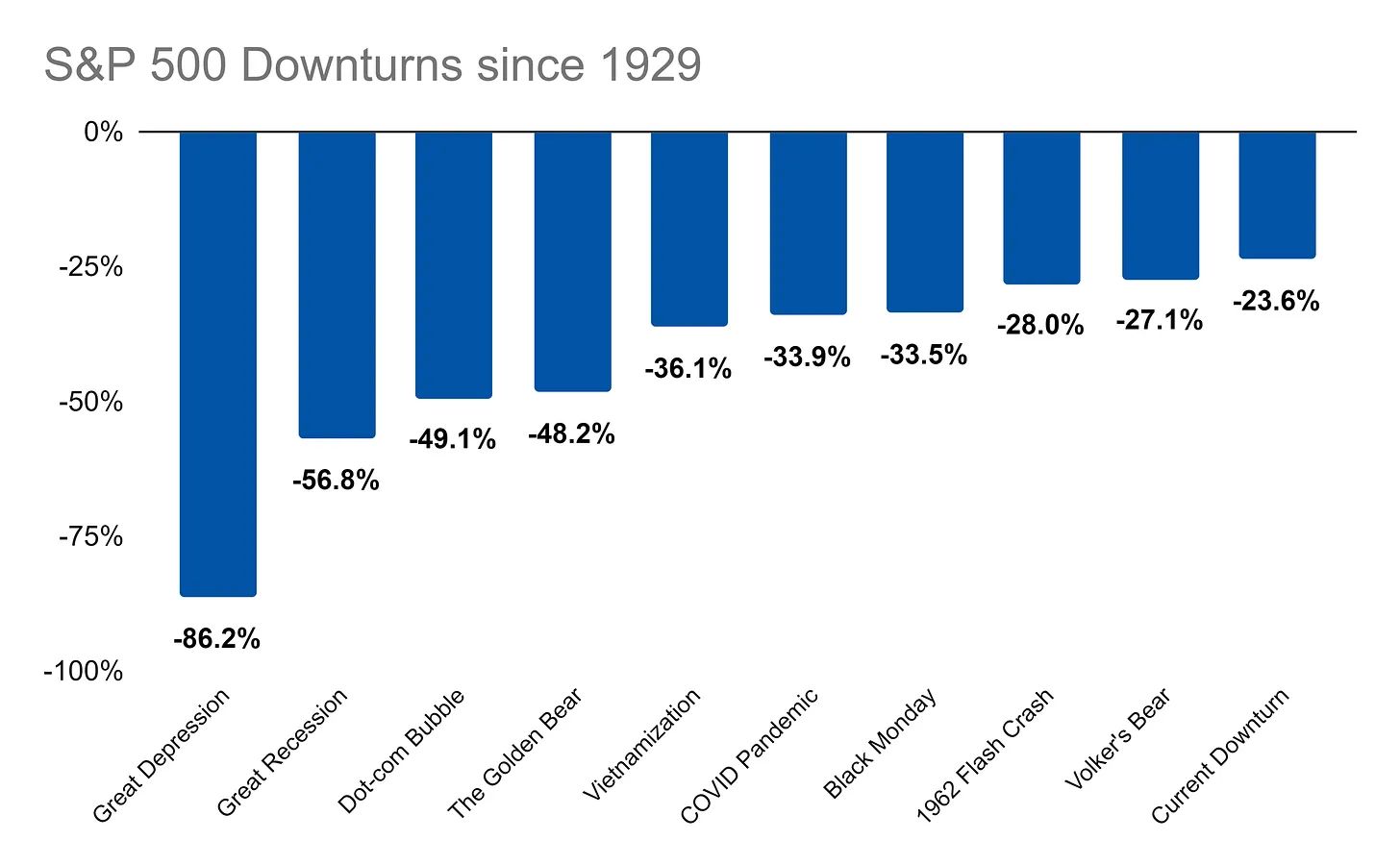

The market decided to go all blue screen on us. In fact, according to the big brains over at the similarly named Endless Metrics, we’re looking down the barrel of the 10th worst correction since 1929.

I’d be lying to you if I told you I knew what was going on. But as a student of the financial game, I believe there are some gems hidden in the pain. As such, I’ve collected the 10 best soundbites from talking to banks and investors over the last month. And we’ll wrap up with some tweets to keep us light on our toes.

“We’re not facing headwinds, but swirling winds”

When there are ~17 macro economic factors battling it out, it’s really hard to apply any prior benchmarks and know what’s going to happen. It feels more like we’re caught in a blender, rather than an environment where a singular factor slaps us in the face.

Formula I Made Up:

Change in S&P = (1 - Inflation) x (Gas Price per Gallon in Omaha) / (Game 6 NBA Finals Combined Score + BitCoin Price ^ # of Formula Shortage Days)

In all seriousness, anyone who thinks they know what’s going on is purely pontificating.

What I do know is that people (and markets) hate uncertainty. And the confluence of multiple events produces a lot of uncertainty. And what makes things even more confounding is despite the bad news, a lot of companies are still doing well - like really well (see: DataDog, Gitlab, Crowdstrike).

So how long do we wait for the shoe to drop?

If I’m racing to the airport for a flight, I’m way more stressed not knowing if I’m going to make it before the doors close, versus knowing for certain I’ll miss the flight.

Give it to me straight, doc.

So until we figure out if we missed the flight or not, it seems like we’ll just keep peeling an arbitrary 5% off the top each week.

“A revenue multiple is only a measure of conviction in your story”

And…

“I don’t need to believe a five year model if you say in three quarters you’ll be cash flow positive.”

A lot of analysts are scarred by covering companies who’ve continually claimed they were 18 months away from free cash flows. We gave them the benefit of the doubt and allowed them to delay the pursuit of FCF to chase revenue at all costs, believing they’d eventually get to a positive bottom line.

The days of kicking the free cash flow can down the road are over.

Revenue multiples are, in a way, a measure of trust. How much do I believe you are going to do what you said you were going to do? How much do I believe in the long term business model you’ve put in front of me?

It’s no wonder why some of the highest trading tech companies today are both free cash flow positive and run by leadership who have personally built up credibility with sell side analysts for decades. The credibility of a lot of CEOs and CFOs are on the line when it comes to long term forecasting.

“The bottom in 2001 is not an apples to apples comparison to whatever the bottom is in 2022.”

Comparing today to 2001 is an apples to oranges comparison. Back then software companies were selling perpetual licenses and could be bought and sold for 4x to 6x maintenance contracts.

Today the way companies monetize their tech is very different.

In other words, if the bottom was 2x back then, that might convert to something like ~3.5x in today’s SaaS and Consumption pricing world.

“If you are spending to grab a market, that’s different than spending to catch someone.”

Only truly transformative companies spending to capture greenfield opportunities will get the nod from investors to keep spending ahead of their growth.

There’s a big difference if you are spending $1.30 to make $1.00 to grab the market versus doing the same to compete based on pricing with incumbents.

Head-to-head competitive pressures won’t result in repeatable, durable revenue growth. But if you are in a dead sprint to gobble up a market that’s moving towards you, then keep feeding the beast.

“Most of the investors I deal with tend to be bipolar.”

Hey, remember when they said growth was wicked awesome? Feels like we changed the recipe for the oatmeal cookies over night. Not. Cool.

“A lot of CISOs are about to realize that the usage based revolution is really just the Splunk Tax they hated all over again.”

Consumption business models were having a hot girl summer. Just pay for what you use! Whew!

This makes a ton of sense in times of hyper growth, but may raise some eyebrows when the music stops and the cost of electricity stays the same. It’s hard to substantiate the same cost structure if your topline slows.

Splunk ran into this problem a few years back, and a similar fate could hit the usage based models of the world when dad comes home from work and turns the thermostat down.

“Someone’s gotta foot the inflation bill. We just aren’t sure yet if it’s the seller or buyer.”

Right now companies selling software, goods, and services are still trying to hold onto price. And that’s OK, because a lot of people and companies built up a cash surplus during COVID, whether it be through stimulus or fundraising.

But eventually they’ll eat through that cushion.

And then we’ll figure out if :

Sellers eat the extra costs and sacrifice profitability to preserve the buyer

Sellers eat the extra costs and look to cut costs internally (cut headcount, kill new projects) to preserve profitability and the buyer

Sellers just burn through goodwill and keep force feeding higher costs to buyer.

There will be more people ‘not hired’ than ‘fired’.

Companies will revise their headcount plans to not hire net new people and shrink by way of not backfilling regular attrition. There will indeed be some layoffs (as we’re already seeing) but there will be much more subtraction by way of less addition, if that makes any sense.

“You’re going to want to dust off that ROI slide.”

The CFO’s #1 job just became saying ‘No’ to net new spending.

“The CFO is now the CFNO. Ha. Ha.”

3x Mid Market Sales Director of the Year, Brian Bresnahan

Company’s need to clearly articulate ROI to land net new business.

Therefore, value needs to be clear to people immediately in order to move deals through the clay layers of middle management approvals. And all software needs to be additive from a productivity perspective - it can’t just be a neat feature.

My top 5 favorite market correction tweets

Quote I’m Pondering:

Sometimes you're flush and sometimes you're bust, and when you're up, it's never as good as it seems, and when you're down, you never think you'll be up again, but life goes on.

Ray Liotta as George Jung in Blow, 2001