Contrary to popular belief, not all "revenue" is created equal.

Not to throw anyone under the bus specifically, but it’s the Wild West these days on FinTwit (that’s finance twitter, for those not talking LTV to CAC in their free time). Pop in and you’ll see online marketplaces calling their GMV Revenue and service based businesses calling their one time Revenue ARR.

So let’s set the record straight.

1/ Gross Merchandise Value (GMV)

Commonly used for marketplaces (Etsy) and payment gateways (Stripe) that charge a fee or take rate. GMV is not a true reflection of a company's revenues, but rather its through-put, as most of the revenue goes to the original seller.

2/ Revenue

This is a GAAP or accounting-based view of topline. GAAP stands for "Generally Accepted Accounting Principles", which is like the super official handbook for bean counters.

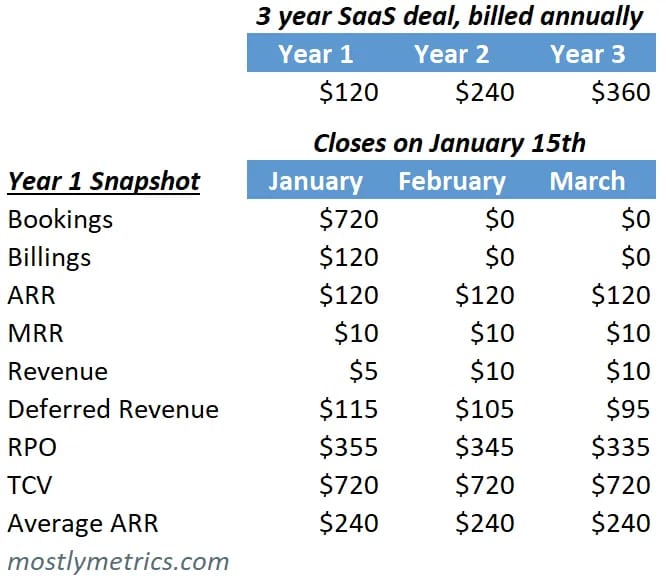

Revenue gets spread out, or accrued, to match the delivery of the product or service. In SaaS, total Revenue will usually trail total ARR and total Billings as it gets accrued over time. You’ll see in the example below.

3/ Deferred Revenue

This is the opposite of accrued revenue and largely a balance sheet and cash flow item. It accounts for money that’s prepaid for goods or services that have yet to be delivered. For example, in a 12-month SaaS contract, in month 4 there would be 8 months of deferred revenue left as a liability on the balance sheet.

4/ Revenue Performance Obligation (RPO)

RPO is all unrecognized contracted revenue. Deferred revenue goes out at most 12 months, so RPO was created to extend even further to capture all of a multi year commitment. It includes both Deferred Revenue and any unbilled portion of a multi year contract.

For a 3 year contract you’d have 12 months in deferred revenue and 36 months in RPO. Of the 36 months, 12 would be current RPO and 24 months would be non-current RPO.

RPO is not a GAAP number and, therefore, does not appear on the balance sheet. Instead, companies report it in the Revenue from Contracts with Customers section of their public filings to make sure they get “credit”.

It’s really popular for consumption based businesses where customers pre-pay, or commit, to lots of usage.

5/ Bookings

This is when the deal closes and the customer signs. It represents the commitment of a customer to spend money with your company. It's based on the execution of the contract, even if they haven't used the service or paid you yet.

It’s when the sales guy hits the big gong.

6/ Billings

This is when the accounting department actually "bills"' the customer for the "booking" that the sales team closed so you can get paid.

The "booking" may be for a three year contract that you "bill" for annually. Therefore you would bill one third of it each year. Billings is what you use when you’re building a cash burn forecast, since it closely tracks the money you’re collecting and can use in operations.

7/ Annual Recurring Revenue (ARR)

ARR represents the annualized revenue run rate of all committed subscription contracts as of the measurement date. It assumes all contracts that expire during the next 12 month's are renewed with existing terms.

Public service announcement:

1x purchases are not ARR.

Consulting services are not ARR.

Most ecommerce is not ARR.

Another, more nuanced, mistake is using the final year of a multi year contract, instead of the current year. Multi-year contracts with deep first-year discounting or volume ramps over time will drive deltas between the first and last year's ARR.

Many companies will claim the larger, exit year Contracted ARR (CARR) as ARR. But CARR will not track to current period GAAP revenue or billings.

8/ Monthly Recurring Revenue (MRR)

This is simply ARR / 12.

Said another way, MRR x 12 = ARR.

Once again, key word is "recurring"

9/ Total Contract Value (TCV)

This is the summation of the annual values within a multi year contract.

Year 1: $120 ARR

Year 2: $240 ARR

Year 3: $360 ARR

TCV = $720 ARR

10/ Average ARR

This is simply:

TCV / # of years

In the example above this would be

Avg. ARR = $720 / 3 = $240

This is important for contracts with upfront discounting or a ramp period in the number of licenses under contract.

Quote I’ve Been Pondering

Once you become an idea’s defender, it’s harder to change your opinion