Actionable Insights

For those that only have a few minutes:

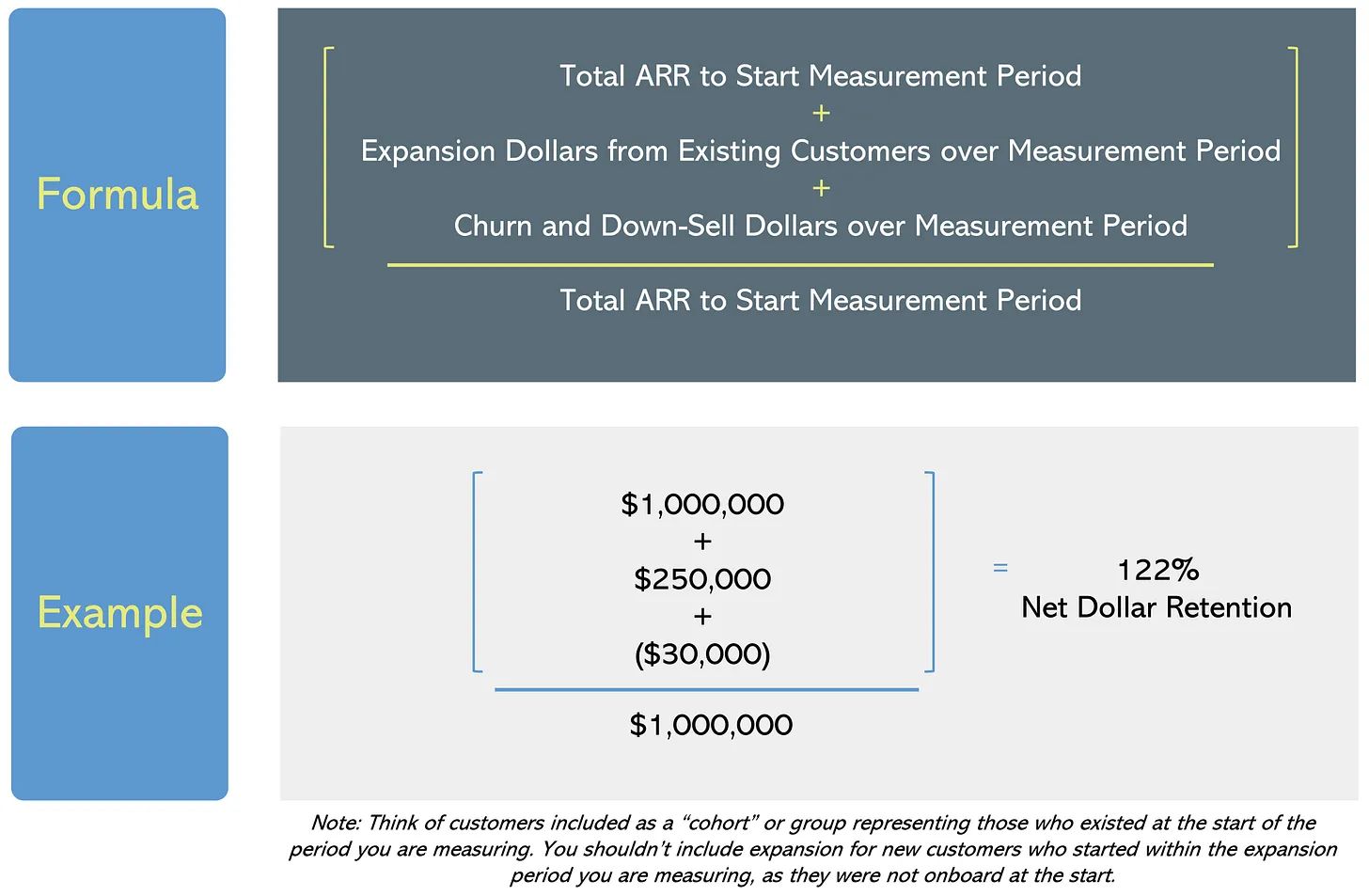

Net Retention is a measure of how much your existing customers expand in a given period, net of any churn or shrink.

Ways to impact Net Retention are to:

Churn less

Sell more of the same product to customers

Sell new products to customers

Increase existing customer usage

Generally, anything over 110% is good and anything over 130% is great

Enterprise customers usually have better net retention than smaller customers

Usage Based monetization models have an easier time increasing Net Retention compared to Subscription

Disclaimer: Not investment advice. Opinions are mine only and not of my employer.

The Art

Net Retention basically throws all your existing customer dynamics into a pot, mixes them up, and spits back out how much your business will grow or decline by, absent any net new customer activity.

A Net Retention of 125% means you could stop selling to new customers and would still grow at 25% next year.

The Science

Let’s jump into the fiery water and see how the math works.

How Do You Change Net Retention?

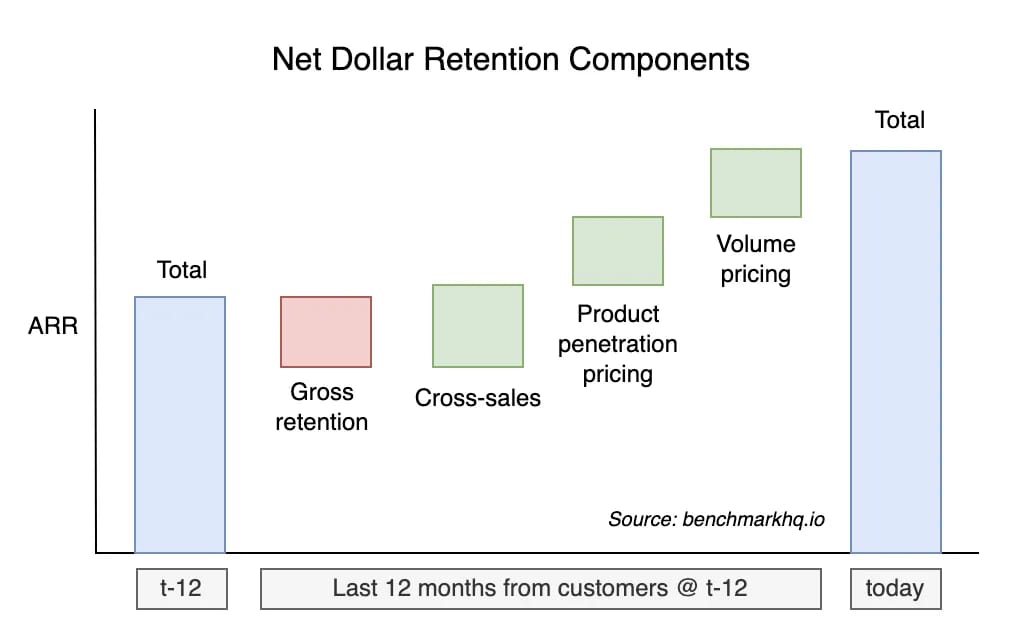

The simplest way to think of it is selling either more licenses or more products. But to put it more eloquently, and take a page out of my friend Geoff Byron’s playbook, we can actually decompose Net Retention into four distinct levers:

You decrease churn (Gross Retention)

Your customer buys more products (Cross Sales)

Your customer buys more licenses (Product Penetration Pricing)

You drive more usage of a product they already bought (Volume Pricing)

What’s “Good” Look Like?

In terms of what Good looks like, anything above 100% means at least you aren’t growing in reverse (the proverbial “leaky bucket”). The highest you can get your Net Retention from the Gross Retention lever is 100%.

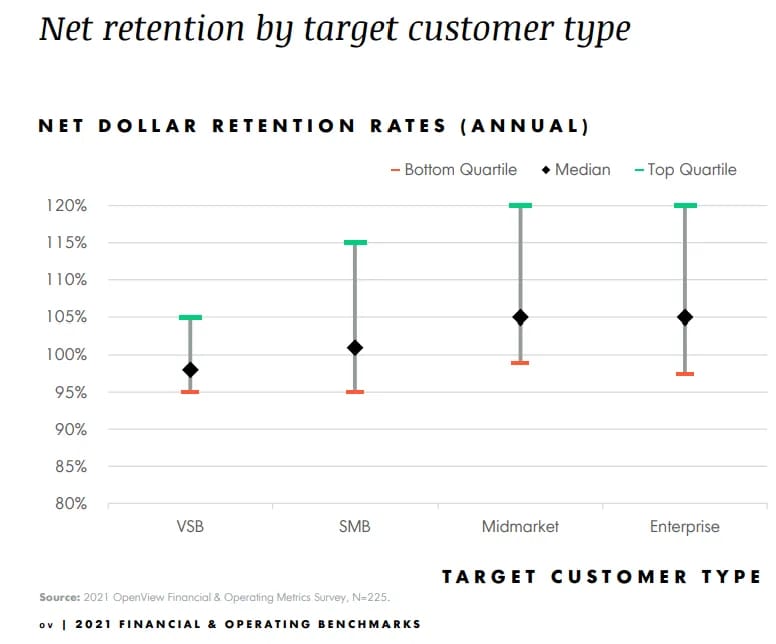

When you factor in the other three levers, OpenView shows that agnostic of customer type, anything above 110% is pretty good.

Jamin Ball, an investor at Altimeter, illustrates how top tier net retention for publicly traded Enterprise tech companies is anything above 130%. Based on his tweet below, you can see that the likes of Snowflake, UIPath, Smartsheet, HashiCorp, Jfrog, SentinelOne, Gitlab, Splunk, DataDog, and Confluent would all grow at least 30% year-over-year even if they didn’t land another customer. That’s powerful.

How Does NRR Vary Across SaaS?

For an even more nuanced take on Net Retention benchmarks across SaaS (software as a service), Lenny Rachitsky of Lenny’s Newsletter did the heavy lifting and surveyed experts in his network. The results are as follows:

Consumer SaaS (Netflix, Spotify, Hulu):

~55% is GOOD

~80% is GREAT

Bottom-Up SaaS (Slack, Figma, Zoom):

~100% is GOOD

~120% is GREAT

Land & Expand Very Small Biz SaaS (Gusto, Hubspot, Mailchimp):

~80% is GOOD

~100% is GREAT

Land & Expand Small Biz / Mid-Market SaaS (Atlassian, Box, Zendesk):

~90% is GOOD

~110% is GREAT

Enterprise SaaS (Salesforce, Workday, ADP):

~110% is GOOD,

~130% is GREAT (supporting what we saw in Jamin’s tweet above)

You can see how the bar gets raised as you go “up-market”. Although it typically takes longer to close a deal with a large customer, and it’s a higher customer acquisition cost, Enterprise customers are great for net retention. Why?

They usually buy in bites, trying your product in corners of the org before going wall-to-wall. Landing the “edge of the wedge” creates opportunities to increase Net Retention by selling more licenses of the same product to other teams in the org later on.

Enterprise customers are less likely to buy multiple products at once, since larger orgs require buy in from more decision makers. This leaves the door open to increase net retention by way of cross selling your other products to other decision makers in the org later on.

Finally, Enterprise customers generally have better renewal rates because it will be more costly and time consuming to rip you out, due to their sheer scale. Plus, procurement usually likes the discounting that comes with signing multi year contracts.

Small businesses are the worst when it comes to Net Retention. They don’t spend a lot, frequently run out of budget, and sometimes go out of business all together. However, there’s a super long tail of them out there. So it is indeed possible to just “Make it up in volume!”

Companies like HubSpot, SurveyMonkey, and Shopify struggled with net retention at times, as their core customers were smaller businesses and entrepreneurs who were relatively fickle by nature.

Shopify, in aggregate across all customers, experienced 100% net retention in the early days, since a lot of one man (or woman) shops shut their doors. However, if you carve out their top tier of customers, net retention is 140%.

Shopify didn’t really stress about their overall net retention because it wasn’t what they were trying to optimize for. They cared more about the absolute volume of customers and the total expansion revenue from the top 10%. They wanted to optimize for this group of customers.

Net Retention isn’t the North Star metric for every company. Especially when you can make up for all that churn in volume. But it’s a constant uphill battle to keep adding customers to the melting bowl of ice cream.

How Does NRR Vary Across Revenue Models?

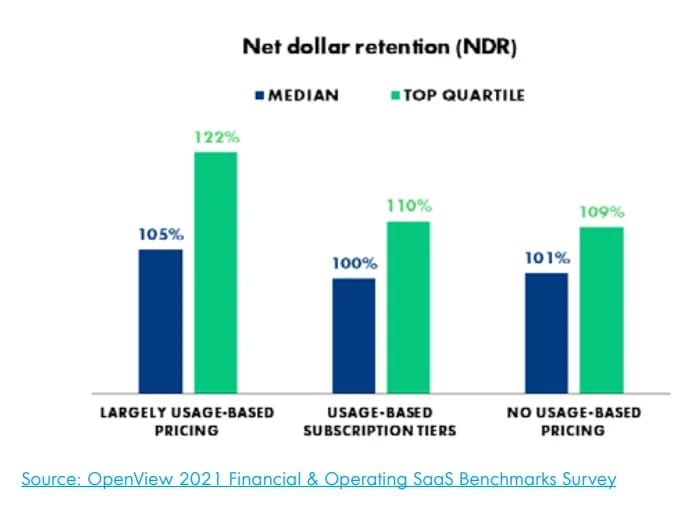

If I were to rank which business models are best geared to benefit from net retention, Usage based models would take the cake. Once you have the customer signed up, all they have to do is keep using the product. The skids are greased.

Usage business models, like an Amazon Web Services or Snowflake, increase net retention as user data increases. This is pretty much the holy grail, as the only certainties in life are death, taxes, and data growth.

This is validated by Kyle Poyar and the smart folks over at OpenView, proving out that Consumption outpoints Subscription businesses ~125% vs ~115% when you compare Net Retention.

In Summary…

It’s liberating to realize how high net retention frees you up to invest more in other parts of your biz, as you’ve got bonus growth and cash flow coming your way. It typically takes less effort (read: less money) to grow an existing customer than to go out and land a net new one.

Net Retention is a way to build “free” growth into your sales motion. I say that partly in jest, because you still need to treat your customers right and make sure they are implementing your services to get max value (which does cost something). All in all, the easiest path to growth is to not lose the customers you already have, and then make them more successful. That way you don’t have to “make it up in volume”.

Smart Stuff I Read at 2AM (Sources)

Geoff Byron - Not all NRR is created equal

Kyle Poyar - NRR for Subscription vs Usage Models

Open View - NRR for Subscription vs Usage Models

Jamin Ball - NRR for Enterprise Companies

Quote I’ve Been Pondering

Failure shows us the way—by showing us what isn’t the way.

-Ryan Holiday, The Obstacle is the Way