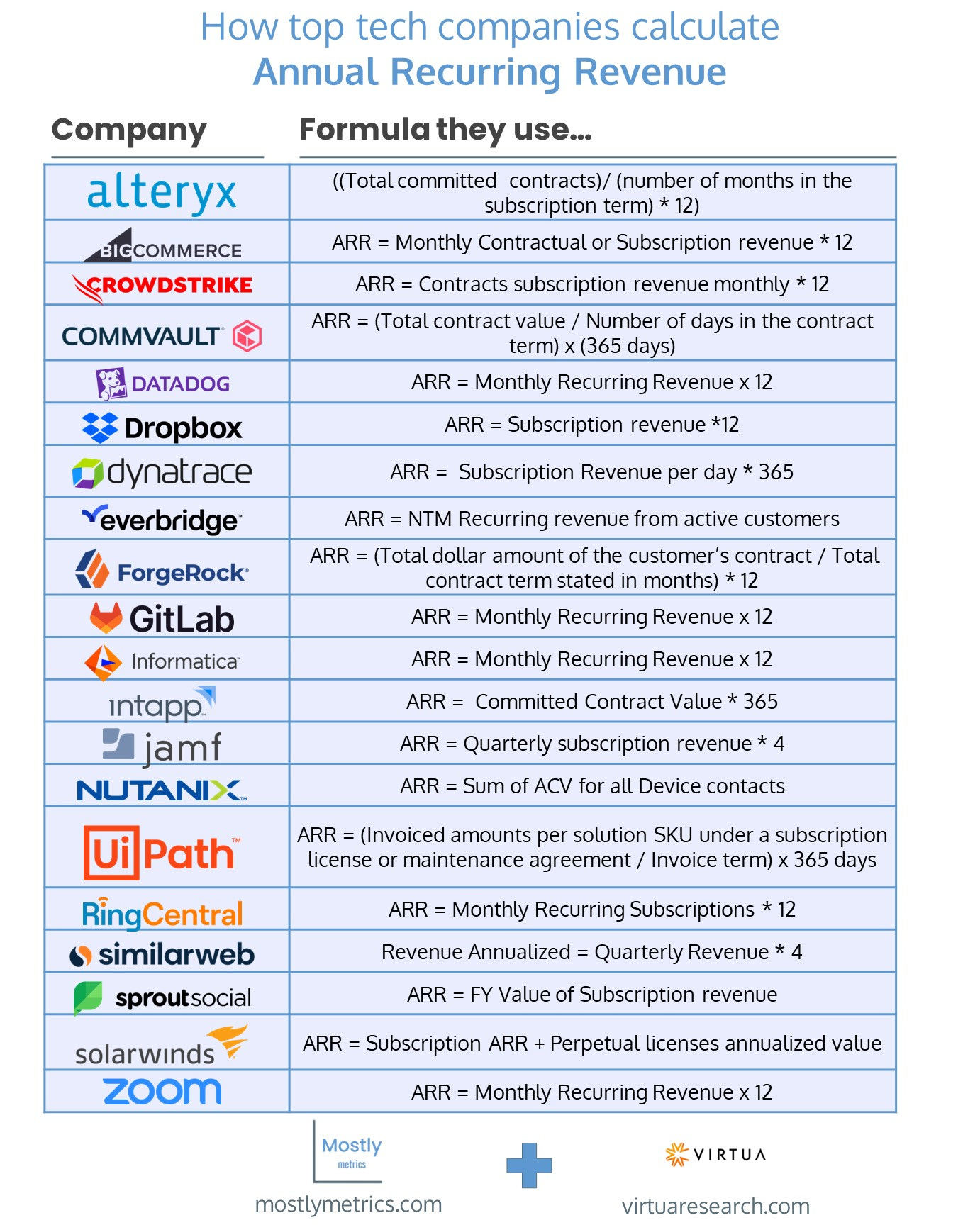

How top tech companies define ARR

Annual recurring revenue isn't as straight forward as you'd think

👋 Hi, it’s CJ Gustafson and welcome to Mostly Metrics, my weekly newsletter where I unpack how the world’s best CFOs and business experts use metrics to make better decisions.

I interviewed Tony Kim, head of tech investments at BlackRock, for the …