Johnny CCC

So before we jump into today’s accounting song and dance, a little story time.

I had a finance professor in college who brought a new meaning to “cash conversion cycle.”

The cash conversion cycle (CCC) is a metric that expresses the time (measured in days) it takes for a company to convert its investments in inventory and other resources into cash flows from sales. You want to get money from your customers faster and pay your suppliers slower.

He ran a costume jewelry business back in the 80s and 90s (like Claire’s or Icing that you’d see at the mall).

Never thought I’d ever talk about Claire’s in my finance newsletter, but here we go

He had a ton of money wrapped up in fake diamonds and sashes and fedoras and makeup, a lot of which would sit on the shelves for months before it was sold.

So he found a way to maximize his “float”. He’d write paper checks to his jewelry vendors and throw them in the mail. But before doing so, he’d also throw them in the microwave. The heat would melt the magnetic coding used to scan the checks. This inevitably turned a seemingly good looking check into something the bank scanning machine would reject.

Most of the time they’d chalk it up to some sort of systems error (this was the early days of scanning stuff) and call him to send another check. By that time he’d bought himself an extra five days.

Genius? Nefarious? You decide.

My finance professor also kinda looked like Adam Sandler

How’s CCC measured?

As stated above, CCC measures the length of time each net input dollar is tied up in the production and sales process before it gets converted into cash received.

This metric takes into account the time needed to:

Sell the inventory,

Collect receivables, and

Pay the bills.

CCC = DIO + DSO - DPO

To go a step further, you need to know your Days Sales Outstanding, Days Inventory Outstanding, and Days Payables Outstanding. It looks complicated, but it’s really not - just some simple division.

DIO = Days Inventory Outstanding = ($ Inventory / $ COGS) * Days in that period

DSO = Days Sales Outstanding = ($ Accts Receivable / $ Revenue) * Days in that period

DPO = Days Payable Outstanding = ($ Accounts Payable / $ Cost of Goods Sold) * Days in that period

What’s the Rub?

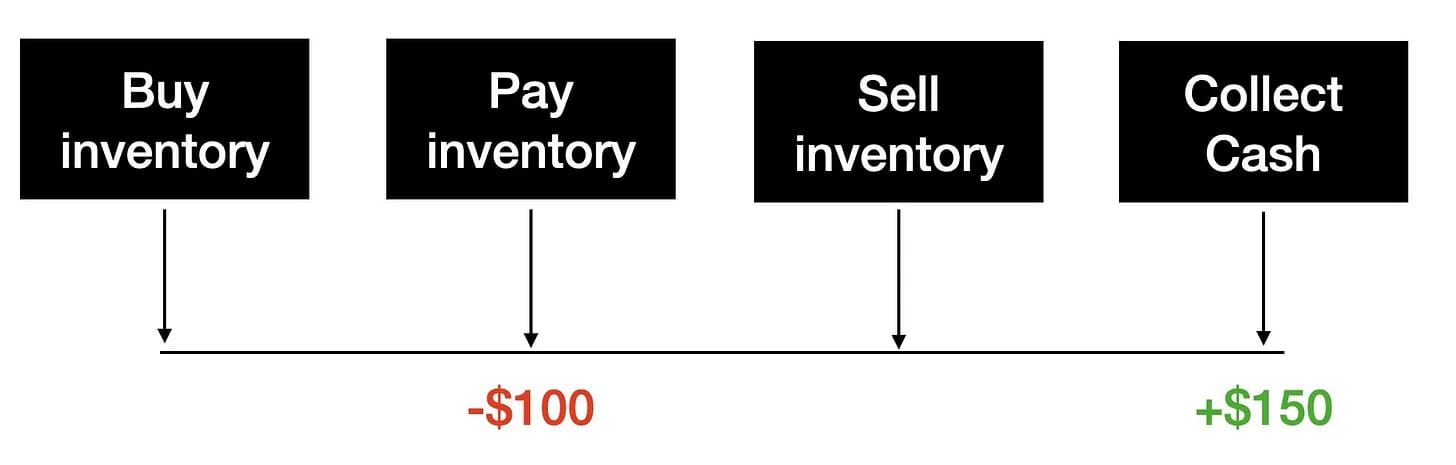

A “cash flow problem” arises when you have to PAY $100 for inventory BEFORE you collect cash from the customer for $150.

What’s the Solution?

Well, you can try to collect cash up front. But that’s not always possible.

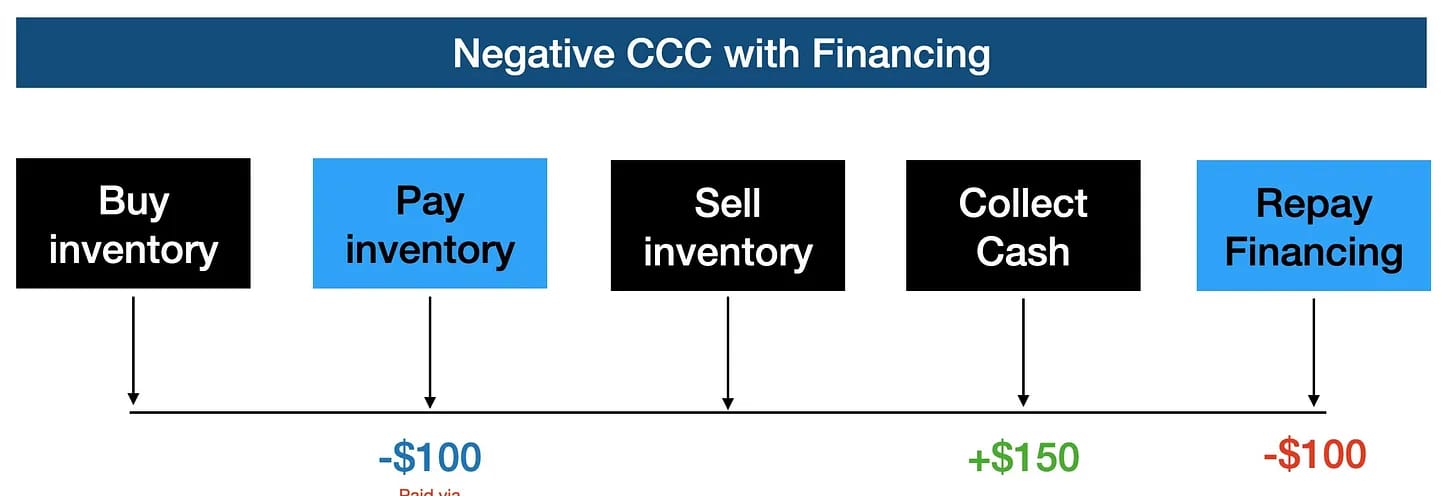

You can also experiment with different financing options to delay your payments and have credit fronted to you.

Who’s this relevant to?

CCC is most effective with retail-type companies, which have inventories that are sold to customers. Consulting businesses, software companies and insurance companies are all examples of companies for whom the inventory portion of the metric is meaningless. But they do still want to get paid by their customers faster and pay their suppliers slower. That part still rings true.

What’s good look like?

Legacy retailers (like department stores) have a CCC of up to 70 days.

Hyper-efficient Walmart and Costco have a CCC of between 7 to 4 days respectively.

Amazon.com has a CCC of -26 days. What this means is that Amazon makes revenue on its inventory 26 days before suppliers need to be paid.

How is that even possible?

Reducing the amount of inventory you hold (i.e., don’t hold too much in your warehouses)

Reducing accounts receivable (i.e., have customers pay you earlier - one click checkout, credit cards, gift cards)

Increasing accounts payable (i.e., pay your suppliers later)

Walmart plays hardball when it comes to #1 and #3. The behemoth is notorious for passing distribution and warehousing costs onto their suppliers and tying their respective payment terms to how fast inventory moves.

Another cash management titan is Unilever, consistently operating at a negative balance.

Unilever’s CCC is hot fire

So what?

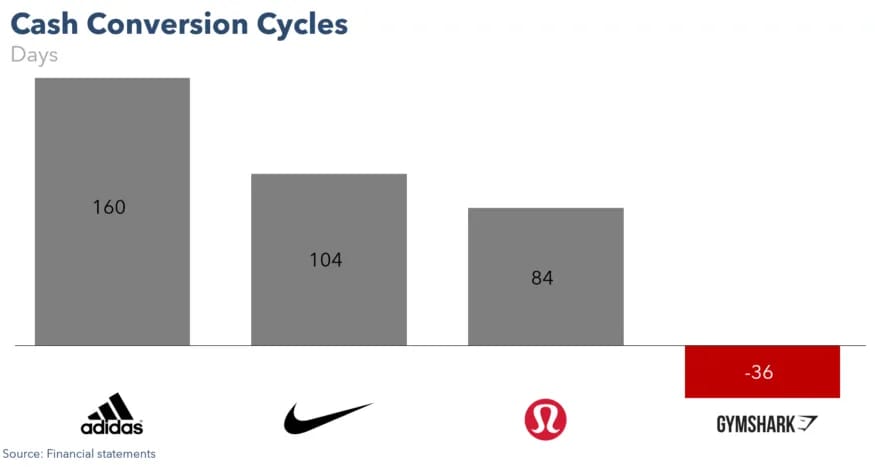

Negative CCC enables companies to grow without the need for external capital.

Gymshark founders had cash on hand for 36 days for every item they sold and used it to finance their growth.

This is a strategic advantage when you are competing against larger companies who are better capitalized.

It means you can plow more money into your business to grow without having to wait around for that check to clear.

And remember - Long A/R cycles are essentially interest free loans to customers that bear opportunity cost directly to your business.

Final CCC Hacks:

Ideally collect cash BEFORE you pay for inventory

Ask your supplier for longer payment terms

Use financing and repay it after you collect cash

Smart Stuff I Read at 2AM:

Working Capital Guide - By Plastiq

Cash Conversion Cycle Basics - Investopedia

CCC Formula - CFA Institute

Walmart CCC tactics - Spend Matters

Gymshark’s CCC story - Menabytes

Businesses that do CCC stuff

Quote I’m Pondering

The best time to plant a tree was 100 years ago, and the second best time was yesterday.

Start now.

-Chinese Proverb