Before we jump in - I was recently asked “What my writing process looks like”.

Glad you asked:

OK, let’s breakdown this week’s formula. Ha. Ha.

Software is eating the world. This much is true. But not every company is a Software company.

More specifically, not every company is a High Tech company.

There are two categories of technology companies in my simple mind: High Tech and Tech Enabled.

And sometimes it can be hard to tell the difference between the two.

At the most basic level, High Tech companies literally wouldn’t exist without their underlying technology - they need to invent something net new.

On the other hand, Tech Enabled companies use existing technology to improve an existing market.

Neither type of business is inherently better. Both solve problems and deliver value to shareholders.

This post is NOT about valuation. We get it - High Tech (usually) trades at high multiples.

I want to compare operating models to see where money is spent and how durable revenue growth is accelerated.

And the results are surprising.

TL;DR:

High Tech companies invent something new (think: DataDog)

Tech Enabled companies use technology to improve their core offering (think: Airbnb)

High Tech companies have higher technical risk (can I actually build it?) than Tech Enabled companies and generally take longer to get their product to market

High Tech companies are assumed to spend more on Research and Development while Tech Enabled companies are assumed to spend more on Sales and Marketing

I’ve chosen a sample of 15 Tech Enabled and 15 High Tech companies from the Russell 1,000, which covers +90% of equity market cap value in the US.

So you know, I’ve excluded:

Any company with a market cap greater than $1 Trillion, as these large outliers may throw off the data set (AAPL, GOOGL, MSFT, FB)

Tesla and AWS since they have components to their businesses that could arguably place them in both categories

Any Tech Enabled companies that don’t break out COGS (e.g., Lemonade) or R&D costs (Carvana, Copart), due to lack of comparability

A few obvious Tech Enabled companies like WeWork, GrubHub, and Vroom didn’t make the cut because they aren’t in the ol’ Russel 1K (sad face)

Comp Set:

Note: All financials below are trailing twelve months (with the exception of 3 yr revenue CAGR) as of May 29th from Pitchbook

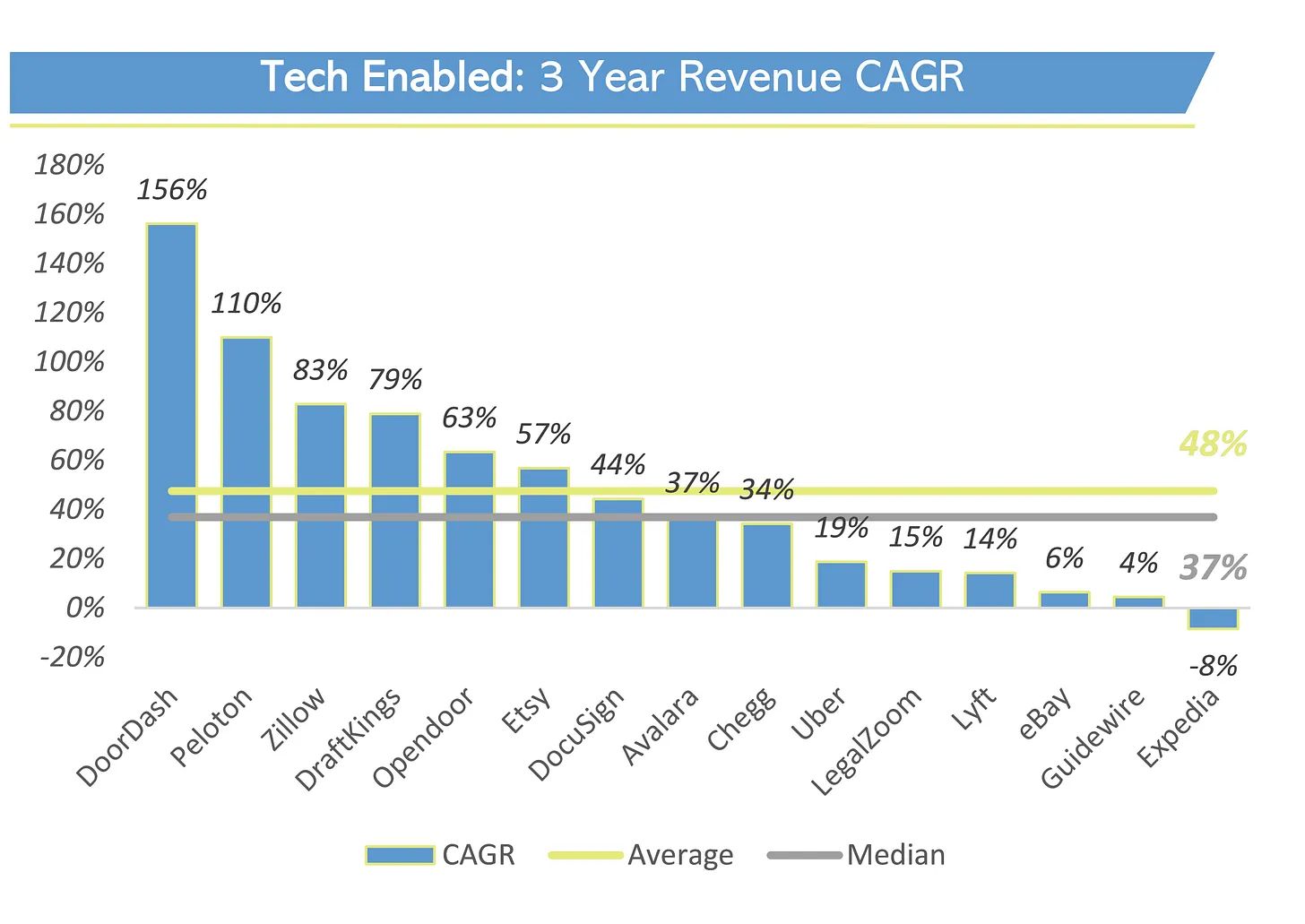

Revenue CAGR (3 years):

High Tech narrowly takes the cake when it comes to topline growth, demonstrating +4% on average and +9% at the data set mid point compared to Tech Enabled

I’d expect the gap in growth to widen in a recessionary environment, as consumer facing platforms like Peloton, Zillow, Ebay and Etsy will be more susceptible to spending changes compared to tech companies with annual commitments

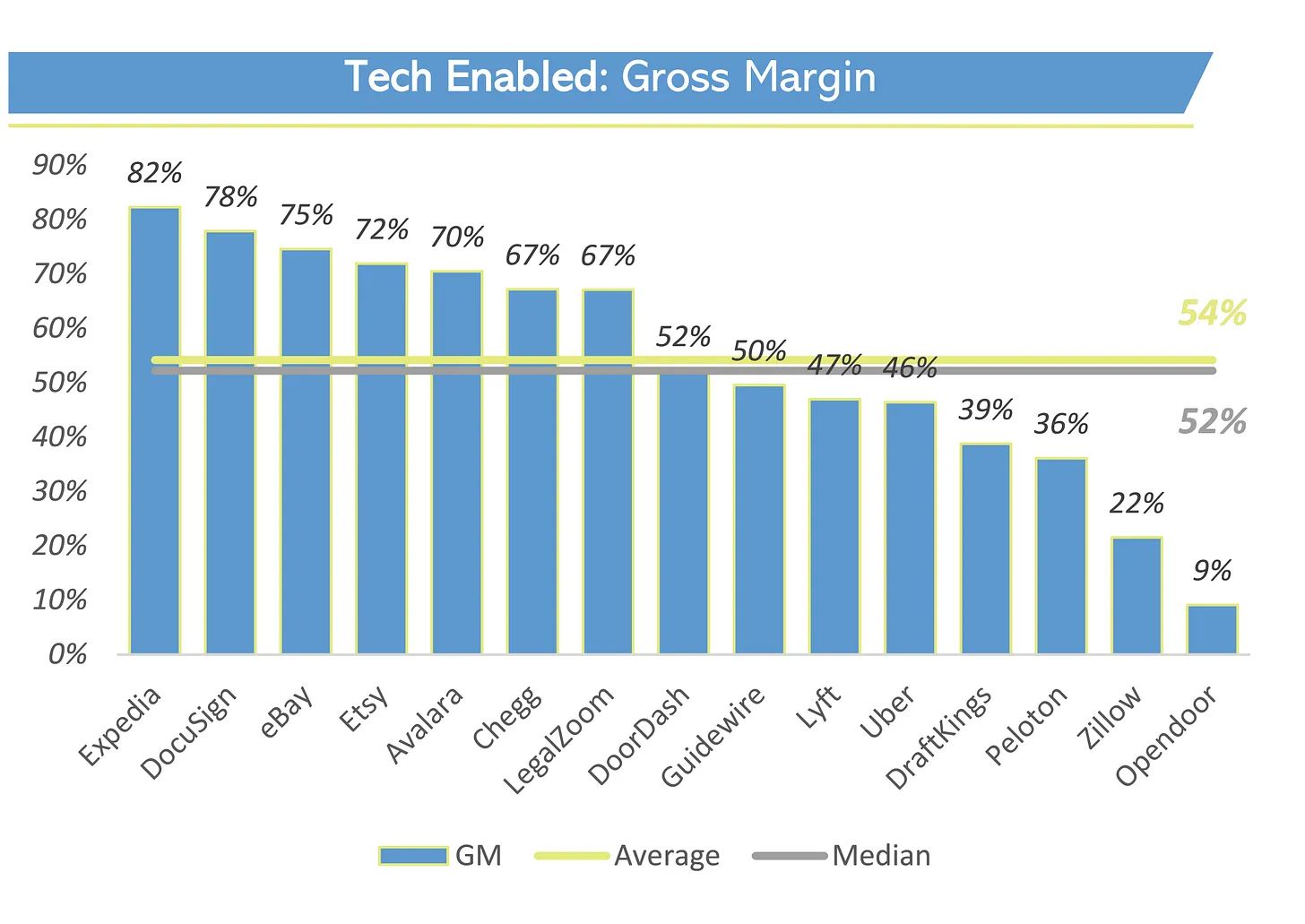

Gross Margin:

Wozers - High Tech companies have a lot more dough left over after paying for their cost to serve. You can find more on gross margin and what “good” looks like here

At most High tech companies cost of sale is comprised of roughly ~50% people (Customer Success, Customer Support) and ~50% hosting costs (AWS, Azure, etc)

Tech Enabled companies get beat up on COGS because a lot of them actually sell “stuff” - like, goods you can touch - which require raw material inputs. Contrary to popular belief, Peloton bikes don’t live in the cloud.

Some of of the Tech Enabled marketplaces have massive Gross Merchandise Values which get widdled down to a much smaller take rate once the sellers get paid out. More on monetization models and take rates here.

“You can say you are this or that type of company, but at the end of the day, you are what your gross margin says you are.”

-Sell side analyst I spoke to this week

Sales and Marketing as % of Revenue:

This one caught me off guard - I actually expected Tech Enabled companies, many of them B2C, to have outsized Sales and Marketing costs

Perhaps I was just biased because LegalZoom, DraftKings, and DoorDash sponsor all the podcasts I listen to

What I didn’t fully account for is the higher Enterprise cost of sale that most High Tech companies pay to sell to other Russell 1,000 Companies

Running a Field Salesforce is expensive, which needs to be supported by marketing programs to drive pipeline

Research and Development as % of Revenue:

I fully expected High Tech companies to dole out more for R&D - it’s the heart and soul of their biz; without the tech they have nothing to sell

Tech Enabled companies rely heavily on existing libraries and opensource software to build their infrastructure

So I was surprised that Tech Enabled companies still spend comparatively half as much on R&D

Net Income as % of Revenue:

SPOILER ALERT: Neither are all that profitable!

The High Tech data set has more firms generating earnings per share, but you can see many are still going DEEP into the red

This is further exacerbated by the huge share based comp charges both types of businesses incur to keep top talent, plastering their P&Ls and driving losses further into the depths

Conclusion:

To put a bow and a ribbon on this jam session, although the market risks and general time to market associated with each business model, they are both in fierce competition for talent. And that talent makes up the bulk of expenses.

By my estimation, costs that walk on two feet make up +75% of expenses at High Tech firms and +60% at Tech Enabled companies. Therefore, it seems to be more about how each type of company organizes people within the P&L rather than actually growing faster, spending less or having radically different bottom line outcomes.

Potentially Reliable Stuff I Read at 2AM (Sources):

Pitchbook for all financial data (Trailing twelve months as of 5/29/21)

Quote I’ve Been Pondering:

“If your wife locks you out of the house, you don't have a problem with your door.”

-Anne Lamott, Bird by Bird: Some Instructions on Writing and Life